The Twin Flywheels of Tokenization Market Adoption; The Next Frontier of CFO Challenges: Integrating AI in Financial Management; Interchange fees: What they are and how they work;

In this week’s edition, I’m diving into Adyen’s all-in-one payments strategy, the accelerating momentum behind tokenization, and how AI is reshaping financial operations from wealth management to CFO

Insights & Reports:

1️⃣ Deep Dive: The Adyen Engine

2️⃣ JP Morgan Payment: Same Currency Wire Flow

3️⃣ The Twin Flywheels of Tokenization Market Adoption

4️⃣ Leveraging behavioral finance to reconnect with HNWIs

5️⃣ The Next Frontier of CFO Challenges: Integrating AI in Financial Management

6️⃣ Inside the Retail Banking Business Architecture: A Modern Overview

7️⃣ Interchange fees: What they are and how they work

8️⃣ Global Payments raises bets on merchant services with $22.7 billion Worldpay deal

9️⃣ Capital One Expects Discover Financial Services Acquisition to Close May 1

TL;DR:

This week’s edition is packed with strategic moves, evolving architectures, and a few surprising twists. I kicked things off with a deep dive into Adyen’s all-in-one engine—far more than just a payments processor, they’re aiming to be the “world’s most customer-focused fintech platform.” By bundling payments, data, and financial services into one integration, Adyen is helping global merchants tackle complexity while driving long-term loyalty (NPS of 66 doesn’t lie).

On the payments rail side, J.P. Morgan continues to flex its muscle with high-speed, high-volume wire payments through its Global Payments API—think treasury settlements in under 2 minutes, processed with a 99.4% STP rate. Meanwhile, I explored how tokenization is gaining real traction, thanks to a self-reinforcing flywheel of corporate innovation and growing customer demand. We’re entering a world where users benefit from tokenized assets without even realizing it—lower fees, greater liquidity, and real-time access all baked in.

This edition also explores how wealth management is getting smarter. From Swiss advisors using generative AI to save 1.5 hours a week, to hyper-personalized client journeys driven by psychographic data, it's clear that AI is turning into the real MVP. But AI isn’t all smooth sailing—CFOs still face hurdles like data quality, compliance headaches, and the challenge of finding tools that go deep enough to be truly useful. Broad platforms are out; workflow-specific depth is in.

For my fellow infrastructure nerds, I broke down modern retail banking architecture—from front-end channels to backend fraud and risk controls. It’s a well-oiled machine that’s anything but simple. And on the card side, I unpacked interchange fees, including the difference between Interchange++ and blended pricing. TL;DR: transparency matters, especially when you're paying 2% on every US card transaction.

Lastly, a few headlines you shouldn’t miss: Global Payments is betting big on merchant services with a $22.7B acquisition of Worldpay. Capital One’s acquisition of Discover is finally expected to close by May 18. And in true fintech-meets-Twitter fashion, Ramp is being considered for a U.S. government charge card pilot—after a tweet from DOGE.

Until next time, stay curious and keep building.

Reports

Insights

Deep Dive: The Adyen Engine

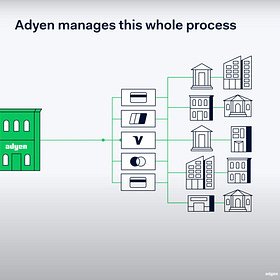

The global commerce and payments landscape is rapidly evolving, and Adyen’s strategy reflects this reality. Consumers expect to buy online, in-store, and everywhere in between, pushing businesses to offer seamless and personalized payment experiences across channels. Meanwhile, payment preferences vary widely by market, new local payment methods emerge, and regulatory demands grow – all driving companies to seek a financial technology partner that can navigate complexity and unlock value. Adyen has deliberately positioned itself as more than a payments processor: its single, end-to-end platform is built to address these challenges. By consolidating payments, financial products, and data in one place, Adyen helps businesses navigate an ever-changing landscape through one integration.

With a clear ambition to be “the world’s most customer-focused financial technology platform,” Adyen has evolved from a pure payments company into a broader fintech partner. Management emphasizes that “payments are not a commodity”, underscoring Adyen’s focus on differentiated value over price. The platform delivers a “unified consumer experience across channels” (online and offline) while ensuring compliance with local regulations. By tackling cost, risk, and performance pain points for merchants, Adyen provides what it calls a “subscription to innovation” – continually rolling out new capabilities that help clients drive growth and efficiency. In essence, Adyen’s long-term strategy is to build lasting, high-value relationships by solving complex problems in global commerce. Its land-and-expand approach means entering into long-term partnerships and steadily growing its share of each customer’s business over time. This strategy has paid off in strong customer loyalty, reflected by a company-high Net Promoter Score (NPS) of 66 in 2024.

Deep Dive: The Adyen Engine

TL;DR: Hey folks – in this edition of Fintech Wrap Up, I dove into the engine behind one of the most interesting players in global payments: Adyen.

JP Morgan Payment: Same Currency Wire Flow

Wire payments are a secure way to move electronic funds from one party to another across a network of banks and transfer agencies around the world.

Transfers can happen person to person, between banks, or using a third-party service. Wires are typically high-value payments that can be used both domestically and internationally, using the same currency or cross-currency foreign exchange (FX).

🔹 Benefits

When using the Global Payments API to send wire payments, you are entitled to the following benefits of banking with J.P. Morgan:

🔹 Global Clearing

J.P. Morgan is one of the largest Global Clearing Banks with up to $10 Trillion processed a day.

🔹 Processing Speed

J.P. Morgan offers processing often in under 2 minutes with a High STP Rates of 99.4% and a book transfer rate of 65.9%.

Keep reading with a 7-day free trial

Subscribe to Fintech Wrap Up to keep reading this post and get 7 days of free access to the full post archives.