Reports: Embedded Finance: Before & After AI; How Digital G2P Payments Benefit Governments; Payments as a Service: The Fast Track to Payments Modernization;

This week, I’ve been diving into some pretty insightful reports that paint a clear picture of where fintech is heading. Let’s get into it.

Insights & Reports:

1️⃣ B2B Buy Now, Pay Later: A Huge Emerging Opportunity

2️⃣ Embedded Finance: Before & After AI

3️⃣ Redefining success: A new playbook for African fintech leaders

4️⃣ How Digital G2P Payments Benefit Governments

5️⃣ Payments as a Service: The Fast Track to Payments Modernization

TL;DR:

Hey everyone — welcome back to another edition of Fintech Wrap Up! This week, I’ve been diving into some pretty insightful reports that paint a clear picture of where fintech is heading. Let’s get into it.

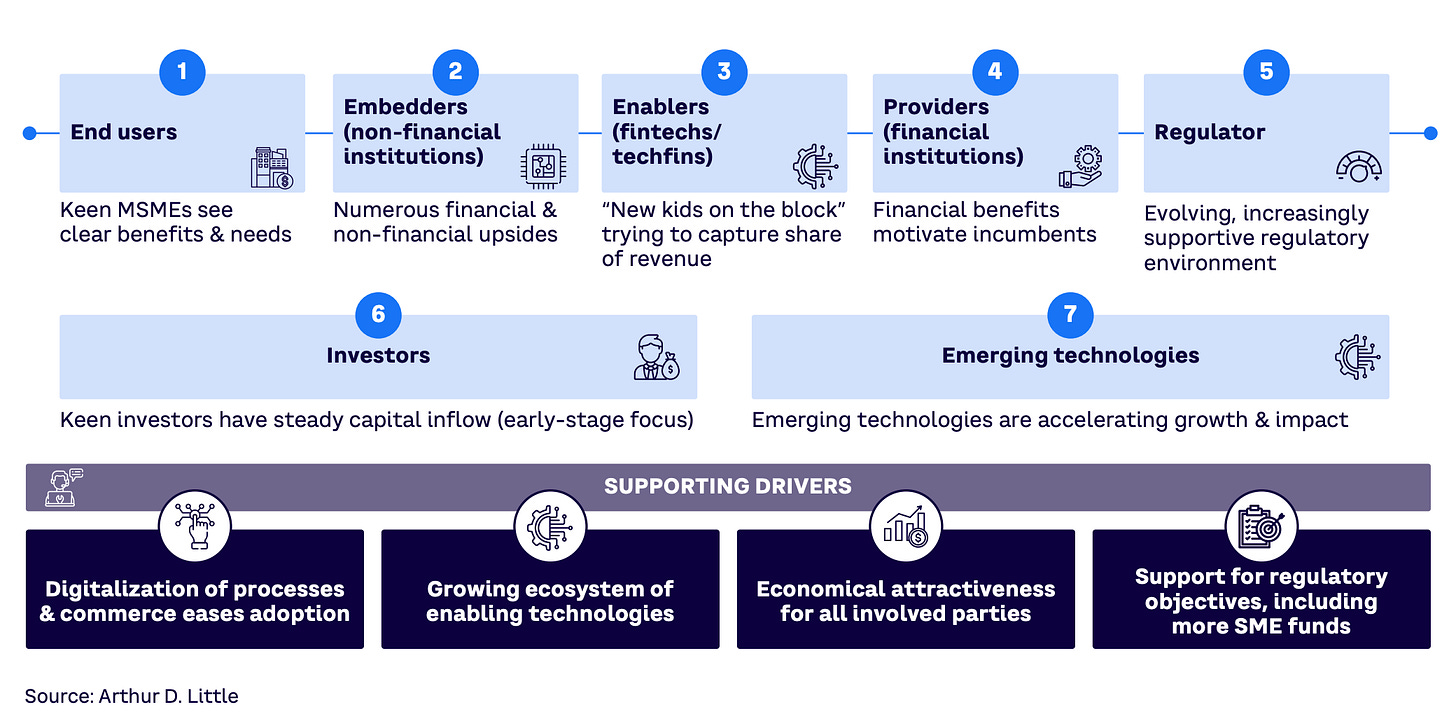

First up, B2B Buy Now, Pay Later is making waves and, frankly, it’s about time. While B2C BNPL has been in the spotlight, the B2B side is a much bigger beast—five times the market size, with higher transaction volumes and stronger repeat business potential. What’s exciting is how it’s solving liquidity and funding challenges for small businesses, especially when embedded into marketplaces and supplier platforms. It’s not just about deferred payments anymore—it’s about smarter trade credit at scale.

Next, I explored how AI is reshaping embedded finance. It’s moving beyond just chatbots and credit scoring—now we’re talking biometric authentication, real-time fraud detection, voice-activated payments, and even sentiment analysis for wealthtech. AI is making embedded finance faster, safer, and more personalized. It’s the “before and after AI” moment for this sector.

Over in Africa, fintech is entering a new era—one that’s less about hypergrowth and more about sustainable value. McKinsey’s latest report shows funding is shifting from equity to debt, partnerships between banks, telcos, and disruptors are increasing, and fintechs are embedding services into verticals like energy and healthcare. The takeaway? If you’re in African fintech, it’s time to tighten operations, verticalize smartly, and think long-term.

Then there’s digital G2P payments, which are proving to be game-changers for public finance. From India’s biometric pension cards to Mexico’s targeted welfare disbursements, digitizing government payouts has reduced fraud, boosted transparency, and even stimulated local economies. Imagine stimulus cards that double as economic engines—like Jersey’s £100 prepaid card that generated a £10M boost for local merchants.

Lastly, I geeked out on Payments as a Service (PaaS). This is the behind-the-scenes transformation that’s powering modern fintech stacks. PaaS offers real-time processing, ISO 20022 integration, and cloud-native flexibility—essentially, it’s what’s letting companies ditch legacy systems and launch new payment flows faster. Think B2B payments with FX built-in, automated payables, or microtransactions for IoT. It's also becoming the backbone for BaaS and embedded finance, with compliance and analytics baked in.

That’s all for now. As always, if you found this interesting, hit reply or share with a fintech friend. Let’s keep the conversation going!

Insights

Reports

B2B Buy Now, Pay Later: A Huge Emerging Opportunity

BNPL is a type of short-term financing that allows customers to purchase goods and services but pay for them in full later, or over time in installments. BNPL offers convenience and flexibility and drives affordability, making it a popular short-term financing option for retail consumers shopping in both e-commerce and brick-and-mortar modes. However, BNPL is not only relevant for B2C; it is even more important for B2B, where the well-known and much-used trade credit has been firmly established as a deferred payment solution.

In principle, B2B BNPL works in the same manner as B2C BNPL, but the end customer is a company instead of an individual. It is offered by individual suppliers or through marketplaces. Individual suppliers are companies that supply other businesses with their products, such as machinery, office furniture, and so forth. These companies can be found across many industries and in different sizes, from micro-, small-, and medium-sized enterprises (MSMEs) to large corporates. They typically require multichannel BNPL solutions to cover in-person and online sales.

Marketplaces are platforms that connect buyers and sellers of goods or services, typically in a specific industry or across several industries. Their number has grown significantly in the last decade — and because they are digital in nature — they are especially inclined to use digital BNPL solutions.

🔹 Maximizing Benefits, Managing Risks

B2B BNPL deserves serious attention and consideration as it addresses two major challenges in the B2B environment:

Keep reading with a 7-day free trial

Subscribe to Fintech Wrap Up to keep reading this post and get 7 days of free access to the full post archives.