Deep Dive: The Adyen Engine

In this edition of Fintech Wrap Up, I dove into the engine behind one of the most interesting players in global payments: Adyen

TL;DR:

Hey folks – in this edition of Fintech Wrap Up, I dove into the engine behind one of the most interesting players in global payments: Adyen. The company has been quietly but powerfully evolving from a payments processor into a full-blown financial technology partner. In 2024, they doubled down on their all-in-one platform approach, making big moves in AI, embedded finance, and unified commerce – think smarter routing, seamless omnichannel experiences, and even branded payout cards for platforms. Adyen's land-and-expand strategy is clearly paying off, with a record NPS of 66 and nearly €2B in net revenue (+23% YoY). They’ve been scaling across the U.S., India, and Brazil while keeping profitability strong – with a 50% EBITDA margin to prove it. It’s a masterclass in high growth without compromising customer obsession. If you're into platform strategy, AI-driven optimization, or embedded financial infrastructure, there’s a lot to unpack and learn from how Adyen is shaping the future of fintech.

Evolving Strategy in a Changing Payments Landscape

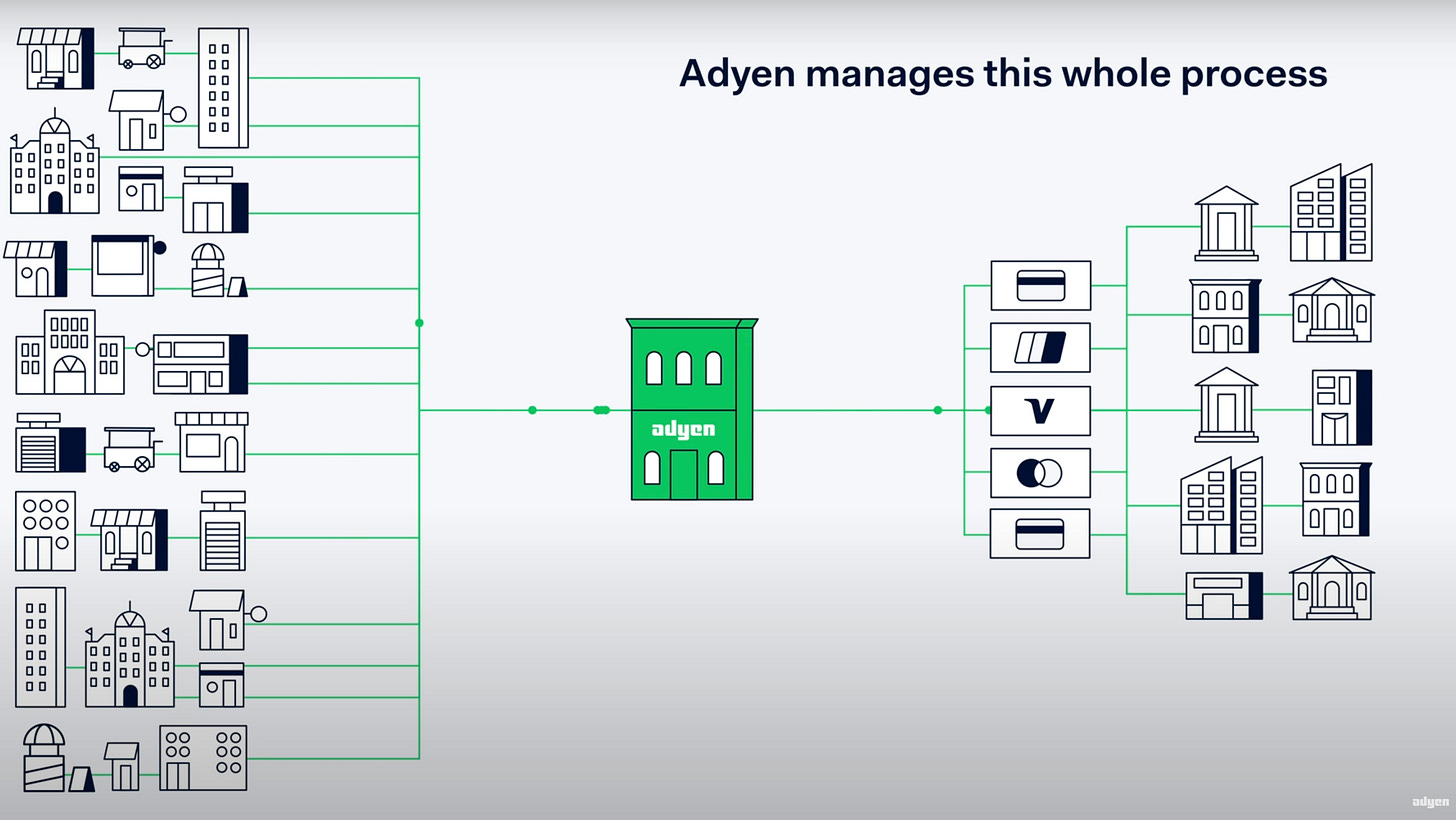

The global commerce and payments landscape is rapidly evolving, and Adyen’s strategy reflects this reality. Consumers expect to buy online, in-store, and everywhere in between, pushing businesses to offer seamless and personalized payment experiences across channels. Meanwhile, payment preferences vary widely by market, new local payment methods emerge, and regulatory demands grow – all driving companies to seek a financial technology partner that can navigate complexity and unlock value. Adyen has deliberately positioned itself as more than a payments processor: its single, end-to-end platform is built to address these challenges. By consolidating payments, financial products, and data in one place, Adyen helps businesses navigate an ever-changing landscape through one integration.

Keep reading with a 7-day free trial

Subscribe to Fintech Wrap Up to keep reading this post and get 7 days of free access to the full post archives.