What is Payment Connectivity?; Four Roles That Banks Can Play in BaaS; How to Set Up a Challenger Bank - Key Considerations;

Welcome to a new edition of the Fintech Wrap Up, your quick dive into the biggest shifts in finance

Insights & Reports:

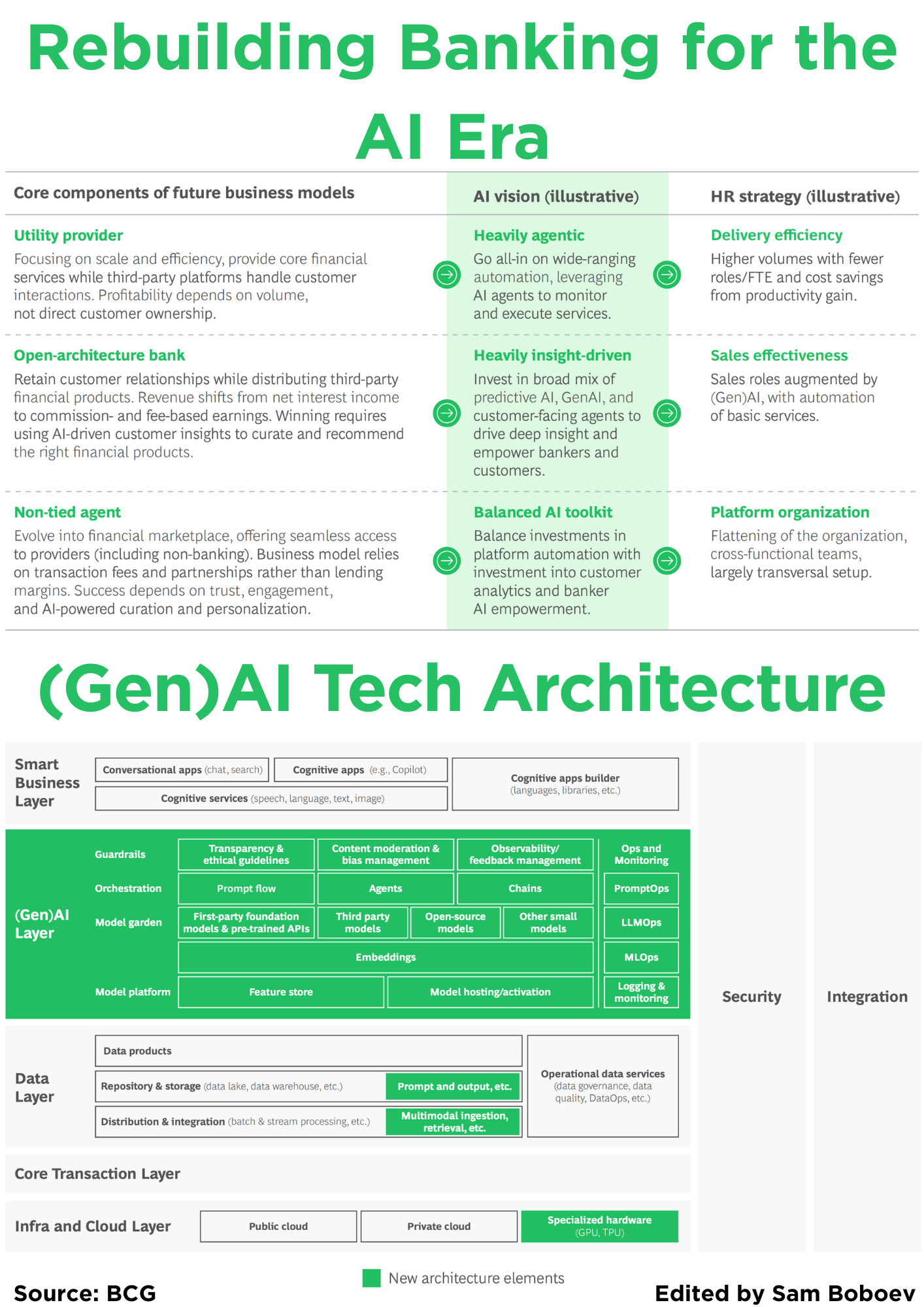

1️⃣ Rebuilding Banking for the AI Era

2️⃣ How to Set Up a Challenger Bank - Key Considerations

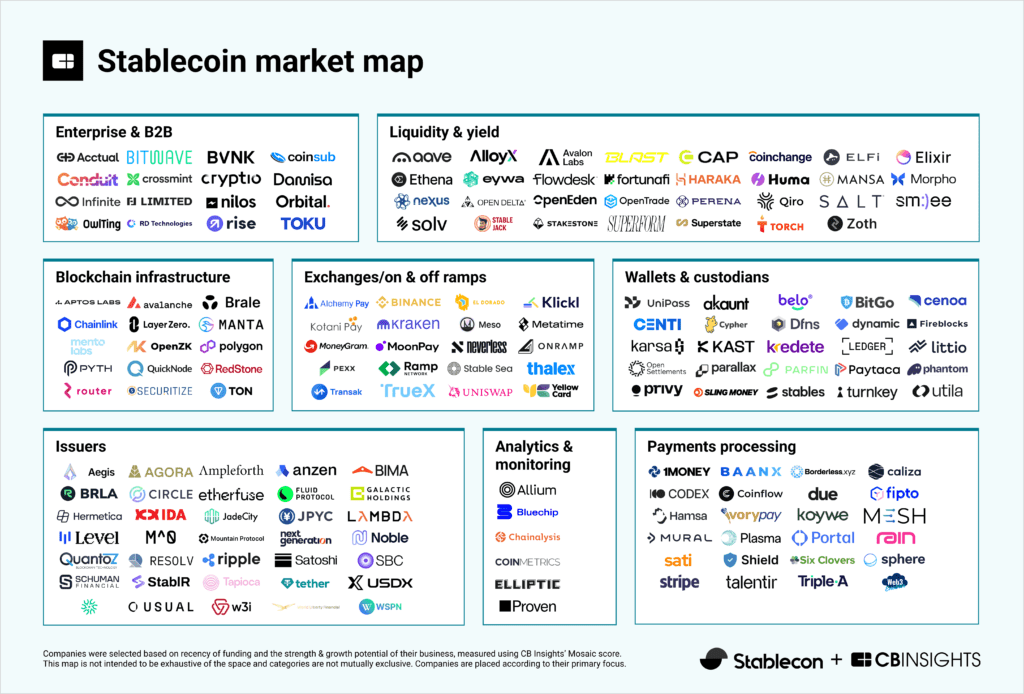

3️⃣ Stablecoins – Treasury and Cash Management Use Case

4️⃣ Four Roles That Banks Can Play in BaaS

5️⃣ Stablecoin Market Map Summary

6️⃣ What is Payment Connectivity?

7️⃣ Front-to-Back Digitization: The Key to Operating Leverage

8️⃣ Stripe in talks with banks over stablecoin integration

9️⃣ Rillet raises $25M from Sequoia Capital to automate general ledger systems using AI

TL;DR:

Welcome to a new edition of the Fintech Wrap Up, your quick dive into the biggest shifts in finance. This week we cover how AI is reshaping banking, the evolving challenger bank playbook, stablecoins in treasury, and the new roles banks are taking in embedded finance.

AI is now a core priority for banks—not just a tech upgrade. BCG notes that success requires rethinking strategy, modernizing infrastructure, and upskilling teams. Leading banks like JPMorgan are building internal AI tools and training executives, but most are still catching up. Real-time data orchestration and governance are key to making AI work at scale.

Challenger banks, meanwhile, are building smarter. Arthur D. Little suggests phased rollouts with salary accounts, digital wallets, and ESG features. Beyond banking, they’re bundling services like trade advisory and logistics to deepen business relationships. Fintech partnerships are also helping them scale faster and offer more without building everything in-house.

Stablecoins are gaining traction in treasury use cases, offering instant liquidity and reduced FX risk. BCG highlights how firms like SpaceX and Ferrari use stablecoins for cross-border transfers and repo transactions. But limitations—like infrastructure gaps and FX friction—remain, even as banks begin integrating stablecoin flows into their systems.

Banks are also evolving in the BaaS ecosystem—as integrators, producers, or full platform providers. By embedding services into third-party channels and APIs, institutions like BBVA and Starling are unlocking new revenue and market access.

Lastly, front-to-back digitization is emerging as the key to real productivity. Despite big tech spend, many banks still lag due to siloed operations. BCG shows that shifting to value-stream-based teams and automated back offices can deliver real gains in efficiency, agility, and customer satisfaction.

In the news: Stripe is deepening its stablecoin work with banks, Rillet raised $25M from Sequoia to automate ledgers with AI, and Monzo hit £1B in revenue as a third of customers now use it as their main bank.

Until next time—keep building, keep rethinking.

Reports

Insights

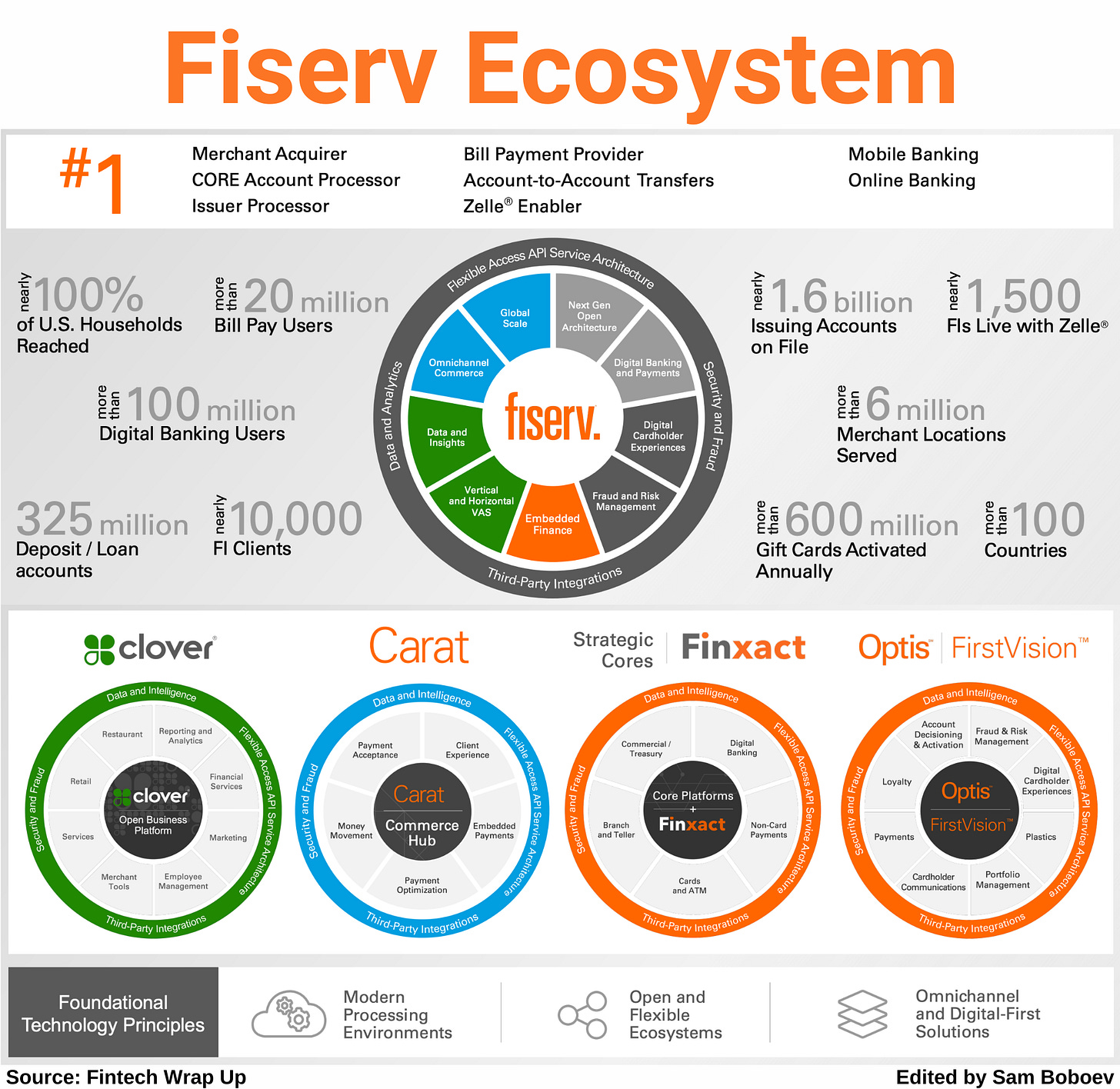

Deep Dive: Inside the Fiserv Flywheel

Fiserv might not grab fintech headlines like flashier startups, but this Fortune 500 financial technology provider is in the midst of a significant evolution. The company has transformed from a traditional back-office tech vendor for banks into a powerhouse of merchant payments and commerce enablement. Today, Fiserv handles over $20 billion in annual revenue and has delivered double-digit growth for decades. With a leadership transition underway and ambitious plans for its flagship platforms – Clover for small businesses and Carat for large enterprises – Fiserv’s strategy and performance warrant a closer look. Why does Fiserv’s evolution matter now? Because it shows how a legacy player can leverage scale, product innovation, and strategic focus to thrive in a fast-changing fintech landscape.

In this deep dive, we’ll unpack Fiserv’s business and product strategy, zoom in on Clover and Carat (including key growth metrics), examine its push into international markets, review recent financial performance and outlook, and discuss the implications of the CEO handoff from Frank Bisignano to Mike Lyons. The picture that emerges is of a company doubling down on an integrated vision of payments and banking – and executing on that vision with notable success. Let’s start with how Fiserv frames its game plan.

Rebuilding Banking for the AI Era

AI is pushing banks to fundamentally transform—not just experiment. To stay competitive, banks must rethink strategy, retool tech and data, upgrade governance, and ready their workforce.

1. Rethink Strategy

Banks must define where AI gives them a lasting edge. Three strategic models are emerging:

- Utility providers: Focused on operational efficiency.

- Open-architecture banks: Offer curated, personalized products.

- Financial marketplaces: Connect customers to a range of services.

Each model uses AI differently but all move beyond traditional lending toward intelligent, customer-centric platforms.

2. Retool Tech and Data

AI success depends on deep system changes, not surface-level fixes.

- Orchestration is critical: Banks need systems that route the right data to the right AI models—especially with GenAI and SLMs.

- Data is the bottleneck: Most failures come from slow, fragmented data. Fixing this requires modern integration, robust governance, and reducing technical debt.

- Modern infrastructure: Legacy systems can’t support real-time AI. Banks must move to hybrid, event-driven systems that support APIs and microservices.

3. Upgrade Governance

Regulators are setting new expectations:

- EU AI Act sets the broadest rules so far, affecting the full AI value chain.

- U.S. and U.K. regulators fold AI into existing financial oversight—but fragmentation in the U.S. adds complexity.

Banks must now govern their own and third-party models, focusing on bias, explainability, and system risk. Standard Chartered and others are already deploying AI to monitor fraud and compliance.

4. Prepare the Organization

Keep reading with a 7-day free trial

Subscribe to Fintech Wrap Up to keep reading this post and get 7 days of free access to the full post archives.