Deep Dive: Inside the Fiserv Flywheel

How Fiserv is expanding Clover and Carat, unlocking value-added services, and driving growth across global markets

A Fintech Giant’s Next Chapter

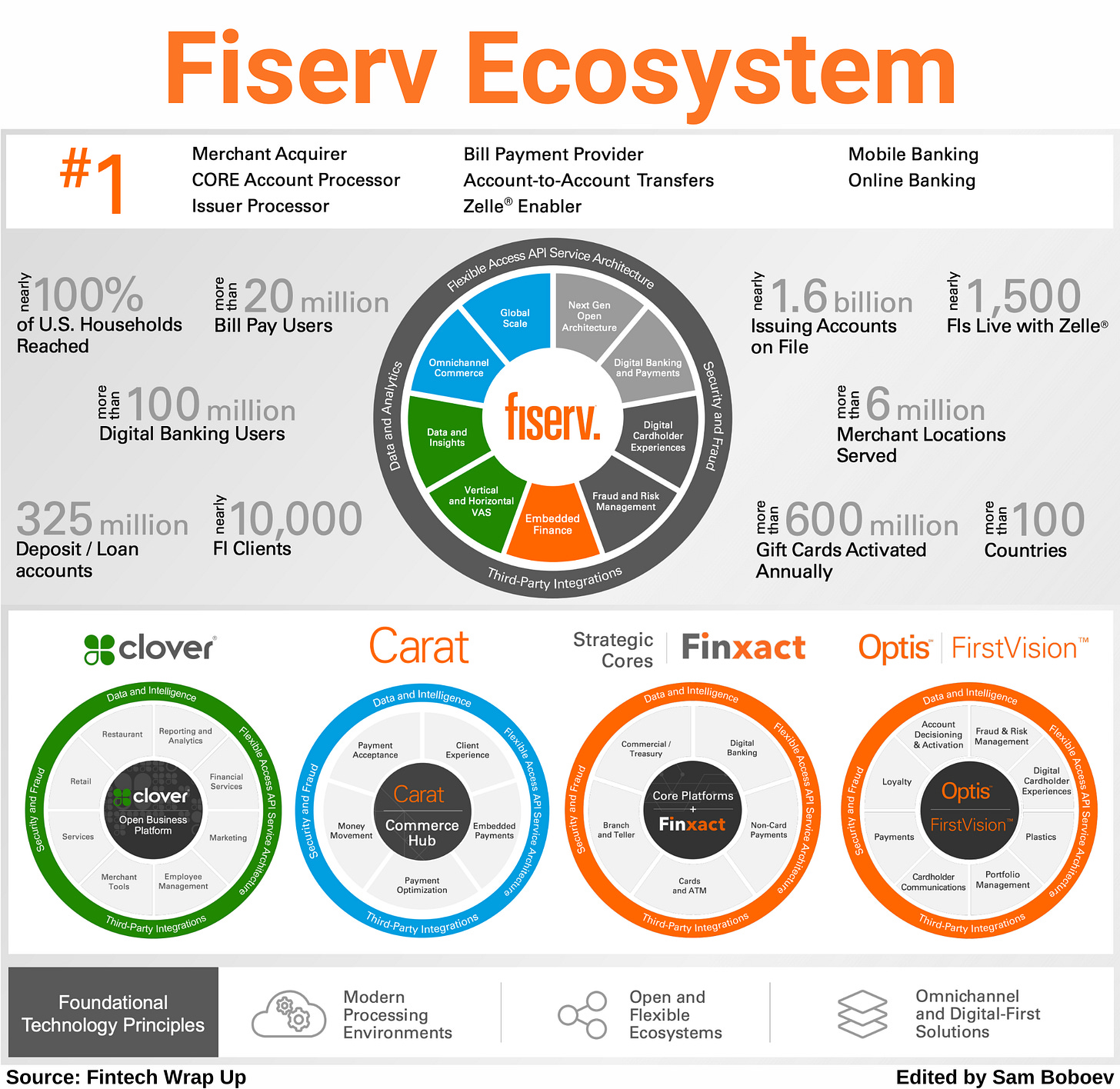

Fiserv might not grab fintech headlines like flashier startups, but this Fortune 500 financial technology provider is in the midst of a significant evolution. The company has transformed from a traditional back-office tech vendor for banks into a powerhouse of merchant payments and commerce enablement. Today, Fiserv handles over $20 billion in annual revenue and has delivered double-digit growth for decades. With a leadership transition underway and ambitious plans for its flagship platforms – Clover for small businesses and Carat for large enterprises – Fiserv’s strategy and performance warrant a closer look. Why does Fiserv’s evolution matter now? Because it shows how a legacy player can leverage scale, product innovation, and strategic focus to thrive in a fast-changing fintech landscape.

In this deep dive, we’ll unpack Fiserv’s business and product strategy, zoom in on Clover and Carat (including key growth metrics), examine its push into international markets, review recent financial performance and outlook, and discuss the implications of the CEO handoff from Frank Bisignano to Mike Lyons. The picture that emerges is of a company doubling down on an integrated vision of payments and banking – and executing on that vision with notable success. Let’s start with how Fiserv frames its game plan.

Business and Product Strategy Overview

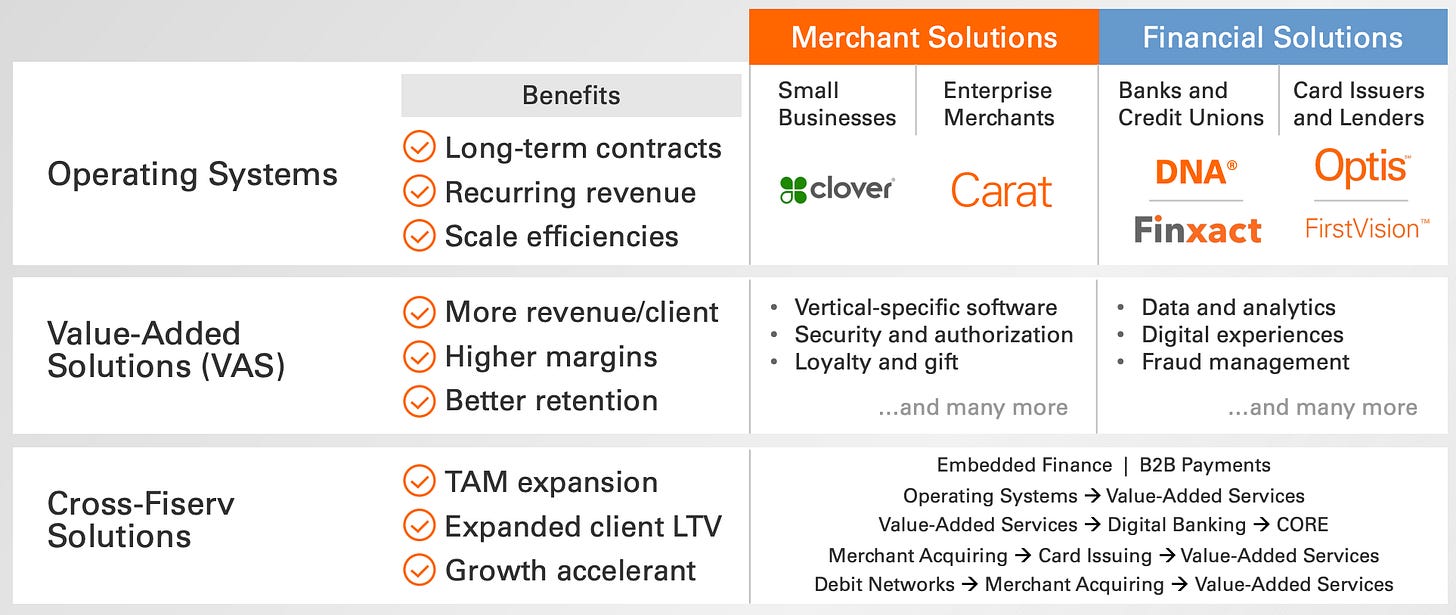

Fiserv’s overarching strategy revolves around integrating its merchant payments capabilities with its financial institution tech. After years of acquisitions (most notably its 2019 First Data merger) and internal development, Fiserv now sits “at the intersection of commerce and banking,” according to new CEO-elect Mike Lyons. This unique model – housing merchant acquiring, point-of-sale technology, core banking systems, and digital payment networks under one roof – creates cross-selling opportunities that Fiserv is eager to exploit. Lyons observes that having the Merchant and Financial Institution businesses together allows Fiserv to “discover new ways for these client segments to work together,” unlocking long-term growth opportunities for all parties.

In practical terms, this means enabling merchants to bundle financial services (for example, offering point-of-sale lending or deposit products in conjunction with payments) and helping banks regain wallet share with small business clients by equipping them with modern payment tools. Fiserv is pushing into embedded finance as well – Lyons notes that merchants like Walmart are using multiple Fiserv solutions spanning merchant acquiring and banking technology, a trend the company plans to grow. A recent example is Fiserv’s acquisition of Payfare, which brings in capabilities to embed financial services (like payouts and digital wallets) into commercial client offerings.

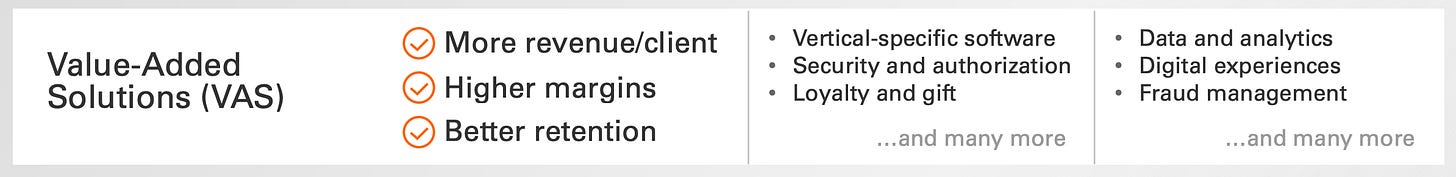

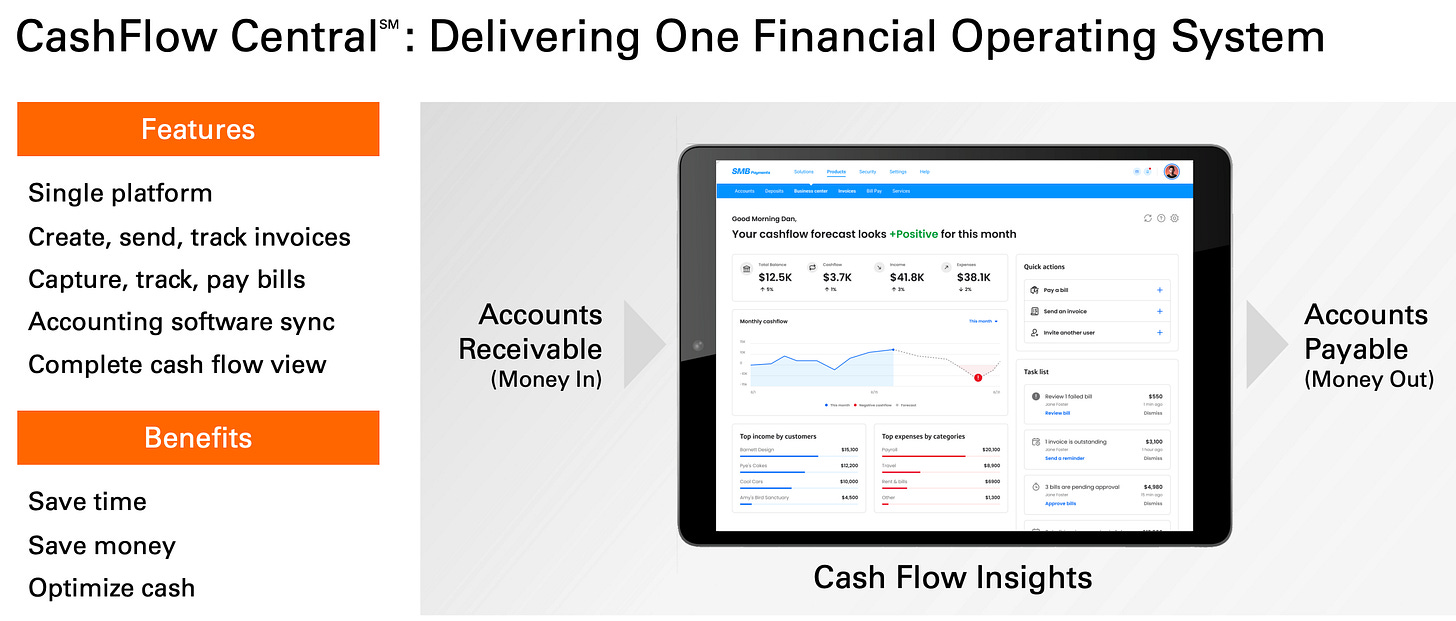

Another core pillar of Fiserv’s strategy is expanding Value-Added Services (VAS) across its client base. Rather than competing on price alone, Fiserv is deepening relationships by offering more software and services on top of payment processing. In 2024 the company introduced multiple new vertical software solutions on Clover, its small-business platform, and launched CashFlow Central℠, a new accounts payable/accounts receivable solution for business clients. Fiserv even struck partnerships like one with ADP® to sell payroll services through Clover – with ADP in turn reselling Clover and CashFlow Central – all aimed at broadening the suite of services merchants get through Fiserv. This focus on VAS not only creates new revenue streams, but also “deepens client relationships and drives value-based (versus price-based) conversations,” Lyons explains.

Keep reading with a 7-day free trial

Subscribe to Fintech Wrap Up to keep reading this post and get 7 days of free access to the full post archives.