What are the Implications of Pay by Bank on Different Players?; eCommerce: Payment Metrics and Tactics; Primary(P) and secondary(S) policy objectives driving Open Banking and Open Finance;

This week, I’m unpacking Robinhood’s bold fintech pivot, the policy drivers behind Open Banking, and what’s shaping payment and crypto regulation in 2025.

Insights & Reports:

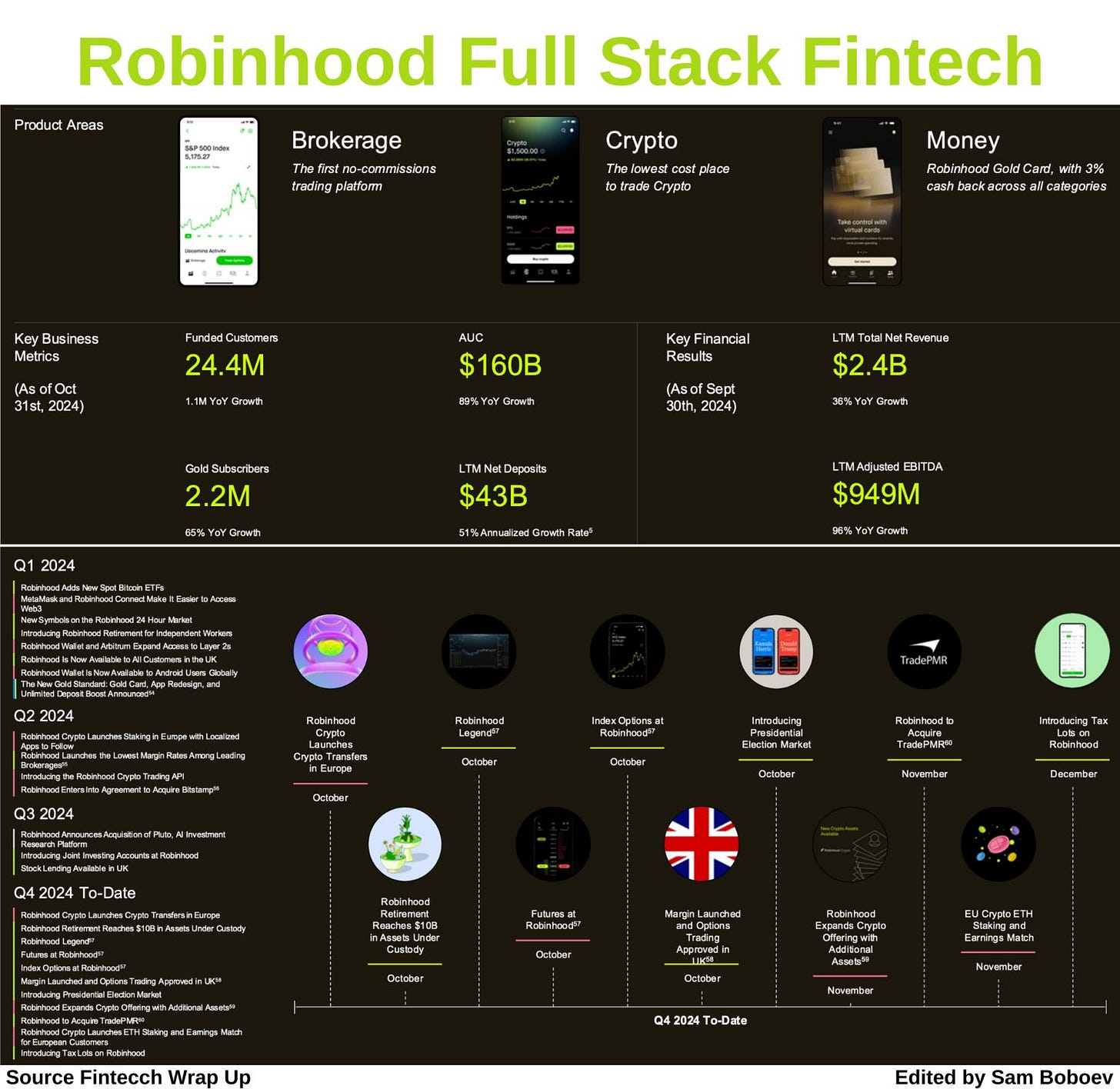

1️⃣Deep Dive: Robinhood’s Full-Stack Fintech Transformation

2️⃣Primary(P) and secondary(S) policy objectives driving Open Banking and Open Finance implementation

3️⃣Core Banking Modernisation: Selecting the Right Strategy

4️⃣eCommerce: Payment Metrics and Tactics

5️⃣Top 10 merchant acquirers processed $10.6 trillion in 2024

6️⃣What are the Implications of Pay by Bank on Different Players?

7️⃣Global Crypto Regulatory Trends for 20251. U.S. Shifts Toward Clarity

8️⃣Kraken Teams Up With Mastercard to Introduce Crypto Debit Cards

9️⃣Visa Is Joining the Paxos, Robinhood Stablecoin Consortium

TL;DR:

This week’s Fintech Wrap Up is packed with big moves and fresh insights shaping the future of finance. Let’s dive right in.

First up, Robinhood is going full-stack—and I mean really full-stack. At its latest Gold Keynote, the company dropped three major announcements: Robinhood Strategies (personalized portfolios managed by pros), Robinhood Banking (coming soon with a juicy 4.00% APY and wealth perks), and Robinhood Cortex, their AI-powered investing assistant. It's clear Robinhood is gunning for that all-in-one financial ecosystem status, and in this edition, I broke down their bold transformation and what it could mean for the industry.

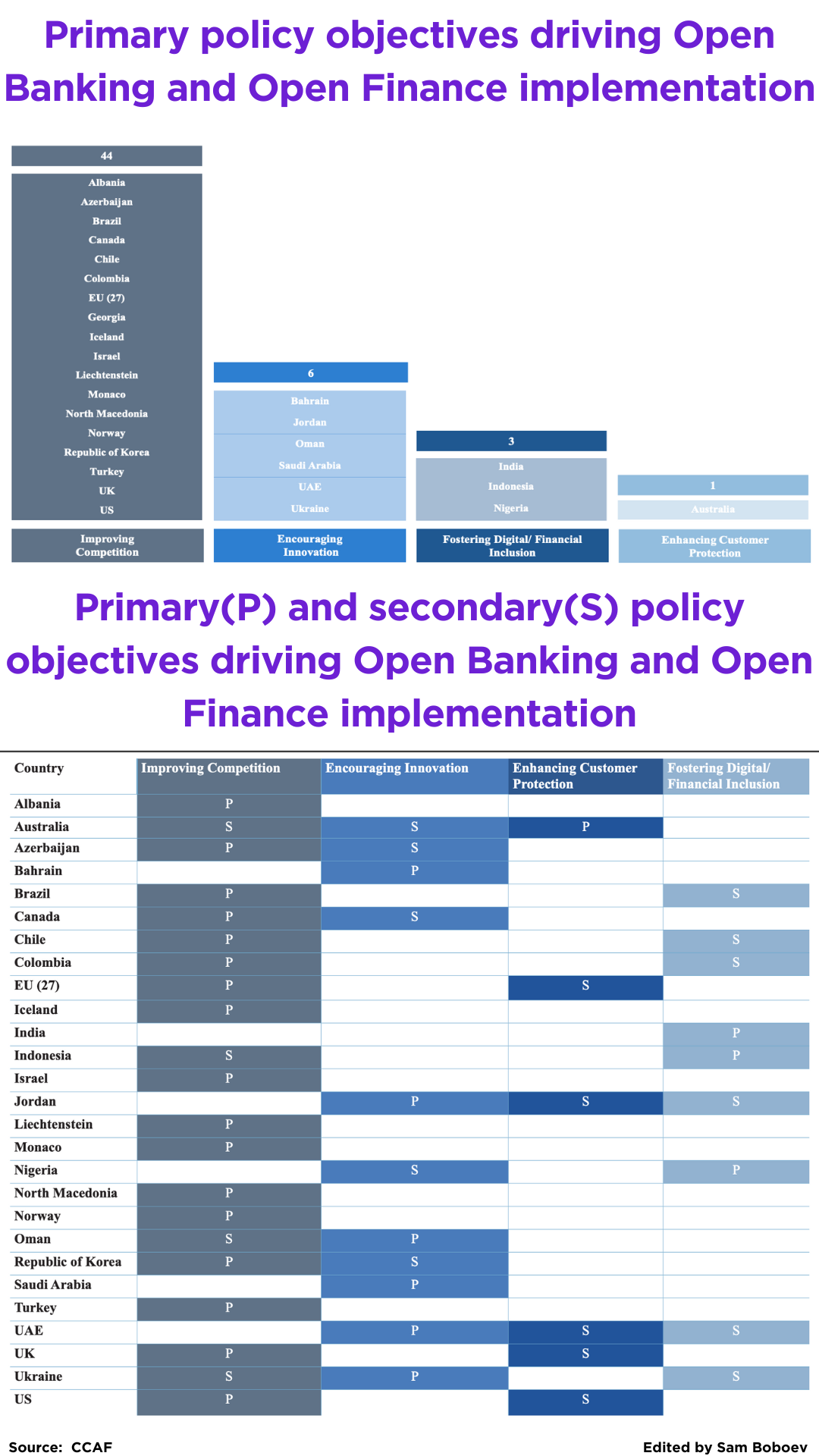

Switching gears to Open Banking and Open Finance—new research shows that across 44 jurisdictions, the primary policy driver is boosting competition. But that’s just part of the picture. From promoting inclusion in emerging markets to sparking innovation in the MENA region, these policies are deeply interconnected and shaping how financial services evolve globally.

Also on the radar: core banking modernisation. Whether you're hollowing out the legacy core, going greenfield, or augmenting existing systems, it’s all about starting with a clear vision and delivering value early. There’s no one-size-fits-all approach, and I loved the nuanced take from Thought Machine on how banks can balance control, cost, and speed.

For eCommerce pros, the latest data shows six payment metrics—like success rate, loss rate, and cost of payments—are now seen as critical across the board. Interestingly, tokenization is slightly down overall, but network tokens are holding strong. And when it comes to improving authorization, SCA and auto-retries are still the go-to tactics, especially among MRC members and enterprise players.

Speaking of scale, the top 10 US merchant acquirers processed a jaw-dropping $10.6 trillion in card volume in 2024. JPMorganChase led the pack with $2.6 trillion, while Square served the most merchants. It’s a reminder that the acquiring market is becoming more concentrated—and more reliant on software-led, integrated solutions.

On the innovation front, Pay by Bank is picking up steam. From smoother consumer experiences to huge cost savings for merchants and new data-driven opportunities for banks, it’s a win-win… mostly. Card networks and processors need to evolve fast to stay relevant, and early fraud risks still need addressing. But overall, it's a shift worth watching closely.

Regulatory clarity is also (finally) coming into focus for crypto. The U.S. is working on cleaner rules, Asia’s leading with clear frameworks, and Europe’s MiCAR is rolling out—albeit unevenly. Meanwhile, DeFi’s under the microscope, and stablecoins are being scrutinized everywhere. Whether it’s the FATF Travel Rule or tokenized bonds, crypto’s collision course with traditional finance is picking up pace.

And before I go—some headlines worth your time: Kraken is teaming up with Mastercard for crypto debit cards, Visa is reportedly joining the stablecoin initiative with Paxos and Robinhood, and Dutch neobank bunq just hit profitability again as it gears up for U.S. expansion.

Reports

Insights

Deep Dive: Robinhood’s Full-Stack Fintech Transformation

Robinhood just made its boldest move yet toward becoming the ultimate all-in-one fintech platform. In this Deep Dive edition of Fintech Wrap Up, I took a closer look at Robinhood’s bold transformation into a full-stack fintech powerhouse.

On March 27, 2025, Robinhood made waves again. At its second annual Gold Keynote, the company unveiled three major products—Robinhood Strategies, Robinhood Banking, and Robinhood Cortex—all designed to bring private banking and professional-grade investing tools to everyday users.

🔹 Robinhood Strategies offers personalized, expert-managed portfolios right inside the app—think of it as wealth management without the Wall Street minimums. Gold members even get assets above $100K managed for free, capped at $250/year.

🔹 Robinhood Banking, launching later this year, is set to deliver a premium banking experience with 4.00% APY on savings, estate and tax planning support, and luxury perks—all wrapped into a mobile-first experience.

🔹 Robinhood Cortex is their upcoming AI-powered investing assistant, designed to help users analyze markets, build trades, and act on insights in real time.

These bold moves aren’t just about product expansion—they’re a clear signal of where Robinhood is headed: toward becoming a full-stack financial ecosystem for the next generation.

So, in light of these announcements, I wanted to take a step back and ask: Where is Robinhood really going? What’s the strategy, and how do these launches fit into the big picture?

Let’s break it down. 👇

Primary(P) and secondary(S) policy objectives driving Open Banking and Open Finance implementation

Regardless of whether a jurisdiction has a single authority, or multiple authorities involved in the process, there are always specific policy objectives that inform their actions.

These objectives typically fall into four main categories, each designed to address distinct aspects of the financial ecosystem. Understanding these policy objectives is essential for developing an accurate picture of Open Banking and Open Finance, as they not only influence the strategic direction but also shape the regulatory landscape and the market’s response to these frameworks. This analysis included reviewing government documents, press releases and discussions with stakeholders in various jurisdictions, which enabled a comprehensive understanding of both primary and secondary objectives. In doing so, a distinction was made between primary objectives, explicitly stated as the key drivers of policy, and secondary objectives, which, while often mentioned alongside the primary goal, were not the focus of regulatory efforts. Figure below summarises how various regulation-led jurisdictions have prioritised these primary policy objectives in their adoption of Open Banking and Open Finance.

The primary policy objective of these initiatives, identified in 44 jurisdictions, is to enhance competition within the financial services industry. This includes the 27 EU countries in which Open Banking is driven by a competition mandate. Additionally, fostering innovation and promoting digital and financial inclusion serve as primary objectives across a selection of emerging markets and developing economies. Interestingly, in five out of six jurisdictions in the MENA region, the primary policy objective is “Encouraging Innovation”. Notably, none of the jurisdictions analysed, except Australia, have chosen “Enhancing Customer Protection” as their primary objective.

Keep reading with a 7-day free trial

Subscribe to Fintech Wrap Up to keep reading this post and get 7 days of free access to the full post archives.