Reports: Europe Diving Into Crypto; Modern Card Issuer: Driving Customer Lifetime Value Through Innovation; Understanding digital identity (eID);

Welcome to the first-ever Reports edition of Fintech Wrap Up. Each week, I’ll be collecting the latest fintech, payments, and banking reports so you don’t have to

Reports:

1️⃣ Europe Diving Into Crypto

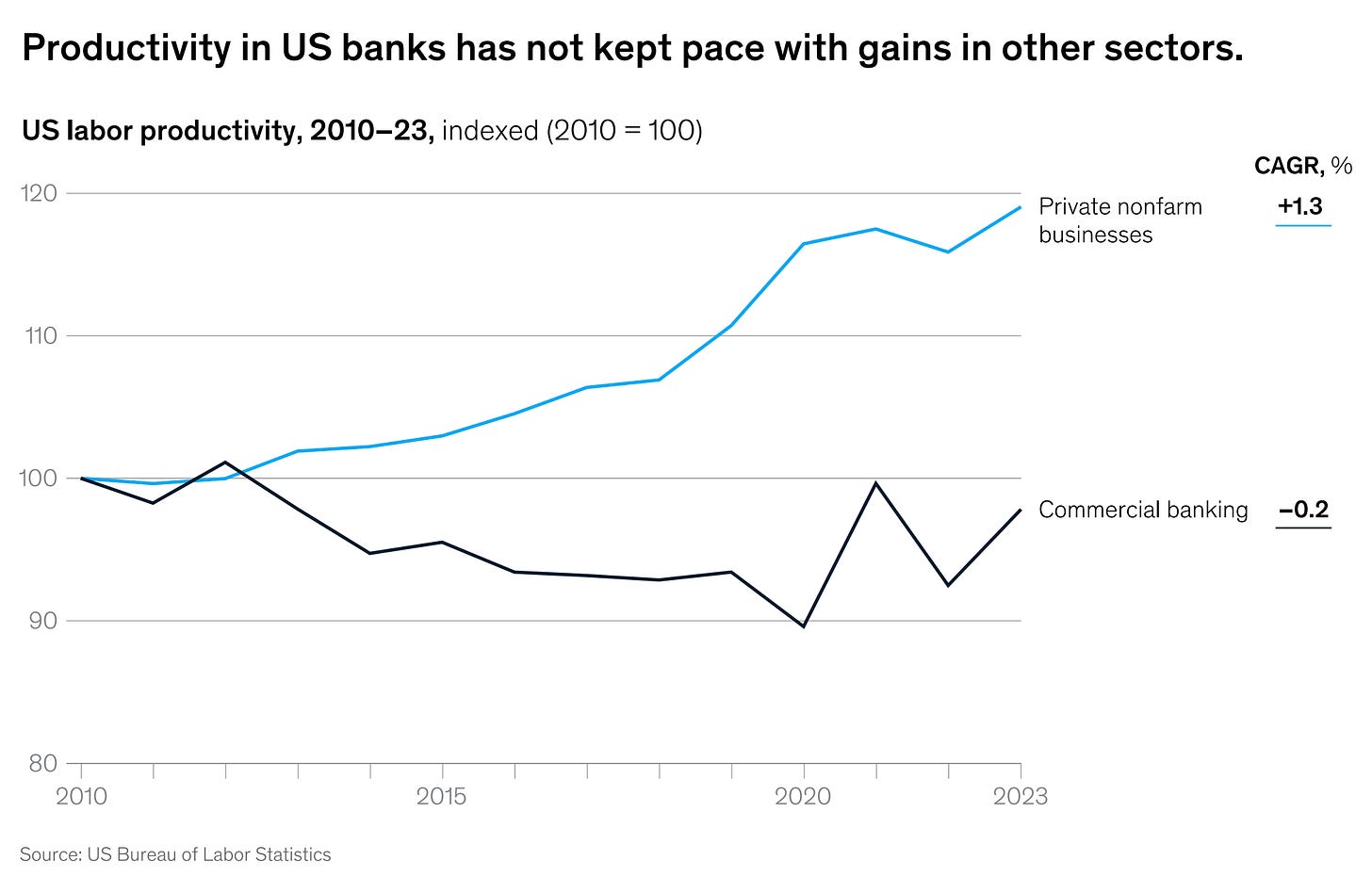

2️⃣ How banks can boost productivity through simplification at scale

3️⃣ Modern Card Issuer: Driving Customer Lifetime Value Through Innovation

4️⃣ Stablecoin Deep Dive: Supply & Usage by Asset (2025)

5️⃣ Understanding digital identity (eID)

TL;DR:

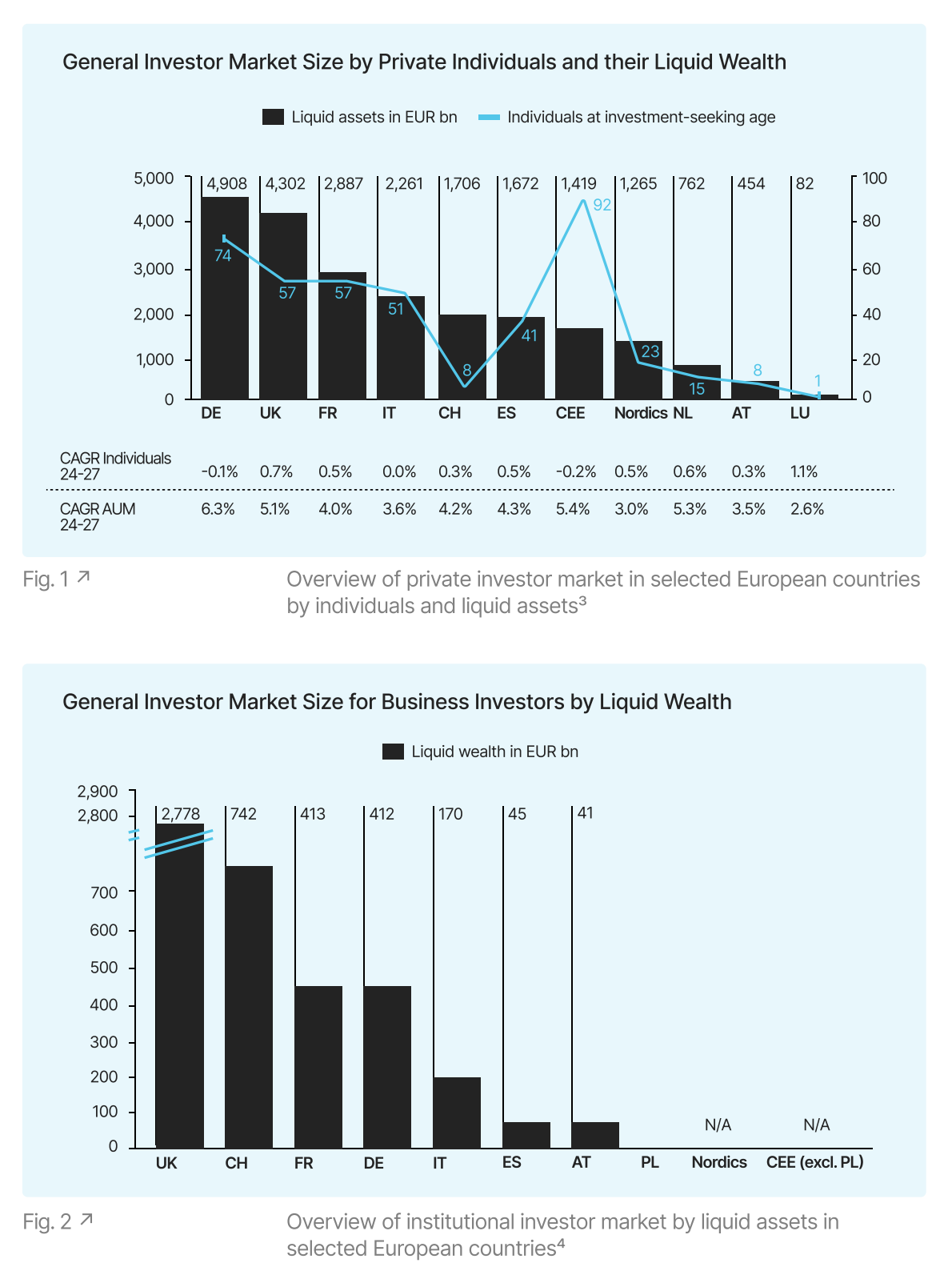

Hey Fintech Fans — I’m trying something new this week! Welcome to the very first Reports edition of Fintech Wrap Up, where I round up the most interesting fintech, banking, and payments reports. In this edition, we’re diving into five standout reports. First up, Europe is quietly but confidently diving into crypto — over 40% of business investors already hold crypto assets, and 80% of financial institutions acknowledge its growing importance (even though adoption is still slow). Then, I looked into how modern card issuers are driving Customer Lifetime Value (CLTV) through smart tech, co-branded partnerships, and better UX — turns out, high-CLTV issuers are 2x more likely to report strong business performance. McKinsey also dropped a solid framework on how banks can boost productivity by simplifying their ops — hint: it’s not just about cost-cutting, but rethinking tech, talent, and customer journeys. I also pulled some insights from a deep dive into stablecoins — USDC is gaining serious momentum thanks to regulatory clarity under MiCAR, overtaking USDT in transfer volume, especially in institutional use cases. Finally, Visa breaks down everything you need to know about digital identity (eID), from how eIDs are issued to their role in reducing friction across digital services. Whether you're in product, compliance, or strategy — there's something in here for you. Let’s dig in!

Reports

Europe Diving Into Crypto

Europe is quietly but steadily embracing crypto—and the latest insights reveal just how deep the rabbit hole goes for investors and financial institutions alike.

Key Insights into European Crypto Adoption

The report at hand gradually explores the market environment for crypto assets in Europe and provides a deep understanding of the current sentiment and preferences of investors and financial institutions (FIs). Finally, it also presents implications for FIs entering the market. Readers with little time might therefore want to take away the following eight key insights:

01 - Growing investor appetite:

More than 16% of private investors and more than 40% of business investors are already invested in crypto. Further 12% of private and 18% of business investors state that they still aim to invest in the future.

02 - Positive outlook on crypto development:

27% of private & 56% business investors are convinced that crypto will become more relevant in the next 3 years. Only 22% of private investors and 17% of business investors have

Keep reading with a 7-day free trial

Subscribe to Fintech Wrap Up to keep reading this post and get 7 days of free access to the full post archives.