Visa's Value Added Services; The SMB fintech market map; Stablecoin-based enterprise treasury management

Welcome to the latest edition of Fintech Wrap Up, where we decode the pulse of modern financial innovation.

Insights & Reports:

1️⃣Plaid - Products, Tech, and Business

2️⃣The Real Picture of SME Cross-Border Payments in Latin America and the Caribbean (LAC)

3️⃣The SMB fintech market map

4️⃣Defining Concepts Right: Embedded Finance vs. BaaS vs. Open Banking

5️⃣Stablecoin-based enterprise treasury management

6️⃣Stablecoin Regulations Gain Momentum, But Progress Varies by Region

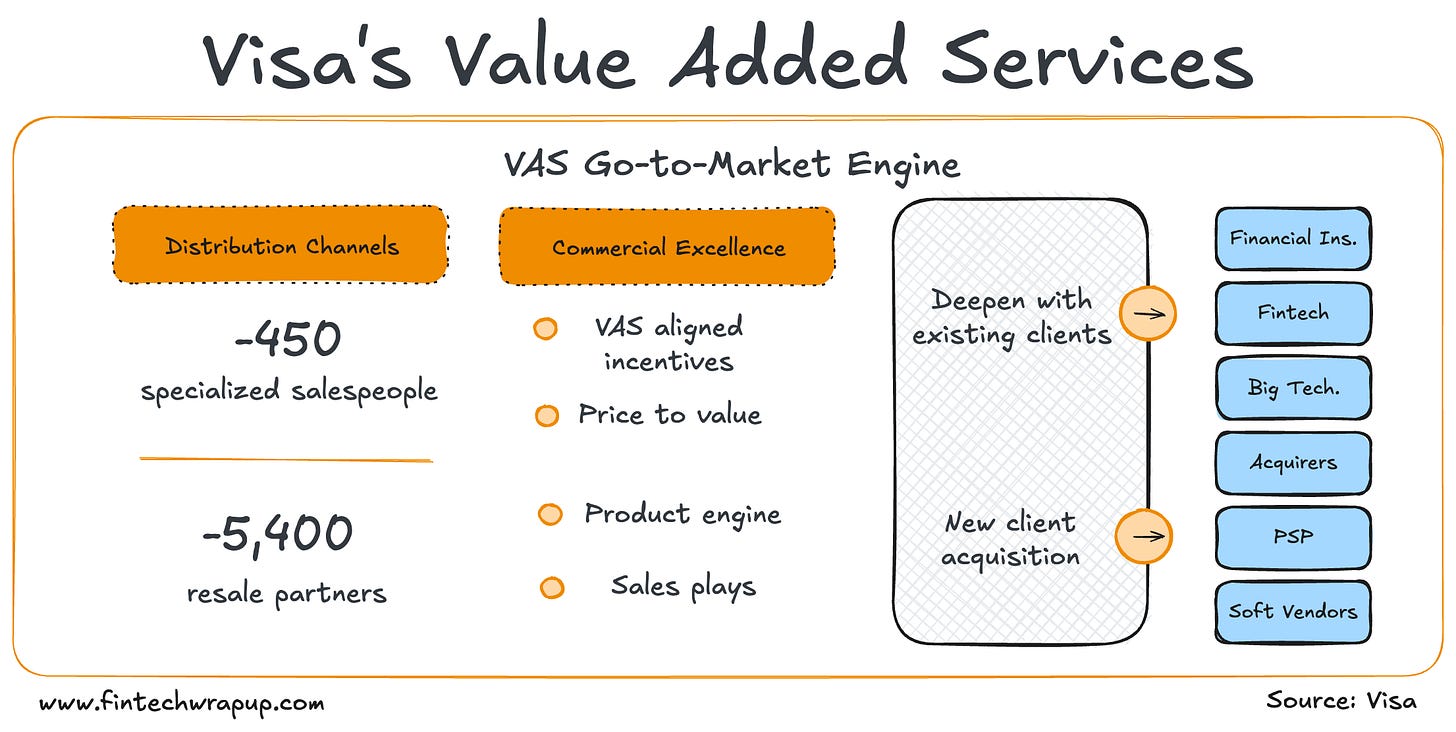

7️⃣Visa's Value Added Services

8️⃣AI Agent Payment

9️⃣PayPal Brings Crypto Payments to the Mainstream With Pay with Crypto

TL;DR:

Welcome to the latest edition of Fintech Wrap Up, where we decode the pulse of modern financial innovation. This week, we’re spotlighting the infrastructure, pain points, and breakthroughs shaping how money moves—from Plaid’s dominance in open banking to stablecoins in treasury, and AI agents making payments on-chain.

Plaid continues to cement its role as the backbone of fintech, quietly powering connectivity for over 500 million accounts via integrations with 12,000+ financial institutions globally. From powering Venmo to enabling neobanks, Plaid's secure APIs have become essential plumbing for everything from P2P payments to investing—especially in a U.S. market lacking standardized open banking rules. Its reach and reliability are what let fintechs scale quickly atop legacy systems, transforming how consumers access financial services.

In Latin America and the Caribbean, cross-border payments for SMEs remain costly, opaque, and painfully slow. A K2 study found fees on $250 transfers average over 23%, with up to 30% in some corridors like Japan-Mexico. SMEs face FX spreads, forced currency conversions, and settlement delays—nearly 20% of payments take over 10 days, and 11% fail. Digital challengers have a clear opening: offer faster, cheaper, and more transparent options, or risk banks losing SME loyalty entirely.

Meanwhile, stablecoins are gaining real traction in enterprise treasury management. They offer real-time, programmable liquidity and simplified global operations—Visa is already using them to settle cross-border payments. Paxos’ USDG even tackles stablecoin adoption hurdles by sharing reserve yield. With tokenization on the rise, stablecoins are poised to remake corporate cash flow at scale.

Also in focus: the evolving definitions of embedded finance, BaaS, and open banking. Think of embedded finance as the umbrella—BaaS delivers modular bank services, and open banking fuels them with secure data access. Together, they’re enabling a more customized and responsive fintech ecosystem.

Finally, AI agents are starting to need payment tools of their own. Traditional rails fall short for micropayments, instant settlement, and global reach—making blockchain-based payments the natural fit. As AI autonomy grows, expect crypto-powered agents to become not just likely, but necessary.

Thanks for reading Fintech Wrap Up—see you next week!

Reports

Insights

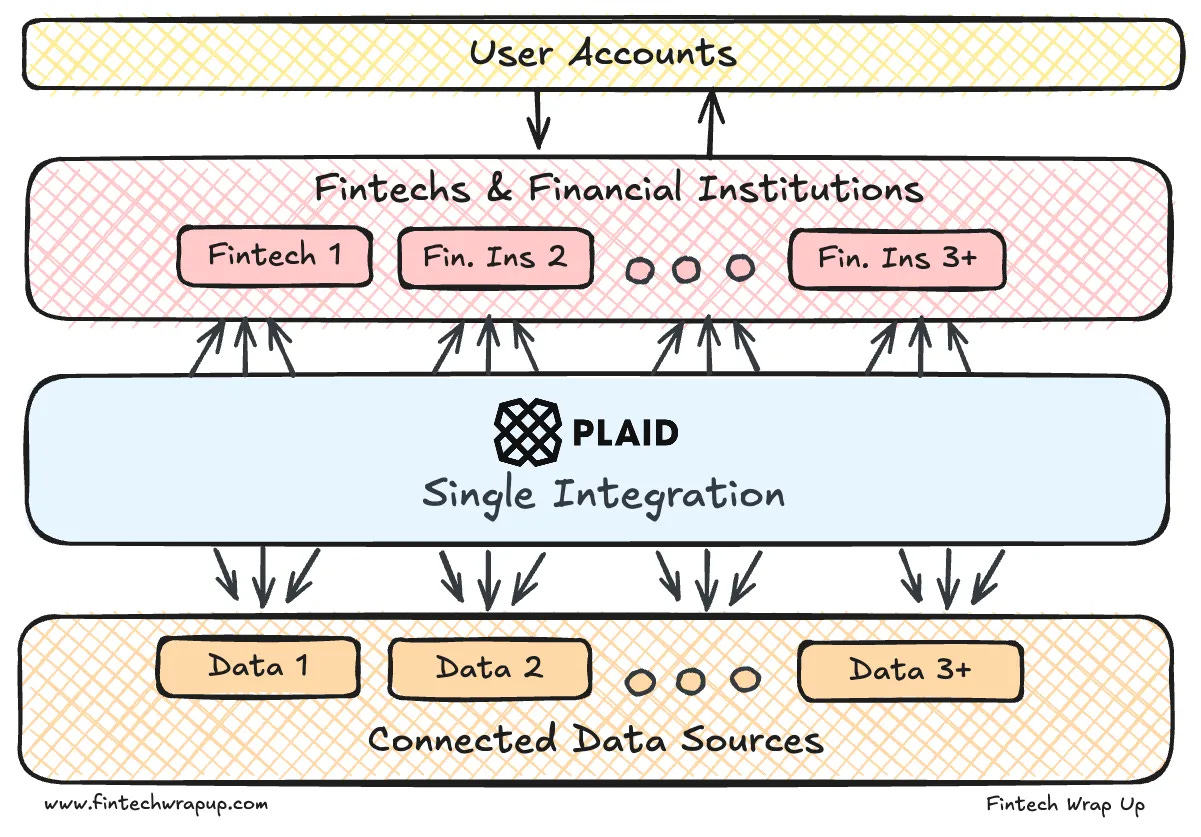

Plaid - Products, Tech, and Business

Open banking has become the backbone of modern fintech, and at the center of this ecosystem is Plaid – a company that functions as the “financial data network” connecting banks, fintech, & consumers

Open banking has become the backbone of modern fintech, and at the center of this ecosystem is Plaid – a company that functions as the “financial data network” connecting banks, fintech apps, and consumers. If you’ve ever linked your bank account to a budgeting app, a payment service, or an investment platform, chances are Plaid powered that connection behind the scenes. Plaid’s API is the invisible engine enabling popular apps like Venmo, Betterment, Chime, Dave and thousands more to securely access your financial data. In fact, Plaid maintains secure integrations with over 12,000 financial institutions across the U.S., Canada, UK, and Europe, and as of 2024 it has connected 500 million (and counting) consumer accounts worldwide. That scale means a huge portion of fintech users rely on Plaid’s plumbing – by one estimate, around one in four U.S. bank account holders had connected through Plaid as early as 2019, a figure likely even higher today. Plaid matters because it has essentially become the fabric of fintech connectivity, allowing innovative services to flourish on top of legacy banking infrastructure. It gives startups and financial giants alike a safe, reliable way to tap into bank accounts, leveling the playing field for fintech innovation in the absence of universal open-banking standards in the U.S. and beyond. In this deep dive, we’ll explore Plaid’s core products and how they power fintech applications, unpack the technology and data flows under its hood, examine its business model and pricing, and place Plaid in the broader context of the global open banking movement.

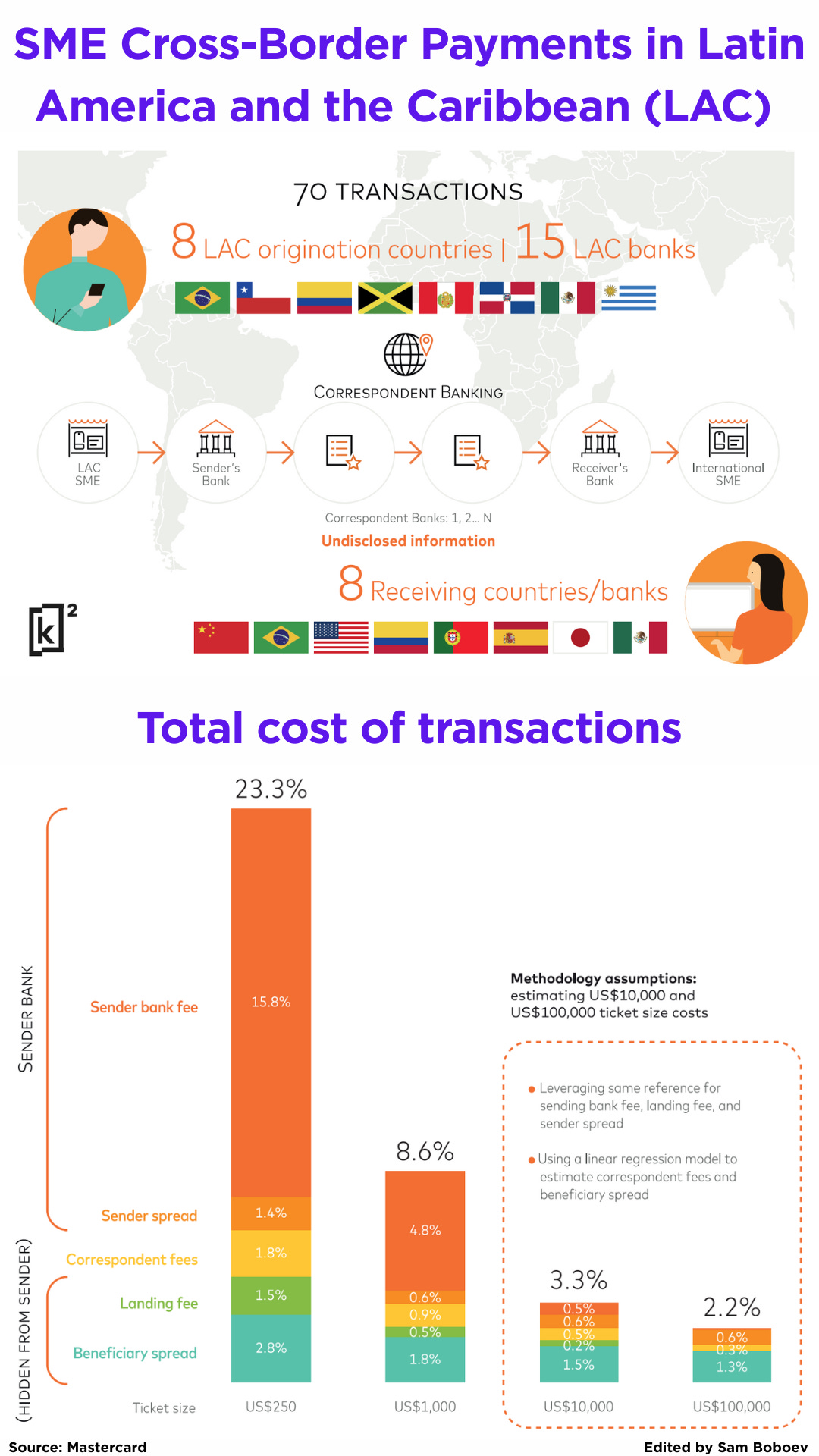

The Real Picture of SME Cross-Border Payments in Latin America and the Caribbean (LAC)

As SMEs expand globally, their need for efficient cross-border payments grows—but today’s infrastructure wasn’t built for them. The traditional correspondent banking system, designed for large corporate transfers, imposes high costs, slow speeds, and limited transparency on SMEs.

A study by K2 analyzed 70 real transactions from SMEs across 8 LAC countries using 15 banks and found alarming cost inefficiencies. Transfers of just $250 averaged a 23.3% total cost—compared to 8.6% for $1,000 and 2.2% for $100,000. In corridors like Japan and Mexico, fees for low-value payments often exceeded 30%.

Keep reading with a 7-day free trial

Subscribe to Fintech Wrap Up to keep reading this post and get 7 days of free access to the full post archives.