Deep Dive: Plaid - Products, Tech, and Business

Open banking has become the backbone of modern fintech, and at the center of this ecosystem is Plaid – a company that functions as the “financial data network” connecting banks, fintech, & consumers

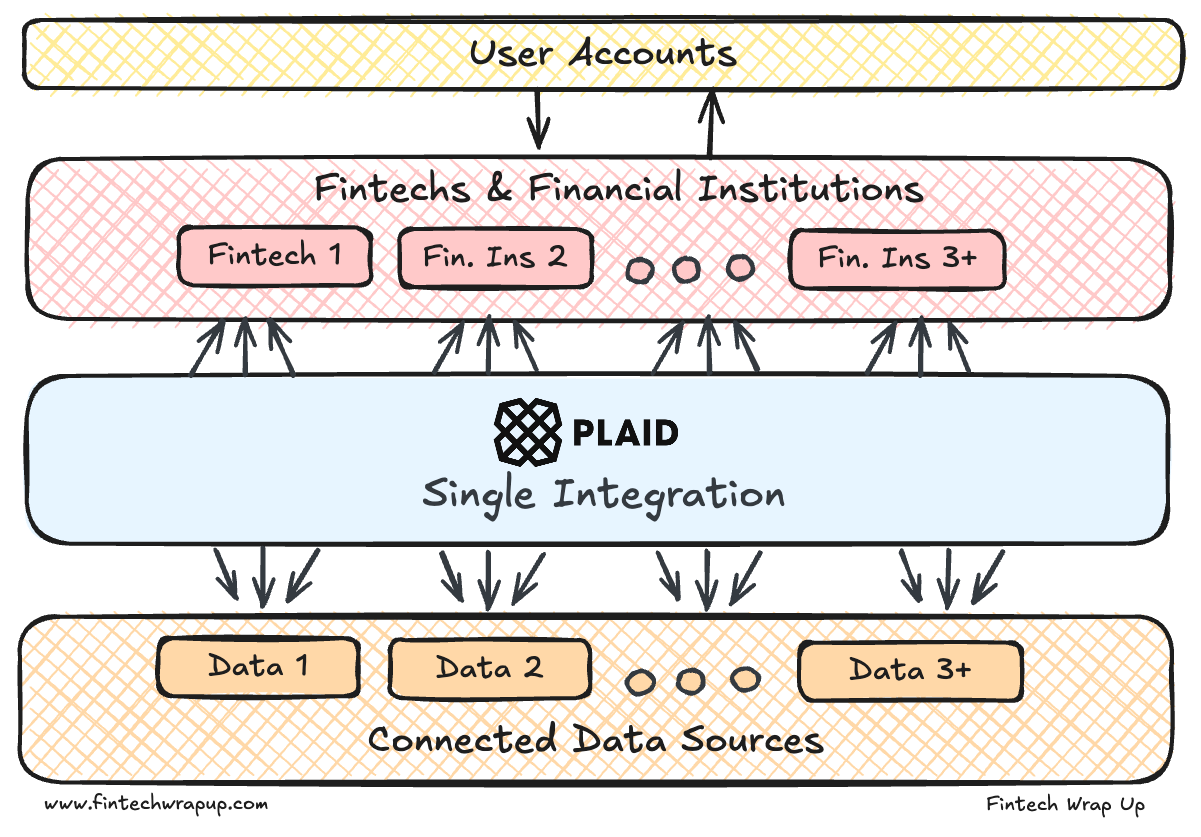

Open banking has become the backbone of modern fintech, and at the center of this ecosystem is Plaid – a company that functions as the “financial data network” connecting banks, fintech apps, and consumers. If you’ve ever linked your bank account to a budgeting app, a payment service, or an investment platform, chances are Plaid powered that connection behind the scenes. Plaid’s API is the invisible engine enabling popular apps like Venmo, Betterment, Chime, Dave and thousands more to securely access your financial data. In fact, Plaid maintains secure integrations with over 12,000 financial institutions across the U.S., Canada, UK, and Europe, and as of 2024 it has connected 500 million (and counting) consumer accounts worldwide. That scale means a huge portion of fintech users rely on Plaid’s plumbing – by one estimate, around one in four U.S. bank account holders had connected through Plaid as early as 2019, a figure likely even higher today. Plaid matters because it has essentially become the fabric of fintech connectivity, allowing innovative services to flourish on top of legacy banking infrastructure. It gives startups and financial giants alike a safe, reliable way to tap into bank accounts, leveling the playing field for fintech innovation in the absence of universal open-banking standards in the U.S. and beyond. In this deep dive, we’ll explore Plaid’s core products and how they power fintech applications, unpack the technology and data flows under its hood, examine its business model and pricing, and place Plaid in the broader context of the global open banking movement.

From Auth to Assets: Inside Plaid’s Product Suite

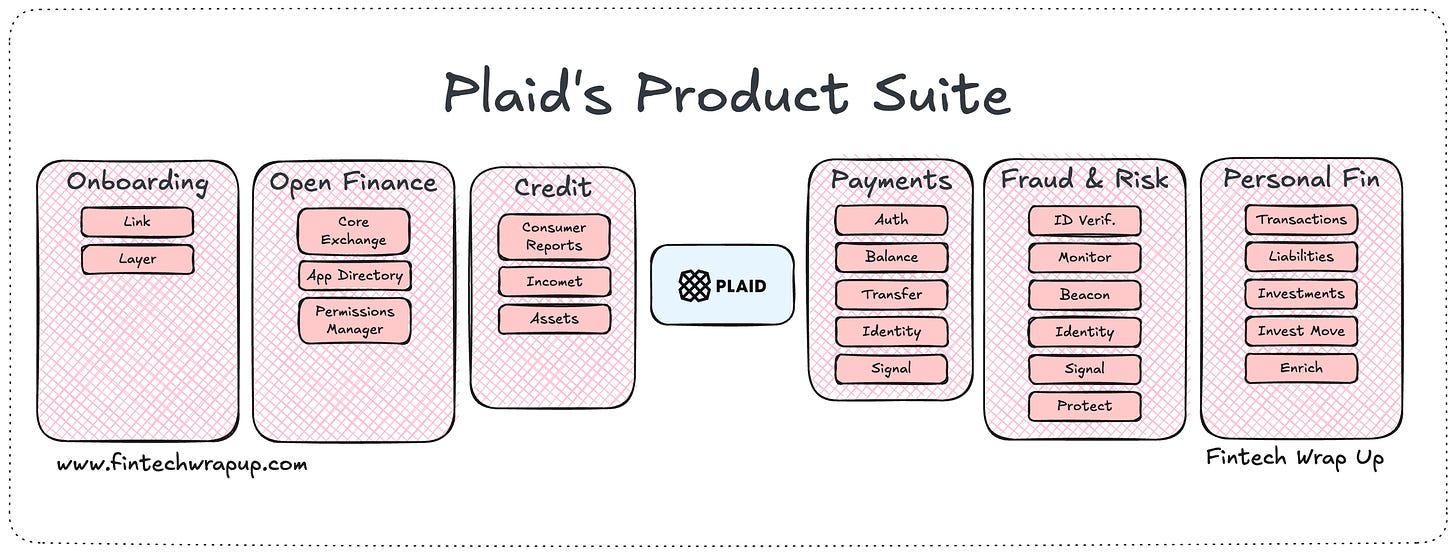

Plaid’s platform offers a suite of API products that together form a comprehensive data connectivity stack. Each product addresses a specific need for fintech developers, from verifying accounts for payments to fetching months of transaction history. At a high level, Plaid takes the diverse, complex data locked inside bank systems and makes it legible and useful for apps. Let’s tour Plaid’s core offerings – and how fintech apps use them – from authentication through insights:

Auth & Balance: Plaid’s first claim to fame was simplifying account verification for payments. The Auth product allows apps to instantly authenticate a user’s bank account and retrieve the account and routing numbers needed for ACH transfers. Instead of waiting days for micro-deposits, a fintech app can use Plaid Auth to confirm a bank account in seconds, enabling features like funding a neobank account or paying a friend on Venmo. Paired with this is Plaid’s Balance API, which provides real-time available balance checks on demand. Fintechs leverage Balance to prevent non-sufficient funds errors – for example, a personal finance app might ping Plaid’s /accounts/balance/get endpoint before initiating a transfer to ensure the user has enough funds. Together, Auth and Balance help fintech apps move money faster and more safely, improving user experience (no one likes a failed payment) and reducing risk of overdrafts. (If you’ve ever seen an app instantly verify your bank or check that you have $$ in your account, that’s likely Plaid under the hood.)

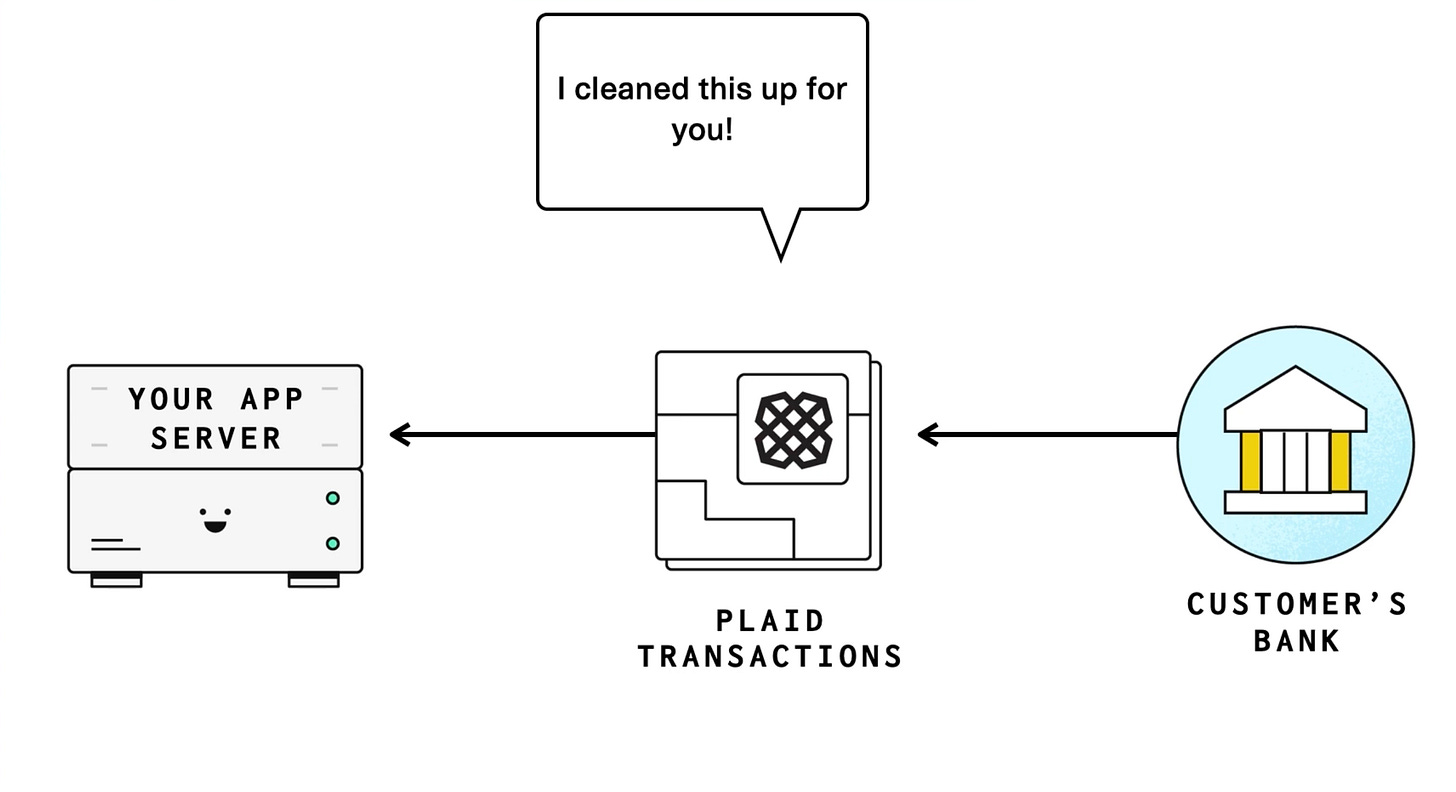

Transactions & Enrich: One of Plaid’s most widely used offerings is its Transactions API, which pulls up to 24 months of transaction history from users’ checking, savings, and credit accounts. This feed of categorized transactions is a treasure trove for fintech apps in budgeting, expense tracking, and financial planning. Apps like Mint or You Need A Budget (YNAB) use Plaid to import all your recent purchases, deposits, and bill payments in seconds, sparing you from manual data entry. Not only does Plaid fetch the raw data, but it also cleans and categorizes transactions, tagging merchant names and expense categories (e.g. groceries, rent) for easy analysis. In fact, Plaid touts about 98% categorization accuracy in its transaction data enrichment. This capability is now offered as a standalone product called Enrich, which fintech developers can use to take any raw transaction list (even their own internal bank data) and have Plaid standardize merchant names, add categories, and even geo-location info. By providing up to two years of historical, standardized transactions, Plaid enables personal finance managers, lending underwriters, and many other apps to derive insights into users’ spending habits and cash flows with minimal effort. The value delivered is clear: richer financial insights and personalized advice for users, powered by Plaid’s aggregation and data science behind the scenes.

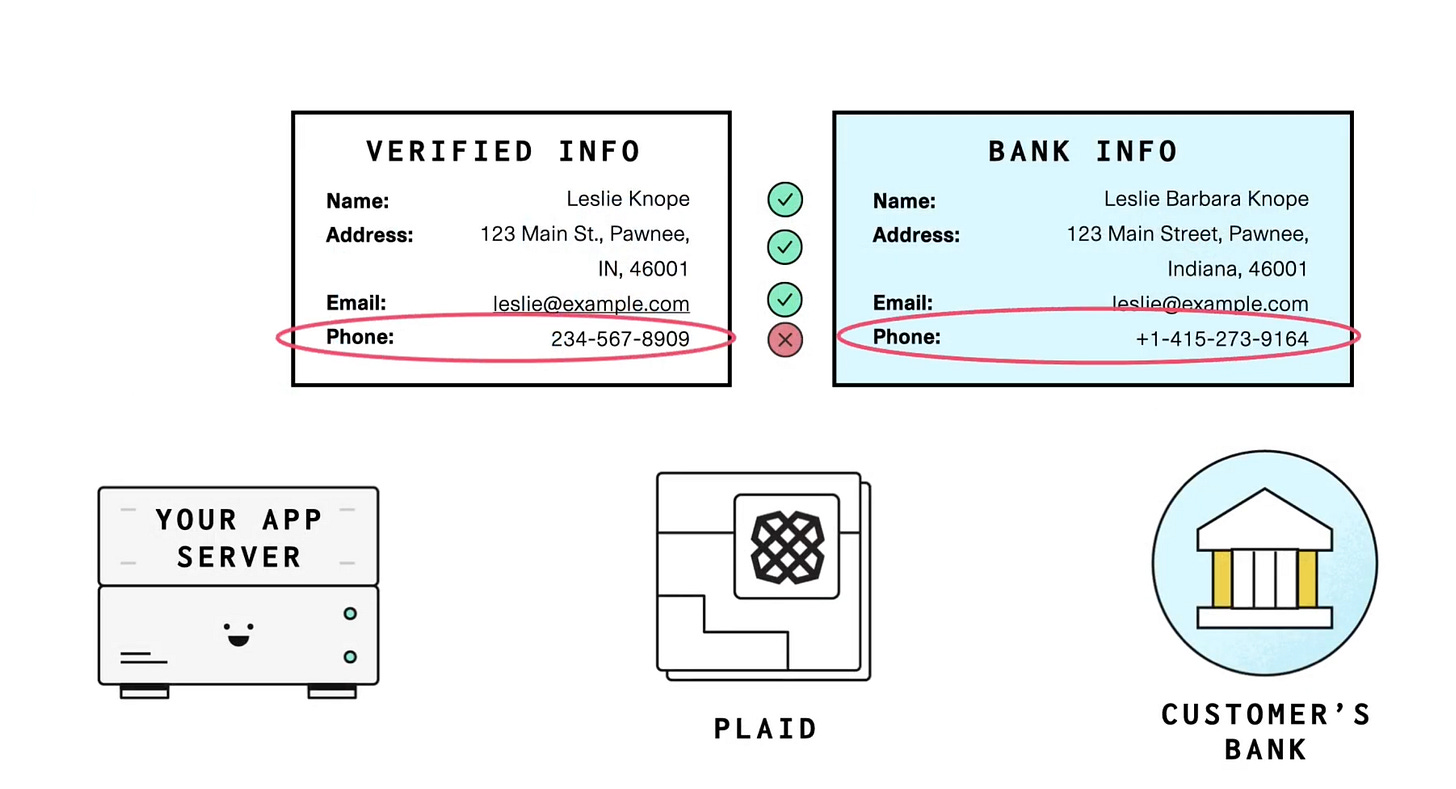

Identity: Financial apps often need to verify that a bank account actually belongs to the user in question – for fraud prevention or compliance reasons. Plaid’s Identity product addresses this by pulling identifying information (like names, addresses, phone numbers and emails) from the user’s bank account profile on file. For example, when you link your bank to a payments app, the app can call Plaid Identity to confirm your name and details match what you provided. This helps verify bank account ownership without requiring manual document uploads. Plaid’s Identity data is read-only and consent-driven, meaning the app only sees it with your permission. It’s a powerful tool to reduce fraud (catching if someone linked an account that isn’t theirs) and streamline user onboarding. Beyond the basic account holder info, Plaid has also expanded into broader identity verification recently – including products like Identity Verification, a KYC solution for verifying identity documents and selfie photos, and

Keep reading with a 7-day free trial

Subscribe to Fintech Wrap Up to keep reading this post and get 7 days of free access to the full post archives.