Understanding Cross-Border Account-to-Account Initiatives by BCG; Understanding The Real Cost of Stablecoin Payments by FXC Intelligence; Nubank's Q3 2025 results

25% OFF FOREVER - LAST DAY

Today is the final day to get 25% off your Fintech Wrap Up subscription.

If you’ve been meaning to join, now’s the moment — the discount ends tonight.

Subscribe while it’s still live. 🚀

Deep Dive of the Week

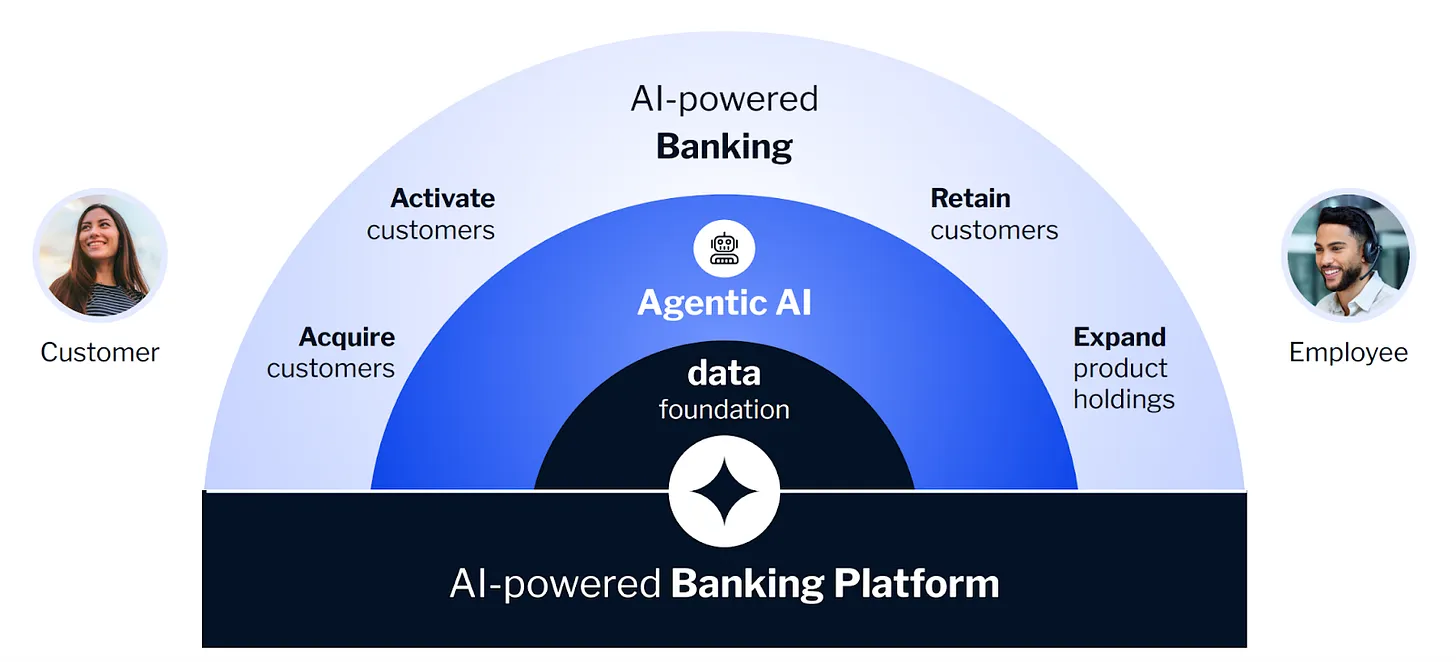

The Agentic AI Era in Banking

I’ll be blunt: who isn’t a little weary of the AI hype in banking? I watched Backbase’s Engage 2025 event in London to gain insights into AI’s role in the banking sector and what Backbase is developing. During the keynote address, CEO Jouk Pleiter asked the audience, “Who’s a little bit tired of all the AI hype?” Numerous hands were raised in agreement. Despite the skepticism, he and others in the industry firmly believe that this wave of AI could be more significant than the internet itself.

Why the gap? Partly because early efforts were siloed experiments, a fancy pilot here, a chatbot there that never touched the bank’s core operations. It’s been easy for executives to label projects as “AI” in presentations without truly scaling them. As Pleiter noted, we’ve seen the internet wave, then the mobile wave, and “we’re now in this AI-inside wave”, which is all about embedding AI into every aspect of banking. This means not just having AI as a side project in areas like fraud detection or marketing, but integrating it throughout marketing, sales, service, operations, compliance, and essentially every function. The next five years in banking will be defined by this infusion of AI into the fabric of how banks work. The promise is huge: imagine AI powering everything behind the scenes, turning banks into truly intelligent organizations. But to get there, banks must move beyond “AI lab” mode and bring AI into production at scale. How? That brings us to the new kid on the block: Agentic AI.

This week’s reports

𝐇𝐞𝐫𝐞 𝐢𝐬 𝐇𝐨𝐰 𝐭𝐨 𝐏𝐫𝐞𝐩𝐚𝐫𝐞 𝐟𝐨𝐫 𝐀𝐠𝐞𝐧𝐭𝐢𝐜 𝐀𝐈 𝐢𝐧 𝐂𝐨𝐦𝐦𝐞𝐫𝐜𝐞 𝐛𝐲 𝐃𝐞𝐥𝐨𝐢𝐭𝐭𝐞

1️⃣𝐇𝐞𝐫𝐞 𝐢𝐬 𝐇𝐨𝐰 𝐭𝐨 𝐏𝐫𝐞𝐩𝐚𝐫𝐞 𝐟𝐨𝐫 𝐀𝐠𝐞𝐧𝐭𝐢𝐜 𝐀𝐈 𝐢𝐧 𝐂𝐨𝐦𝐦𝐞𝐫𝐜𝐞 𝐛𝐲 𝐃𝐞𝐥𝐨𝐢𝐭𝐭𝐞

3️⃣𝗦𝗼𝗺𝗲𝘁𝗶𝗺𝗲𝘀 𝗶𝘁 𝗵𝗶𝘁𝘀 𝗺𝗲 𝗵𝗼𝘄 𝗺𝘂𝗰𝗵 𝘄𝗲 𝘂𝗻𝗱𝗲𝗿𝗲𝘀𝘁𝗶𝗺𝗮𝘁𝗲 𝘁𝗵𝗲 𝗮𝗰𝘁𝘂𝗮𝗹 𝗰𝗼𝘀𝘁 𝗼𝗳 𝗯𝘂𝗶𝗹𝗱𝗶𝗻𝗴 𝗶𝗻 𝘀𝗶𝗹𝗼𝘀

4️⃣𝐈’𝐥𝐥 𝐛𝐞 𝐡𝐨𝐧𝐞𝐬𝐭 — 𝐈 𝐝𝐢𝐝𝐧’𝐭 𝐞𝐱𝐩𝐞𝐜𝐭 𝐭𝐡𝐞 𝐬𝐭𝐚𝐛𝐥𝐞𝐜𝐨𝐢𝐧 𝐜𝐨𝐧𝐯𝐞𝐫𝐬𝐚𝐭𝐢𝐨𝐧 𝐭𝐨 𝐟𝐥𝐢𝐩 𝐭𝐡𝐢𝐬 𝐟𝐚𝐬𝐭

5️⃣𝐒𝐢𝐧𝐠𝐚𝐩𝐨𝐫𝐞 𝐅𝐢𝐧𝐭𝐞𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝟐𝟎𝟐𝟓

6️⃣𝐇𝐨𝐰 𝐭𝐨 𝐁𝐮𝐢𝐥𝐝 𝐚 𝐁𝐚𝐧𝐤 𝐒𝐩𝐨𝐧𝐬𝐨𝐫𝐬𝐡𝐢𝐩 𝐏𝐫𝐨𝐠𝐫𝐚𝐦 𝐓𝐡𝐚𝐭 𝐀𝐜𝐭𝐮𝐚𝐥𝐥𝐲 𝐖𝐨𝐫𝐤𝐬

7️⃣𝐂𝐨𝐫𝐩𝐨𝐫𝐚𝐭𝐞 𝐓𝐫𝐞𝐚𝐬𝐮𝐫𝐲 𝐈n 𝐭𝐡𝐞 𝐖𝐚𝐥𝐥𝐞𝐭 𝐄𝐫𝐚 — 𝐇𝐞𝐫𝐞’𝐬 𝐇𝐨𝐰 𝐈 𝐖𝐨𝐮𝐥𝐝 𝐀𝐩𝐩𝐫𝐨𝐚𝐜𝐡 𝐈𝐭

This week’s insights

1️⃣𝐅𝐫𝐚𝐮𝐝 𝐏𝐫𝐞𝐯𝐞𝐧𝐭𝐢𝐨𝐧 𝐏𝐥𝐚𝐲𝐛𝐨𝐨𝐤 𝐟𝐨𝐫 𝟐𝟎𝟐𝟔 𝐛𝐲 𝐒𝐮𝐦𝐬𝐮𝐛

2️⃣𝐔𝐧𝐝𝐞𝐫𝐬𝐭𝐚𝐧𝐝𝐢𝐧𝐠 𝐓𝐡𝐞 𝐑𝐞𝐚𝐥 𝐂𝐨𝐬𝐭 𝐨𝐟 𝐒𝐭𝐚𝐛𝐥𝐞𝐜𝐨𝐢𝐧 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝐛𝐲 𝐅𝐗𝐂 𝐈𝐧𝐭𝐞𝐥𝐥𝐢𝐠𝐞𝐧𝐜𝐞

3️⃣𝟱 𝗪𝗮𝘆𝘀 𝗕𝗹𝗮𝗰𝗸 𝗙𝗿𝗶𝗱𝗮𝘆 𝗜𝘀 𝗥𝗲𝘀𝗵𝗮𝗽𝗶𝗻𝗴 𝗢𝗻𝗹𝗶𝗻𝗲 𝗣𝗮𝘆𝗺𝗲𝗻𝘁𝘀 𝗯𝘆 Nuvei

4️⃣𝐍𝐮𝐛𝐚𝐧𝐤’𝐬 𝐐𝟑 𝟐𝟎𝟐𝟓 𝐫𝐞𝐬𝐮𝐥𝐭𝐬

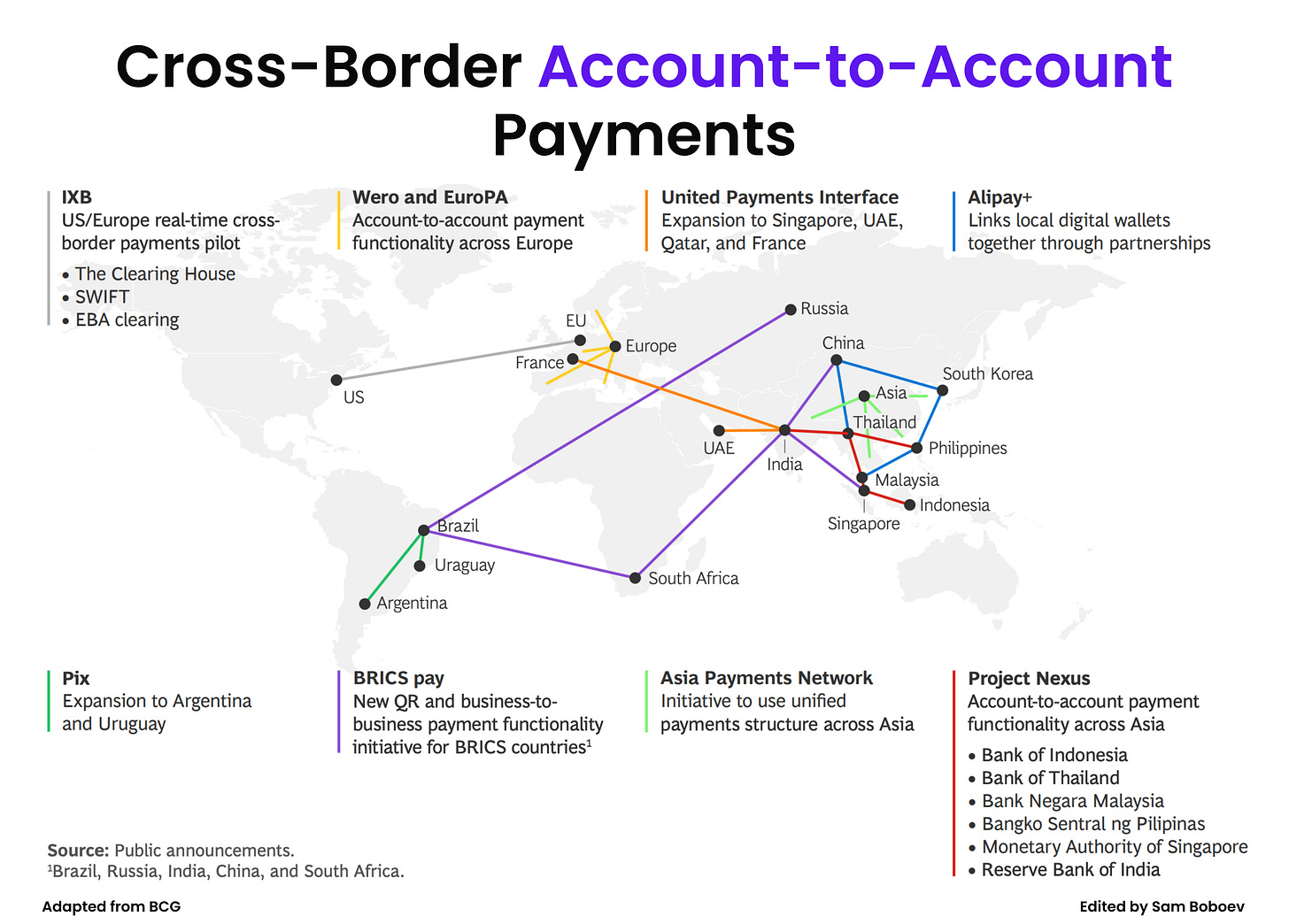

5️⃣𝐔𝐧𝐝𝐞𝐫𝐬𝐭𝐚𝐧𝐝𝐢𝐧𝐠 𝐂𝐫𝐨𝐬𝐬-𝐁𝐨𝐫𝐝𝐞𝐫 𝐀𝐜𝐜𝐨𝐮𝐧𝐭-𝐭𝐨-𝐀𝐜𝐜𝐨𝐮𝐧𝐭 𝐈𝐧𝐢𝐭𝐢𝐚𝐭𝐢𝐯𝐞𝐬 𝐛𝐲 𝐁𝐂𝐆

6️⃣𝐔𝐧𝐝𝐞𝐫𝐬𝐭𝐚𝐧𝐝𝐢𝐧𝐠 𝐭𝐡𝐞 𝐬𝐡𝐢𝐟𝐭 𝐟𝐫𝐨𝐦 𝐮𝐧𝐢𝐯𝐞𝐫𝐬𝐚𝐥 𝐛𝐚𝐧𝐤𝐢𝐧𝐠 𝐭𝐨 𝐭𝐡𝐞 𝐩𝐥𝐚𝐭𝐟𝐨𝐫𝐦 𝐞𝐜𝐨𝐧𝐨𝐦𝐲

7️⃣𝐔𝐧𝐝𝐞𝐫𝐬𝐭𝐚𝐧𝐝𝐢𝐧𝐠 𝐭𝐡𝐞 𝐡𝐢𝐝𝐝𝐞𝐧 𝐝𝐚𝐭𝐚 𝐠𝐚𝐩 𝐢𝐧 𝐚𝐠𝐞𝐧𝐭𝐢𝐜 𝐜𝐨𝐦𝐦𝐞𝐫𝐜𝐞

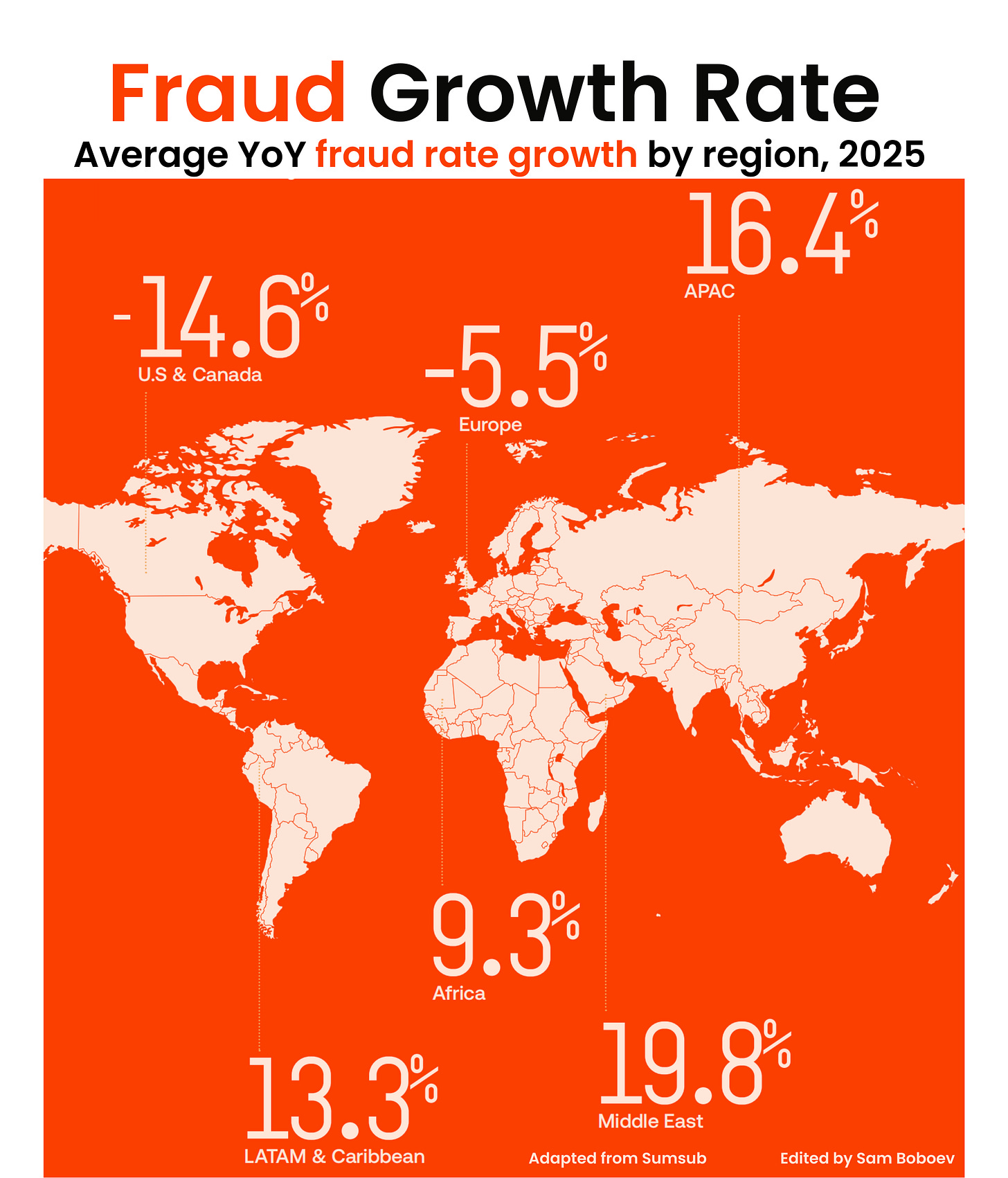

𝐅𝐫𝐚𝐮𝐝 𝐏𝐫𝐞𝐯𝐞𝐧𝐭𝐢𝐨𝐧 𝐏𝐥𝐚𝐲𝐛𝐨𝐨𝐤 𝐟𝐨𝐫 𝟐𝟎𝟐𝟔 𝐛𝐲 𝐒𝐮𝐦𝐬𝐮𝐛

I just finished reviewing Sumsub’s Identity Fraud Report 2025–2026. What they found is a very different fraud landscape than even two years ago and fintech must be aware of these changes.

Sumsub analyzed 4 million+ fraud attempts across 300+ companies and surveyed 1.2K+ end users and 300+ fraud professionals.

Here are the numbers that stood out to me:

👉 𝐓𝐡𝐞 𝐒𝐨𝐩𝐡𝐢𝐬𝐭𝐢𝐜𝐚𝐭𝐢𝐨𝐧 𝐒𝐡𝐢𝐟𝐭: 𝐟𝐞𝐰𝐞𝐫 𝐚𝐭𝐭𝐚𝐜𝐤𝐬, 𝐛𝐮𝐭 𝐞𝐚𝐜𝐡 𝐨𝐧𝐞 𝐢𝐬 𝟏𝟖𝟎% 𝐦𝐨𝐫𝐞 𝐚𝐝𝐯𝐚𝐧𝐜𝐞𝐝

Fraudsters are abandoning low-quality tricks.

→ 180% increase in “sophisticated fraud”

→ 142% YoY growth in synthetic identities

→ 388% surge in duplicate submissions

→ Deepfake-driven selfie mismatches now account for 35.4% of fraud in APAC

→ Forged documents dropped 11% YoY

→ Blacklist violations dropped 50% YoY

So even if fraud percentages remain stable, the impact of each successful attack is much bigger.

👉 𝐀𝐈 𝐢𝐧𝐝𝐮𝐬𝐭𝐫𝐢𝐚𝐥𝐢𝐳𝐞𝐬 𝐟𝐫𝐚𝐮𝐝 — 𝐝𝐨𝐜𝐮𝐦𝐞𝐧𝐭 𝐟𝐨𝐫𝐠𝐞𝐫𝐢𝐞𝐬 𝐚𝐫𝐞 𝐧𝐨𝐰 𝐧𝐞𝐚𝐫-𝐩𝐞𝐫𝐟𝐞𝐜𝐭

Fraudsters have moved from “copy-paste” edits to AI-assisted forgery factories.

The report highlights:

Keep reading with a 7-day free trial

Subscribe to Fintech Wrap Up to keep reading this post and get 7 days of free access to the full post archives.