Uncovering The New Race Between Instant and Traditional Cross-Border Rails; Portugal Fintech Ecosystem 2025; The World's Biggest Cryptocurrencies in 2025

Video of the Week

Deep Dive of the Week

Why Circle Built Arc and How It Changes Payments

“Another new blockchain? Really?” That was my first reaction when Circle announced Arc, their very own Layer-1 network. As a fintech person who’s seen every buzzword from DeFi to CBDCs come and go, I approached Arc with skepticism and curiosity in equal measure. But after digging in, I realized Arc isn’t just another me-too crypto project. It’s Circle basically saying: “Hey, if you want something done right, build it yourself.” In this article, I’ll break down what Arc is, why it exists, and how it could reshape payments, all in plain English. Let’s dive in.

This week’s reports

𝐔𝐧𝐝𝐞𝐫𝐬𝐭𝐚𝐧𝐝𝐢𝐧𝐠 𝐜𝐨𝐫𝐞 𝐛𝐚𝐧𝐤𝐢𝐧𝐠 𝐬𝐲𝐬𝐭𝐞𝐦 𝐦𝐨𝐝𝐞𝐫𝐧𝐢𝐳𝐚𝐭𝐢𝐨𝐧 𝐛𝐲 𝐙𝐚𝐟𝐢𝐧

1️⃣𝐔𝐧𝐝𝐞𝐫𝐬𝐭𝐚𝐧𝐝𝐢𝐧𝐠 𝐜𝐨𝐫𝐞 𝐛𝐚𝐧𝐤𝐢𝐧𝐠 𝐬𝐲𝐬𝐭𝐞𝐦 𝐦𝐨𝐝𝐞𝐫𝐧𝐢𝐳𝐚𝐭𝐢𝐨𝐧 𝐛𝐲 𝐙𝐚𝐟𝐢𝐧

2️⃣𝐓𝐡𝐞 𝐓𝐰𝐨 𝐁𝐢𝐠 𝐓𝐡𝐢𝐧𝐠𝐬 𝐈 𝐋𝐞𝐚𝐫𝐧𝐞𝐝 𝐀𝐛𝐨𝐮𝐭 𝐀𝐠𝐞𝐧𝐭𝐢𝐜 𝐀𝐈 𝐢𝐧 𝐅𝐢𝐧𝐚𝐧𝐜𝐞

3️⃣𝐖𝐡𝐚𝐭 𝐅𝐢𝐧𝐭𝐞𝐜𝐡𝐬 𝐆𝐞𝐭 𝐖𝐫𝐨𝐧𝐠 𝐀𝐛𝐨𝐮𝐭 𝐎𝐩𝐞𝐫𝐚𝐭𝐢𝐨𝐧𝐬 (𝐀𝐧𝐝 𝐇𝐨𝐰 𝐓𝐨 𝐅𝐢𝐱 𝐈𝐭)

4️⃣𝐔𝐧𝐝𝐞𝐫𝐬𝐭𝐚𝐧𝐝𝐢𝐧𝐠 𝐡𝐨𝐰 𝐂𝐡𝐚𝐢𝐧𝐥𝐢𝐧𝐤 𝐰𝐨𝐫𝐤𝐬

5️⃣𝐖𝐡𝐲 𝐈𝐧𝐭𝐞𝐫𝐨𝐩𝐞𝐫𝐚𝐛𝐢𝐥𝐢𝐭𝐲 𝐖𝐢𝐥𝐥 𝐃𝐞𝐜𝐢𝐝𝐞 𝐭𝐡𝐞 𝐖𝐢𝐧𝐧𝐞𝐫𝐬 𝐢𝐧 𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐀𝐬𝐬𝐞𝐭𝐬

6️⃣𝐁𝐚𝐧𝐤𝐬 𝐔𝐧𝐝𝐞𝐫𝐬𝐭𝐚𝐧𝐝 𝐖𝐡𝐲 𝐘𝐨𝐮 𝐀𝐫𝐞 𝐒𝐭𝐫𝐮𝐠𝐠𝐥𝐢𝐧𝐠 𝐖𝐢𝐭𝐡 “𝐄𝐯𝐞𝐫𝐲𝐝𝐚𝐲 𝐏𝐫𝐨𝐝𝐮𝐜𝐭𝐬”

7️⃣𝐓𝐡𝐞 𝐒𝐭𝐚𝐛𝐥𝐞𝐜𝐨𝐢𝐧 𝐁𝐮𝐬𝐢𝐧𝐞𝐬𝐬 (𝐭𝐡𝐞 𝐭𝐢𝐭𝐥𝐞 𝐬𝐩𝐞𝐚𝐤𝐬 𝐟𝐨𝐫 𝐢𝐭𝐬𝐞𝐥𝐟 𝐡𝐨𝐧𝐞𝐬𝐭𝐥𝐲)

This week’s insights

1️⃣𝐓𝐡𝐞 𝐖𝐨𝐫𝐥𝐝’𝐬 𝐁𝐢𝐠𝐠𝐞𝐬𝐭 𝐂𝐫𝐲𝐩𝐭𝐨𝐜𝐮𝐫𝐫𝐞𝐧𝐜𝐢𝐞𝐬 𝐢𝐧 𝟐𝟎𝟐𝟓

2️⃣𝐇𝐨𝐰 𝐈 𝐄𝐱𝐩𝐥𝐚𝐢𝐧 𝐭𝐡𝐞 𝐀𝐠𝐞𝐧𝐭𝐢𝐜 𝐀𝐈 𝐒𝐭𝐚𝐢𝐫𝐜𝐚𝐬𝐞 𝐭𝐨 𝐁𝐚𝐧𝐤𝐢𝐧𝐠 𝐓𝐞𝐚𝐦𝐬

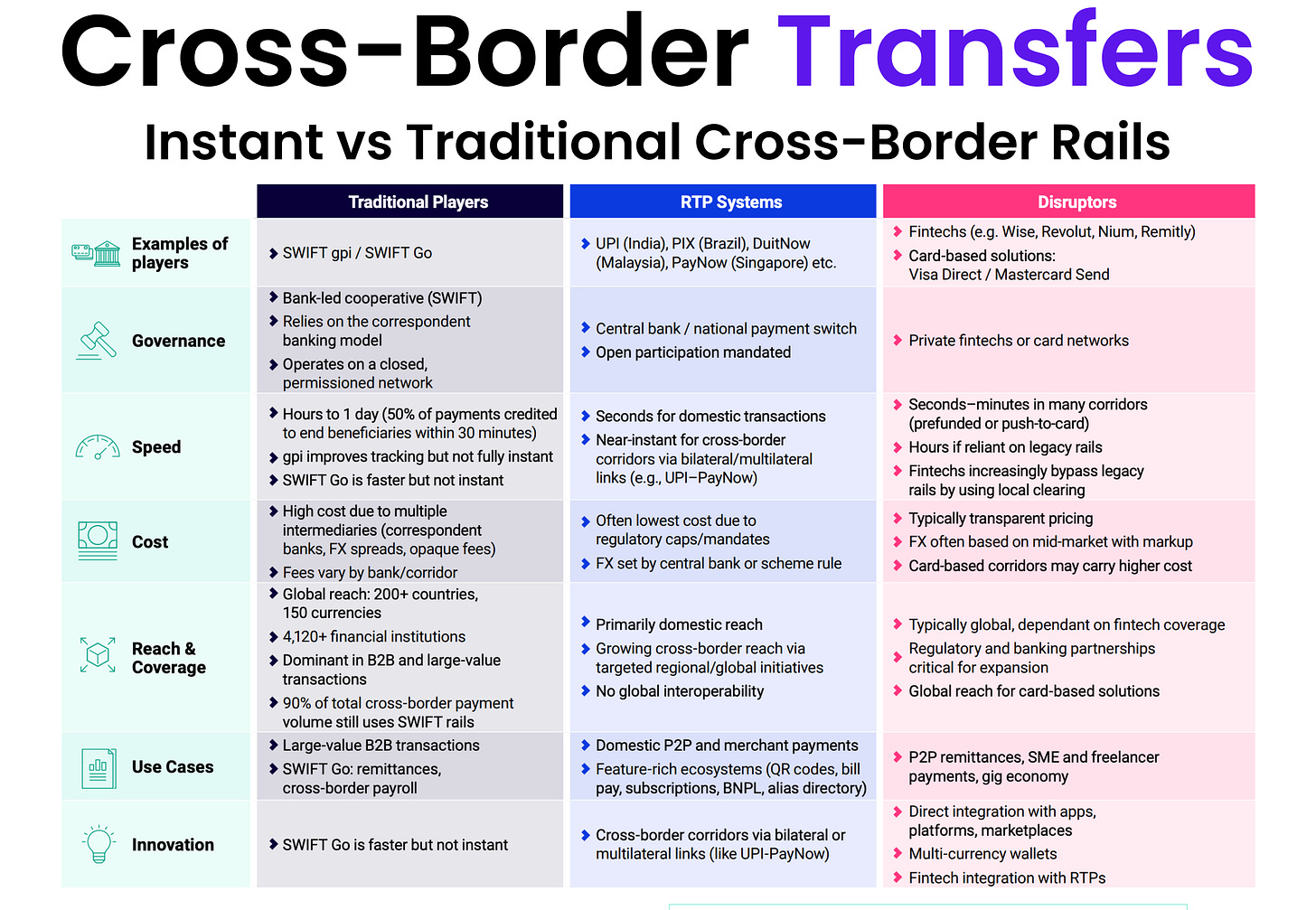

3️⃣𝐔𝐧𝐜𝐨𝐯𝐞𝐫𝐢𝐧𝐠 𝐓𝐡𝐞 𝐍𝐞𝐰 𝐑𝐚𝐜𝐞 𝐁𝐞𝐭𝐰𝐞𝐞𝐧 𝐈𝐧𝐬𝐭𝐚𝐧𝐭 𝐚𝐧𝐝 𝐓𝐫𝐚𝐝𝐢𝐭𝐢𝐨𝐧𝐚𝐥 𝐂𝐫𝐨𝐬𝐬-𝐁𝐨𝐫𝐝𝐞𝐫 𝐑𝐚𝐢𝐥𝐬

4️⃣𝐔𝐧𝐝𝐞𝐫𝐬𝐭𝐚𝐧𝐝𝐢𝐧𝐠 𝐏𝐈, 𝐄𝐌𝐈, 𝐚𝐧𝐝 𝐂𝐈 𝐋𝐢𝐜𝐞𝐧𝐬𝐞𝐬: 𝐖𝐡𝐚𝐭’𝐬 𝐭𝐡𝐞 𝐃𝐢𝐟𝐟𝐞𝐫𝐞𝐧𝐜𝐞?

5️⃣𝐏𝐨𝐫𝐭𝐮𝐠𝐚𝐥 𝐅𝐢𝐧𝐭𝐞𝐜𝐡 𝐄𝐜𝐨𝐬𝐲𝐬𝐭𝐞𝐦 𝟐𝟎𝟐𝟓

6️⃣𝐔𝐧𝐝𝐞𝐫𝐬𝐭𝐚𝐧𝐝𝐢𝐧𝐠 𝐡𝐨𝐰 𝐢𝐧𝐜𝐞𝐧𝐭𝐢𝐯𝐞𝐬 𝐬𝐡𝐚𝐩𝐞 𝐬𝐭𝐚𝐛𝐥𝐞𝐜𝐨𝐢𝐧 𝐢𝐧𝐟𝐫𝐚𝐬𝐭𝐫𝐮𝐜𝐭𝐮𝐫𝐞 𝐜𝐡𝐨𝐢𝐜𝐞𝐬 𝐛𝐲 𝐅𝐗𝐂 𝐈𝐧𝐭𝐞𝐥𝐥𝐢𝐠𝐞𝐧𝐜𝐞

7️⃣𝐔𝐧𝐝𝐞𝐫𝐬𝐭𝐚𝐧𝐝𝐢𝐧𝐠 𝐡𝐨𝐰 𝐩𝐚𝐲𝐦𝐞𝐧𝐭 𝐫𝐞𝐜𝐨𝐧𝐜𝐢𝐥𝐢𝐚𝐭𝐢𝐨𝐧 𝐰𝐨𝐫𝐤𝐬 𝐛𝐲 𝐒𝐭𝐫𝐢𝐩𝐞

𝐓𝐡𝐞 𝐖𝐨𝐫𝐥𝐝’𝐬 𝐁𝐢𝐠𝐠𝐞𝐬𝐭 𝐂𝐫𝐲𝐩𝐭𝐨𝐜𝐮𝐫𝐫𝐞𝐧𝐜𝐢𝐞𝐬 𝐢𝐧 𝟐𝟎𝟐𝟓

The global crypto market is now nearing $3 trillion, and the distribution of value tells a very clear story about where things are heading.

Bitcoin is still the anchor.

It’s approaching a $2 trillion market cap, which is wild when you think about how long people have been calling it “dead.” Ethereum follows at $391 billion, holding strong as the leading smart contract ecosystem.

These two continue to define the core of crypto — everything else is built around them.

But the most interesting shift to me is what’s happening outside the big two.

_____

🔹 𝐒𝐭𝐚𝐛𝐥𝐞𝐜𝐨𝐢𝐧𝐬 𝐚𝐫𝐞 𝐧𝐨𝐰 𝐭𝐫𝐮𝐞 𝐠𝐢𝐚𝐧𝐭𝐬

Stablecoins are no longer infrastructure in the background. They’re becoming major assets in their own right.

- USDT: $184B

- USDC: $76B

Their rise shows one thing clearly: the world is demanding digital dollars for trading, payments, and moving money globally without friction. They’re the bridge that connects traditional finance with the on-chain economy.

🔹 𝐋𝐚𝐲𝐞𝐫-𝟏 𝐚𝐥𝐭𝐞𝐫𝐧𝐚𝐭𝐢𝐯𝐞𝐬 𝐚𝐫𝐞 𝐜𝐚𝐫𝐯𝐢𝐧𝐠 𝐭𝐡𝐞𝐢𝐫 𝐩𝐥𝐚𝐜𝐞

Projects like Solana, BNB, and Cardano continue to grow because developers and users want faster, cheaper networks. Whether they can sustain it long term is still the big question, but the demand is real.

____

👉 𝐍𝐞𝐰 𝐞𝐧𝐭𝐫𝐚𝐧𝐭𝐬 𝐚𝐫𝐞 𝐫𝐞𝐬𝐡𝐚𝐩𝐢𝐧𝐠 𝐧𝐢𝐜𝐡𝐞𝐬

Keep reading with a 7-day free trial

Subscribe to Fintech Wrap Up to keep reading this post and get 7 days of free access to the full post archives.