Deep Dive: Why Circle Built Arc and How It Changes Payments

“Another new blockchain? Really?” That was my first reaction when Circle announced Arc, their very own Layer-1 network. As a fintech person who’s seen every buzzword from DeFi to CBDCs come and go, I approached Arc with skepticism and curiosity in equal measure. But after digging in, I realized Arc isn’t just another me-too crypto project. It’s Circle basically saying: “Hey, if you want something done right, build it yourself.” In this article, I’ll break down what Arc is, why it exists, and how it could reshape payments, all in plain English. Let’s dive in.

Why Build a New Blockchain for Stablecoins?

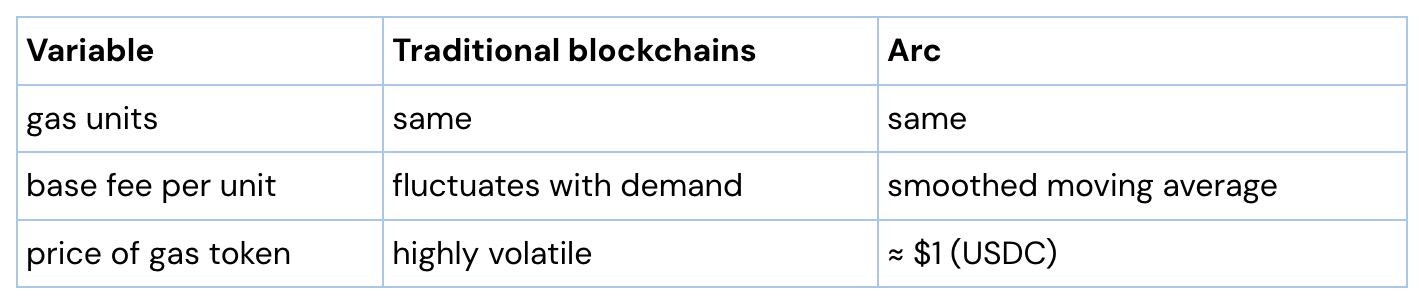

Stablecoins like USDC have thrived on existing blockchains (Ethereum, Solana, you name it). So why would Circle create a whole new network? In one word: frustration. Businesses using stablecoins keep hitting the same walls on current chains: gas fees that swing like a volatile meme coin, the need to hold separate crypto just to pay those fees, and the fact that every transaction is public for all to see. These pain points aren’t just theoretical. I’ve heard CFOs complain about unpredictable costs and compliance teams worry over privacy.

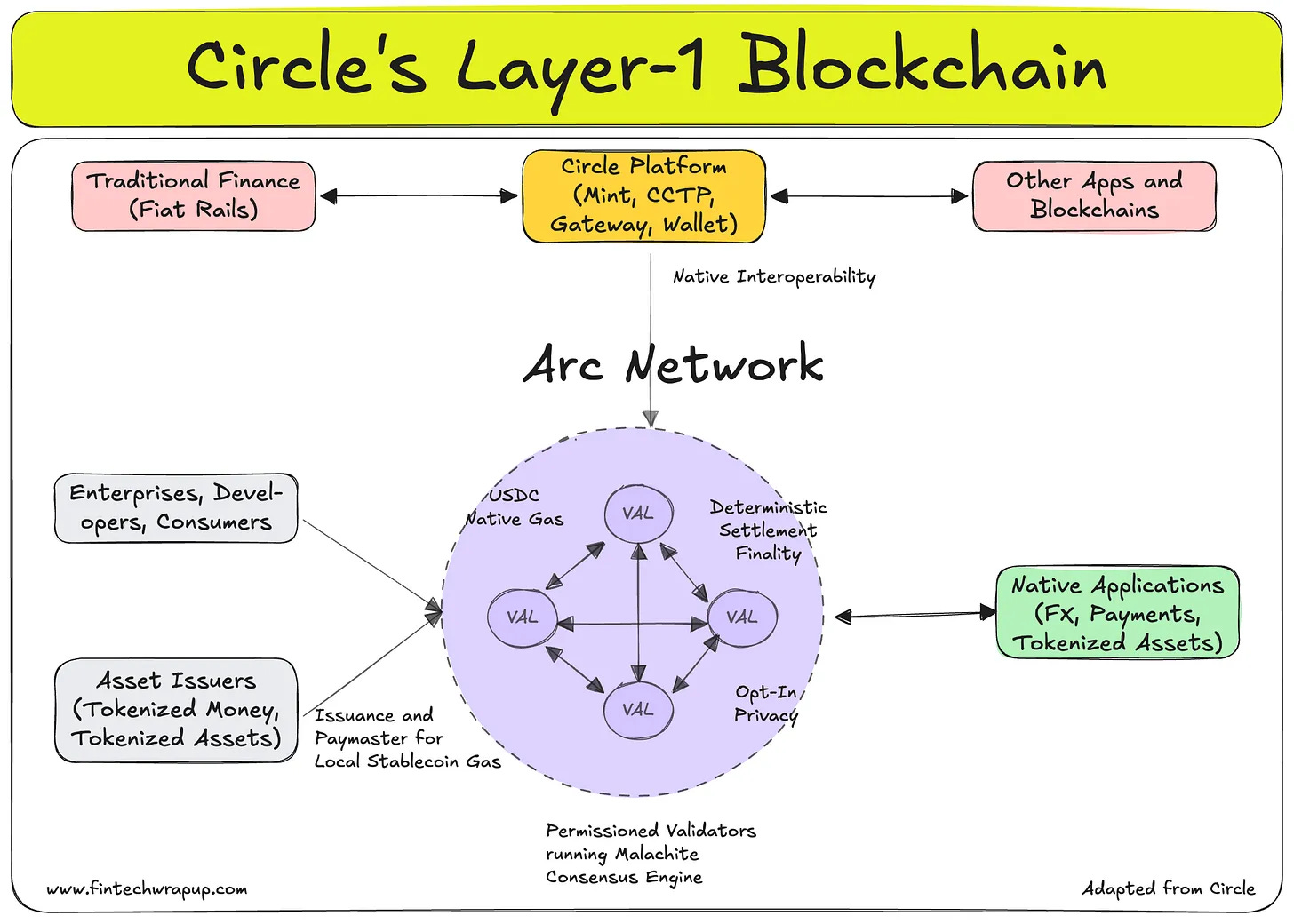

Arc is Circle’s answer to the “make stablecoins more usable” wishlist. Arc is a purpose-built, EVM-compatible Layer-1 blockchain optimized for stablecoin finance. In non-jargon: it’s a new network that only cares about making digital dollars (and other fiat tokens) move efficiently. Circle basically looked at what institutions hate about public blockchains: wild fee volatility, uncertain settlement, zero privacy, and engineered Arc to fix each of those:

Gas paid in USDC (stable fees): No more sweating over ETH or SOL prices just to send a payment. On Arc, fees are denominated in dollars via USDC, so costs stay predictable.

Deterministic finality: Transactions on Arc settle fast we’re talking sub-second and once they’re done, they’re done. No “6 block confirmations” or chance of reorgs undoing your transfer.

Opt-in privacy: Arc is designed to support selective privacy, meaning you can hide the details of a transaction from the public while still proving compliance to regulators or auditors.

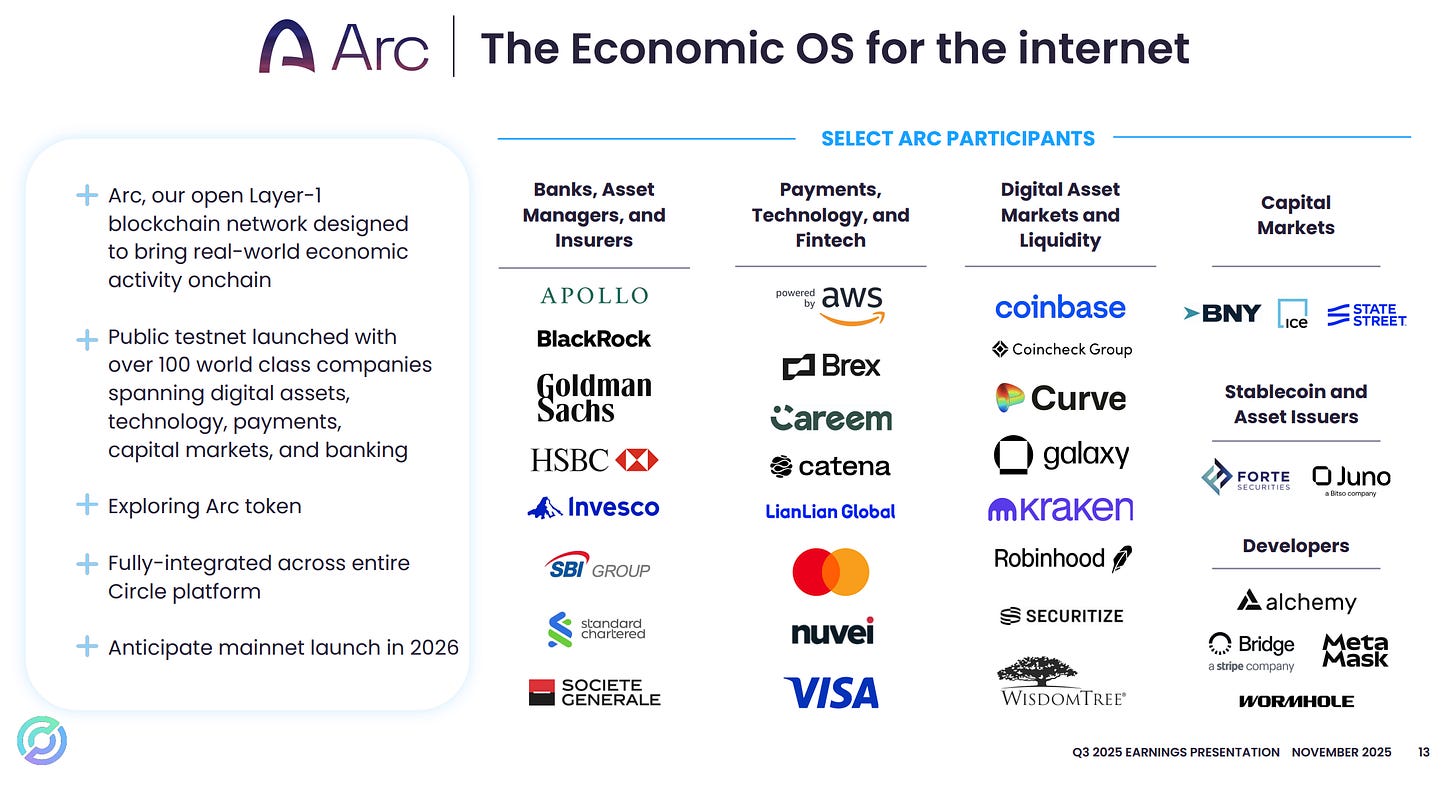

Circle didn’t gather these features out of thin air; they align with what big financial players and standards bodies have been seeking. In fact, Arc’s design aligns with principles for financial market infrastructure that demand clear final settlement and risk controls. It’s an “Economic OS for the internet,” Circle says, built to bring real-world finance on-chain without the usual crypto chaos. Grandiose? Sure. But when 100+ institutions from BlackRock and Goldman Sachs to Visa and Mastercard are already kicking Arc’s tires in its testnet, it’s hard not to pay attention.

Building on Arc: Use Cases and Integrations

So Arc sounds technically interesting, but what can you actually do with it, and how does it connect to the broader fintech and crypto ecosystems? The short answer: pretty much anything you can do with smart contracts today, but turbocharged for money movement. And thanks to Circle’s efforts, Arc is launching with an impressive list of integration partners and tools to make building easier.

Keep reading with a 7-day free trial

Subscribe to Fintech Wrap Up to keep reading this post and get 7 days of free access to the full post archives.