Visa, Kroo Bank, Tink, and Utilita completed first commercial Variable Recurring Payment; Understanding International P2M UPI Transactions; Understanding How Bilt Turned Rent Into a Fintech Flywheel

Black Friday: Lock in 25% Off Forever

This week, I am offering something I have never done before. You can join the annual plan with a 25% discount that stays with you forever. Not just this year. Every year you stay subscribed, you keep the same discounted price.

The offer is live now and expires in one week (03.12.2025).

Lock in the 25% Lifetime Discount!

Deep Dive of the Week

Adyen’s Approach to Agentic Commerce

Hey fintech friends, ever feel like the future is sneaking up on you? This morning, I imagined myself asking an AI assistant to “just buy my usual coffee beans,” and it actually tried to do it. No app, no website, just a chat and a confirmed order. This really could be the future, or I would say even the near future. Agentic commerce, where AI agents do the shopping for us, is no longer in the distant future; it’s slowly becoming part of our daily conversation. And if you’re a fintech nerd like me, you know this raises equal parts excitement and existential unease. Are merchants about to lose touch with customers to some algorithmic middleman? Who’s keeping an eye on fraud when bots start buying at scale? As I dug into Adyen’s latest moves in this space, I realized they’re not just asking these questions; they’re building the answers. Let’s unpack what Adyen is up to with agentic commerce, what they unveiled in their recent Investor Day, and how it stacks up against Stripe, Visa, and the rest of the cool kids.

This week’s reports

𝐄𝐱𝐩𝐥𝐚𝐢𝐧𝐢𝐧𝐠 𝐇𝐨𝐰 𝐁𝐚𝐧𝐤𝐬 𝐂𝐚𝐧 𝐈𝐧𝐭𝐞𝐠𝐫𝐚𝐭𝐞 𝐏𝐮𝐛𝐥𝐢𝐜 𝐁𝐥𝐨𝐜𝐤𝐜𝐡𝐚𝐢𝐧𝐬

1️⃣𝐄𝐱𝐩𝐥𝐚𝐢𝐧𝐢𝐧𝐠 𝐇𝐨𝐰 𝐁𝐚𝐧𝐤𝐬 𝐂𝐚𝐧 𝐈𝐧𝐭𝐞𝐠𝐫𝐚𝐭𝐞 𝐏𝐮𝐛𝐥𝐢𝐜 𝐁𝐥𝐨𝐜𝐤𝐜𝐡𝐚𝐢𝐧𝐬

2️⃣𝐇𝐨𝐰 𝐀𝐈 𝐚𝐧𝐝 𝐒𝐭𝐚𝐛𝐥𝐞𝐜𝐨𝐢𝐧𝐬 𝐀𝐫𝐞 𝐑𝐞𝐰𝐫𝐢𝐭𝐢𝐧𝐠 𝐭𝐡𝐞 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝐏𝐥𝐚𝐲𝐛𝐨𝐨𝐤

3️⃣𝐖𝐡𝐚𝐭 𝐏𝐡𝐚𝐬𝐞 𝟐 𝐨𝐟 𝐭𝐡𝐞 𝐞-𝐇𝐊𝐃 𝐏𝐢𝐥𝐨𝐭 𝐑𝐞𝐯𝐞𝐚𝐥𝐬 𝐀𝐛𝐨𝐮𝐭 𝐂𝐁𝐃𝐂𝐬

4️⃣𝐆𝐞𝐫𝐦𝐚𝐧𝐲’𝐬 𝐁𝐚𝐧𝐤𝐢𝐧𝐠 𝐀𝐩𝐩𝐬 𝐀𝐫𝐞 𝐄𝐯𝐨𝐥𝐯𝐢𝐧𝐠 𝐅𝐚𝐬𝐭 — 𝐇𝐞𝐫𝐞’𝐬 𝐖𝐡𝐚𝐭’𝐬 𝐂𝐡𝐚𝐧𝐠𝐢𝐧𝐠

5️⃣𝐑𝐞𝐢𝐦𝐚𝐠𝐢𝐧𝐢𝐧𝐠 𝐭𝐡𝐞 𝐟𝐮𝐭𝐮𝐫𝐞 𝐨𝐟 𝐛𝐚𝐧𝐤𝐢𝐧𝐠 𝐰𝐢𝐭𝐡 𝐚𝐠𝐞𝐧𝐭𝐢𝐜 𝐀𝐈

6️⃣𝐔𝐧𝐝𝐞𝐫𝐬𝐭𝐚𝐧𝐝𝐢𝐧𝐠 𝐡𝐨𝐰 𝐭𝐡𝐞 𝐬𝐭𝐚𝐛𝐥𝐞𝐜𝐨𝐢𝐧 𝐦𝐚𝐫𝐤𝐞𝐭 𝐡𝐢𝐭 $𝟑𝟎𝟎𝐁 𝐞𝐱𝐩𝐥𝐚𝐢𝐧𝐞𝐝 𝐛𝐲 𝐁𝐢𝐧𝐚𝐧𝐜𝐞

7️⃣𝐇𝐨𝐰 𝐭𝐨 𝐓𝐮𝐫𝐧 𝐀𝐈 𝐅𝐫𝐨𝐦 𝐚 𝐇𝐲𝐩𝐞 𝐈𝐧𝐭𝐨 𝐑𝐞𝐚𝐥 𝐕𝐚𝐥𝐮𝐞 𝐢𝐧 𝐅𝐢𝐧𝐚𝐧𝐜𝐢𝐚𝐥 𝐒𝐞𝐫𝐯𝐢𝐜𝐞𝐬 𝐛𝐲 𝐁𝐂𝐆

This week’s insights

1️⃣𝐓𝐨𝐝𝐚𝐲, 𝐕𝐢𝐬𝐚, 𝐊𝐫𝐨𝐨 𝐁𝐚𝐧𝐤, 𝐓𝐢𝐧𝐤, 𝐚𝐧𝐝 𝐔𝐭𝐢𝐥𝐢𝐭𝐚 𝐪𝐮𝐢𝐞𝐭𝐥𝐲 𝐦𝐚𝐝𝐞 𝐩𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝐡𝐢𝐬𝐭𝐨𝐫𝐲

2️⃣𝐔𝐧𝐝𝐞𝐫𝐬𝐭𝐚𝐧𝐝𝐢𝐧𝐠 𝐓𝐡𝐞 𝐄𝐯𝐨𝐥𝐮𝐭𝐢𝐨𝐧 𝐨𝐟 𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐀𝐬𝐬𝐞𝐭𝐬 𝐚𝐧𝐝 𝐂𝐫𝐲𝐩𝐭𝐨 𝐛𝐲 𝐆𝐚𝐥𝐚𝐱𝐲

3️⃣𝐔𝐧𝐝𝐞𝐫𝐬𝐭𝐚𝐧𝐝𝐢𝐧𝐠 𝐖𝐡𝐞𝐧 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝐁𝐞𝐜𝐨𝐦𝐞 𝐘𝐨𝐮𝐫 𝐍𝐞𝐱𝐭 𝐏𝐫𝐨𝐝𝐮𝐜𝐭 𝐛𝐲 𝐓𝐢𝐝𝐞𝐦𝐚𝐫𝐤

4️⃣𝐔𝐧𝐝𝐞𝐫𝐬𝐭𝐚𝐧𝐝𝐢𝐧𝐠 𝐇𝐨𝐰 𝐁𝐢𝐥𝐭 𝐓𝐮𝐫𝐧𝐞𝐝 𝐑𝐞𝐧𝐭 𝐈𝐧𝐭𝐨 𝐚 𝐅𝐢𝐧𝐭𝐞𝐜𝐡 𝐅𝐥𝐲𝐰𝐡𝐞𝐞𝐥

5️⃣𝐔𝐧𝐝𝐞𝐫𝐬𝐭𝐚𝐧𝐝𝐢𝐧𝐠 𝐈𝐧𝐭𝐞𝐫𝐧𝐚𝐭𝐢𝐨𝐧𝐚𝐥 𝐏𝟐𝐌 𝐔𝐏𝐈 𝐓𝐫𝐚𝐧𝐬𝐚𝐜𝐭𝐢𝐨𝐧𝐬 𝐛𝐲 𝐁𝐂𝐆 & 𝐍𝐏𝐂𝐈

6️⃣𝐔𝐧𝐝𝐞𝐫𝐬𝐭𝐚𝐧𝐝𝐢𝐧𝐠 𝐡𝐨𝐰 𝐂𝐡𝐚𝐢𝐧𝐥𝐢𝐧𝐤 𝐚𝐧𝐝 𝐌𝐚𝐬𝐭𝐞𝐫𝐜𝐚𝐫𝐝 𝐄𝐧𝐚𝐛𝐥𝐞 𝐎𝐧𝐜𝐡𝐚𝐢𝐧 𝐂𝐫𝐲𝐩𝐭𝐨 𝐏𝐮𝐫𝐜𝐡𝐚𝐬𝐞𝐬

7️⃣𝐔𝐧𝐝𝐞𝐫𝐬𝐭𝐚𝐧𝐝𝐢𝐧𝐠 𝐡𝐨𝐰 𝐚 𝐫𝐞𝐜𝐮𝐫𝐫𝐢𝐧𝐠 𝐛𝐢𝐥𝐥𝐢𝐧𝐠 𝐬𝐨𝐥𝐮𝐭𝐢𝐨𝐧 𝐚𝐜𝐭𝐮𝐚𝐥𝐥𝐲 𝐰𝐨𝐫𝐤𝐬

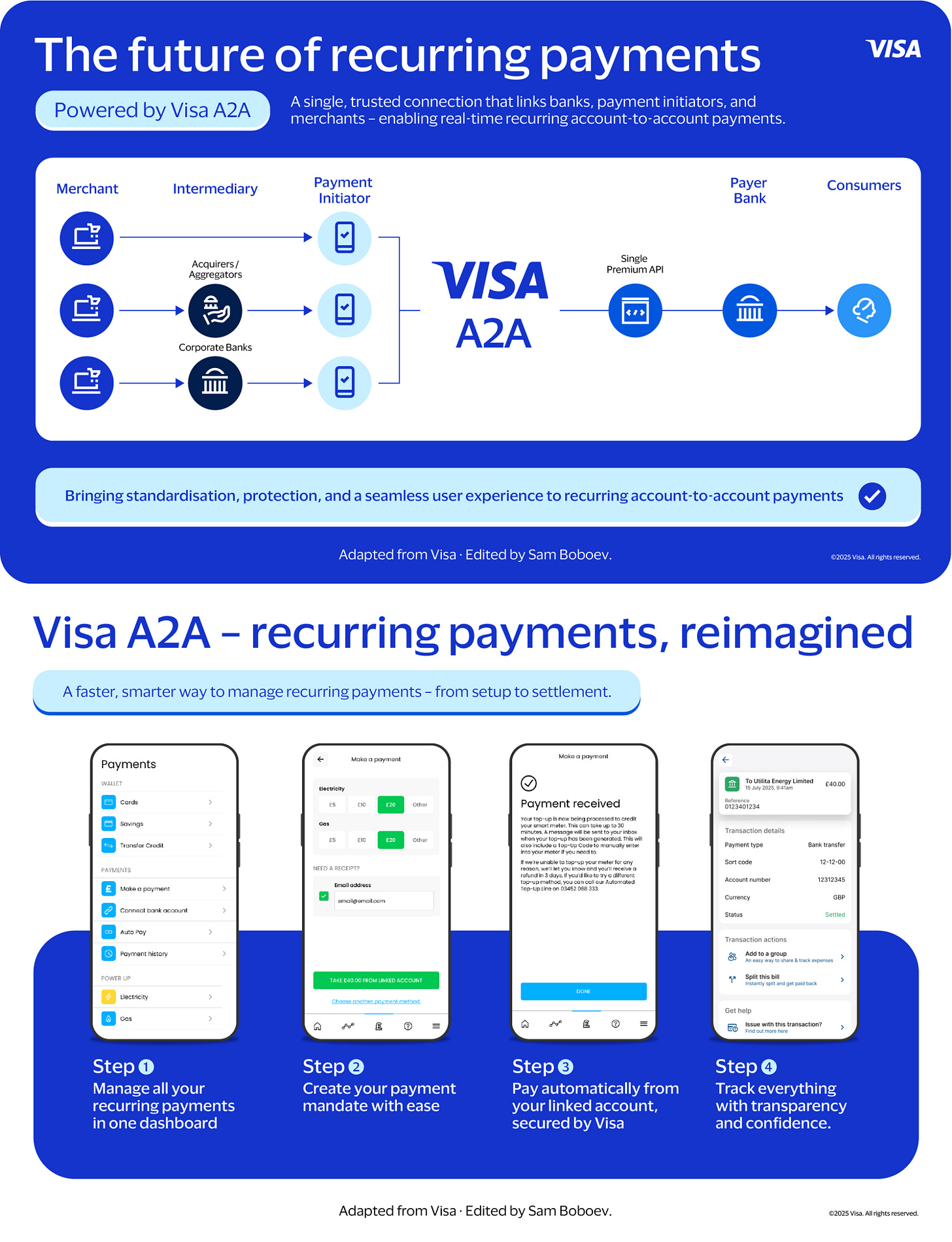

𝐓𝐨𝐝𝐚𝐲, 𝐕𝐢𝐬𝐚, 𝐊𝐫𝐨𝐨 𝐁𝐚𝐧𝐤, 𝐓𝐢𝐧𝐤, 𝐚𝐧𝐝 𝐔𝐭𝐢𝐥𝐢𝐭𝐚 𝐪𝐮𝐢𝐞𝐭𝐥𝐲 𝐦𝐚𝐝𝐞 𝐩𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝐡𝐢𝐬𝐭𝐨𝐫𝐲

They completed the first commercial Variable Recurring Payment (cVRP) powered by Visa A2A - ahead of its rollout across the UK.

If you’ve ever wondered how “smart” recurring payments will work in the open banking world — here’s the explainer 👇

👉 𝗪𝗵𝗮𝘁’𝘀 𝗮 𝗰𝗩𝗥𝗣?

Think of a cVRP as the next evolution of Direct Debits — but powered by open banking.

Instead of giving merchants permanent pull access to your account…

You grant them controlled, variable access (e.g., “you can take my monthly bill, but cap it at £150”).

That means you stay in control — you can set limits, revoke permission anytime, and see every transaction in real time.

👉 𝗛𝗼𝘄 𝗩𝗶𝘀𝗮 𝗔𝟮𝗔 𝗳𝗶𝘁𝘀 𝗶𝗻

The biggest blocker for cVRPs so far? No commercial model. No trustmark. No consumer protection.

Visa A2A fixes that by combining:

✅ Open banking rails (instant payments via Faster Payments)

✅ Card-like protections (dispute resolution + “Secured by Visa” trustmark)

✅ Standardised rules across banks and payment initiators

So you get the speed of open banking with the safety of Visa — something the industry has been waiting for.

👉 𝗛𝗼𝘄 𝘁𝗵𝗲 𝗳𝗶𝗿𝘀𝘁 𝗰𝗩𝗥𝗣 𝘄𝗼𝗿𝗸𝗲𝗱

Keep reading with a 7-day free trial

Subscribe to Fintech Wrap Up to keep reading this post and get 7 days of free access to the full post archives.