Deep Dive: Adyen’s Approach to Agentic Commerce

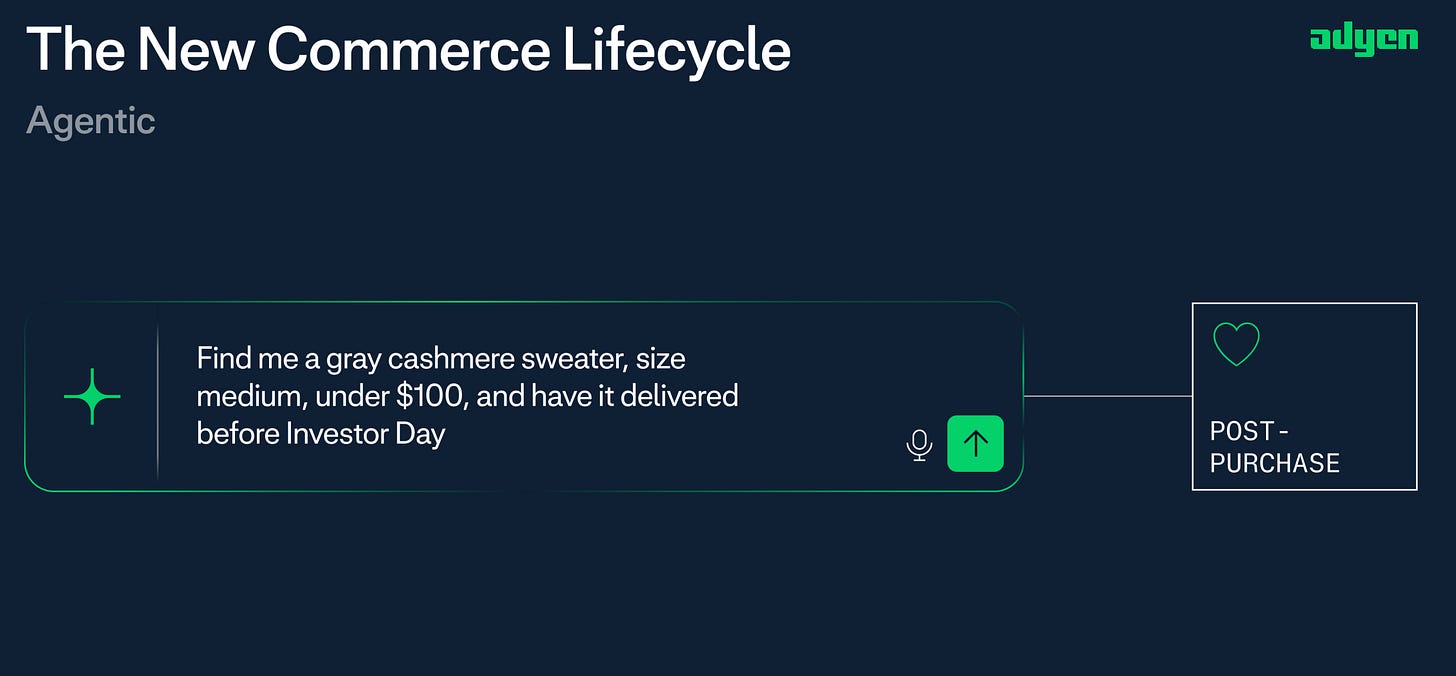

Hey fintech friends, ever feel like the future is sneaking up on you? This morning, I imagined myself asking an AI assistant to “just buy my usual coffee beans,” and it actually tried to do it. No app, no website, just a chat and a confirmed order. This really could be the future, or I would say even the near future. Agentic commerce, where AI agents do the shopping for us, is no longer in the distant future; it’s slowly becoming part of our daily conversation. And if you’re a fintech nerd like me, you know this raises equal parts excitement and existential unease. Are merchants about to lose touch with customers to some algorithmic middleman? Who’s keeping an eye on fraud when bots start buying at scale? As I dug into Adyen’s latest moves in this space, I realized they’re not just asking these questions; they’re building the answers. Let’s unpack what Adyen is up to with agentic commerce, what they unveiled in their recent Investor Day, and how it stacks up against Stripe, Visa, and the rest of the cool kids.

Adyen’s Merchant-First Playbook for AI Commerce

Adyen is approaching agentic commerce with a clear mantra: keep merchants in the driver’s seat. They actually published a “merchant-first agentic commerce” framework outlining four key principles to ensure AI shopping adds to merchants’ business instead of subtracting from it:

Act on behalf of a real customer. Any AI agent transacting should have verifiable, cryptographic proof of the user’s intent and permission. (No random bots making purchases—there’s got to be a human in the loop authorizing it, even if behind the scenes.) This ties into things like Google’s AP2 “Mandates” (digitally signed instructions), which ensure an agent isn’t going rogue. Adyen is on board with using strong digital verification so that an order from an AI is as trustworthy as one from the user themselves.

Maintain merchant control of payment setup. Merchants shouldn’t have to rip out their payment systems or lose control over how payments are processed. Adyen emphasizes that merchants can keep their own tokenization strategies, payment routing, and setups. In practice, that means if a merchant uses Adyen (or any processor) to handle payments, an AI agent should plug into that existing flow, not force the merchant onto some new rails. (OpenAI’s protocol echoes this: merchants remain the merchant of record and use their own processor for the actual charge. Adyen certainly likes that stance.)

Recognize the customer across channels. AI agents shouldn’t nullify the work merchants have done to build loyalty and personalized experiences. Adyen talks about ensuring things like loyalty programs and customer preferences carry through when an agent interacts. For example, if you’ve earned a 10% loyalty discount with a retailer, your AI agent ought to know and apply that, rather than shopping blindly as a “new” customer every time. This principle is about avoiding the dilution of the customer relationship just because an AI is in the middle.

Merchants own the relationship & data. This one’s huge: Adyen believes the merchant should own the agentic commerce relationship, the customer relationship, and the data, not the AI interface. In plain terms, if I buy something via an AI agent, the merchant still gets the data on that sale and the ability to follow up with me, just as if I bought directly. They don’t want an OpenAI or a Google interjecting “I’ll handle the customer from here, thanks.” Adyen’s saying nope, the AI is just a new channel, not a new owner of the customer.

Together, these principles are aimed at making agentic commerce an “additive channel” for merchants, not a dilutive or disintermediating one. Adyen is clearly hearing from its merchants that they’re excited about selling via AI, but terrified of being disintermediated. (I mean, who wants to wake up and find all your sales come from some AI marketplace that gives you zero customer insight?)

Adyen is not developing this in a vacuum. In Adyen’s 2025 Investors Day, Adyen’s Co-CEO Ingo Uytdehaage literally said their collaboration on Google’s AP2 protocol is a “natural extension” of Adyen’s mission to give merchants the building blocks for tomorrow’s commerce. Adyen wants a “common rulebook” for AI payments that ensures security and interoperability across the ecosystem. In practice, that means they’re at the table with Google, Visa, OpenAI, etc., hashing out standards so that, say, a Shopify store, an Adyen enterprise merchant, and a Stripe small business can all accept agent-driven orders in a secure, consistent way.

Keep reading with a 7-day free trial

Subscribe to Fintech Wrap Up to keep reading this post and get 7 days of free access to the full post archives.