Stripe Strategy Map; Visa as a Service Stack; Why Open Banking Adoption Is Still Stuck

Video of the week

Deep Dive of the Week

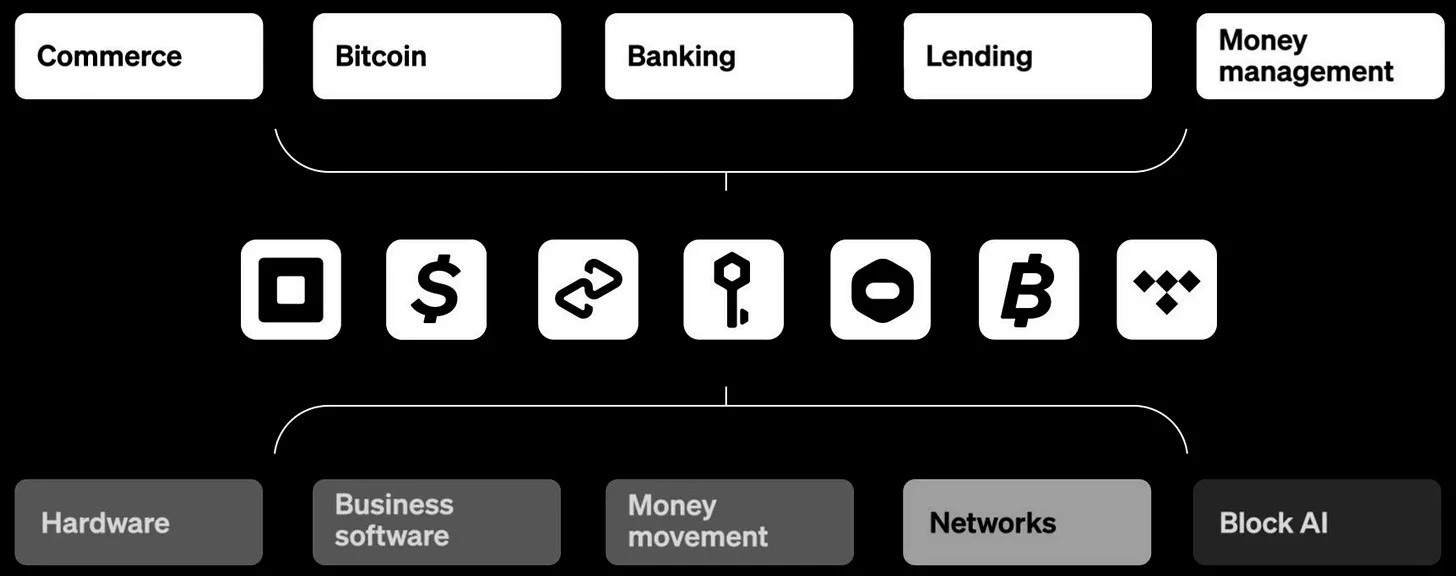

Inside Block’s Product Strategy

Block has been easy to overlook in the broader fintech discourse. But the company has been steadily assembling a product architecture that pushes well beyond traditional payments. After going through the 2025 Investor Day presentation, I see a clear pattern: Block is building networks, financial primitives, and agent interfaces across Cash App and Square. I want to break down how those pieces fit together and why the strategy matters for anyone building in fintech.

This week’s reports

𝐄𝐱𝐩𝐥𝐨𝐫𝐢𝐧𝐠 𝐕𝐢𝐬𝐚’𝐬 𝐒𝐭𝐫𝐚𝐭𝐞𝐠𝐲 𝐢𝐧 𝟐𝟎𝟐𝟓

1️⃣𝐄𝐱𝐩𝐥𝐨𝐫𝐢𝐧𝐠 𝐕𝐢𝐬𝐚’𝐬 𝐒𝐭𝐫𝐚𝐭𝐞𝐠𝐲 𝐢𝐧 𝟐𝟎𝟐𝟓

2️⃣𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐫𝐞𝐜𝐨𝐧𝐜𝐢𝐥𝐢𝐚𝐭𝐢𝐨𝐧 𝟏𝟎𝟏 𝐛𝐲 𝐒𝐭𝐫𝐢𝐩𝐞

3️⃣𝐇𝐨𝐰 𝐛𝐚𝐧𝐤𝐬 𝐜𝐚𝐧 𝐬𝐭𝐚𝐲 𝐫𝐞𝐥𝐞𝐯𝐚𝐧𝐭 𝐢𝐧 𝐚 𝐩𝐥𝐚𝐭𝐟𝐨𝐫𝐦 𝐞𝐜𝐨𝐧𝐨𝐦𝐲

4️⃣𝐖𝐡𝐲 𝐈𝐧𝐝𝐢𝐚’𝐬 𝐅𝐚𝐥𝐥𝐢𝐧𝐠 𝐔𝐏𝐈 𝐓𝐢𝐜𝐤𝐞𝐭 𝐒𝐢𝐳𝐞𝐬 𝐀𝐫𝐞 𝐀𝐜𝐭𝐮𝐚𝐥𝐥𝐲 𝐚 𝐒𝐮𝐩𝐞𝐫𝐩𝐨𝐰𝐞𝐫

5️⃣𝐔𝐧𝐝𝐞𝐫𝐬𝐭𝐚𝐧𝐝𝐢𝐧𝐠 𝐓𝐡𝐞 𝐏𝐨𝐰𝐞𝐫 𝐨𝐟 𝐄𝐜𝐨𝐬𝐲𝐬𝐭𝐞𝐦𝐬 𝐢𝐧 𝐀𝐟𝐫𝐢𝐜𝐚’𝐬 𝐅𝐢𝐧𝐭𝐞𝐜𝐡 𝐑𝐢𝐬𝐞

6️⃣𝐃𝐞𝐞𝐩 𝐃𝐢𝐯𝐞 𝐢𝐧𝐭𝐨 𝐀𝐒𝐄𝐀𝐍 𝐅𝐢𝐧𝐭𝐞𝐜𝐡 𝟐𝟎𝟐𝟓

7️⃣𝐄𝐱𝐩𝐥𝐨𝐫𝐢𝐧𝐠 𝐚𝐢𝐫𝐥𝐢𝐧𝐞 𝐩𝐚𝐲𝐦𝐞𝐧𝐭 𝐟𝐥𝐨𝐰

This week’s insights

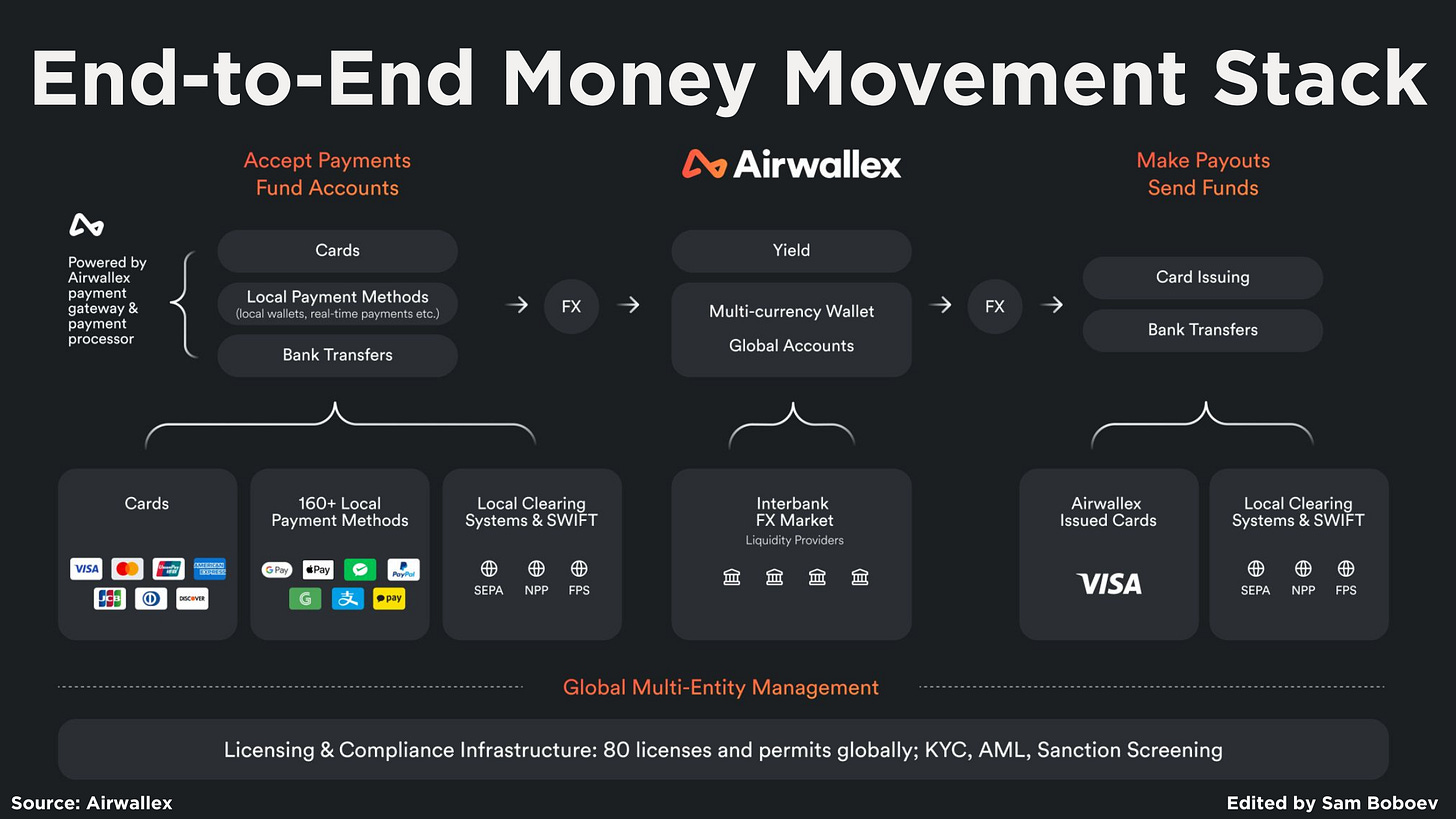

1️⃣𝐄𝐧𝐝-𝐭𝐨-𝐄𝐧𝐝 𝐦𝐨𝐧𝐞𝐲 𝐦𝐨𝐯𝐞𝐦𝐞𝐧𝐭 𝐬𝐭𝐚𝐜𝐤

2️⃣𝐔𝐧𝐝𝐞𝐫𝐬𝐭𝐚𝐧𝐝𝐢𝐧𝐠 𝐩𝐚𝐲𝐦𝐞𝐧𝐭 𝐝𝐞𝐜𝐥𝐢𝐧𝐞𝐬 𝐢𝐧 𝐠𝐚𝐦𝐢𝐧𝐠 𝐜𝐨𝐦𝐦𝐞𝐫𝐜𝐞

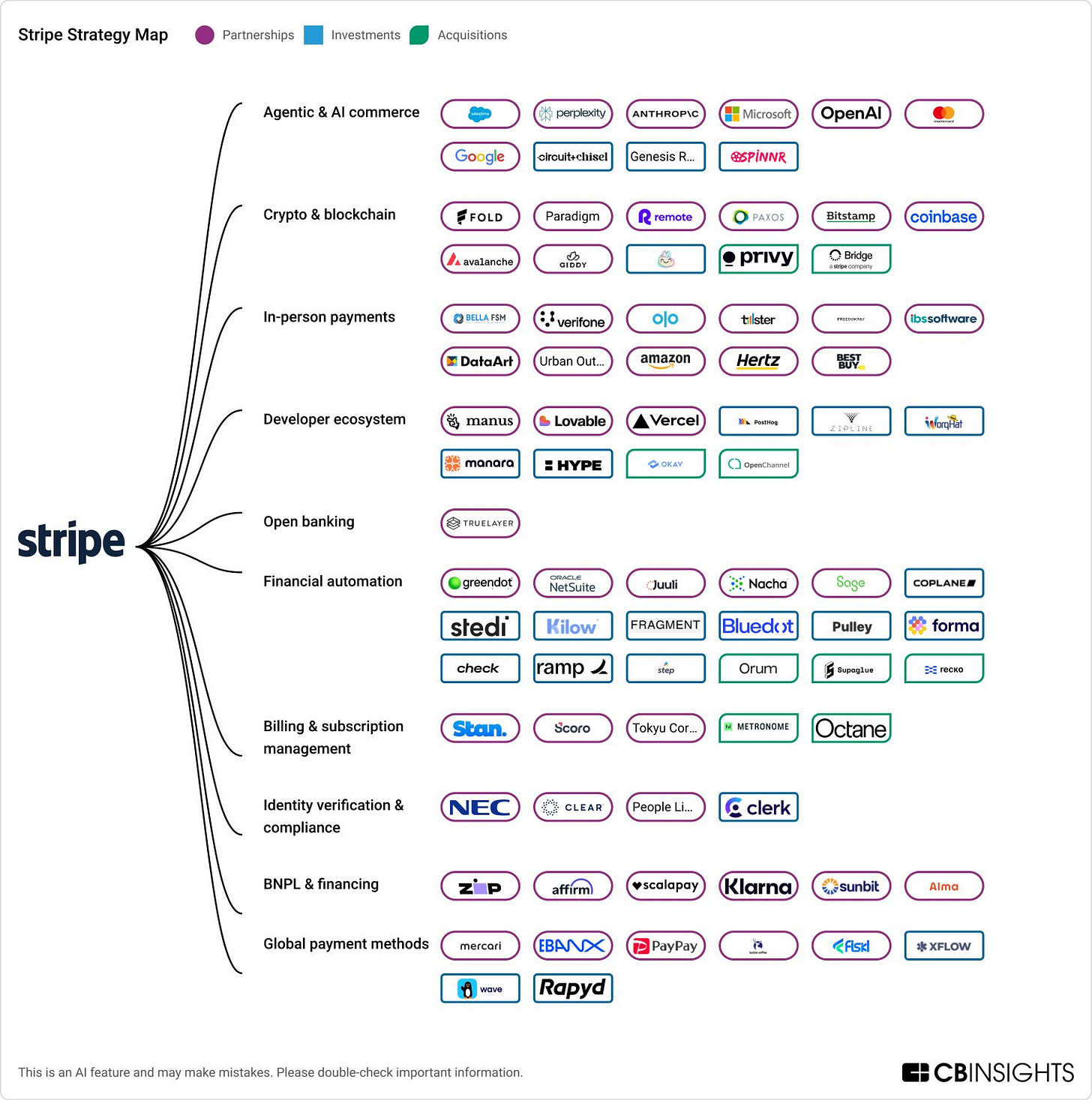

3️⃣𝐒𝐭𝐫𝐢𝐩𝐞 𝐒𝐭𝐫𝐚𝐭𝐞𝐠𝐲 𝐌𝐚𝐩

4️⃣𝐕𝐢𝐬𝐚 𝐚𝐬 𝐚 𝐒𝐞𝐫𝐯𝐢𝐜𝐞 𝐒𝐭𝐚𝐜𝐤

5️⃣𝐖𝐡𝐲 𝐎𝐩𝐞𝐧 𝐁𝐚𝐧𝐤𝐢𝐧𝐠 𝐀𝐝𝐨𝐩𝐭𝐢𝐨𝐧 𝐈𝐬 𝐒𝐭𝐢𝐥𝐥 𝐒𝐭𝐮𝐜𝐤

6️⃣𝐄𝐱𝐩𝐥𝐨𝐫𝐢𝐧𝐠 𝐌𝐞𝐫𝐜𝐡𝐚𝐧𝐭 𝐀𝐜𝐪𝐮𝐢𝐫𝐢𝐧𝐠 𝐕𝐚𝐥𝐮𝐞 𝐂𝐡𝐚𝐢𝐧 𝐛𝐲 𝐅𝐥𝐚𝐠𝐬𝐡𝐢𝐩 𝐀𝐝𝐯𝐢𝐬𝐨𝐫𝐲 𝐏𝐚𝐫𝐭𝐧𝐞𝐫𝐬

7️⃣𝐓𝐡𝐞 𝐀𝐠𝐞𝐧𝐭𝐢𝐜 𝐂𝐨𝐦𝐦𝐞𝐫𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐌𝐚𝐩 𝐄𝐱𝐩𝐥𝐚𝐢𝐧𝐞𝐝

𝐄𝐧𝐝-𝐭𝐨-𝐄𝐧𝐝 𝐦𝐨𝐧𝐞𝐲 𝐦𝐨𝐯𝐞𝐦𝐞𝐧𝐭 𝐬𝐭𝐚𝐜𝐤

I have been studying how global financial platforms stitch together payments, FX, accounts and payouts under one infrastructure. What Airwallex built is a good example of what an end to end money movement stack looks like in practice. Here is a simple breakdown of how the system works and how companies can use it.

____

🔹 𝐀𝐜𝐜𝐞𝐩𝐭𝐢𝐧𝐠 𝐩𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝐚𝐧𝐝 𝐟𝐮𝐧𝐝𝐢𝐧𝐠 𝐚𝐜𝐜𝐨𝐮𝐧𝐭𝐬

Airwallex starts at the entry point. Businesses can accept money through cards, 160 plus local payment methods and bank transfers. Everything feeds into a single balance.

This is useful if you operate in multiple markets and want one operator to handle the processing and local acquiring.

____

🔹 𝐌𝐨𝐯𝐢𝐧𝐠 𝐛𝐞𝐭𝐰𝐞𝐞𝐧 𝐜𝐮𝐫𝐫𝐞𝐧𝐜𝐢𝐞𝐬

Once the money is in, the next step is FX. Airwallex routes conversions through its interbank liquidity partners and gives you the ability to convert inside the platform.

For multi market teams, the main advantage is predictable conversion logic and fewer external hops.

____

🔹 𝐇𝐨𝐥𝐝𝐢𝐧𝐠 𝐚𝐧𝐝 𝐦𝐚𝐧𝐚𝐠𝐢𝐧𝐠 𝐟𝐮𝐧𝐝𝐬

Keep reading with a 7-day free trial

Subscribe to Fintech Wrap Up to keep reading this post and get 7 days of free access to the full post archives.