Deep Dive: Inside Block’s Product Strategy

Block has been easy to overlook in the broader fintech discourse. But the company has been steadily assembling a product architecture that pushes well beyond traditional payments. After going through the 2025 Investor Day presentation, I see a clear pattern: Block is building networks, financial primitives, and agent interfaces across Cash App and Square. I want to break down how those pieces fit together and why the strategy matters for anyone building in fintech.

Block’s 16-Year Transformation

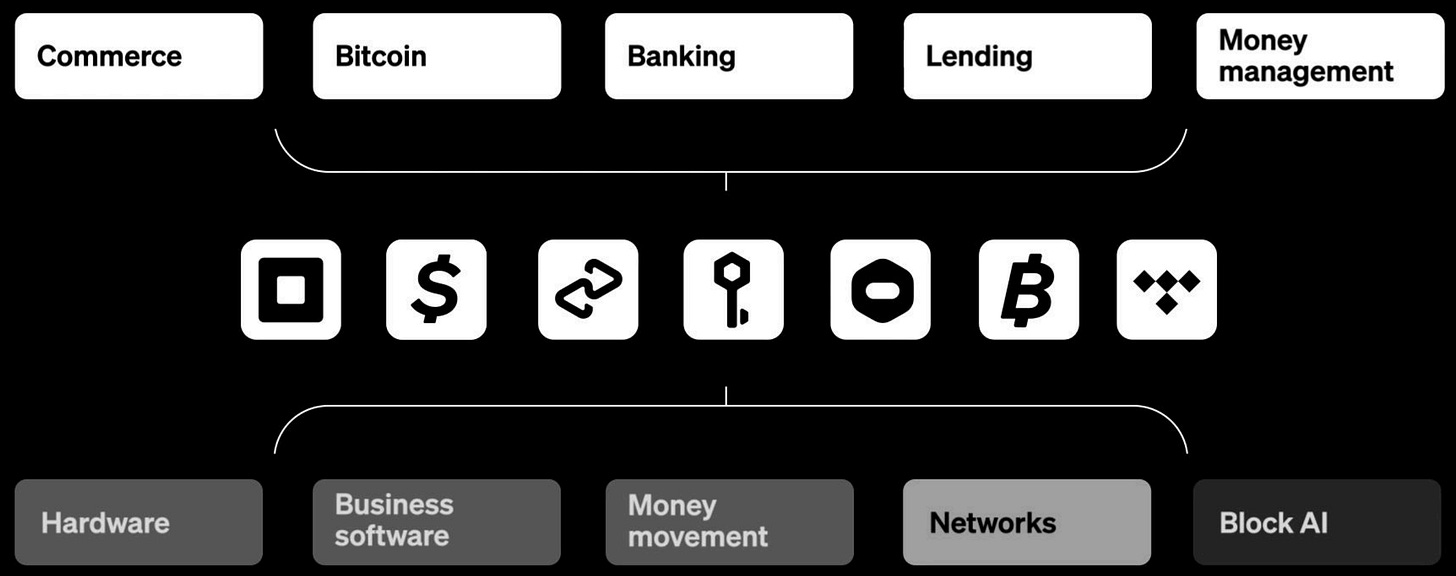

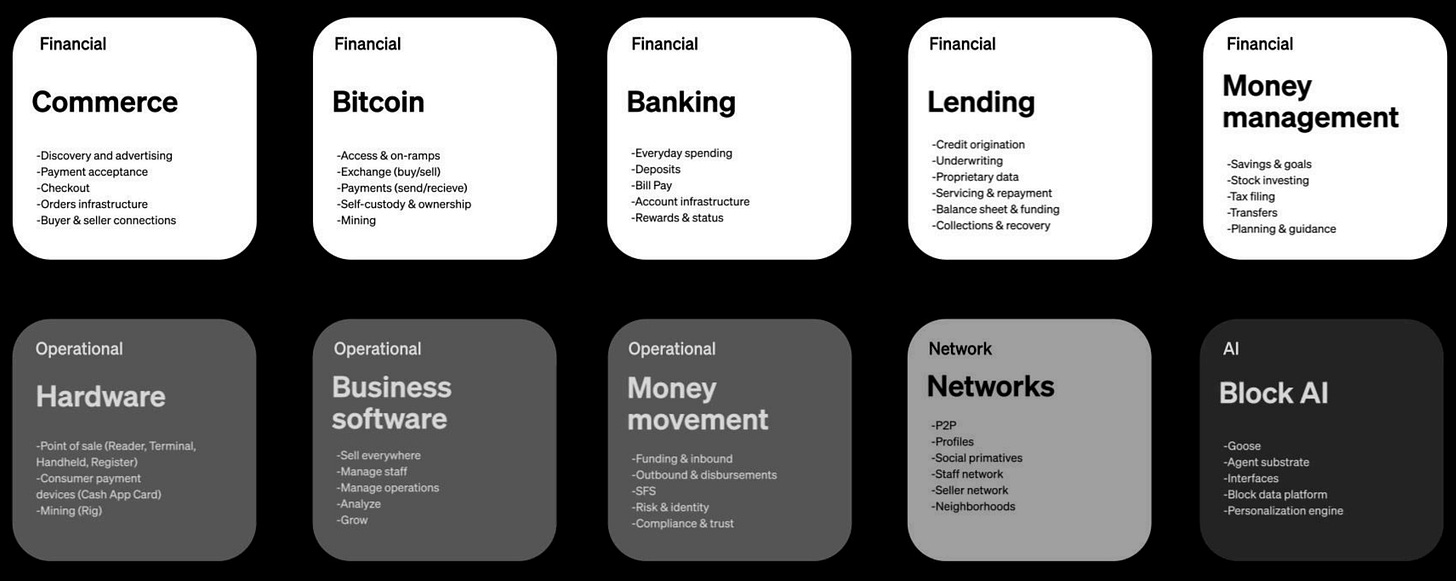

Remember when Square’s whole deal was that a little white card reader that plugged into your phone? Me too. Block has come a long way since those early POS days. As Jack Dorsey’s team tells it, they now have “an extremely unique set of product capabilities… from our hardware to our networks to our Bitcoin stack to our underwriting capabilities”. In plain English: they own the whole stack, the POS terminals, the payment rails (including a new global Bitcoin payments network), the software, and even the banking back-end.

Cash App went from a humble P2P payment app to “a full-fledged consumer finance platform”. On the seller side, Square evolved from a mobile reader into a unified commerce machine. Over 16 years, Block has stitched these pieces into a cohesive ecosystem. The pitch? Two “smartest apps”, one for small businesses (Square) and one for consumers (Cash App), tied together by new network effects and blockchain tech.

Think of it like Facebook bought Venmo, Afterpay, and a crypto startup, and then told developers to build everything on its own servers. Unlike siloed products, Block increasingly blends ecosystems: Cash App users can buy with Afterpay; Square sellers can route payments through Bitcoin rails; employees of Square merchants get paid into Cash App, etc. As Block’s own slides put it, they’re “leveraging our capabilities to build networks that only Block can create”. In other words, they’re betting on being vertically integrated so tightly that no one else can easily copy the entire bundle

Cash App Pillars

At Investor Day, Block laid out five pillars for Cash App: network expansion, commerce (via the Cash Card), banking, Bitcoin, and automation (Moneybot). Let’s unpack those, because each one is a strategic rabbit hole.

Network Expansion

Block’s mantra: Cash App is fundamentally a network, and every new user “lifts all boats”. Classic network-effects strategy: the more friends you add, the more useful the app. So their top priority is literally driving more connections between users. How? By smoothing out core flows and adding social features. They’re obsessing over login/sign-up friction, payment success rates, push notifications, basically anything that gets you using the app and inviting your friends.

One example: Pools a feature for collective money pots (concert tickets, group trips, etc.). Pools launched in summer 2024 and promptly “has been a key way to drive new connections on Cash App”. In practice, people create a Pool, invite friends, and suddenly they’re connected and transacting together. Each of those new connections generates more peer-to-peer volume and more app engagement. Pools is just the “beginning” of their social money push, expect gamified savings challenges, gift cards, and more because, in their words, “money should be more collective… more fun”.

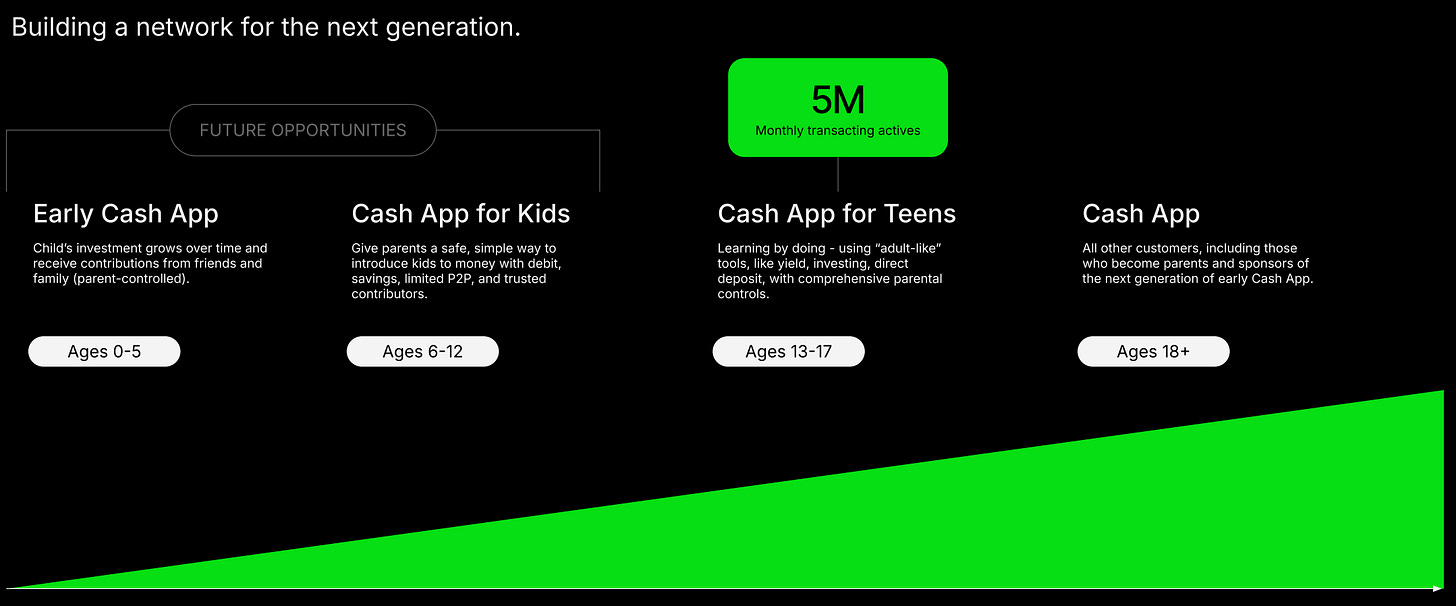

They’re also targeting teens and families as a whole new subnet of the network. Turns out 1-in-5 U.S. teens already have a Cash App debit card, and Block plans to make them lifetime users by bundling kid-friendly features. Point being: Cash App’s growth engine isn’t some novel algo, it’s good old network effects but turbocharged with clever product design for the next generation.

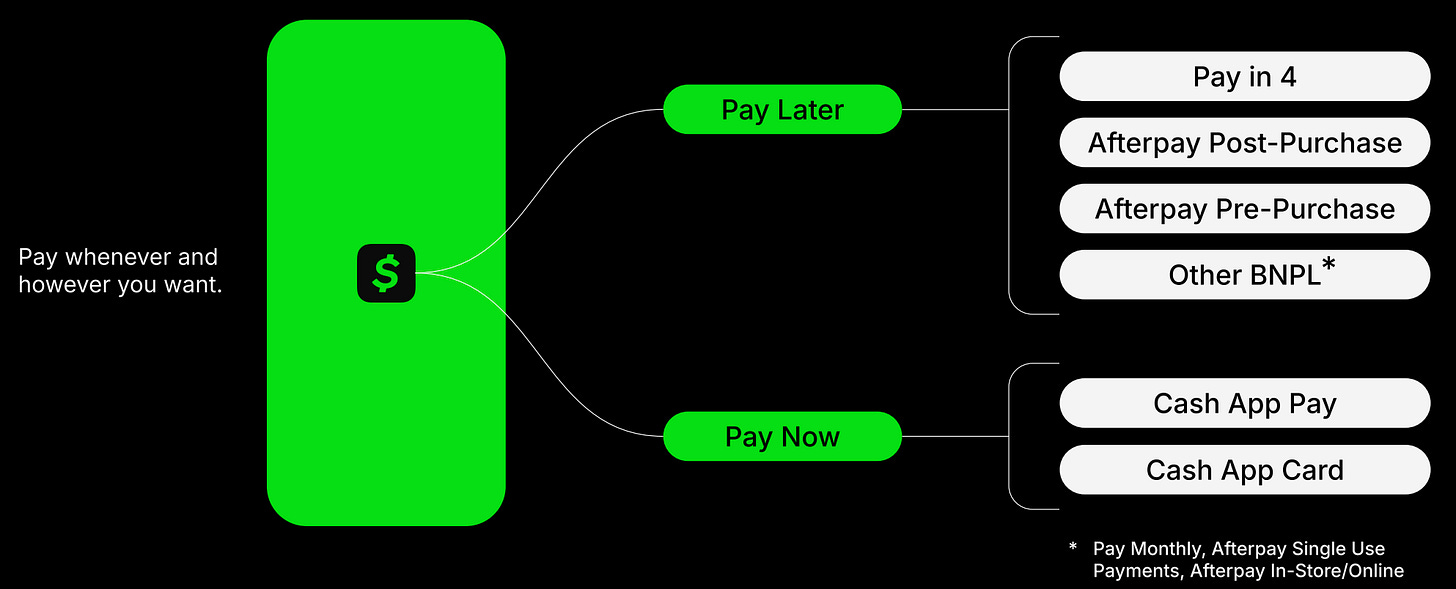

Commerce

Cash App’s commerce strategy revolves around the Cash Card (its Visa debit card) and pushing merchants to accept Cash App Pay. Cash Card is “the cornerstone of our commerce suite” and Block isn’t modest about it. It’s the fourth-largest debit card

Keep reading with a 7-day free trial

Subscribe to Fintech Wrap Up to keep reading this post and get 7 days of free access to the full post archives.