Reports: Banks and Public Sector Drive Blockchain Adoption; What’s Required for Pay by Bank to Take Off?; Islamic Fintech 2024/25: Shaping the Future of Ethical Finance;

This week’s Fintech Wrap Up is packed with some deep dives into the future of digital identity, ethical finance, blockchain adoption, and the ongoing evolution of Pay by Bank and fintech funding

Insights & Reports:

1️⃣ Digital identity and payments

2️⃣ Islamic Fintech 2024/25: Shaping the Future of Ethical Finance

3️⃣ Banks and Public Sector Drive Blockchain Adoption

4️⃣ What’s Required for Pay by Bank to Take Off?

5️⃣ State of FinTech Q1 2025

TL;DR:

This week’s Fintech Wrap Up is packed with some deep dives into the future of digital identity, ethical finance, blockchain adoption, and the ongoing evolution of Pay by Bank and fintech funding. I kicked things off with a look at how digital identity is becoming the backbone of economic inclusion—McKinsey says it could even boost GDP by up to 13% by 2030. Payments are proving to be a powerful on-ramp for identity systems, especially when backed by trust, privacy, and interoperability standards like FIDO and eIDAS. From there, I explored the rise of Islamic Fintech, where Shariah-compliant CBDCs, blockchain-based Sukuk, and tokenized assets are opening up capital markets and reshaping how ethical finance works. It’s fascinating to see digital-only Islamic banks and gold-backed stablecoins take center stage.

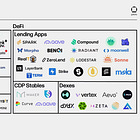

Speaking of blockchain, 2025 could be a tipping point for adoption in finance and the public sector. Stablecoins might hit $3.7 trillion by 2030, mostly dollar-denominated, and governments are piloting blockchain for aid distribution, record management, and digital ID. On the payments side, I unpacked what’s holding back Pay by Bank—spoiler: it needs credit lines, cashback rewards, better fraud protection, and way more consumer education. But with US merchants paying sky-high swipe fees, the cost advantage is real. Finally, I wrapped things up with the State of Fintech Q1 2025, where funding is steady at $10B/quarter, but investors are leaning into mature, revenue-generating fintechs. M&A is strong, and Payments still leads the funding charts.

Catch you in the next edition—plenty more fintech shifts on the horizon.

Insights

Stablecoins – The Infrastructure Opportunity

The stablecoin infrastructure landscape is rapidly evolving, with companies increasingly vertically integrating through in-house development or acquisitions—like MoonPay’s purchase of orchestration platform Iron.

This shift is lowering barriers for businesses and PSPs to adopt stablecoins, making stablecoin transactions feel seamless and comparable to traditional payments.

B2B payment infrastructure platforms are emerging as the backbone of this ecosystem. They offer a full stack of services—digital and fiat wallets, FX liquidity sourcing, on-chain settlement optimization, local bank connectivity, compliance automation, and licensing. These platforms enable smoother fiat-to-fiat cross-border transactions using a “stablecoin sandwich,” significantly enhancing accessibility and user experience.

🔹 Growing stablecoin utility

Stablecoins have initially gained traction in markets where traditional fiat systems struggle—such as in volatile economies, remittances, and global freelancer payments. Enterprises and PSPs are increasingly adopting stablecoins for these use cases.

Looking ahead, stablecoins have the potential to disrupt the $150 trillion cross-border B2B payments market by reducing costs, complexity, and settlement times. However, fiat-based providers like Wise and Airwallex remain strong competitors due to their robust liquidity networks and efficient services.

While stablecoin payments already outperform in speed—especially in hard-to-reach regions and during weekends—this alone isn’t enough. For broader adoption, stablecoins must consistently beat fiat in accessibility, cost, reliability, and integration with existing financial systems. Infrastructure providers face the challenge of delivering on this promise.

🔹 Remaining Friction Points

Despite progress, several major friction points are holding back broader adoption of stablecoins for payments:

1. Shallow Liquidity: On/off-ramping stablecoins to various fiat currencies lacks sufficient liquidity, especially in less common markets. This drives up costs and limits transaction volumes, often making stablecoin transfers as expensive—or even more so—than fiat alternatives.

2. Slow Fiat Offboarding: The "last mile" of stablecoin payments still depends on local fiat systems, which can introduce delays, particularly outside of business hours.

3. Limited Bank Participation: Wider adoption requires more banks to join the stablecoin ecosystem. That, in turn, depends on regulatory clarity—especially in the U.S., which plays a crucial role due to its deep capital markets.

4. Risk & Compliance Infrastructure: Scalable compliance systems are needed to support 24/7/365 stablecoin transactions, which operate on new rails with different data structures and faster settlement speeds.

Source Dawn

Reports

Digital identity and payments

Digital identity is a critical enabler of economic inclusion and public service delivery. According to the World Bank, around 850 million people globally still lack official identification. Even among those with ID, many do not have access to secure digital identities that are usable across services. McKinsey estimates that countries implementing well-designed digital identity systems could see a GDP uplift of 3–13% by 2030.

Payments are a high-frequency touchpoint in people's lives and can serve as a practical on-ramp for digital identity adoption. When identity and payments are linked, the result is a more secure, seamless user experience—whether for onboarding, authentication, or access to services. This creates a feedback loop where digital identity drives trust in payments, and payments reinforce the relevance and value of digital identity.

Trust is identified as the foundation of any successful digital identity system. Users will only adopt these systems if they are secure, transparent, and easy to use.

- Data privacy and protection: Users must know how their data is being used and be able to give or revoke consent.

- Security: Systems must be resilient to cyberattacks and unauthorized access.

- Inclusivity: Identity systems should work for people of all demographics, including those with limited digital literacy or access.

To build trusted ecosystems, public-private collaboration is essential. Governments provide regulatory clarity, legal frameworks, and national-scale infrastructure, while the private sector contributes technical expertise, innovation, and user-facing applications. Global standards like FIDO, eIDAS, and the OIDF are crucial to ensure interoperability, portability, and recognition of digital identities across platforms and borders.

Keep reading with a 7-day free trial

Subscribe to Fintech Wrap Up to keep reading this post and get 7 days of free access to the full post archives.