Stablecoins – The Infrastructure Opportunity; Crypto Lending Market; Expense management - Setting up a card program;

In this week’s Fintech Wrap Up, I’m diving into stablecoins as payment infrastructure, the rebound of DeFi lending, and how banks are navigating rising geopolitical risks

Insights & Reports:

1️⃣ Stablecoins – The Infrastructure Opportunity

2️⃣ Banking on Uncertainty: Thriving Through the Tariff Storm

3️⃣ Crypto Lending Market

4️⃣ Expense management - Setting up a card program

5️⃣ Circle Payments Network (CPN): B2B Cross-Border Payments, Reimagined

6️⃣ Deep Dive: Revolut - One App to Rule Them All

7️⃣ PayPal and Coinbase Expand Partnership to Drive Innovation of Stablecoin-based Solutions

8️⃣ Nubank clears major hurdle in securing Mexico banking license

9️⃣ Mastercard unveils end-to-end capabilities to power stablecoin transactions

TL;DR:

This week, I took a deep dive into the evolving landscape of stablecoins, which are starting to feel more like real infrastructure than just crypto buzzwords. From MoonPay snapping up orchestration platform Iron to platforms offering full fiat-onchain bridges, we’re seeing a clear shift toward smoother, more accessible cross-border payments. But we’re not quite there yet – shallow liquidity, slow offboarding, and bank hesitancy still hold us back. Circle’s CPN is one to watch though, blending offchain and onchain architecture for B2B cross-border payments and aiming to reinvent FX routing and settlement altogether.

On the macro side, April’s tariff hikes sent shockwaves through global markets. U.S. and European banks took a hit, and with geopolitical risk now amplifying everything from credit to cyber threats, banks will need to seriously up their scenario planning and digital resilience. The era of spreadsheets and periodic stress tests is long gone.

In crypto lending, we’re seeing a clear flip. CeFi took a huge hit post-Genesis and BlockFi, but DeFi lending has roared back—up 959% in two years. Still, the overall market is down from its 2021 peak, showing this space is rebuilding, not rebounding blindly.

I also looked at card issuing for expense management – a must-have for companies offering employee benefits or business spending solutions. The lesson? Don’t just bolt on a card program. Whether you go processor-only or with a managed provider, the setup will make or break your experience across markets.

In news you might’ve missed: PayPal and Coinbase are teaming up to boost PYUSD usage, Mastercard is going all-in on stablecoin payments with new wallet-to-checkout capabilities, and Nubank just cleared a major hurdle to becoming a full-service bank in Mexico. Big moves all around.

Thanks for tuning in to this week’s Fintech Wrap Up – I’ll catch you in the next one!

Reports

Insights

Deep Dive: Revolut - One App to Rule Them All

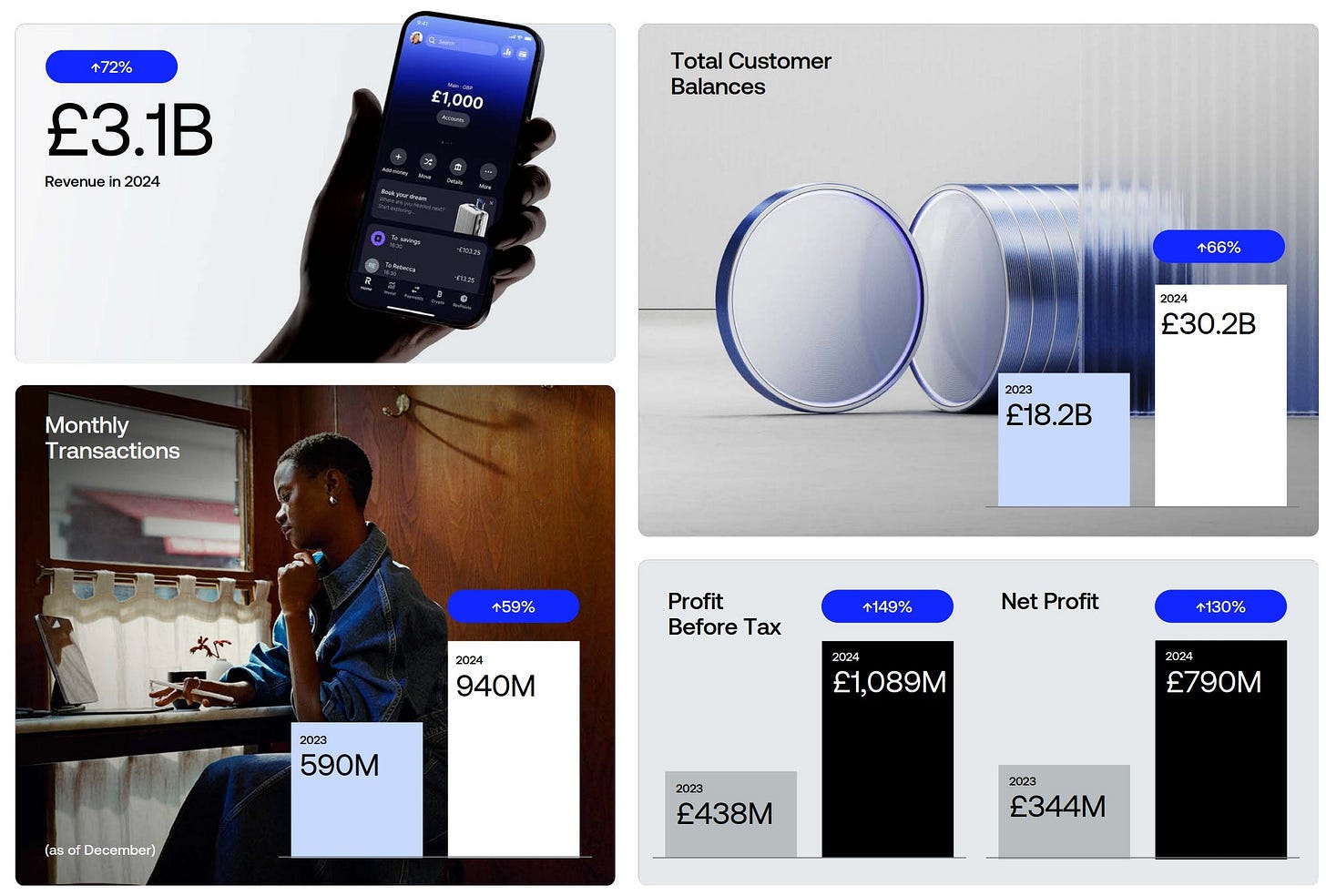

From its scrappy startup days to becoming a true financial super-app, Revolut now boasts over 52 million customers worldwide, handling more than £1 trillion in transactions just last year. They’ve built a diversified revenue machine, pulling in money from cards, subscriptions, wealth products, business accounts, and more — with 2024 revenues hitting £3.1 billion and a net profit of £790 million. What stood out to me is how Revolut isn’t just about banking anymore — it’s about lifestyle too, with premium plans like Ultra offering everything from unlimited lounge access to free mobile data via eSIMs. I also loved diving into leadership insights from CEO Nik Storonsky, who shared how Revolut bets on speed, aggressive product launches, and a KPI-driven culture to fuel its massive growth. Plus, a special look at CGO Antoine Le Nel’s refreshingly bold take on why traditional growth metrics like CAC are overrated. All in all, Revolut’s story from 2022 to 2024 is a masterclass in how to scale fast, stay profitable, and build a platform that customers genuinely love — and I can’t wait to see what’s next for them.

Deep Dive: Revolut - One App to Rule Them All

From its scrappy startup days to becoming a true financial super-app, Revolut now boasts over 52 million customers worldwide, handling more than £1 trillion in transactions just last year

Stablecoins – The Infrastructure Opportunity

The stablecoin infrastructure landscape is rapidly evolving, with companies increasingly vertically integrating through in-house development or acquisitions—like MoonPay’s purchase of orchestration platform Iron.

This shift is lowering barriers for businesses and PSPs to adopt stablecoins, making stablecoin transactions feel seamless and comparable to traditional payments.

B2B payment infrastructure platforms are emerging as the backbone of this ecosystem. They offer a full stack of services—digital and fiat wallets, FX liquidity sourcing, on-chain settlement optimization, local bank connectivity, compliance automation, and licensing. These platforms enable smoother fiat-to-fiat cross-border transactions using a “stablecoin sandwich,” significantly enhancing accessibility and user experience.

Keep reading with a 7-day free trial

Subscribe to Fintech Wrap Up to keep reading this post and get 7 days of free access to the full post archives.