Real banking use cases by Agentic AI; Understanding How "Wise Platform" Powering Banks and Enterprises; The architecture of orchestrated mulitagent systems in banking

Video of the Week

Post of the Week

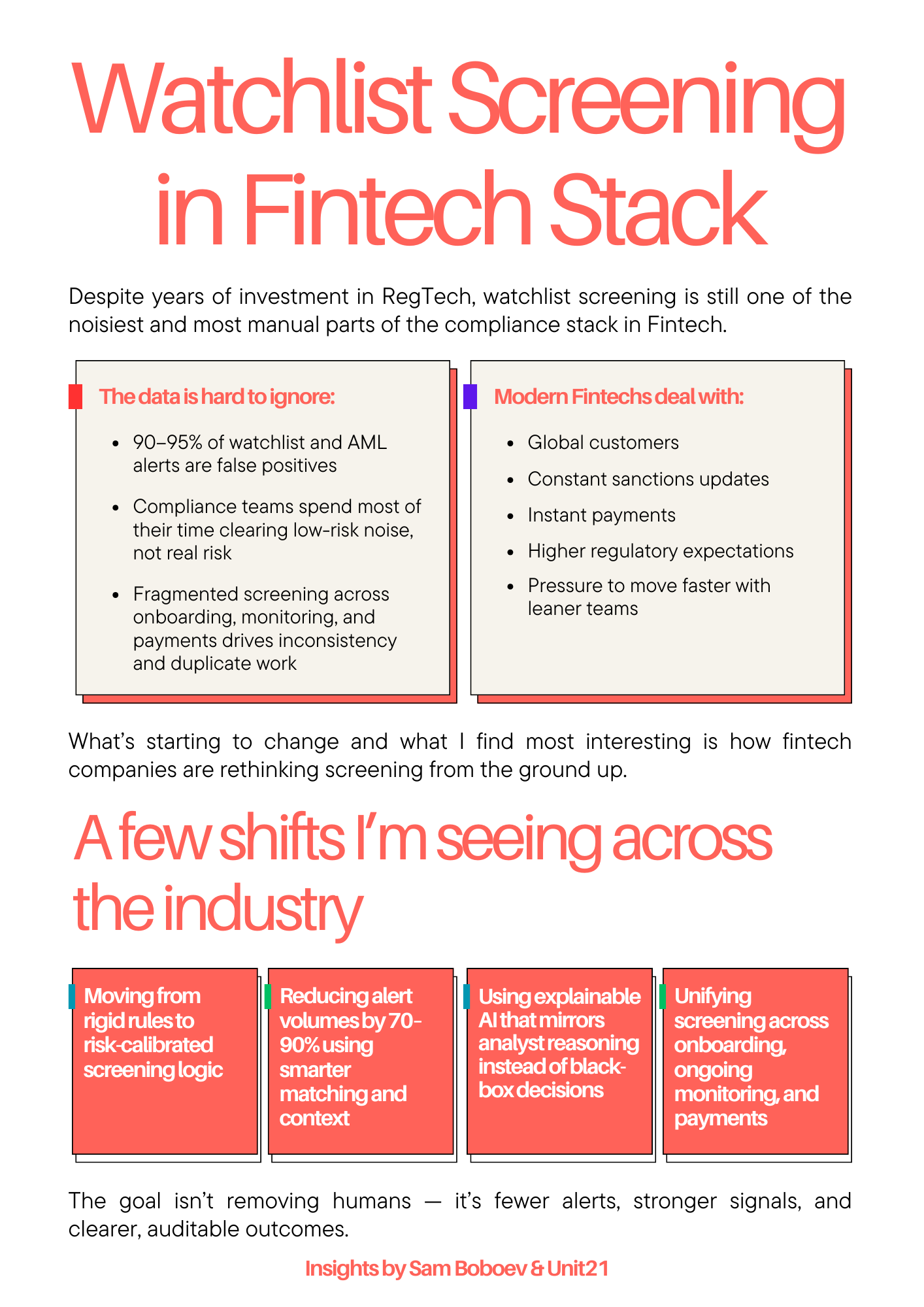

𝐖𝐚𝐭𝐜𝐡𝐥𝐢𝐬𝐭 𝐒𝐜𝐫𝐞𝐞𝐧𝐢𝐧𝐠 𝐢𝐧 𝐅𝐢𝐧𝐭𝐞𝐜𝐡 𝐒𝐭𝐚𝐜𝐤

Despite years of investment in RegTech, watchlist screening is still one of the noisiest and most manual parts of the compliance stack in Fintech.

____

The data is hard to ignore:

• 90–95% of watchlist and AML alerts are false positives across many institutions

• Compliance teams spend the majority of their time reviewing low-risk matches, not real threats

• Fragmented screening across onboarding, ongoing monitoring, and payments leads to inconsistent decisions and duplicated work

____

As volumes grow and real-time payments expand, this model simply doesn’t scale. The real problem isn’t a lack of technology.

It’s outdated screening logic and disconnected systems.

Most screening setups were built for static, rules-based environments. But today, fintechs are dealing with:

→ Global customers

→ Constant sanctions updates

→ Instant payments

→ Higher regulatory expectations

→ Pressure to move faster with leaner teams

____

What’s starting to change and what I find most interesting is how fintech companies are rethinking screening from the ground up.

Not as a compliance checkbox, but as a precision risk filter applied consistently across the full customer lifecycle.

A few shifts I’m seeing across the industry:

• Moving from rigid rules to risk-calibrated screening logic

• Reducing alert volumes by 70–90% using smarter matching and context

• Using explainable AI that mirrors analyst reasoning instead of black-box decisions

• Unifying screening across onboarding, ongoing monitoring, and payments

The goal isn’t to remove humans from the loop. It’s to give compliance teams fewer alerts, better signals, and clearer explanations — while maintaining auditability and regulatory confidence.

____

I’ll be joining a live session by Unit21 next week to unpack how fintech compliance teams are redesigning watchlist screening for 2026 and beyond.

If you’re leading compliance, risk, or building fintech infrastructure, it’s worth a listen.

Deep Dive of the Week

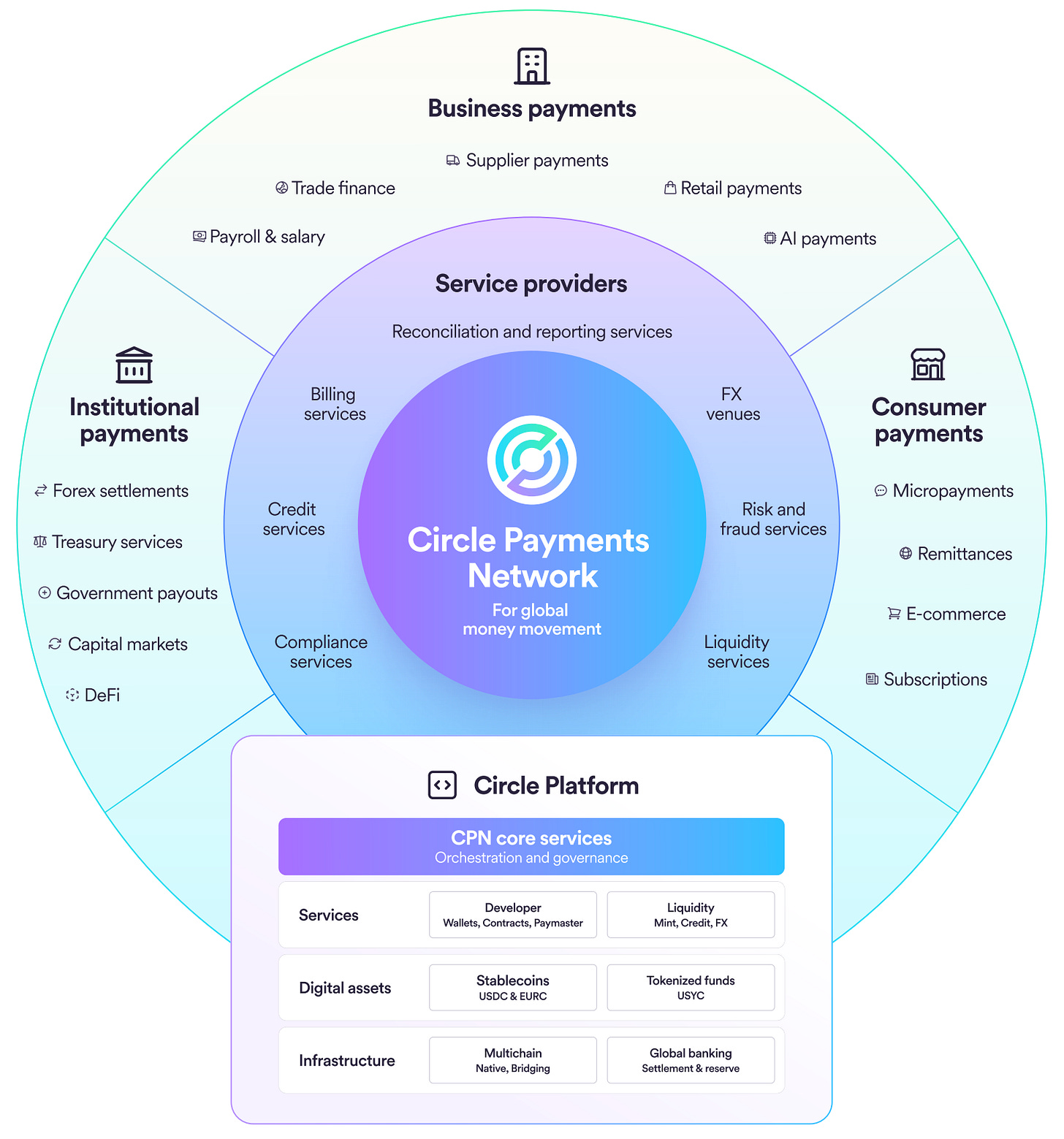

Inside Circle’s Payments Network

It’s 2026, but we still use bank wires that hop through multiple intermediaries, take days, and charge a toll in fees to move money across borders. Circle’s new Circle Payments Network (CPN) is a bid to change that. After reviewing the CPN whitepaper, developer docs, and the launch talk, I see a clear strategy: Circle is building an open, stablecoin-based payment network that connects financial institutions under a compliance-first framework. In this deep dive, I’ll break down how CPN works from first principles and why it matters for anyone building in fintech.

This week’s reports

𝐇𝐨𝐰 𝐁𝐚𝐧𝐤𝐬 𝐚𝐧𝐝 𝐅𝐢𝐧𝐭𝐞𝐜𝐡𝐬 𝐒𝐡𝐨𝐮𝐥𝐝 𝐏𝐫𝐞𝐩𝐚𝐫𝐞 𝐟𝐨𝐫 𝐏𝐨𝐬𝐭-𝐐𝐮𝐚𝐧𝐭𝐮𝐦 𝐒𝐞𝐜𝐮𝐫𝐢𝐭𝐲

1️⃣𝐇𝐨𝐰 𝐁𝐚𝐧𝐤𝐬 𝐚𝐧𝐝 𝐅𝐢𝐧𝐭𝐞𝐜𝐡𝐬 𝐒𝐡𝐨𝐮𝐥𝐝 𝐏𝐫𝐞𝐩𝐚𝐫𝐞 𝐟𝐨𝐫 𝐏𝐨𝐬𝐭-𝐐𝐮𝐚𝐧𝐭𝐮𝐦 𝐒𝐞𝐜𝐮𝐫𝐢𝐭𝐲

2️⃣𝐑𝐞𝐠𝐮𝐥𝐚𝐭𝐨𝐫𝐬 𝐀𝐫𝐞 𝐈𝐧𝐯𝐞𝐬𝐭𝐢𝐧𝐠, 𝐁𝐮𝐭 𝐍𝐨𝐭 𝐢𝐧 𝐚 𝐂𝐨𝐨𝐫𝐝𝐢𝐧𝐚𝐭𝐞𝐝 𝐖𝐚𝐲

3️⃣𝐄𝐮𝐫𝐨𝐩𝐞𝐚𝐧 𝐛𝐚𝐧𝐤𝐬 𝐚𝐫𝐞 𝐝𝐨𝐧𝐞 𝐝𝐞𝐛𝐚𝐭𝐢𝐧𝐠 𝐬𝐭𝐚𝐛𝐥𝐞𝐜𝐨𝐢𝐧𝐬. 𝐓𝐡𝐞𝐲 𝐚𝐫𝐞 𝐛𝐮𝐢𝐥𝐝𝐢𝐧𝐠 𝐭𝐡𝐞𝐦

4️⃣𝐇𝐨𝐰 𝐀𝐈 𝐀𝐜𝐭𝐮𝐚𝐥𝐥𝐲 𝐂𝐫𝐞𝐚𝐭𝐞𝐬 𝐕𝐚𝐥𝐮𝐞 𝐢𝐧 𝐁𝐚𝐧𝐤𝐢𝐧𝐠

5️⃣𝐖𝐡𝐲 𝐀𝐜𝐜𝐨𝐮𝐧𝐭 𝐎𝐰𝐧𝐞𝐫𝐬𝐡𝐢𝐩 𝐈𝐬 𝐍𝐨 𝐋𝐨𝐧𝐠𝐞𝐫 𝐭𝐡𝐞 𝐌𝐞𝐚𝐬𝐮𝐫𝐞 𝐨𝐟 𝐅𝐢𝐧𝐚𝐧𝐜𝐢𝐚𝐥 𝐈𝐧𝐜𝐥𝐮𝐬𝐢𝐨𝐧

6️⃣𝟗𝟗% 𝐨𝐟 𝐁𝐚𝐧𝐤𝐬 𝐈𝐧𝐯𝐞𝐬𝐭 𝐢𝐧 𝐂𝐮𝐬𝐭𝐨𝐦𝐞𝐫-𝐅𝐚𝐜𝐢𝐧𝐠 𝐀𝐈. 𝐎𝐧𝐥𝐲 𝟑𝟐% 𝐒𝐞𝐞 𝐑𝐞𝐚𝐥 𝐑𝐞𝐭𝐮𝐫𝐧𝐬

7️⃣𝐁𝐫𝐚𝐳𝐢𝐥 𝐓𝐨𝐤𝐞𝐧𝐢𝐳𝐚𝐭𝐢𝐨𝐧 𝐑𝐞𝐩𝐨𝐫𝐭 𝟐𝟎𝟐𝟓

This week’s insights

1️⃣𝐔𝐧𝐝𝐞𝐫𝐬𝐭𝐚𝐧𝐝𝐢𝐧𝐠 𝐕𝐢𝐬𝐚’𝐬 𝐂𝐨𝐦𝐦𝐞𝐫𝐜𝐢𝐚𝐥 & 𝐌𝐨𝐧𝐞𝐲 𝐌𝐨𝐯𝐞𝐦𝐞𝐧𝐭 𝐒𝐨𝐥𝐮𝐭𝐢𝐨𝐧𝐬

2️⃣𝐔𝐧𝐝𝐞𝐫𝐬𝐭𝐚𝐧𝐝𝐢𝐧𝐠 𝐅𝐢𝐬𝐞𝐫𝐯’𝐬 𝐁𝐮𝐬𝐢𝐧𝐞𝐬𝐬 𝐚𝐧𝐝 𝐏𝐫𝐨𝐝𝐮𝐜𝐭 𝐒𝐭𝐫𝐚𝐭𝐞𝐠𝐲

3️⃣𝐑𝐞𝐚𝐥 𝐛𝐚𝐧𝐤𝐢𝐧𝐠 𝐮𝐬𝐞 𝐜𝐚𝐬𝐞𝐬 𝐩𝐨𝐰𝐞𝐫𝐞𝐝 𝐛𝐲 𝐀𝐠𝐞𝐧𝐭𝐢𝐜 𝐀𝐈

4️⃣𝐔𝐧𝐝𝐞𝐫𝐬𝐭𝐚𝐧𝐝𝐢𝐧𝐠 𝐇𝐨𝐰 “𝐖𝐢𝐬𝐞 𝐏𝐥𝐚𝐭𝐟𝐨𝐫𝐦” 𝐏𝐨𝐰𝐞𝐫𝐢𝐧𝐠 𝐁𝐚𝐧𝐤𝐬 𝐚𝐧𝐝 𝐄𝐧𝐭𝐞𝐫𝐩𝐫𝐢𝐬𝐞𝐬

5️⃣𝐔𝐧𝐝𝐞𝐫𝐬𝐭𝐚𝐧𝐝𝐢𝐧𝐠 𝐎𝐩𝐞𝐫𝐚𝐭𝐢𝐨𝐧𝐚𝐥 𝐌𝐨𝐝𝐞𝐥 𝐓𝐨𝐤𝐞𝐧𝐢𝐬𝐞𝐝 𝐌𝐨𝐧𝐞𝐲 𝐌𝐚𝐫𝐤𝐞𝐭 𝐅𝐮𝐧𝐝𝐬

6️⃣𝐇𝐨𝐰 𝐀𝐈 𝐈𝐬 𝐁𝐞𝐢𝐧𝐠 𝐔𝐬𝐞𝐝 𝐭𝐨 𝐂𝐨𝐦𝐛𝐚𝐭 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐅𝐫𝐚𝐮𝐝

7️⃣𝐓𝐡𝐞 𝐚𝐫𝐜𝐡𝐢𝐭𝐞𝐜𝐭𝐮𝐫𝐞 𝐨𝐟 𝐨𝐫𝐜𝐡𝐞𝐬𝐭𝐫𝐚𝐭𝐞𝐝 𝐦𝐮𝐥𝐭𝐢𝐚𝐠𝐞𝐧𝐭 𝐬𝐲𝐬𝐭𝐞𝐦𝐬 𝐢𝐧 𝐛𝐚𝐧𝐤𝐢𝐧𝐠

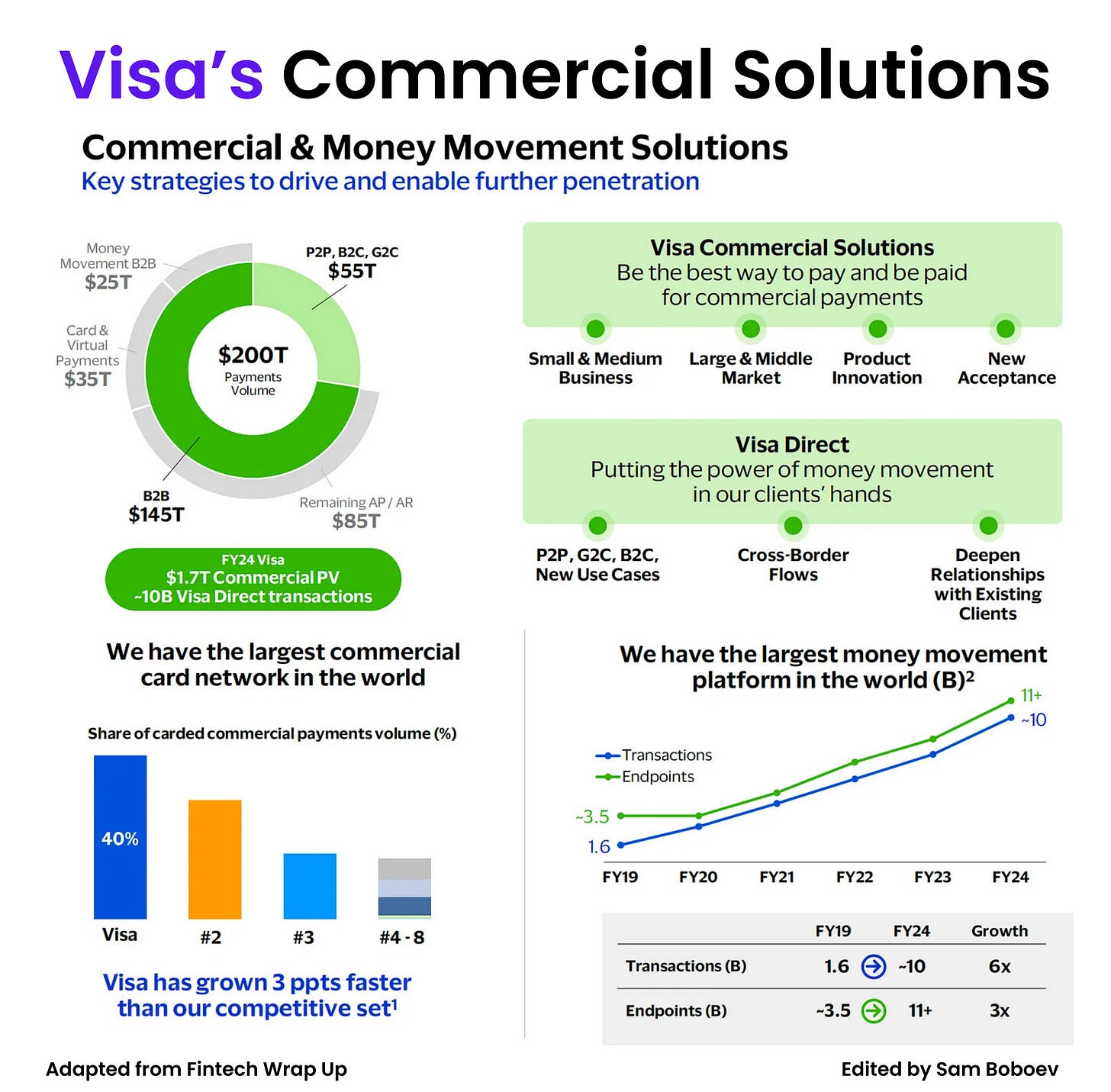

𝐔𝐧𝐝𝐞𝐫𝐬𝐭𝐚𝐧𝐝𝐢𝐧𝐠 𝐕𝐢𝐬𝐚’𝐬 𝐂𝐨𝐦𝐦𝐞𝐫𝐜𝐢𝐚𝐥 & 𝐌𝐨𝐧𝐞𝐲 𝐌𝐨𝐯𝐞𝐦𝐞𝐧𝐭 𝐒𝐨𝐥𝐮𝐭𝐢𝐨𝐧𝐬

Most people still think of Visa as a consumer card company. That mental model is outdated.

The real growth engine today sits in Commercial & Money Movement Solutions, Visa’s business focused on payment flows outside traditional consumer-to-merchant card swipes. This includes B2B payments, person-to-person transfers, business payouts, and government flows.

According to Chris Newkirk, President of CMS, the CMS strategy is built on two platforms. Visa Commercial Solutions targets B2B use cases such as payables, procurement, travel and expense, employee spend, and public sector payments. Visa Direct focuses on money movement at scale, covering P2P transfers, gig economy payouts, insurance disbursements, remittances, and selected B2B flows that move funds between accounts.

The addressable market here is massive. Visa estimates roughly $200 trillion in annual volume across these non-consumer flows, split between $55 trillion in money movement and $145 trillion in B2B payments.

This is not just a long-term bet. Since 2021, CMS revenues have grown at a 22 percent compound annual rate. In fiscal 2024 alone, Visa processed $1.7 trillion in commercial card volume and nearly 10 billion Visa Direct transactions. And yet, Visa still describes its penetration of this market as minimal.

The focus is deliberate. Within B2B, Visa is targeting about $60 trillion of flows where it can monetize effectively. Around $25 trillion comes from cross-border B2B payments, supported by capabilities such as Currencycloud and Visa B2B Connect. Another $35 trillion comes from domestic and cardable B2B spend, including procurement, travel, and contractor payments. These segments account for roughly 80 percent of the revenue opportunity in B2B payments.

Keep reading with a 7-day free trial

Subscribe to Fintech Wrap Up to keep reading this post and get 7 days of free access to the full post archives.