Deep Dive: Inside Circle’s Payments Network

It’s 2026, but we still use bank wires that hop through multiple intermediaries, take days, and charge a toll in fees to move money across borders. Circle’s new Circle Payments Network (CPN) is a bid to change that. After reviewing the CPN whitepaper, developer docs, and the launch talk, I see a clear strategy: Circle is building an open, stablecoin-based payment network that connects financial institutions under a compliance-first framework. In this deep dive, I’ll break down how CPN works from first principles and why it matters for anyone building in fintech.

An internet-native switchboard for money

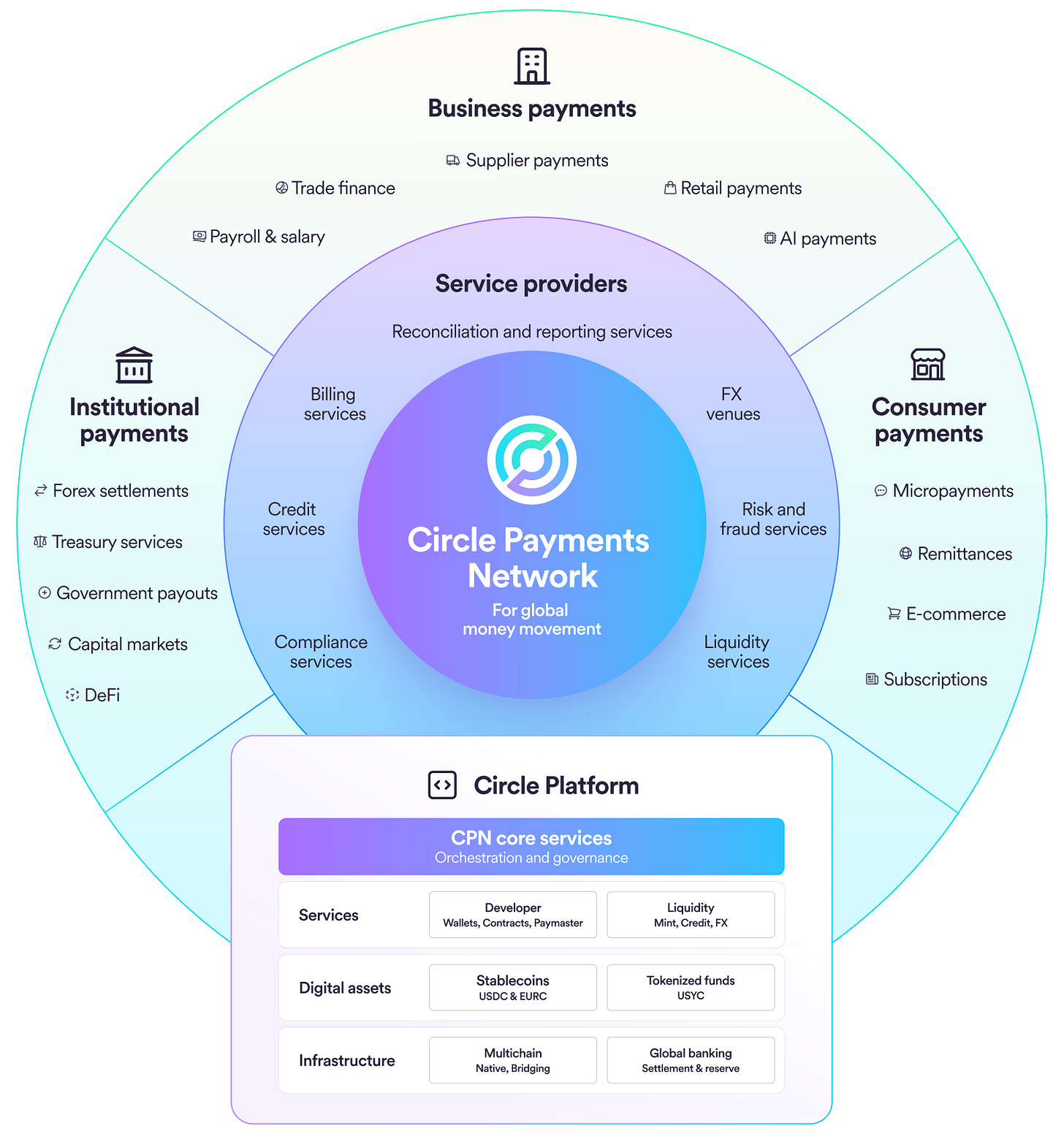

Think of CPN not as just another payment app or single corridor solution, but as an intelligent switchboard for global money movement. It’s a network where banks, fintechs, and payment companies plug in once and gain the ability to transact with each other in near-real-time. CPN’s design combines the reliability of traditional payment systems with the openness and speed of blockchain rails. In essence, Circle has created a coordination protocol that uses fiat-backed stablecoins (like USDC, and eventually EURC) as the settlement medium. By leveraging a stablecoin on public blockchains, payments can settle in seconds, 24/7, without touching correspondent banking chains. At the same time, CPN bakes in compliance and governance from the ground up, so only regulated institutions participate and every transaction meets AML/KYC standards.

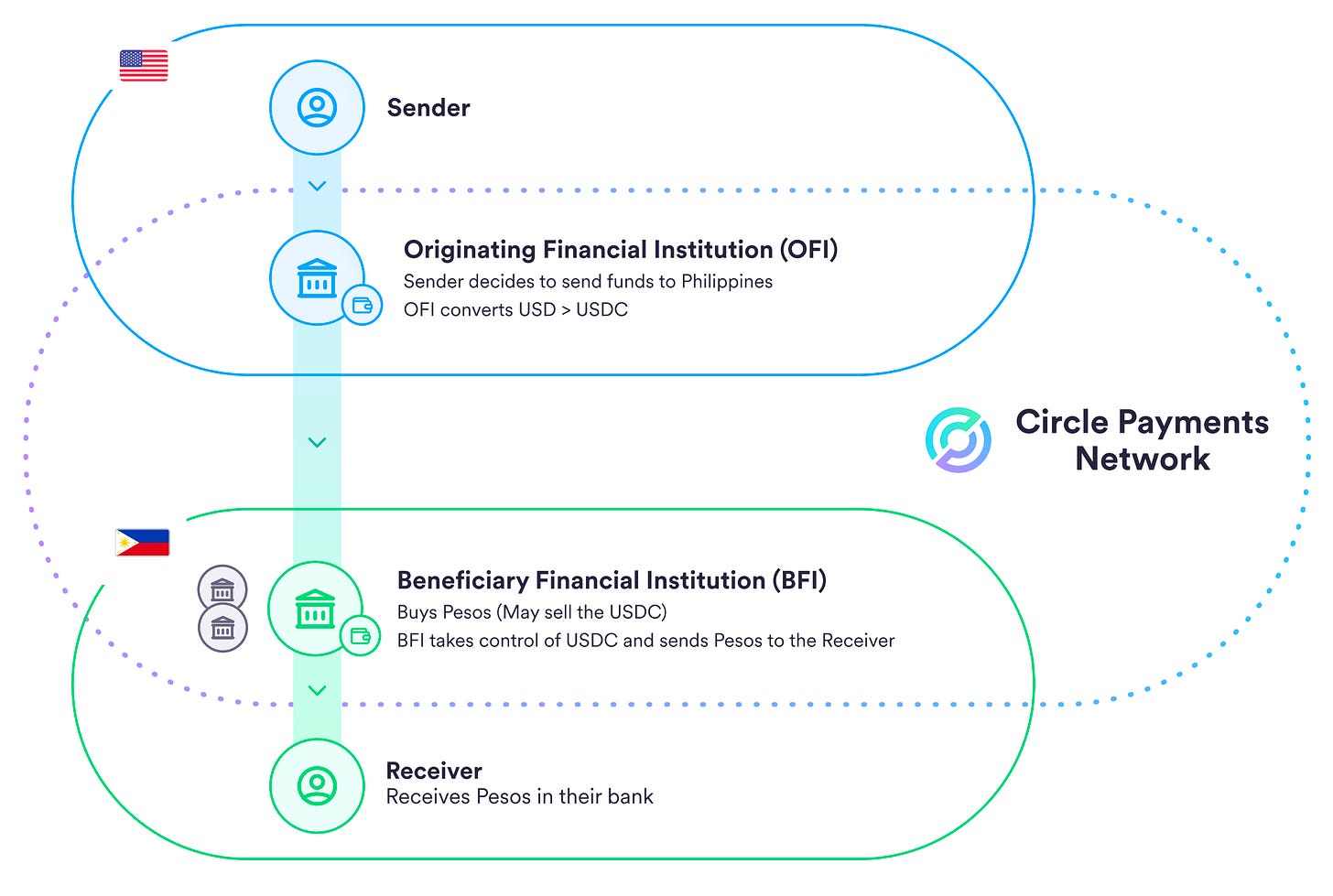

What does this look like in practice? Originating Financial Institutions (OFIs) say a bank or fintech on the sender’s side can connect to CPN and reach any Beneficiary Financial Institution (BFI) on the receiver’s side with a single integration. The OFI handles the sender’s onboarding, KYC, and fiat-to-USDC conversion (onramp). The BFI on the other end receives USDC and converts it to local currency for payout (offramp). Circle sits in the middle as the network operator and orchestrator, but notably, Circle isn’t holding or moving the funds itself; instead, CPN acts as a marketplace and protocol that coordinates the exchange of messages and USDC between member institutions. This “many-to-many” network means an OFI can instantly discover payout partners in any country without negotiating one-off partnerships or keeping money parked in foreign bank accounts. The result is an always-on network where a payment that might have taken 3–5 banks and several days can now complete in minutes via a single stablecoin transfer.

How CPN works: four steps to settle a payment

To understand the system-level design, let’s walk through a typical CPN cross-border payment. Say a fintech in the U.S. (the OFI) needs to send $1000 to a bank in the Philippines (the BFI) on behalf of a customer. CPN orchestrates this through four main stages:

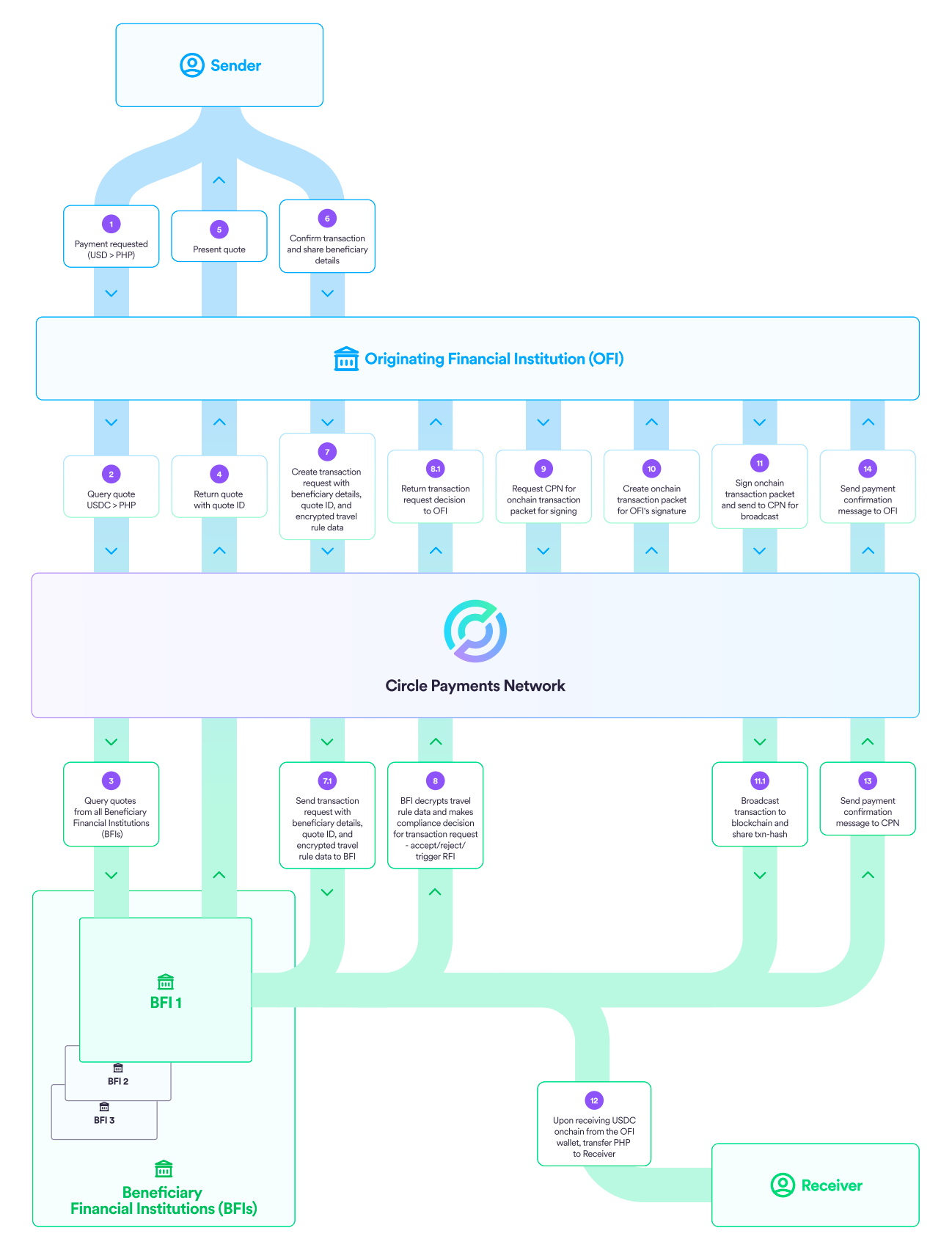

Quote generation: The OFI’s system requests a competitive FX quote for converting USD to PHP. Through one API call, CPN’s network pings multiple BFIs in the Philippines for their rates. Within seconds, quotes come back and are locked in, eliminating FX volatility risk during the transfer.

Payment setup: The OFI selects the best quote (based on price or perhaps preferred partner). The sender approves, and the OFI creates a payment request. Here CPN handles compliance data, the OFI encrypts the sender’s travel rule information (sender and beneficiary KYC details), and includes it with the payment request. The chosen BFI receives this encrypted data, performs its own checks (ensuring it’s comfortable with the counterparty and transaction), and if all looks good, approves the payment.

On-chain transfer: Once approved, Circle’s system generates an on-chain transaction object for the stablecoin transfer. The OFI signs this transaction (using its USDC wallet) and submits it. Now the magic happens on the blockchain: USDC moves from the OFI’s wallet directly to the BFI’s wallet as a near-instant token transfer. CPN’s coordination layer validates the transaction details (correct amount, token, recipient address, etc.) and broadcasts it to the public blockchain. Both OFI and BFI get notified as soon as the transaction is confirmed on-chain.

Keep reading with a 7-day free trial

Subscribe to Fintech Wrap Up to keep reading this post and get 7 days of free access to the full post archives.