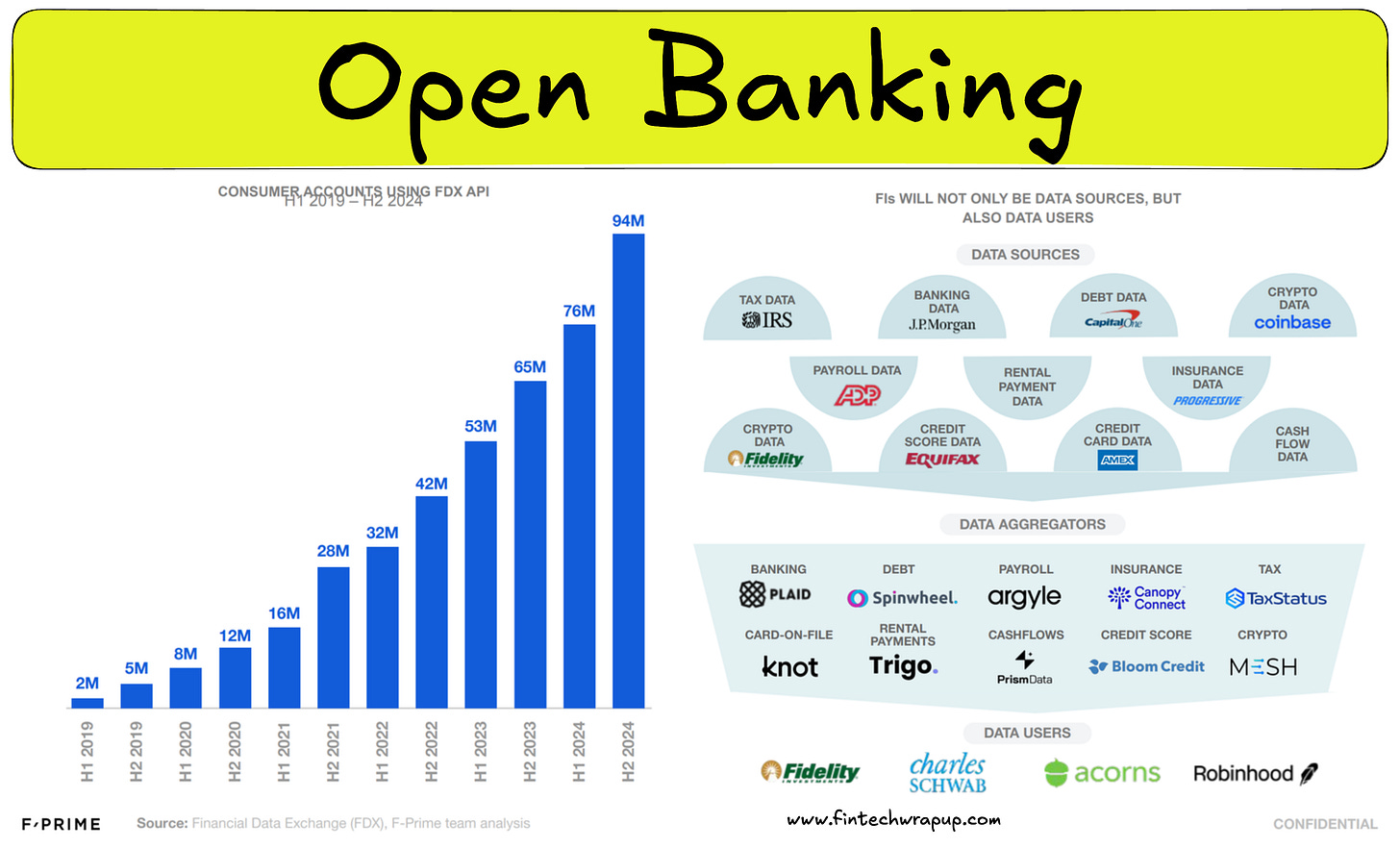

Open Banking in Wealth Management: From Data Sharing to Personalized Portfolios; Agentic Commerce: Mobile or the Metaverse; Inefficient bank onboarding sparks friction for merchants

Looking for VC & accelerator recommendations

Wraap Up [https://wraapup.com/] is live — our AI-powered financial infrastructure is helping companies streamline FX risk management, reconciliation, and close their books faster.

We’ve built our foundation around AI FX management, multi-currency accounts, international transfers, and ERP integrations — all designed to simplify the financial back office.

We’re now gearing up for the next phase, connecting with VCs and incubator programs that support early-stage fintech and AI automation companies.

If you know any great:

💸 Fintech-focused VCs (Pre-Seed to Seed)

🧠 Funds investing in AI-powered financial infrastructure

🌍 Incubators with strong fintech networks (UK, EU, or US)

—I’d love your recommendations, intros, or “you should talk to X” messages.

Daily news on Payments Wrap Up

Deep Dive of the Week

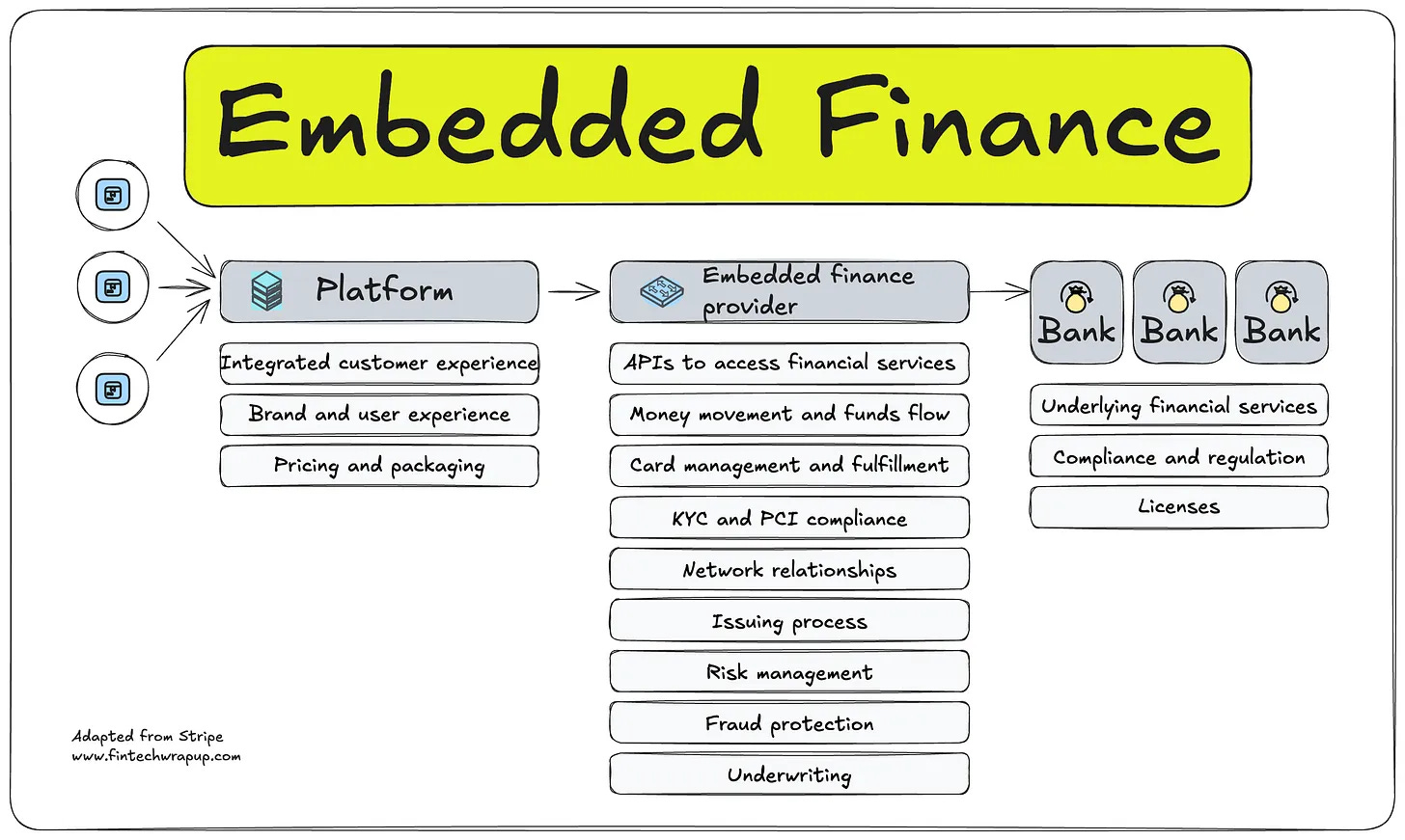

Embedded Finance for SaaS Platforms: What It Means and Why It Matters

Embedded finance is the practice of weaving financial services directly into software products and platforms. In other words, non-financial apps and marketplaces let users access bank accounts, payments, lending, insurance or other financial tools without leaving the app they already use. This idea may sound daunting, but it’s rapidly becoming a core part of fintech and SaaS strategy. As startups and incumbents alike explore this new frontier, product leaders are asking: How does embedded finance work? What can we embed? Why invest in it – and what are the pitfalls?

This week’s reports

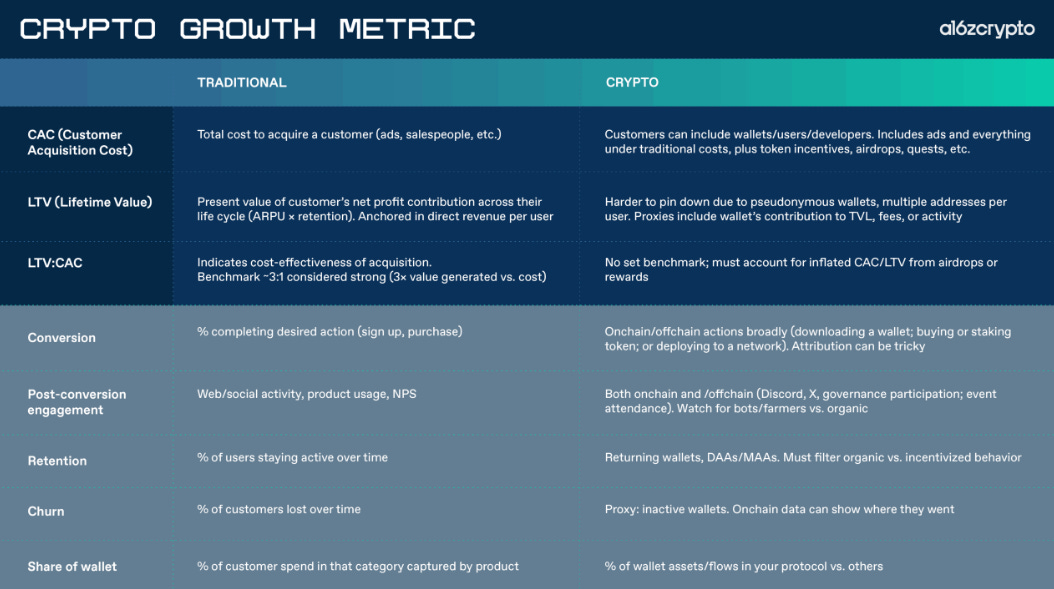

One Metric Doesn’t Fit All: Why Crypto Growth Defies a Single Dashboard

1️⃣One Metric Doesn’t Fit All: Why Crypto Growth Defies a Single Dashboard

Keep reading with a 7-day free trial

Subscribe to Fintech Wrap Up to keep reading this post and get 7 days of free access to the full post archives.