Deep Dive: Embedded Finance for SaaS Platforms: What It Means and Why It Matters

Embedded finance is the practice of weaving financial services directly into software products and platforms. In other words, non-financial apps and marketplaces let users access bank accounts, payments, lending, insurance or other financial tools without leaving the app they already use. This idea may sound daunting, but it’s rapidly becoming a core part of fintech and SaaS strategy. As startups and incumbents alike explore this new frontier, product leaders are asking: How does embedded finance work? What can we embed? Why invest in it – and what are the pitfalls?

This guide cuts through the jargon to explain embedded finance in plain terms. We’ll cover its evolution, how it’s built, what services get embedded, the benefits and challenges for software platforms, and even how crypto is reshaping the space. Throughout, we cite industry analysis and real examples to ground the discussion. Think of this as a crash course for product managers, fintech founders, and strategists looking to understand – and perhaps leverage – embedded finance on their platforms.

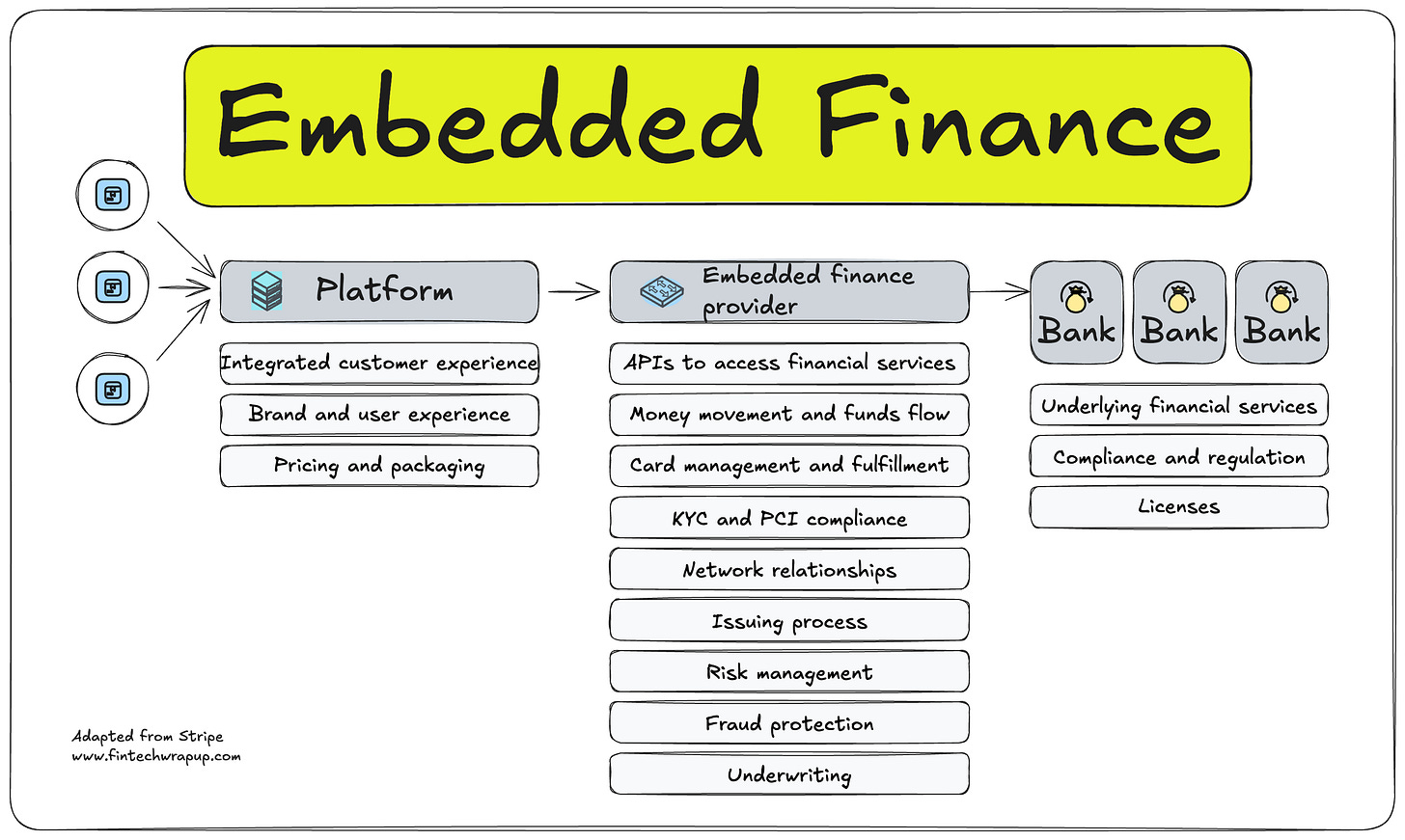

What it isn’t: Simply adding Stripe or PayPal for payments (that’s now table stakes). Embedded finance goes beyond payments to build whole financial products (accounts, loans, cards, insurance, etc.) into your software. It relies on modern APIs and often on Banking-as-a-Service partnerships with regulated banks. In short: it means turning your non-financial software into a one-stop shop where users can also manage their money, all in one familiar place.

Fintech Wrap Up is a reader-supported publication. To support my work, consider becoming a free or paid subscriber.From SaaS to Fintech: The Evolution of Embedded Finance

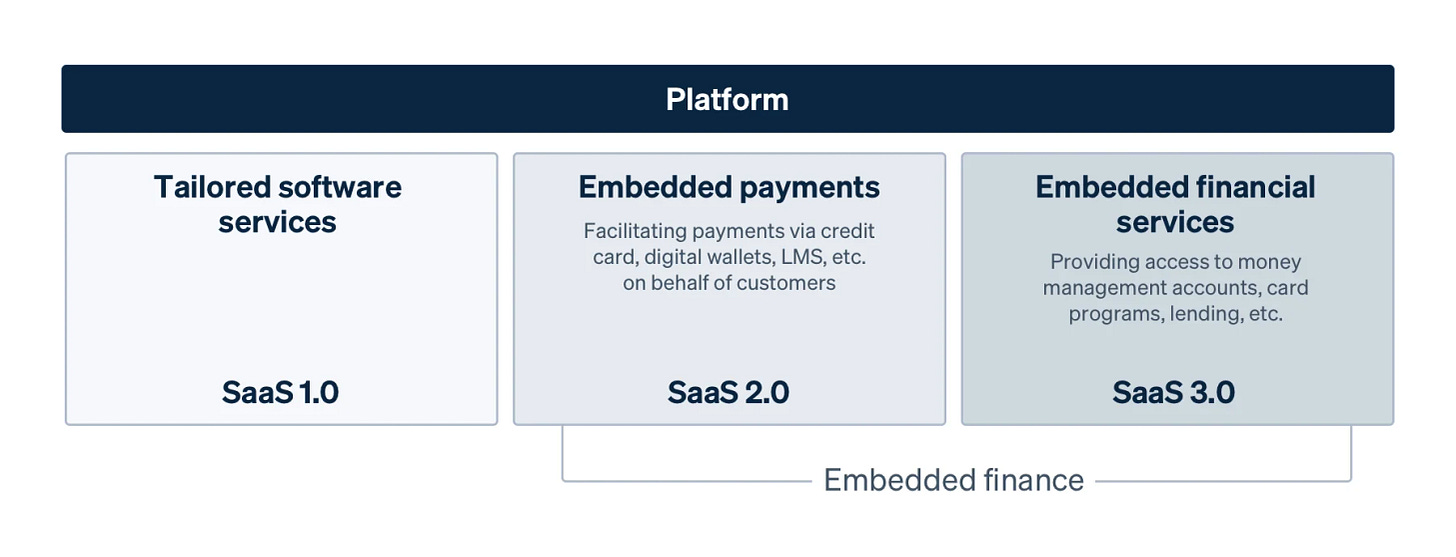

Over the last decade, software businesses have changed how they go to market. Early SaaS (“Software-as-a-Service 1.0”) focused only on billing recurring subscriptions. Soon it became clear that embedding payments (a milestone now seen as “SaaS 2.0”) was essential: any modern platform needed a built-in way to accept customer payments. Today, a new wave (“SaaS 3.0” or simply embedded finance) has arrived. Companies are layering in financial products beyond checkout: business bank accounts, debit cards, working capital loans, insurance, payroll and more.

Historic examples: This is not entirely new. Private-label credit cards at retail stores and auto loans at dealerships have been around for decades. What’s different now is the seamless, digital integration of finance into every app and service. You might not even notice the bank behind the scenes when you open a money management app or click “buy now, pay later” at checkout – that’s embedded finance in action.

Why now? Three converging trends made this possible: (1) APIs and fintech infrastructure – new middleware and Banking-as-a-Service (BaaS) platforms mean banks can expose accounts, cards, and loans to third parties via code; (2) Mobile and cloud ubiquity – customers expect everything on their phone or browser, including financial tools; and (3) Open banking and data – regulations and bank APIs give software firms access to rich customer data, allowing real-time underwriting and services.

Who leads? Initially, vertical SaaS firms led the charge. Industry-specific platforms like Mindbody (wellness studios), Toast (restaurants), and Shopify (e-commerce) started by reselling financial services (often payments), then moved to embedding them deeply. These “winner-take-most” vertical players already owned the customer relationships and data, so adding finance was a natural upsell. But horizontally-oriented platforms and marketplaces (e.g. gig economy apps, HR software, procurement platforms) are now jumping in too. According to McKinsey, “platforms” – from retailers and software firms to telecoms – are well placed to distribute finance because they have a large, engaged user base and frequent customer interactions.

Keep reading with a 7-day free trial

Subscribe to Fintech Wrap Up to keep reading this post and get 7 days of free access to the full post archives.