Smart Routing And Cascading Solutions In Payment Orchestration; Crypto Card Comparison (2025); Application and Platform Disposition Framework for Banks

Daily news on Payments Wrap Up

This week’s reports

AI x Commerce

2️⃣Why Hotel Chains Need to Rethink Payments (and Fast)

3️⃣How the U.S. Can Benefit from an Effective Crypto Tax Policy

4️⃣From Billions to Trillions: Stablecoins’ Next Leap

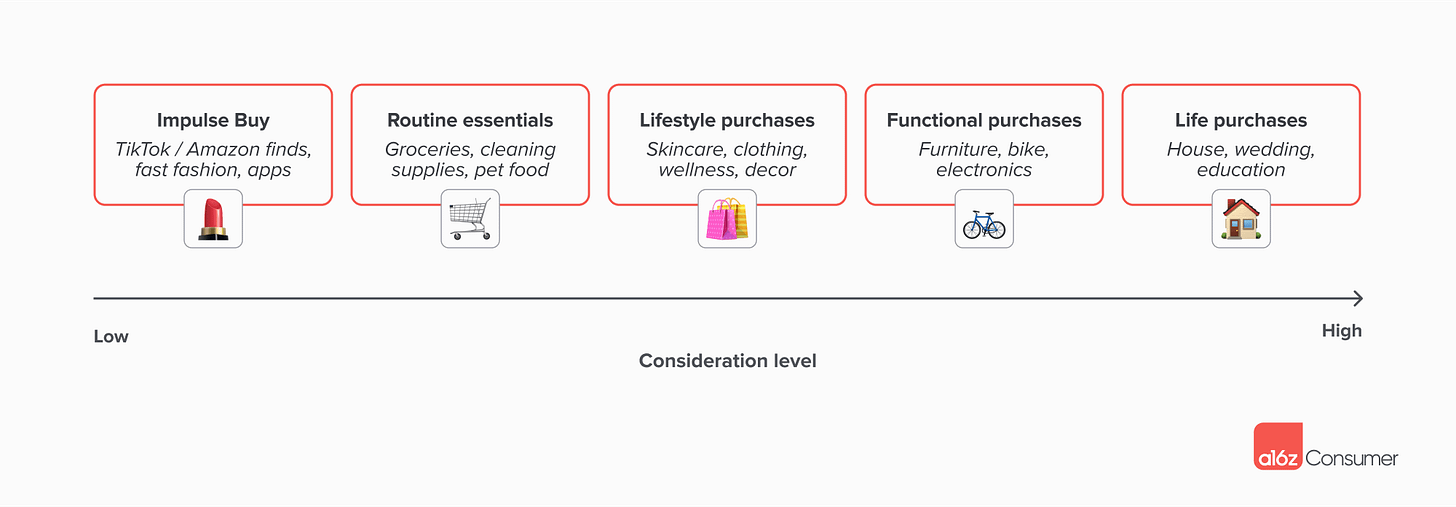

5️⃣AI agents take control of the buying and paying process

7️⃣Neobank Valuations: Scale Wins, Multiples Bites

This week’s insights

1️⃣The Embedded Finance Playbook for Marketplaces and the Gig Economy

2️⃣What is a Method URL in 3D Secure Payments?

3️⃣Application and Platform Disposition Framework for Banks

4️⃣Let's learn how Ramp grew from corporate cards to $1B revenue

5️⃣Crypto Card Comparison (2025)

6️⃣Money Movement: Past, Present & Future

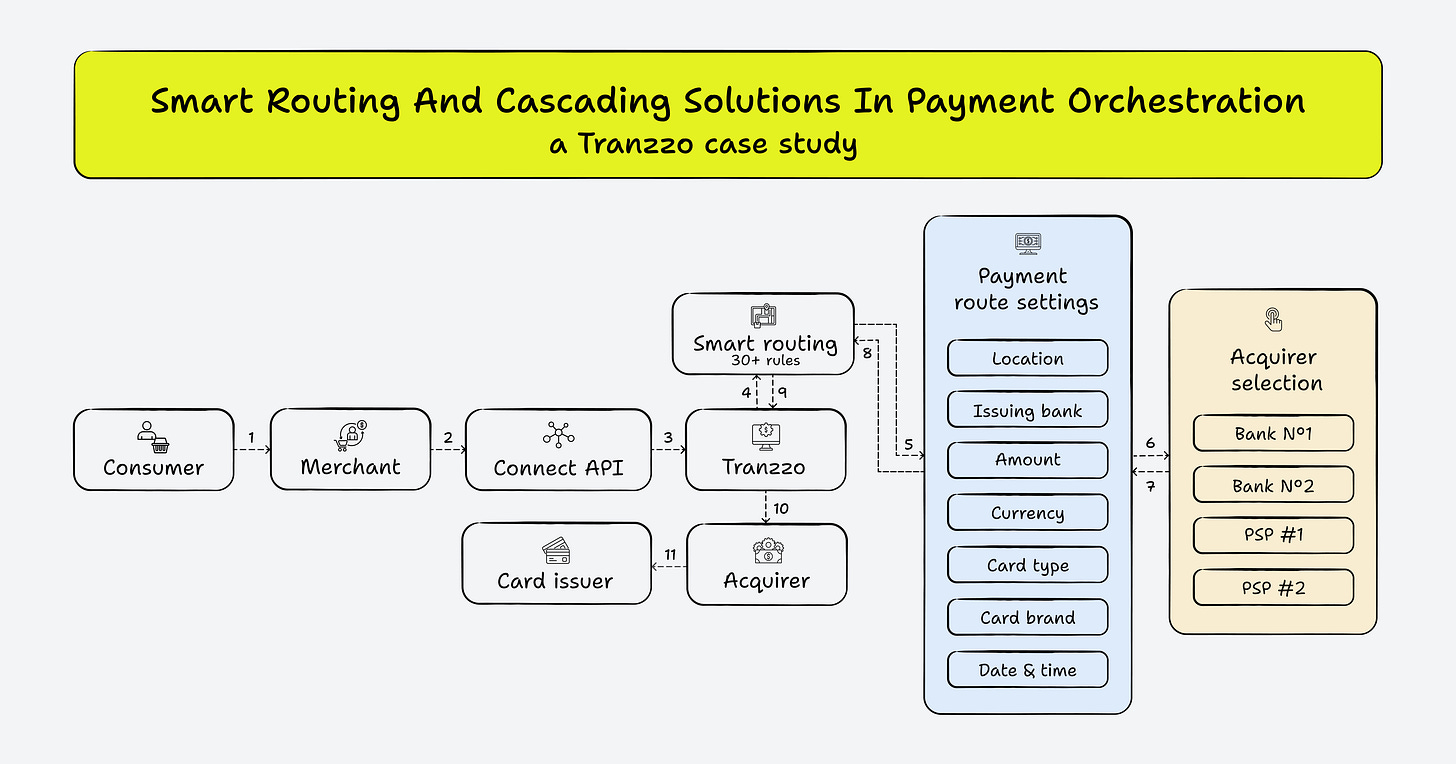

7️⃣Smart Routing And Cascading Solutions In Payment Orchestration

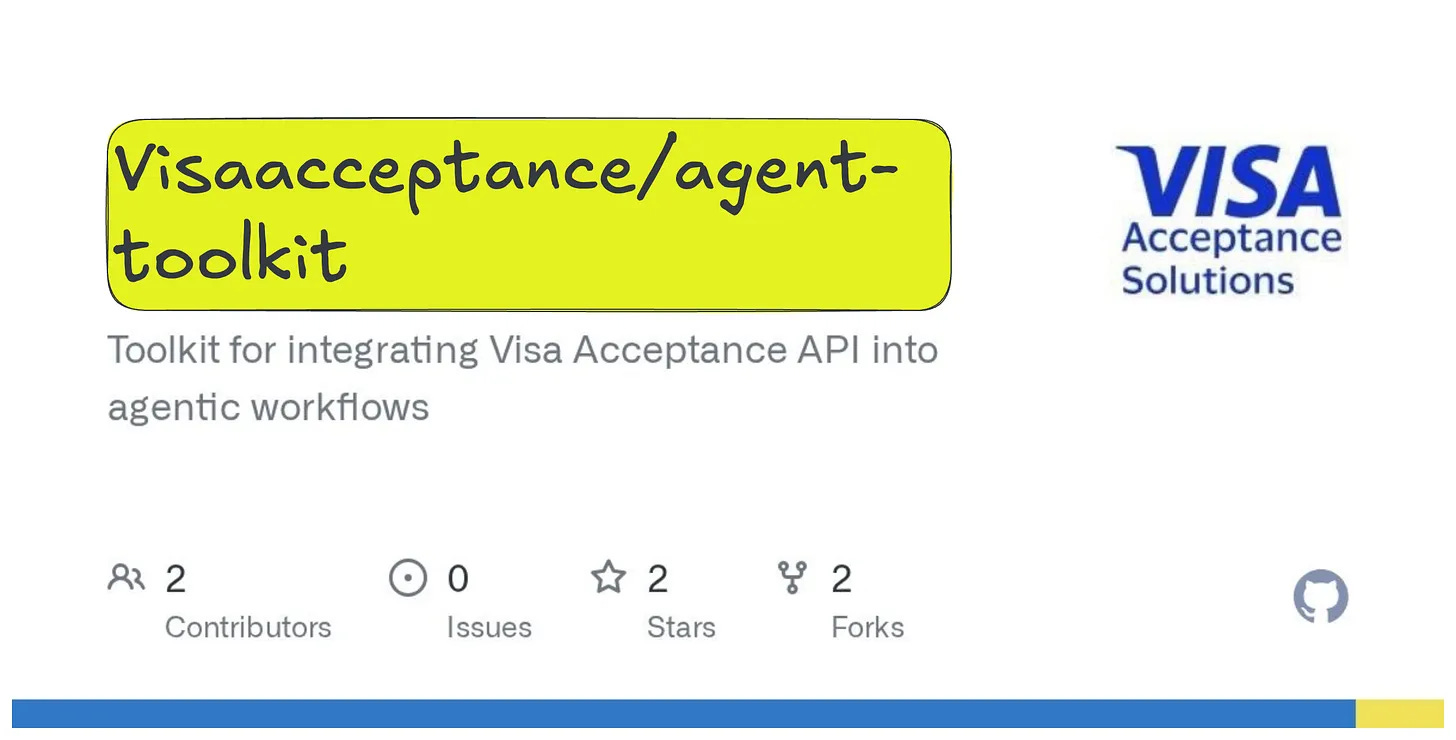

MCP to MVP - Building Agentic Commerce on Visa Rails

Imagine telling an AI assistant to “plan my trip to Miami,” then sitting back as it finds the perfect flight, hotel, and even buys that new fishing reel you wanted – all on its own. That’s the vision behind Visa’s Intelligent Commerce, a new platform that lets AI “agent” software find, shop, and buy on your behalf. At Visa’s recent Product Drop 2025 event, CEO Ryan McInerney and Chief Product Officer Jack Forestell unveiled this initiative as a “new way to buy with AI in the same trusted, secure way to pay”. It’s Visa’s big bet on agentic commerce, where autonomous AI agents handle the whole shopping journey for consumers. The goal? To close the “discovery – to – purchase” gap – so when an AI finds you the perfect item, it can actually check out and pay seamlessly, with all the fraud protections and trust of Visa’s network.

One thing’s for sure, the commerce UX is evolving. In a few years, we might reminisce about how we used to spend hours comparison – shopping and filling out forms, while our AI butlers handle the mundane purchasing in the background. And Visa will be quietly running the register for all those machine – mediated transactions – taking its (hopefully reduced) cut, but at far greater volume. New world, same Visa? Not exactly, but Visa is doing what savvy incumbents do – skate to where the puck is headed. And in 2025, that puck is an autonomous agent eager to buy stuff for us. Get ready – your next customer might not be human, and now is the time to plan for it.

The Embedded Finance Playbook for Marketplaces and the Gig Economy

👉 Payments Infrastructure

A robust, flexible payments infrastructure is non-negotiable. Platforms need to support diverse options—cross-border solutions, split payments, escrow, and orchestration—while meeting compliance requirements like KYC and AML. Transparency around fees, FX, and security builds trust across buyers, sellers, and workers.

👉 Real-Time Payments

Workers and SMEs increasingly demand instant access to funds. Faster payouts improve cash flow and flexibility, with many gig workers even willing to pay fees for real-time transfers. SMEs depend on quick settlement for day-to-day operations. But fragmented global RTP systems and regulations create hurdles for platforms expanding internationally.

👉 Embedded Finance

Embedded finance is becoming a key differentiator, with platforms like Shopify and Grab embedding lending, insurance, and savings into their ecosystems. This turns platforms into financial hubs, enabling SMEs and gig workers to access critical tools within a single interface.

Keep reading with a 7-day free trial

Subscribe to Fintech Wrap Up to keep reading this post and get 7 days of free access to the full post archives.