Deep Dive: MCP to MVP - Building Agentic Commerce on Visa Rails

In this deep dive, we’ll break down what Visa Intelligent Commerce is offering, why it matters for the fintech and payments ecosystem, and where it might be headed

Fintech Wrap Up is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Imagine telling an AI assistant to “plan my trip to Miami,” then sitting back as it finds the perfect flight, hotel, and even buys that new fishing reel you wanted – all on its own. That’s the vision behind Visa’s Intelligent Commerce, a new platform that lets AI “agent” software find, shop, and buy on your behalf. At Visa’s recent Product Drop 2025 event, CEO Ryan McInerney and Chief Product Officer Jack Forestell unveiled this initiative as a “new way to buy with AI in the same trusted, secure way to pay”. It’s Visa’s big bet on agentic commerce, where autonomous AI agents handle the whole shopping journey for consumers. The goal? To close the “discovery – to – purchase” gap – so when an AI finds you the perfect item, it can actually check out and pay seamlessly, with all the fraud protections and trust of Visa’s network.

One thing’s for sure, the commerce UX is evolving. In a few years, we might reminisce about how we used to spend hours comparison – shopping and filling out forms, while our AI butlers handle the mundane purchasing in the background. And Visa will be quietly running the register for all those machine – mediated transactions – taking its (hopefully reduced) cut, but at far greater volume. New world, same Visa? Not exactly, but Visa is doing what savvy incumbents do – skate to where the puck is headed. And in 2025, that puck is an autonomous agent eager to buy stuff for us. Get ready – your next customer might not be human, and now is the time to plan for it.

In this deep dive, we’ll break down what Visa Intelligent Commerce is offering, why it matters for the fintech and payments ecosystem, and where it might be headed – including how it intersects with Web3’s world of programmable money and crypto. Let’s dig in.

Visa’s Intelligent Commerce

Visa’s Intelligent Commerce initiative is essentially a developer platform and partner program to enable AI – driven buying. It introduces a suite of five APIs – spanning tokenization, authentication, personalization data, payment instructions, and payment signals – designed to let AI agents transact as securely and smoothly as any human shopper. Visa also announced an agent onboarding framework (through a partner program) that will vet and certify AI agents before they can tap into the network. And they didn’t go it alone – Visa lined up key partnerships with big names across AI and fintech to jumpstart this ecosystem. They’re collaborating with OpenAI to help set agentic commerce standards and enable use cases on OpenAI’s platforms. They’re working with Stripe (a leading payments processor already experimenting with agents) to adopt Visa’s solution and drive agent – based payments. Perplexity AI, a fast – growing AI search platform, is integrating Visa’s personalization APIs to make its shopping recommendations more tailored. Ramp, known for business finance, is exploring B2B agent use cases with Visa. And Scale AI is partnering on the infrastructure side to support enterprise – grade agent commerce. In short, Visa is rallying both AI innovators and traditional payment players to build out an “agentic commerce” network backed by Visa’s trust.

So what do these new APIs actually do?

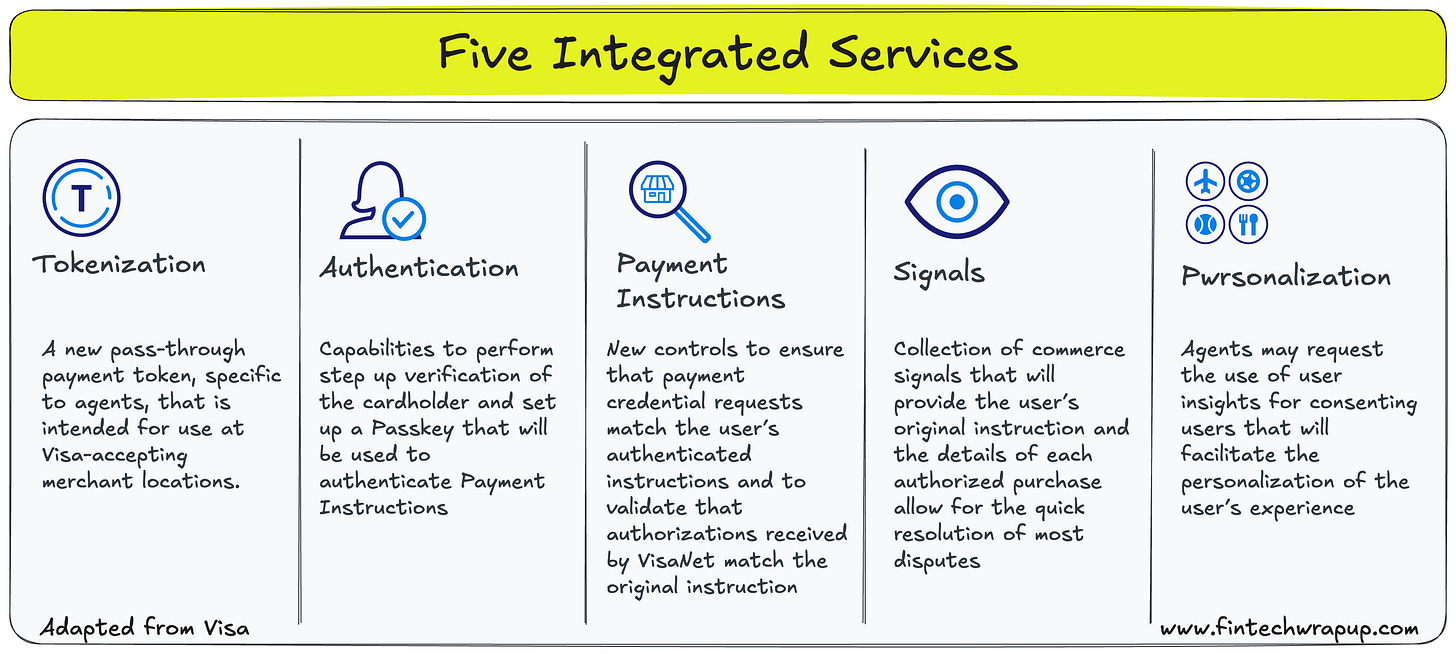

Visa described five core services that together give an AI agent the same capabilities a human user has in e – commerce today – with extra guardrails. Here’s a quick rundown –

AI – Ready Cards (Tokenization & Authentication) – Visa is upgrading its tried – and – true tokenization and user authentication tech (the “workhorses” of digital payments) for the agent era. Tokenization means your 16 – digit card number gets replaced with a unique digital token. In this case, Visa will issue a token specific to your AI agent once your bank verifies “you are you”. That token is bound to your agent and locked by default – it only activates for purchases when you (the human) give your agent permission. Meanwhile, strong authentication (think Visa Secure, 3 – D Secure, biometrics, etc.) is built in so that when you first “onboard” your card to an agent, your bank verifies it’s really you and approves enabling that agent. In essence, your AI assistant gets its own Visa card token that it can use, but only under your explicit consent and only with that trusted agent platform.

Personalization (Data Tokens) – One big advantage of an AI shopping for you is that it can know your preferences. Visa has a service called Data Tokens which takes insights from your purchase history (e.g. brands you like, hotels you prefer, your dining tastes) and packages them into privacy – preserving “insights” an agent can use. Importantly, Visa emphasizes you stay in control of your data – you must opt in and consent to share these personalization tokens, and you can turn them off anytime. The data tokens don’t expose your raw transaction history; they’re more like hints (“user prefers boutique hotels over budget options”) that an AI can plug into its prompts to refine recommendations. In the demo, once the user toggled on personalization, the agent’s travel suggestions immediately improved – no more beach hotels (which the user hates) and more sushi restaurants and activities that matched his actual interests. The takeaway – Visa is injecting its rich transaction data into the AI’s logic – with user permission – to make agent – led shopping feel eerily spot – on (and to save you from endless irrelevant search results).

Payment Instructions – This is a brand new API Visa built to serve as a “digital handshake” of trust between user and agent. When your agent is ready to buy something, it will present you with a summary – the items, prices, merchant, etc. – and ask for your go – ahead. Visa’s Payment Instructions API will then record the exact purchase parameters you approved (the who/what/when of that transaction) and store it as a signed record. Think of it as the agent’s permission slip – it proves the AI had your authorization to make that specific purchase. This instruction is basically the user’s intent, formally captured. It ensures that later, if there’s any dispute (“Hey, did my AI just buy the wrong flight?”), there’s an authoritative log of what you actually agreed to. It also limits what the agent can spend your money on – a clever way to prevent a runaway bot from buying 100 TVs on your card. Visa is essentially formalizing, “Yes, my user said it’s OK to buy these items under these conditions.”

Keep reading with a 7-day free trial

Subscribe to Fintech Wrap Up to keep reading this post and get 7 days of free access to the full post archives.