JPMorgan Strategy Breakdown; JPMorgan's Real Advantage Is Platform Compounding; How Agentic Commerce Reshapes the Online Travel Agent (OTA) Merchant of Record Model

Video of the Week

Deep Dive of the Week

Mastercard’s Value-Added Services & Solutions

In recent years, Mastercard’s Value-Added Services & Solutions (VAS) segment has emerged as a key growth engine for the company. In the latest quarter (Q3 FY25), VAS net revenue reached $3.4 billion, jumping 25% year-over-year – far outpacing the 12% growth of the core payment network business. This brought total net revenue to $8.6 billion for the quarter (up 17% YoY), with VAS now contributing roughly 40% of the pie. Management highlights that these services are not new or ancillary, but rather “a critical part of the business” that differentiates Mastercard’s offerings in areas like analytics, security, and fraud prevention.

Mastercard’s strategic positioning of VAS can be understood through what CFO Sachin Mehra calls a “virtuous circle.” Every payment transaction that Mastercard processes yields data; the more transactions on the network, the more data insights the company can harness. Mastercard then leverages those insights to develop value-added services – for example, fraud scoring models or market analytics – which it sells back to banks, merchants, and other customers. These services in turn make the core payment products more valuable and stickier, attracting additional volume (and thus more data) back to the network. This feedback loop has strengthened over time, enabling Mastercard to diversify beyond traditional transaction fees. Today, roughly 60% of Mastercard’s services revenue is directly “network-linked” – tied to its payment network usage (think tools like card transaction authentication, fraud scoring, chargeback solutions) – and this portion has grown at ~17% CAGR from 2022–2024. In short, VAS is deeply interwoven with Mastercard’s core business, driving a flywheel of data and revenue.

This week’s reports

𝐓𝐰𝐨 𝐭𝐡𝐢𝐧𝐠𝐬 𝐚𝐛𝐨𝐮𝐭 𝐬𝐭𝐚𝐛𝐥𝐞𝐜𝐨𝐢𝐧𝐬 𝐭𝐡𝐚𝐭 𝐚𝐫𝐞 𝐬𝐭𝐢𝐥𝐥 𝐦𝐢𝐬𝐮𝐧𝐝𝐞𝐫𝐬𝐭𝐨𝐨𝐝

1️⃣𝐓𝐰𝐨 𝐭𝐡𝐢𝐧𝐠𝐬 𝐚𝐛𝐨𝐮𝐭 𝐬𝐭𝐚𝐛𝐥𝐞𝐜𝐨𝐢𝐧𝐬 𝐭𝐡𝐚𝐭 𝐚𝐫𝐞 𝐬𝐭𝐢𝐥𝐥 𝐦𝐢𝐬𝐮𝐧𝐝𝐞𝐫𝐬𝐭𝐨𝐨𝐝

2️⃣𝐔𝐧𝐝𝐞𝐫𝐬𝐭𝐚𝐧𝐝𝐢𝐧𝐠 𝐡𝐨𝐰 𝐀𝐈 𝐚𝐬𝐬𝐢𝐬𝐭𝐚𝐧𝐭𝐬 𝐚𝐫𝐞 𝐫𝐞𝐬𝐡𝐚𝐩𝐢𝐧𝐠 𝐭𝐡𝐞 𝐛𝐮𝐲𝐞𝐫 𝐣𝐨𝐮𝐫𝐧𝐞𝐲

3️⃣𝐓𝐨𝐤𝐞𝐧𝐢𝐬𝐞𝐝 𝐦𝐨𝐧𝐞𝐲 𝐦𝐚𝐫𝐤𝐞𝐭𝐬 𝐢𝐧 𝐬𝐢𝐦𝐩𝐥𝐞 𝐰𝐨𝐫𝐝𝐬

4️⃣𝐓𝐡𝐞 𝟐𝟎𝟐𝟔 𝐁𝐚𝐧𝐤𝐢𝐧𝐠 𝐏𝐫𝐞𝐝𝐢𝐜𝐭𝐢𝐨𝐧𝐬 𝐑𝐞𝐩𝐨𝐫𝐭

5️⃣𝐖𝐡𝐲 𝐎𝐧𝐥𝐲 𝟏𝟎% 𝐨𝐟 𝐅𝐢𝐧𝐚𝐧𝐜𝐢𝐚𝐥 𝐈𝐧𝐬𝐭𝐢𝐭𝐮𝐭𝐢𝐨𝐧𝐬 𝐀𝐫𝐞 𝐑𝐞𝐚𝐝𝐲 𝐟𝐨𝐫 𝐀𝐈 𝐀𝐠𝐞𝐧𝐭𝐬

6️⃣𝐓𝐡𝐞 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐒𝐭𝐚𝐜𝐤 𝐈𝐬 𝐅𝐫𝐚𝐠𝐦𝐞𝐧𝐭𝐢𝐧𝐠, 𝐚𝐧𝐝 𝐓𝐡𝐚𝐭’𝐬 𝐭𝐡𝐞 𝐏𝐨𝐢𝐧𝐭

7️⃣𝐀𝐈 𝐂𝐡𝐚𝐧𝐠𝐞𝐝 𝐅𝐫𝐚𝐮𝐝 𝐈𝐧 𝐅𝐢𝐧𝐭𝐞𝐜𝐡 𝐅𝐚𝐬𝐭𝐞𝐫 𝐓𝐡𝐚𝐧 𝐌𝐨𝐬𝐭 𝐂𝐨𝐦𝐩𝐚𝐧𝐢𝐞𝐬 𝐑𝐞𝐚𝐥𝐢𝐬𝐞

This week’s insights

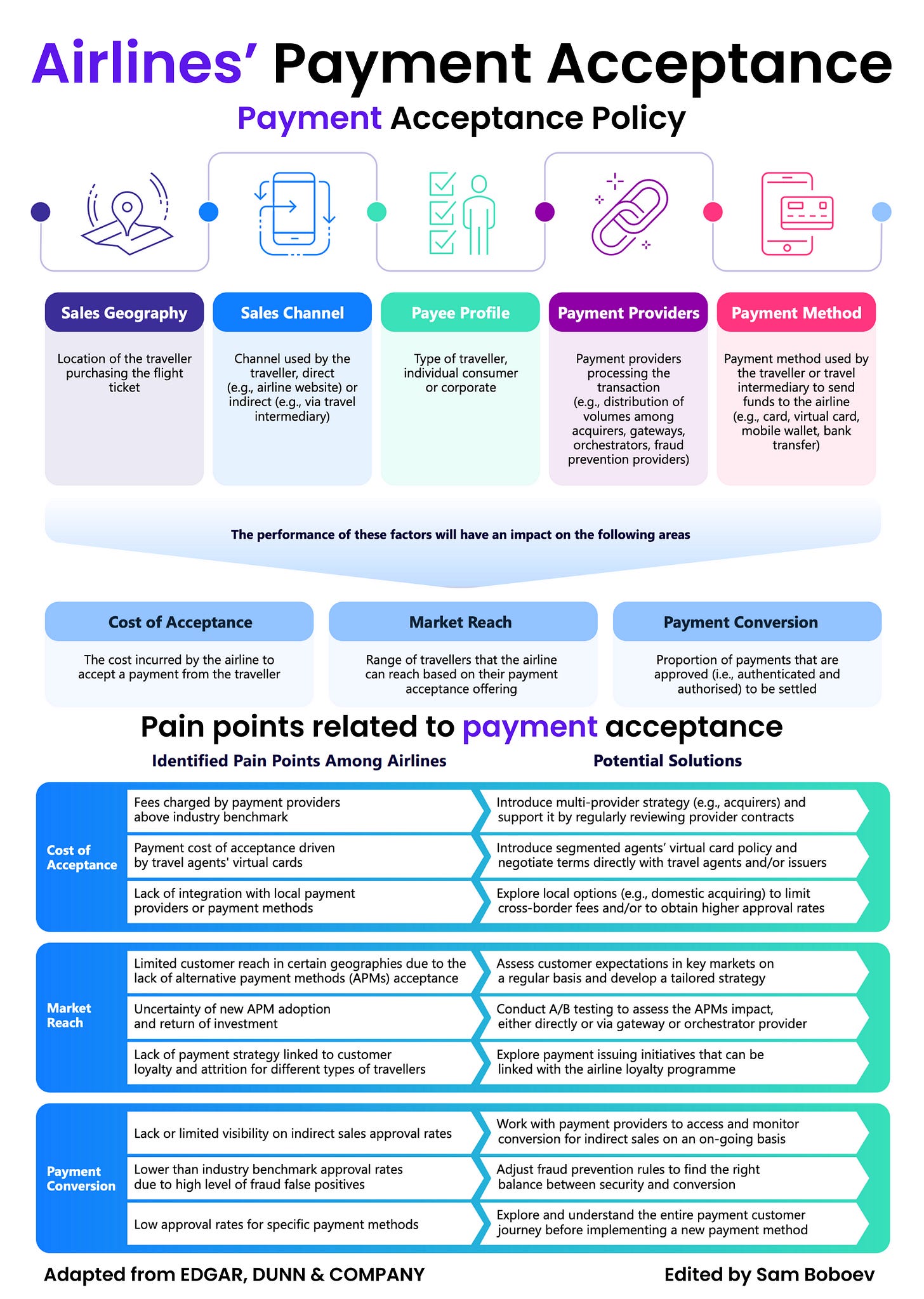

1️⃣𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐀𝐜𝐜𝐞𝐩𝐭𝐚𝐧𝐜𝐞 𝐈𝐬 𝐍𝐨𝐰 𝐚 𝐒𝐭𝐫𝐚𝐭𝐞𝐠𝐢𝐜 𝐋𝐞𝐯𝐞𝐫 𝐟𝐨𝐫 𝐀𝐢𝐫𝐥𝐢𝐧𝐞𝐬

2️⃣𝐇𝐨𝐰 𝐀𝐠𝐞𝐧𝐭𝐢𝐜 𝐂𝐨𝐦𝐦𝐞𝐫𝐜𝐞 𝐑𝐞𝐬𝐡𝐚𝐩𝐞𝐬 𝐭𝐡𝐞 𝐎𝐧𝐥𝐢𝐧𝐞 𝐓𝐫𝐚𝐯𝐞𝐥 𝐀𝐠𝐞𝐧𝐭 (𝐎𝐓𝐀) 𝐌𝐞𝐫𝐜𝐡𝐚𝐧𝐭 𝐨𝐟 𝐑𝐞𝐜𝐨𝐫𝐝 𝐌𝐨𝐝𝐞𝐥

3️⃣𝐖𝐡𝐲 𝐬𝐮𝐜𝐜𝐞𝐬𝐬 𝐢𝐧 𝐁𝐚𝐚𝐒 𝐢𝐬 𝐧𝐨𝐭 𝐚𝐛𝐨𝐮𝐭 𝐀𝐏𝐈𝐬, 𝐛𝐮𝐭 𝐚𝐛𝐨𝐮𝐭 𝐨𝐩𝐞𝐫𝐚𝐭𝐢𝐧𝐠 𝐦𝐨𝐝𝐞𝐥𝐬

4️⃣𝐇𝐨𝐰 𝐄𝐮𝐫𝐨𝐩𝐞𝐚𝐧 𝐂𝐨𝐦𝐩𝐚𝐧𝐢𝐞𝐬 𝐌𝐮𝐬𝐭 𝐏𝐫𝐞𝐩𝐚𝐫𝐞 𝐟𝐨𝐫 𝐀𝐠𝐞𝐧𝐭𝐢𝐜 𝐂𝐨𝐦𝐦𝐞𝐫𝐜𝐞 & 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬

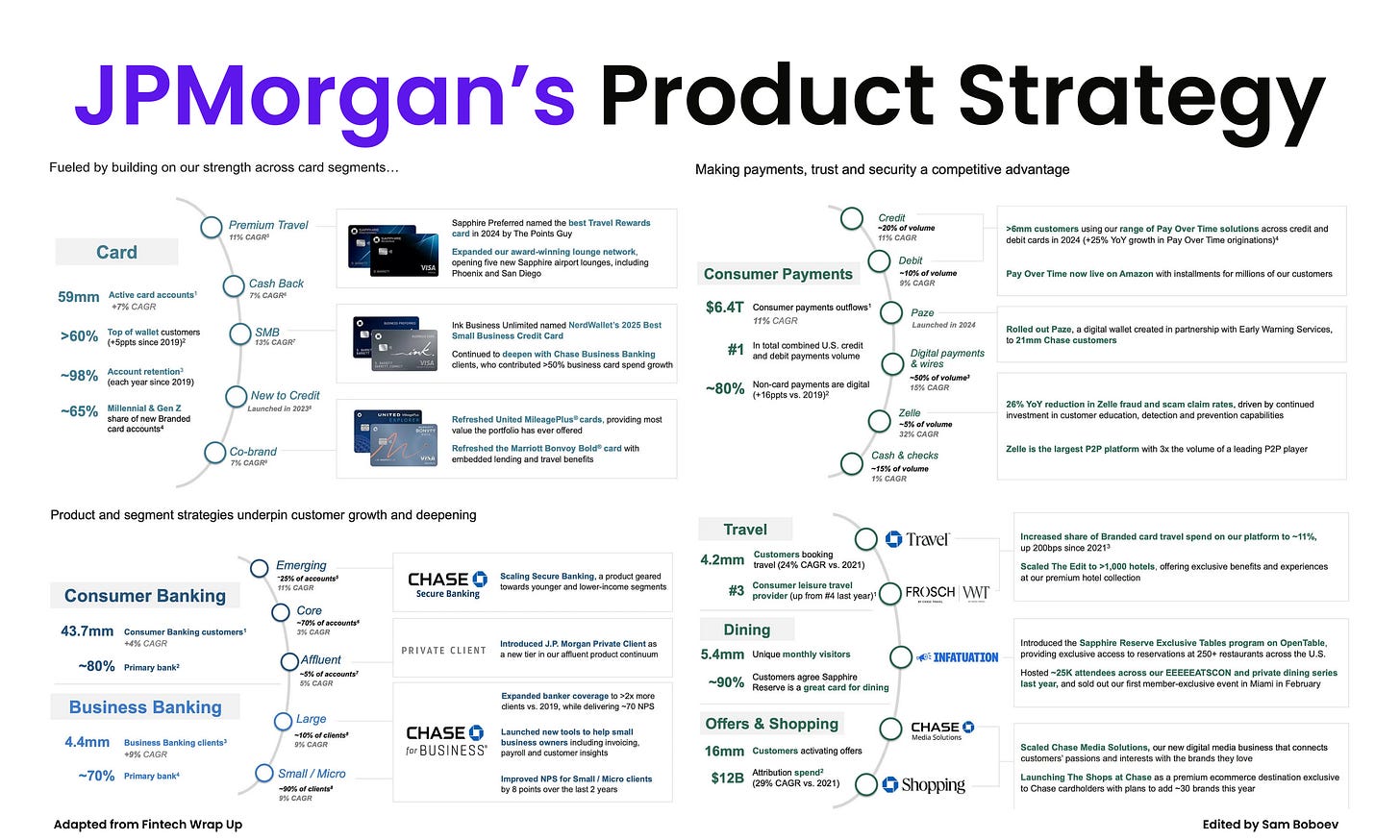

5️⃣𝐉𝐏𝐌𝐨𝐫𝐠𝐚𝐧 𝐒𝐭𝐫𝐚𝐭𝐞𝐠𝐲 𝐁𝐫𝐞𝐚𝐤𝐝𝐨𝐰𝐧

6️⃣𝐉𝐏𝐌𝐨𝐫𝐠𝐚𝐧’𝐬 𝐑𝐞𝐚𝐥 𝐀𝐝𝐯𝐚𝐧𝐭𝐚𝐠𝐞 𝐈𝐬 𝐏𝐥𝐚𝐭𝐟𝐨𝐫𝐦 𝐂𝐨𝐦𝐩𝐨𝐮𝐧𝐝𝐢𝐧𝐠

7️⃣𝐒𝐭𝐫𝐮𝐜𝐭𝐮𝐫𝐢𝐧𝐠 𝐘𝐨𝐮𝐫 𝐔𝐊 𝐋𝐢𝐜𝐞𝐧𝐬𝐞 𝐒𝐭𝐫𝐚𝐭𝐞𝐠𝐲

𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐀𝐜𝐜𝐞𝐩𝐭𝐚𝐧𝐜𝐞 𝐈𝐬 𝐍𝐨𝐰 𝐚 𝐒𝐭𝐫𝐚𝐭𝐞𝐠𝐢𝐜 𝐋𝐞𝐯𝐞𝐫 𝐟𝐨𝐫 𝐀𝐢𝐫𝐥𝐢𝐧𝐞𝐬

Over the past few years, especially following COVID, airlines have significantly changed how they approach payment acceptance. What was once treated as a back-office function is now recognised as a strategic capability that directly affects revenue, cost, and market reach.

Historically, most airlines optimised payments mainly for direct channels such as their website or mobile app. Today, that approach is no longer sufficient. A rising share of airline sales flows through indirect channels, including online travel agencies, travel management companies, and GDS or NDC connections. This shift has increased complexity and pushed airlines to manage payment acceptance more proactively across channels and markets.

I came across EDC very recently. Through its work with airlines globally, EDC observes a clear move away from one-size-fits-all payment acceptance policies. Airlines increasingly account for sales geography, customer and payee profiles, preferred local payment methods, and the payment providers processing transactions. This flexibility is essential, as payment acceptance policies underpin the airline’s broader payments strategy and directly influence cost of acceptance, conversion rates, and market coverage.

---

Despite differences in size, region, and business model, similar pain points appear consistently across airlines.

One common challenge is limited visibility into payment performance data. Without detailed insights, airlines struggle to identify where revenue is being lost. In several cases, deeper analysis revealed significant card decline issues in specific markets that had gone unnoticed.

Keep reading with a 7-day free trial

Subscribe to Fintech Wrap Up to keep reading this post and get 7 days of free access to the full post archives.