Deep Dive: Mastercard’s Value-Added Services & Solutions

In recent years, Mastercard’s Value-Added Services & Solutions (VAS) segment has emerged as a key growth engine for the company. In the latest quarter (Q3 FY25), VAS net revenue reached $3.4 billion, jumping 25% year-over-year – far outpacing the 12% growth of the core payment network business. This brought total net revenue to $8.6 billion for the quarter (up 17% YoY), with VAS now contributing roughly 40% of the pie. Management highlights that these services are not new or ancillary, but rather “a critical part of the business” that differentiates Mastercard’s offerings in areas like analytics, security, and fraud prevention.

Mastercard’s strategic positioning of VAS can be understood through what CFO Sachin Mehra calls a “virtuous circle.” Every payment transaction that Mastercard processes yields data; the more transactions on the network, the more data insights the company can harness. Mastercard then leverages those insights to develop value-added services – for example, fraud scoring models or market analytics – which it sells back to banks, merchants, and other customers. These services in turn make the core payment products more valuable and stickier, attracting additional volume (and thus more data) back to the network. This feedback loop has strengthened over time, enabling Mastercard to diversify beyond traditional transaction fees. Today, roughly 60% of Mastercard’s services revenue is directly “network-linked” – tied to its payment network usage (think tools like card transaction authentication, fraud scoring, chargeback solutions) – and this portion has grown at ~17% CAGR from 2022–2024. In short, VAS is deeply interwoven with Mastercard’s core business, driving a flywheel of data and revenue.

What Do Mastercard’s Value-Added Services Include?

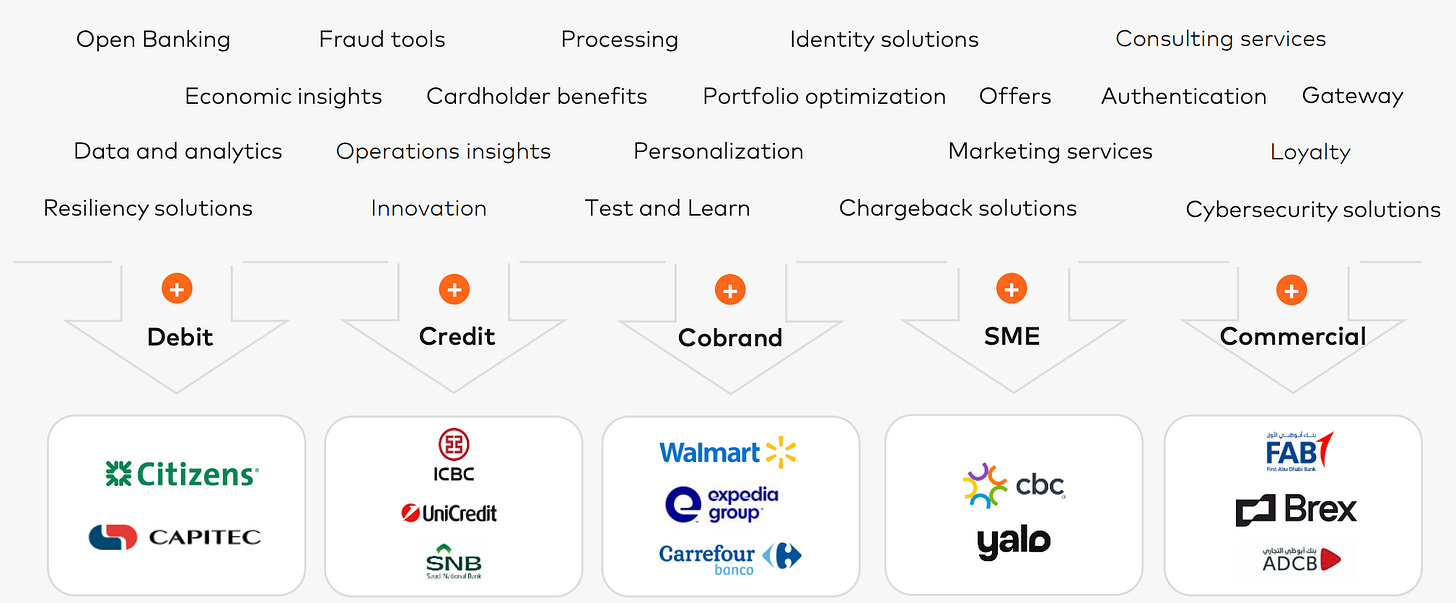

When we talk about VAS, what exactly falls under this umbrella? In Mastercard’s case, it’s a broad portfolio of technology, data, and consulting offerings built on top of the payment network. As an overview, Mastercard now provides: fraud prevention and cybersecurity tools, credit and identity decisioning services, loyalty and marketing programs, open banking connectivity, real-time payment solutions, data analytics, consulting, processing, and more. These aren’t abstract ideas – they’re concrete products and solutions that Mastercard sells to its customers (banks, merchants, fintechs, governments) to help them run their businesses more intelligently and securely. Below are some of the key categories and examples of services in the VAS segment:

Cybersecurity & Fraud Solutions: Mastercard offers a suite of Cyber & Intelligence services to combat threats across the payment lifecycle. This includes AI-powered fraud detection models, transaction risk scoring, biometric authentication, and cyber threat monitoring. For instance, after acquiring the cyber intelligence firm Recorded Future in 2024, Mastercard launched Mastercard Threat Intelligence – a service that combines payment network data with broader cybersecurity insights to help banks preempt attacks. The company also provides tools for vulnerability assessment and DDoS protection for financial institutions. These offerings generate revenue via licensing or usage fees for the technology, and they deepen clients’ trust in using Mastercard’s network for secure transactions.

Loyalty, Marketing & Consumer Engagement: Another major VAS arena is helping clients attract and retain customers. Mastercard runs loyalty and rewards programs for banks and merchants – for example, managing credit card reward points, personalization of offers, and even merchant-funded reward networks. A recent example is Mastercard Commerce Media, an advertising and loyalty analytics platform that Mastercard introduced in late 2025. Commerce Media launched with a data-rich network of 500 million permissioned consumers and 25,000 merchant advertisers, enabling brands to deliver targeted, personalized offers based on spending insights. Services like these earn revenue through campaign fees or platform subscriptions, and they leverage Mastercard’s unique spending data to drive marketing ROI for clients. In addition, Mastercard provides consulting on loyalty strategy, campaign management tools, and redemption platforms (e.g. its Global Rewards network), often bundling these with card programs to differentiate issuers’ offerings.

Open Banking & Account-Based Services: Through acquisitions like Finicity and Aiia, Mastercard has built an open banking platform that allows the sharing of financial data and initiation of payments from bank accounts (with consumer consent). These services let fintech developers and banks verify accounts, pull transaction history for credit scoring, or move funds via ACH and real-time payment rails – all through Mastercard’s APIs. Open Banking is a pure value-added service (it operates beyond card rails) that Mastercard monetizes via API calls or subscription fees for data access. It’s a strategic play into the expanding world of account-to-account payments and financial data services, extending Mastercard’s reach into payments flows that don’t involve a card swipe. Notably, open banking connectivity is part of Mastercard’s broader “multi-rail” strategy: if money moves through any rail (cards, ACH, RTP, blockchain, etc.), Mastercard aims to provide the infrastructure or services for it. This segment also ties into services like account owner verification, credit decisioning analytics (using bank account data), and even bill payment solutions.

Keep reading with a 7-day free trial

Subscribe to Fintech Wrap Up to keep reading this post and get 7 days of free access to the full post archives.