Is your bank’s architecture ready for Open Banking?; Payment Orchestration vs. Payment Gateway: What’s the Difference; Banking in APAC - Strategic elements of transformation;

Welcome to the latest edition of Fintech Wrap Up—your quick guide to what’s moving the financial world

Insights & Reports:

1️⃣ Is your bank’s architecture ready for Open Banking?

2️⃣ Impacts of tokenization

3️⃣ Types of mobile payments and the technology that enables them

4️⃣ Starling Bank Explores ‘Range of Expansion Options’ in US

5️⃣ A practical approach to stopping scams and money mules early

6️⃣ Is GenAI the most powerful tool ever introduced to the payments industry?

7️⃣ Payment Orchestration vs. Payment Gateway: What’s the Difference

8️⃣ Banking in APAC - Strategic elements of transformation

9️⃣ Revolut to acquire BNP Paribas-owned Argentine lender Cetelem in market expansion

TL;DR:

Welcome to the latest edition of Fintech Wrap Up—your quick guide to what’s moving the financial world.

Is your bank’s architecture ready for Open Banking? Legacy systems aren’t built for real-time, API-first ecosystems. To compete, banks must embrace microservices, consent APIs, and layered security—starting small and scaling smart. The shift is picking up speed across Europe and South America.

Tokenization isn’t eliminating intermediaries—it’s evolving them. Banks, brokers, and custodians are adapting with programmable assets, on-chain operations, and hybrid infrastructures. Platforms like 21X show how smart contracts are rewriting the rules of finance.

Mobile payments have gone mainstream, but not all are created equal. From tap-to-pay NFC to QR codes and embedded checkouts, the tech stack—wallets, APIs, and secure storage—is what enables seamless global payments.

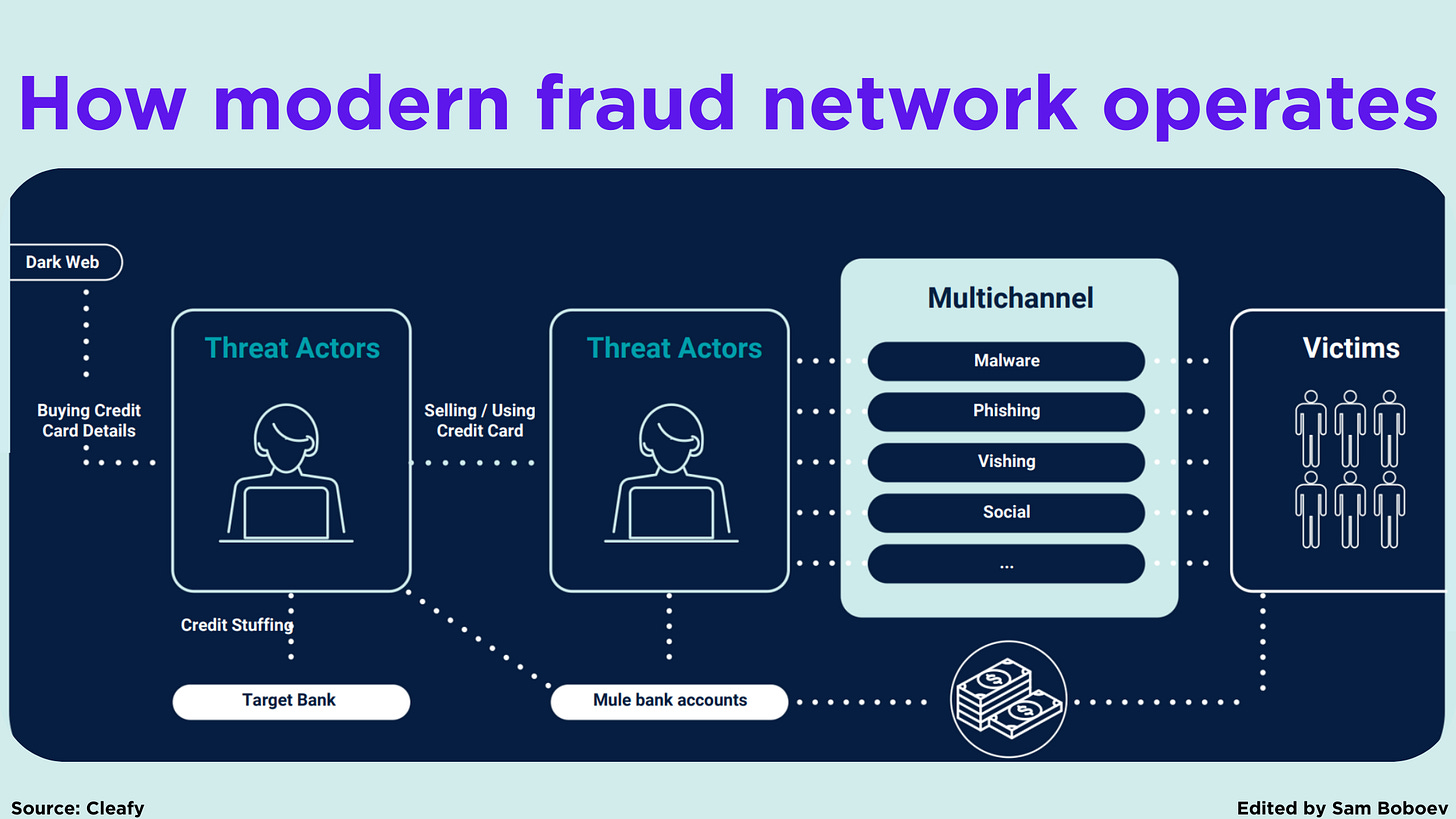

APP fraud is on the rise, costing the UK £485M in 2023 alone. Since victims authorize these scams, banks must shift to context-aware detection that spots manipulation before transactions happen—think remote access, behavioral red flags, and real-time monitoring.

Meanwhile, GenAI is becoming a payments powerhouse—boosting developer output, automating KYC, slashing fraud, and powering customer support. From collections to underwriting, AI is saving costs and unlocking efficiency across the board.

And if you’re managing online payments, orchestration beats gateways. While gateways handle one route, orchestration dynamically picks the best path for each transaction—improving conversion, reducing cost, and adding resilience.

In APAC, banks are transforming fast—modernizing core systems, embedding finance, and prioritizing data-driven, customer-first strategies. Those getting the balance right are set to lead the next chapter of digital banking.

Thanks for reading Fintech Wrap Up!

Reports

Insights

Wise – Building a World of Money Without Borders

Moving money internationally has long been notorious for high costs and hassle. Over £22 trillion crosses borders each year, projected to reach £28 trillion by 2027 as globalization drives more migration, remote work, and global commerce. By Wise’s own 2025 estimate, the number may be as high as £32 trillion annually. Historically, this market was dominated by big banks and legacy remittance providers relying on an antiquated correspondent banking network. International transfers often meant “expensive, slow and inefficient service, reliant on outdated infrastructure,” as Wise’s 2023 report bluntly puts it. Banks and incumbents like Western Union layered on fees and hidden exchange rate markups – profiting from customers’ lack of transparency. The result: sending money abroad could cost 5-8% in fees (often not obvious upfront) and take days to arrive.

Wise was founded to change this status quo. Its vision of “Money Without Borders” is about making moving money “as cheap, fast, and convenient as sending an email,” in the words of its co-founder. Wise’s core innovation was using technology and clever account structures to eliminate intermediaries and hidden fees, giving users the real mid-market exchange rate and charging only a low upfront fee. As we’ll see, this strategy is forcing the industry to evolve. Today, many fintechs and even banks are racing to offer cheaper, easier cross-border payments – yet traditional banks remain Wise’s primary competitors, still handling the majority of cross-currency transactions. A growing field of digital challengers (from neobanks like Revolut to PayPal’s Xoom and others) are also carving out niches. But Wise has a head start in scale, efficiency, and trust – built over a decade of singular focus on solving this problem.

Is your bank’s architecture ready for Open Banking?

The future of financial services hinges on one word: interoperability. Open Banking isn’t just a trend—it’s reshaping how banks, fintechs, and even regulators think about financial data access, payment initiation, and customer experience.

At the heart of this movement lies a simple but powerful idea: enable secure, standardized access to financial data through Open APIs. But implementing Open Banking is anything but simple.

Let’s break it down 👇

The core challenge? Architecture.

Legacy banking systems—often built on mainframes—aren’t designed for open, real-time, API-first ecosystems. They’re reliable but brittle, difficult to scale, and complex to modify. Introducing Open APIs into this environment demands a phased, security-first transformation.

Key principles of a robust Open Banking architecture:

✅ Security by design

Think layered defenses, encrypted data in transit, and compliance with FAPI and CIBA standards. This protects against phishing, man-in-the-middle attacks, and ensures customer consent is managed safely.

✅ Event-driven microservices

High-volume use cases like Payment Initiation Services (PIS) require scalable solutions. Command-query responsibility segregation (CQRS), containerized deployments, and messaging middleware help handle spikes in traffic while maintaining performance.

✅ Auditability and observability

Every interaction—especially around consent—needs immutable audit logs. These must integrate with reporting tools and observability platforms to support compliance and real-time monitoring.

✅ Scalable consent management

Consent APIs serve as a system of record—allowing secure registration, revocation, and status queries. Critical events like expiration notifications must be processed asynchronously and cost-effectively.

Keep reading with a 7-day free trial

Subscribe to Fintech Wrap Up to keep reading this post and get 7 days of free access to the full post archives.