Reports: Global Fraud Trends 2025; AI x crypto crossovers; Bank Tech Index;

Let’s dive into this week’s curated collection of fintech reports, whitepapers, and expert guidelines in the latest edition of Fintech Wrap Up. Every resource featured is available for download

Reports:

1️⃣ State of Crypto Q2 2025

2️⃣ Agentic AI

3️⃣ Is the global cross-border payment market really worth $1 quadrillion?

4️⃣ Bank Tech Index

5️⃣ Global Fraud Trends 2025

6️⃣ AI x crypto crossovers

7️⃣ Why SME banking matters

TL;DR:

Welcome to this week’s Fintech Wrap Up — where crypto adoption surges, AI agents step up, and banks finally get serious about tech.

Coinbase’s State of Crypto reveals stablecoins are booming, with 161M holders and $717B in monthly volume—nearly matching Visa. Tokenized real-world assets hit $21B, and 60% of Fortune 500s are running blockchain projects. SMBs are following suit, but regulation remains the key to unlocking full adoption.

In AI news, Debmalya Biswas explores Agentic AI—a leap beyond chatbots to autonomous agents that can plan, adapt, and act. From managing sales to optimizing HVAC systems, these agents promise enterprise-grade automation—if built responsibly.

The IMF estimates global cross-border payments neared $1 quadrillion in 2024, driven mostly by institutional money. USD still leads, but China’s renminbi is gaining ground, reshaping payment corridors amid geopolitical fragmentation.

Infosys’ Bank Tech Index shows banks are moving beyond pilots—AI is driving fraud detection, customer service, and hiring. But legacy data and compliance hurdles remain.

Fraud is still a $10.6M problem per merchant, says Ravelin. Refund abuse is rising fast, and AI is now both a defense tool and a threat, used by fraudsters as well.

Finally, a16z crypto highlights how AI and blockchain are converging into autonomous economic agents—on-chain actors that can earn, learn, and optimize. And Backbase makes the case for SME banking as a $285B opportunity—if banks can act fast.

See you next week!

Insights

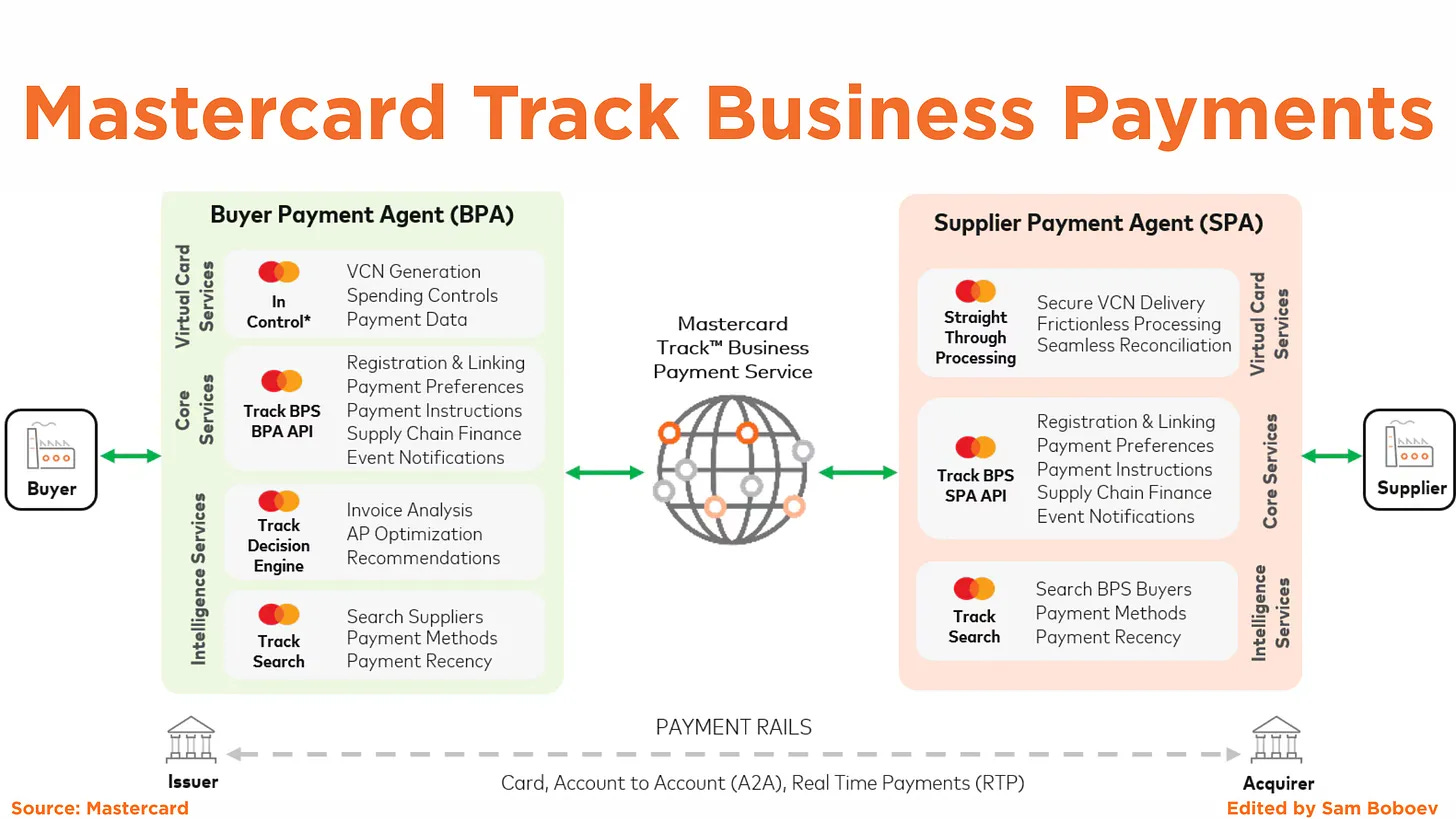

What is Mastercard Track?; Digital Lending: Capabilities-as-a-Service (CaaS); Payment System Modular Functional Flow;

Reports

State of Crypto Q2 2025

The future of money isn’t coming — it’s here. But most people haven’t realized just how fast it’s moving.

According to Coinbase’s latest State of Crypto report, we're entering a new era of financial infrastructure — and stablecoins, tokenized assets, and blockchain are leading the charge.

Let’s break it down 👇

💸 Stablecoins aren’t niche anymore

With 161 million holders (more than the populations of the 10 largest cities combined), stablecoins settled over $717B in April 2025 alone — nearly matching Visa’s monthly volumes. They now account for nearly 10% of all USD in circulation.

Why? They solve real pain points:

- Cheaper, faster remittances

- Lower payment processing fees

- Cross-border payroll without the headaches

- Protection from inflation

- Financial access for the unbanked

🧾 Tokenized real-world assets (RWAs) are exploding

RWAs have grown 245x since 2020, reaching $21B. From tokenized treasuries (for yield without friction) to invoices and private credit (for unlocking liquidity), real businesses are using tokens to get paid faster, cheaper, and more transparently.

🏢 Enterprises are building onchain

60% of Fortune 500 companies are working on blockchain initiatives, and on average they run nearly 10 onchain projects each. Use cases span payments, supply chains, identity, and treasury.

Even more striking — 47% of F500 execs say their company’s investment in onchain tech has increased, and 1 in 5 now see it as core to their business strategy.

🏪 SMBs are catching up fast

In 2025, small and mid-sized businesses doubled their usage of crypto across the board — 34% now use crypto, 18% use stablecoins, and 32% have accepted crypto payments.

84% are interested in using crypto, and most say it helps them solve key problems like high fees and slow payments.

💼 Institutional money is following the momentum

More than 4 in 5 institutional investors plan to increase crypto exposure this year. Bitcoin and Ethereum ETFs are among the fastest-growing ever launched. And 76% of investors want exposure to tokenized assets by 2026.

Keep reading with a 7-day free trial

Subscribe to Fintech Wrap Up to keep reading this post and get 7 days of free access to the full post archives.