How the payment ecosystem works to process payments; The Impact of Stablecoins on Trading; USAT: Tether’s stablecoin for the US market;

We are looking for strategic partners

What are the best sources or communities you’d recommend to connect with potential strategic partners — whether that’s fintech platforms, SaaS vendors, channel partners, or ecosystem builders?

We are building Wraap Up [https://wraapup.com/] — an AI-powered finance platform. Company has already launched initial stack of products to help businesses manage money smarter:

✅ Multi-currency business accounts

✅ International transfers

✅ FX with competitive rates

✅ AI-powered FX risk management tool — helping businesses protect margins and reduce exposure

If you’ve gone through this journey or have recommendations, I’d love to hear your insights. Introductions are more than welcome too?

Daily news on Payments Wrap Up

Deep Dive of the Week

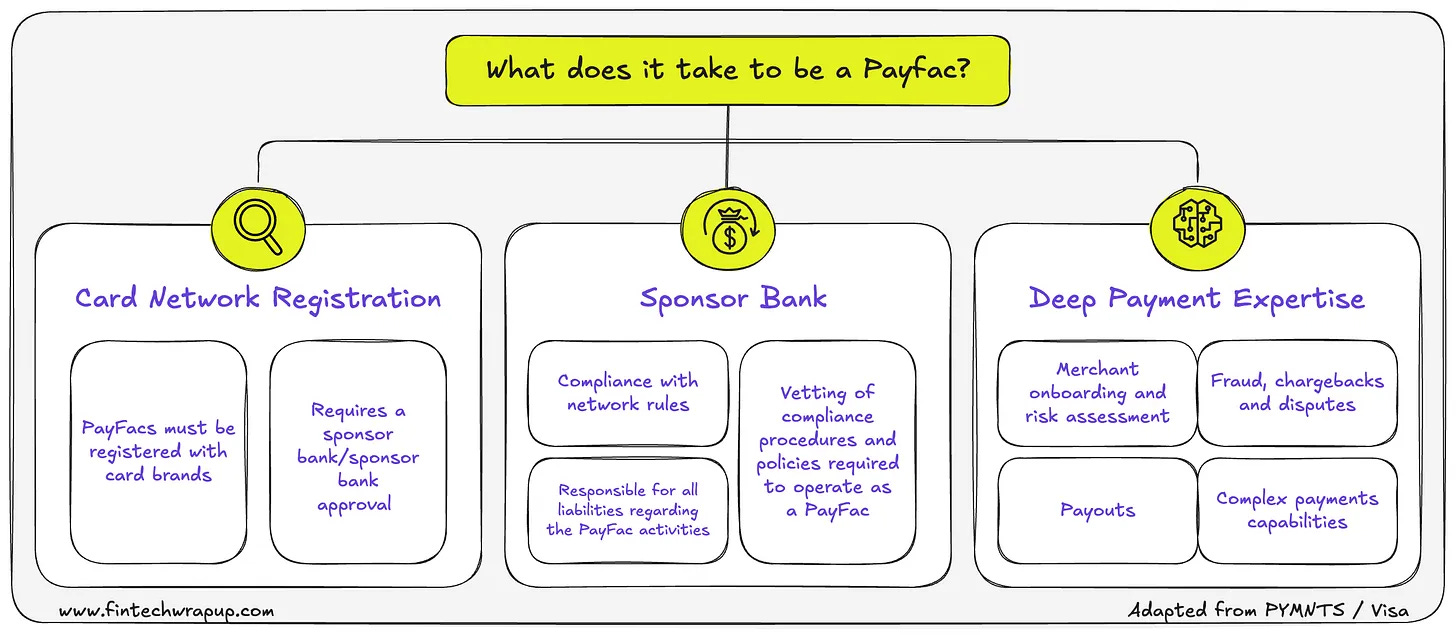

A Guide to Payment Facilitation and Facilitators (Payfacs)

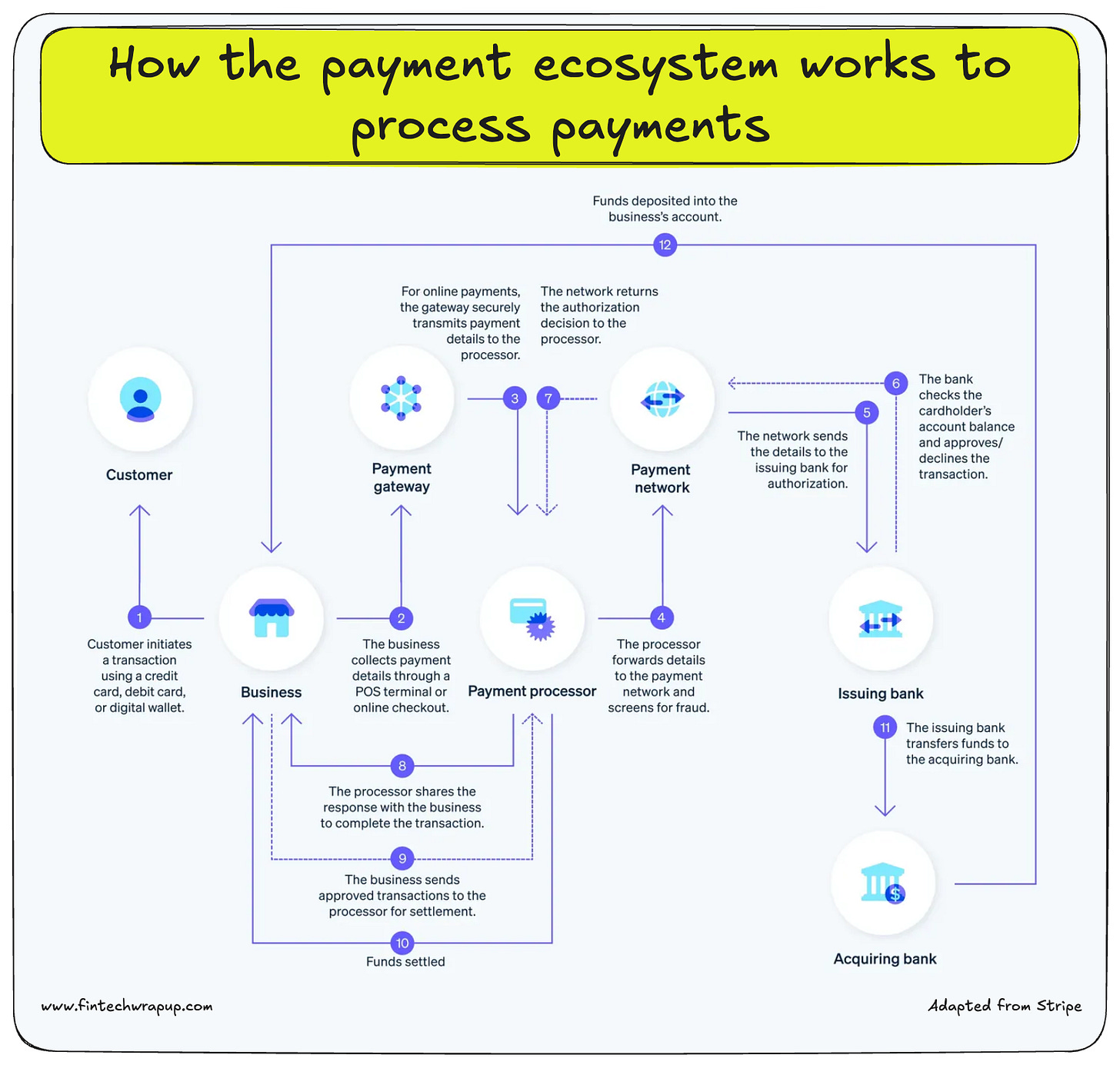

Payment facilitation (Payfac) might not get as much buzz as crypto or AI, but it underpins a growing share of digital commerce. Today’s PayFacs process billions in transactions, and by 2025 the model is expected to handle more than $4 trillion globally. These providers act as master merchants, aggregating countless sub‑accounts to let SaaS platforms, marketplaces and other businesses accept payments with minimal friction. Yet the details behind underwriting, risk, compliance and economics can seem opaque. In this deep dive, we’ll unpack what a PayFac is, trace its evolution from the early days of card acquiring to the present, and explore why this model matters for product managers, founders, payments strategists and developers alike.

This week’s reports

When Blockchain Experience Matters — and When It Doesn’t

Keep reading with a 7-day free trial

Subscribe to Fintech Wrap Up to keep reading this post and get 7 days of free access to the full post archives.