Deep Dive: A Guide to Payment Facilitation and Facilitators (Payfacs)

Payment facilitation (Payfac) might not get as much buzz as crypto or AI, but it underpins a growing share of digital commerce.

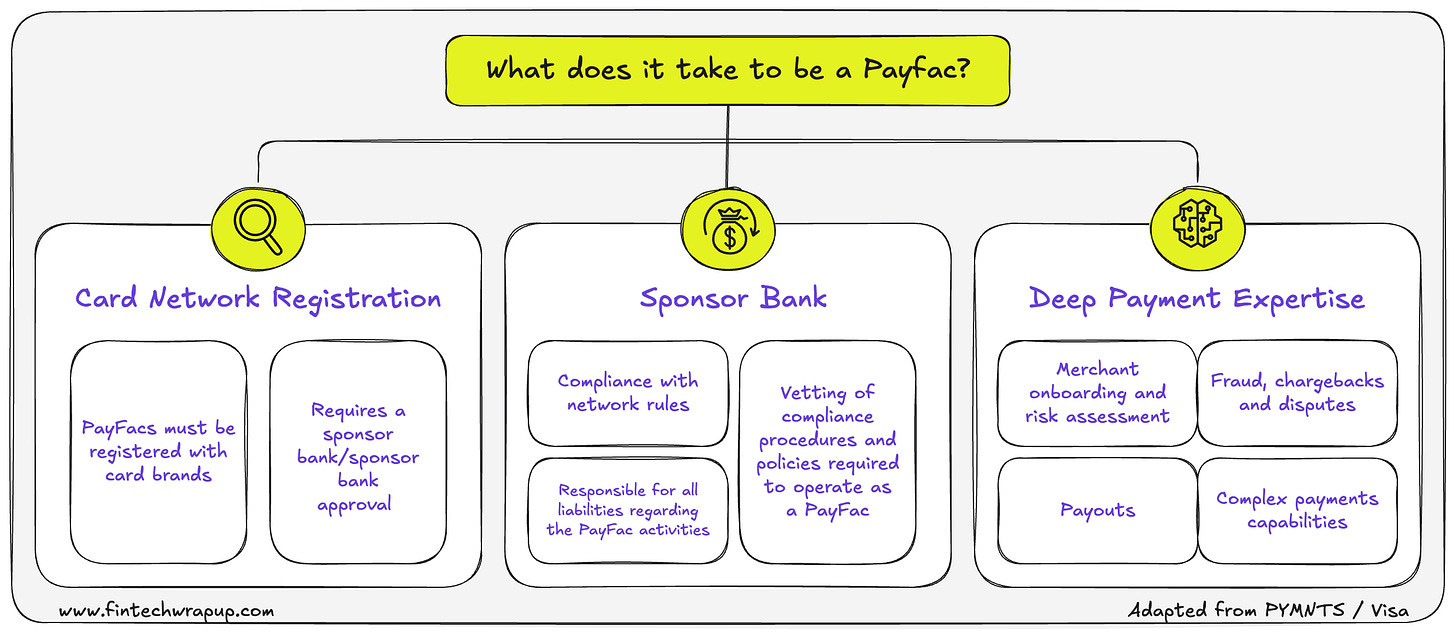

Payment facilitation (Payfac) might not get as much buzz as crypto or AI, but it underpins a growing share of digital commerce. Today’s PayFacs process billions in transactions, and by 2025 the model is expected to handle more than $4 trillion globally. These providers act as master merchants, aggregating countless sub‑accounts to let SaaS platforms, marketplaces and other businesses accept payments with minimal friction. Yet the details behind underwriting, risk, compliance and economics can seem opaque. In this deep dive, we’ll unpack what a PayFac is, trace its evolution from the early days of card acquiring to the present, and explore why this model matters for product managers, founders, payments strategists and developers alike.

Fintech Wrap Up is a reader-supported publication. To support my work, consider becoming a free or paid subscriber.What is a Payment Facilitator (PayFac)?

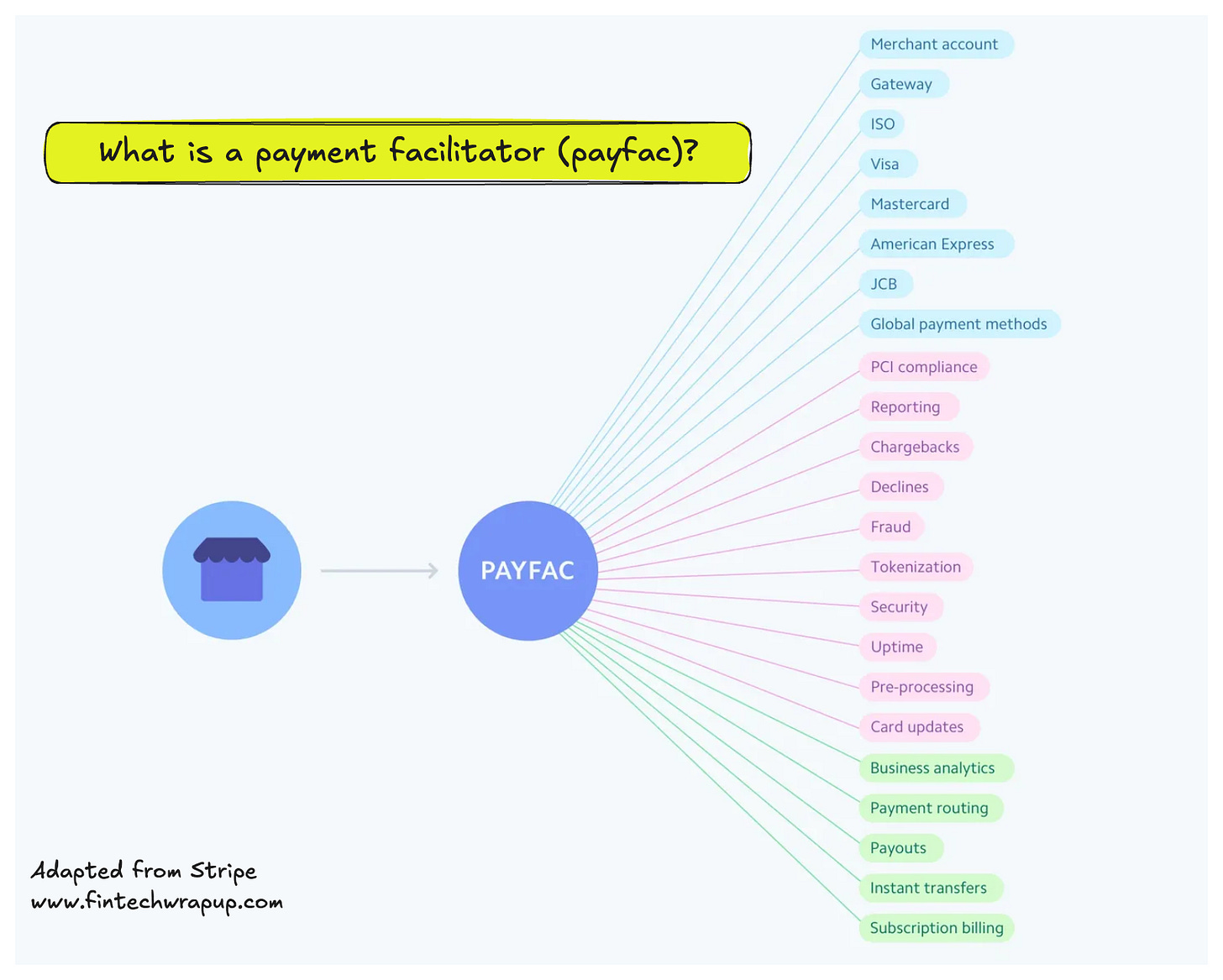

A payment facilitator (PayFac) is a company that streamlines how businesses accept electronic payments by acting as an intermediary between those businesses and the traditional payments infrastructure. Instead of each merchant obtaining its own merchant account with an acquiring bank (a process that can be complex and time-consuming), a PayFac holds a master merchant account and onboards many sub-merchants under its umbrella. In other words, the PayFac aggregates multiple businesses into one payment system, simplifying merchant onboarding and payment processing for those businesses.

PayFacs typically provide an all-in-one solution that includes payment processing, merchant account services, and often value-added features like fraud prevention, risk management, and compliance handling. For example, a small artisan selling jewelry online might find it daunting to set up a direct merchant account and integrate with a bank. By signing up under a PayFac’s platform, that artisan can start accepting credit card payments quickly as a sub-merchant, while the PayFac handles the heavy lifting of payments infrastructure.

This model offers clear benefits to businesses, especially smaller ones. Sub-merchants enjoy streamlined sign-up (faster onboarding with minimal paperwork), flat-rate pricing (simple fees instead of complex interchange schedules), and outsourced risk and compliance support from the PayFac. Meanwhile, the PayFac and its acquiring bank partner take on responsibilities like underwriting each sub-merchant for risk, ensuring transactions are secure and compliant (PCI DSS, KYC/AML checks), and handling chargebacks or disputes on behalf of sub-merchants. In essence, the PayFac serves as the merchant of record with the payment networks, allowing its sub-merchants to transact without each needing a direct acquiring relationship.

Keep reading with a 7-day free trial

Subscribe to Fintech Wrap Up to keep reading this post and get 7 days of free access to the full post archives.