How crypto can evolve Consumer-to-Business (C2B) payments; Stablecoins: the commercial opportunity; Rewiring The Money Stack

Daily news on Payments Wrap Up

This week’s reports

Stablecoin Summer: Hype, Regulation, and What Comes Next

1️⃣ Stablecoin Summer: Hype, Regulation, and What Comes Next

2️⃣ Dynamic currency conversion vs. traditional currency conversion

3️⃣ Tokenization in Capital Markets: From Experimentation to Transformation

4️⃣ Are Marketplaces Defensible in the Age of AI Purchasing Agents?

5️⃣ How AI Agents Are Turning Conversation Into Commerce and Payments

6️⃣ Battling next-gen financial fraud

7️⃣ 3 Key Steps for Bank Merger Teach Integration Success

This week’s insights

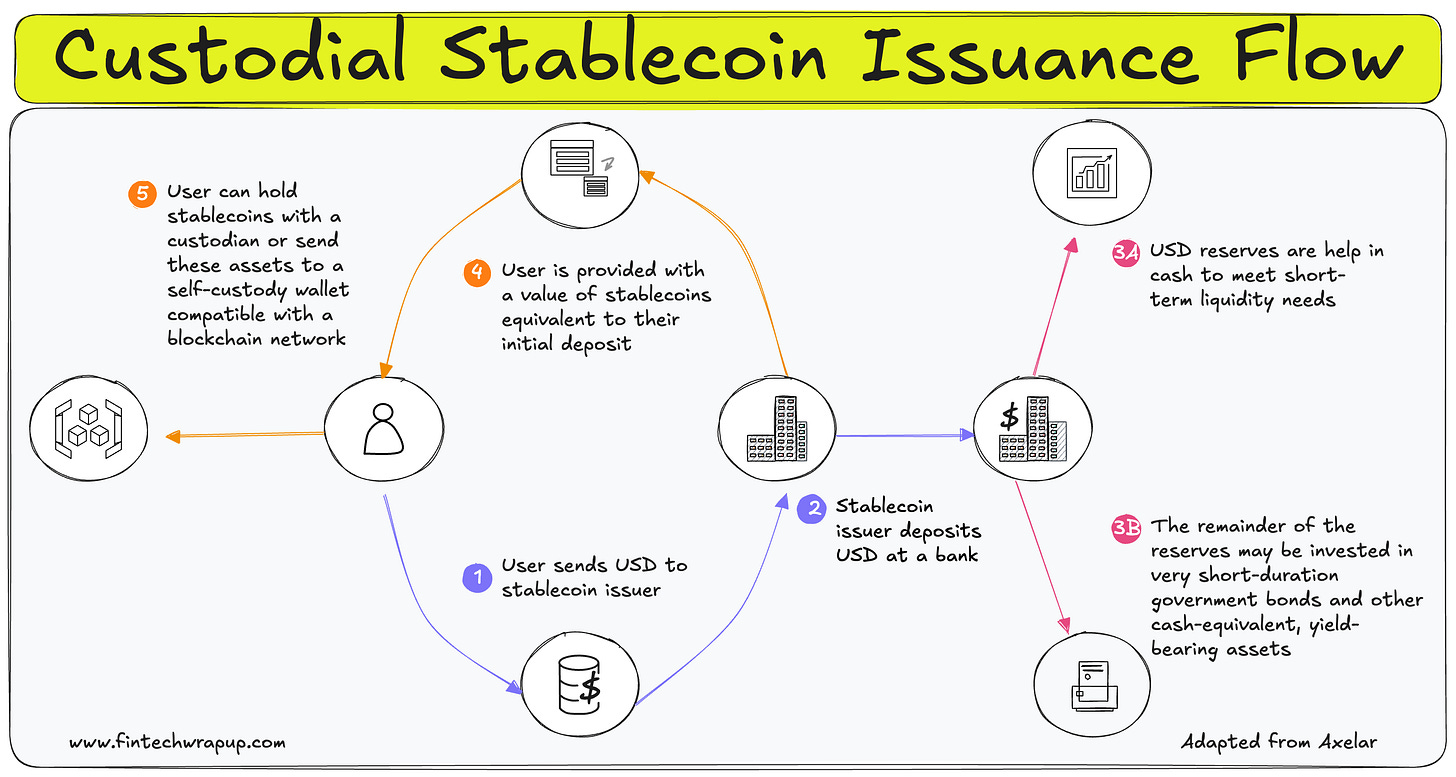

1️⃣ Issuance Flow for Custodial Stablecoins: How It Works

2️⃣ Stablecoins: the commercial opportunity

3️⃣ Stablecoins Timeline

4️⃣ How Traditional Finance is Investing in Blockchain

5️⃣ How crypto can evolve Consumer-to-Business (C2B) payments

6️⃣ Exploring How Payment Orchestration Is Transforming with Ixopay

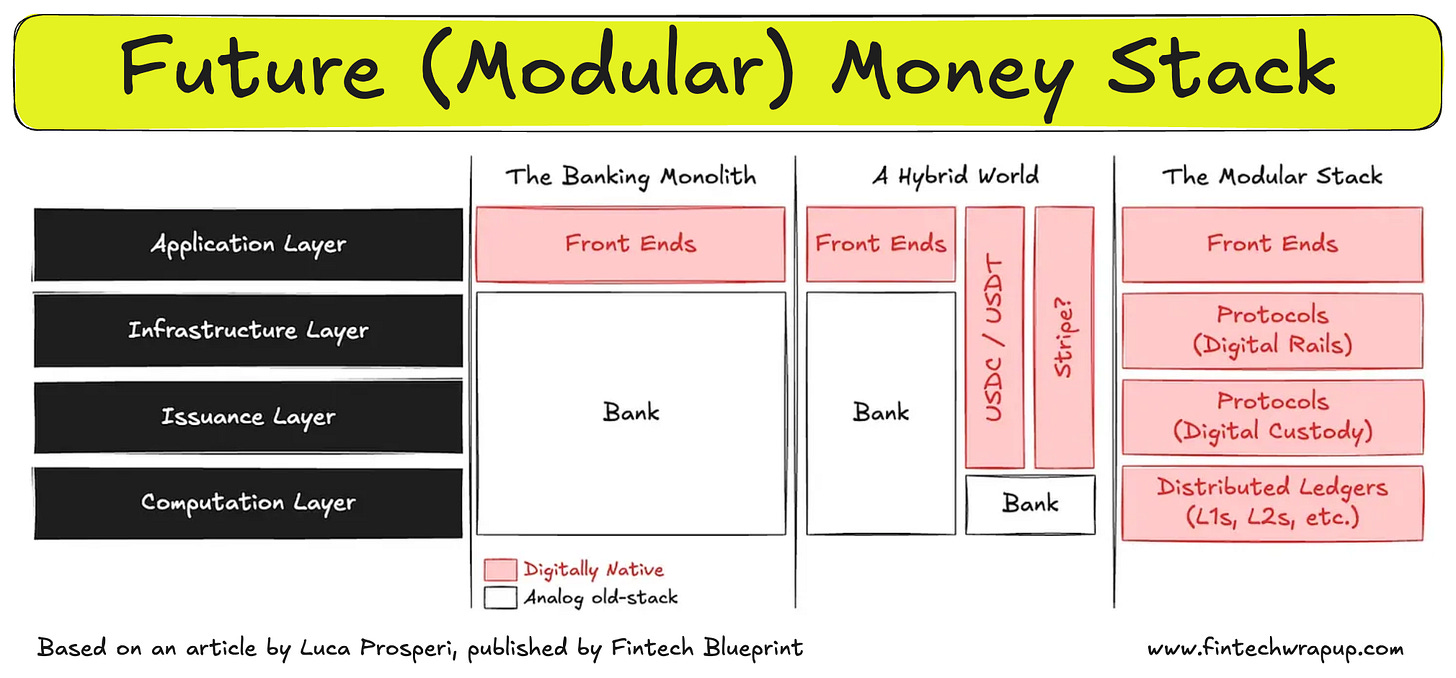

7️⃣ Rewiring The Money Stack

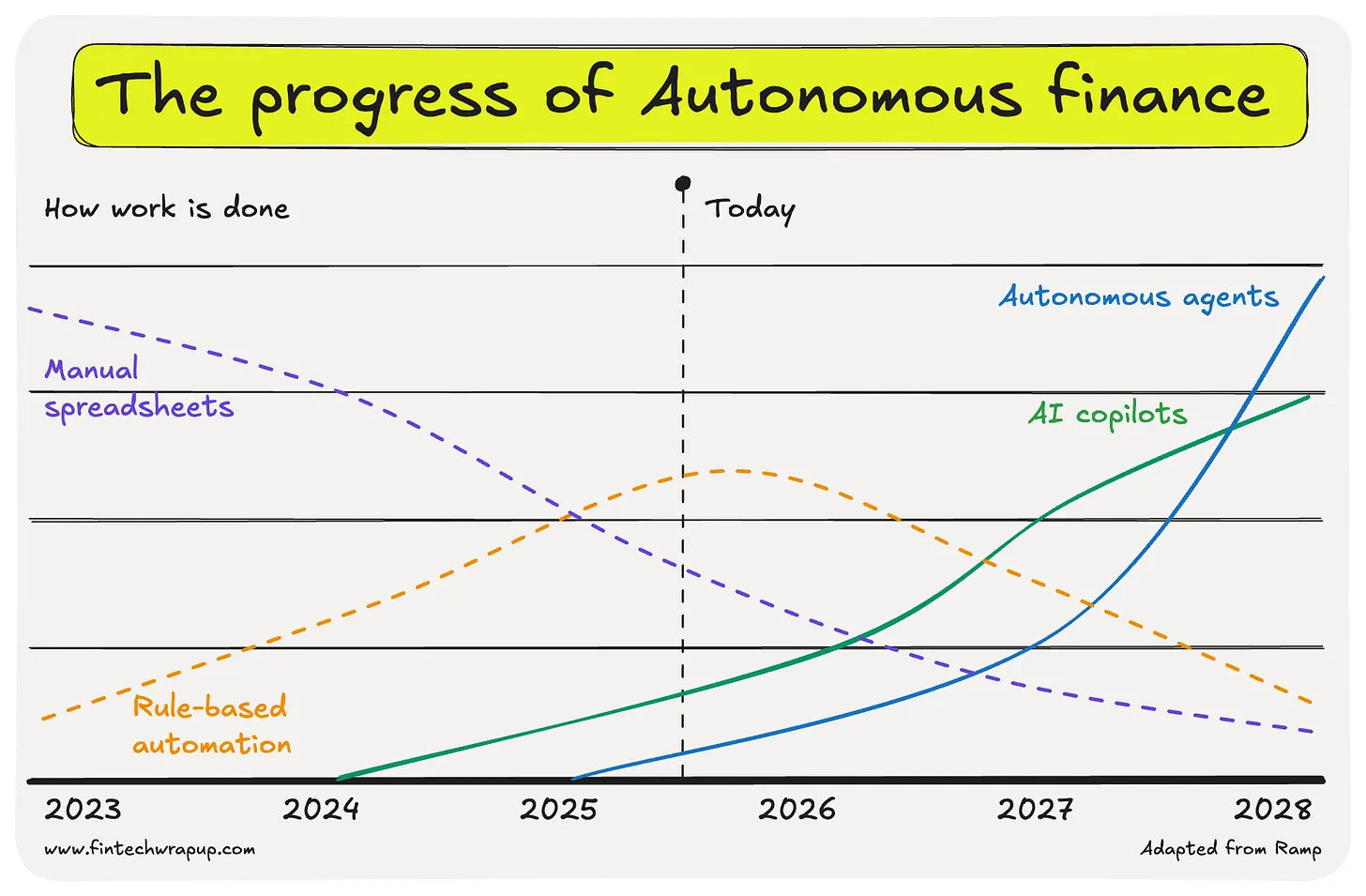

Automation Is Eating the CFO Stack — Ramp Shows How

Financial teams have long been stuck in a “bump, bump, bump” routine of manual busywork – to borrow a phrase from Winnie-the-Pooh. But that’s changing fast. In the last year, AI has barreled into the finance back-office. Expense reports are getting filed by bots. Invoices are paying themselves. And one startup in particular – Ramp – just raised a whopping $500 million to pick up the pace. What’s going on here?

My take: AI will take over the busywork, not the brains. We still need humans to set goals, make judgment calls, and handle exceptions. But the days of finance teams drowning in low-value tasks are numbered. And thank goodness – life’s too short to spend it copying numbers between spreadsheets.

Issuance Flow for Custodial Stablecoins: How It Works

Stablecoins have become one of the most widely used innovations in digital finance, bridging the gap between traditional money and blockchain networks. At their core, custodial stablecoins are digital tokens backed 1:1 by fiat reserves, most often U.S. dollars, held by a regulated issuer. But what does the actual issuance process look like? Let’s break down the flow.

The process begins when a user sends U.S. dollars (USD) to a stablecoin issuer. This could be done through a wire transfer, ACH, or card payment. The issuer is typically a regulated entity, such as Circle (USDC) or Paxos (USDP), which guarantees that each token is fully backed.

Next, the issuer deposits the user’s USD into a bank account. This bank account is typically segregated from the issuer’s own operating funds and managed under strict oversight to ensure transparency and security.

Once the funds are deposited, the issuer must determine how to manage the reserves. Here, two paths emerge:

Keep reading with a 7-day free trial

Subscribe to Fintech Wrap Up to keep reading this post and get 7 days of free access to the full post archives.