Deep Dive: Automation Is Eating the CFO Stack — Ramp Shows How

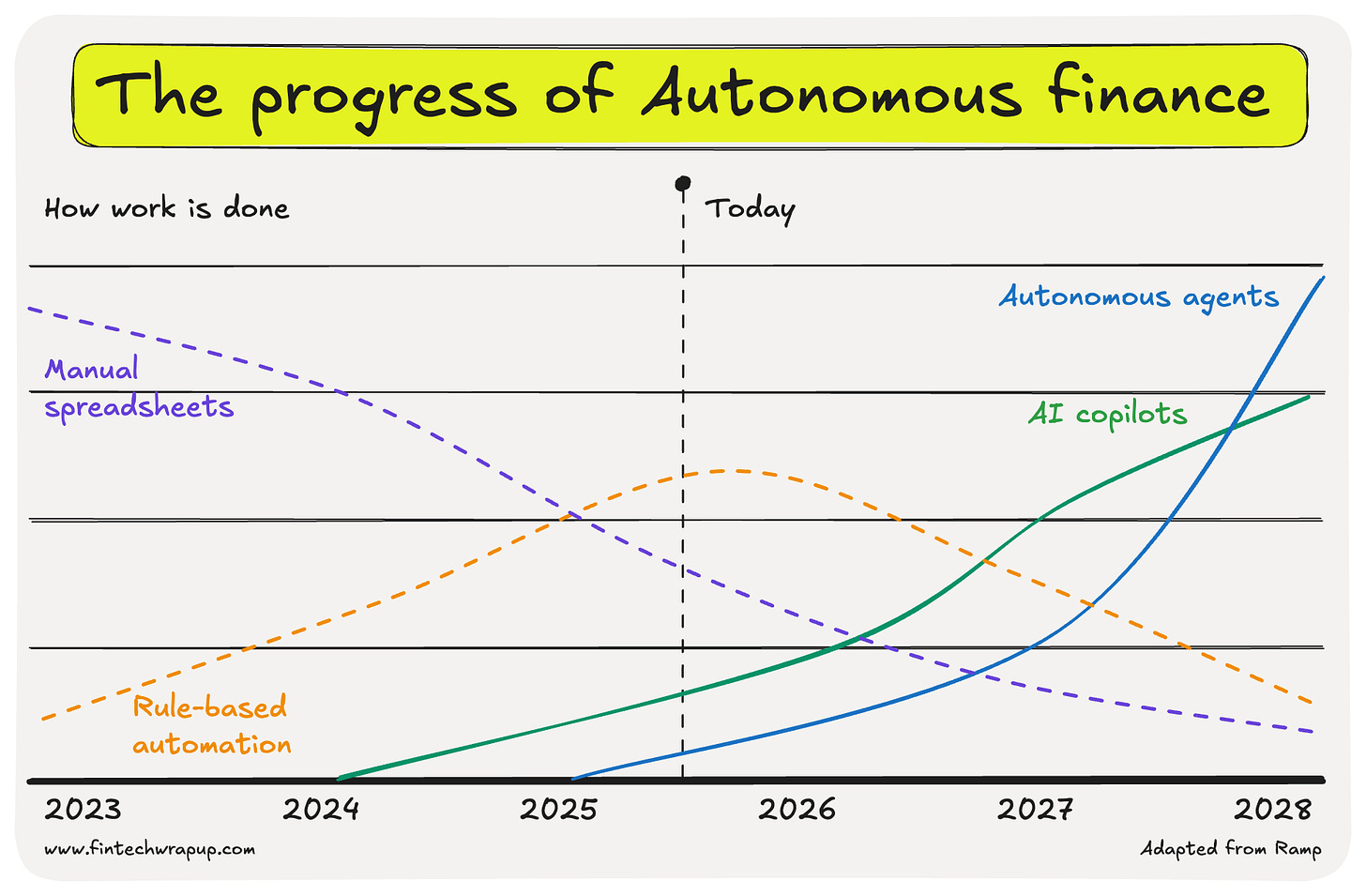

In the last year, AI has barreled into the finance back-office. Expense reports are getting filed by bots. Invoices are paying themselves. What’s going on here?

Financial teams have long been stuck in a “bump, bump, bump” routine of manual busywork – to borrow a phrase from Winnie-the-Pooh. But that’s changing fast. In the last year, AI has barreled into the finance back-office. Expense reports are getting filed by bots. Invoices are paying themselves. And one startup in particular – Ramp – just raised a whopping $500 million to pick up the pace. What’s going on here?

My take: AI will take over the busywork, not the brains. We still need humans to set goals, make judgment calls, and handle exceptions. But the days of finance teams drowning in low-value tasks are numbered. And thank goodness – life’s too short to spend it copying numbers between spreadsheets.

AI Invaded the Finance Department

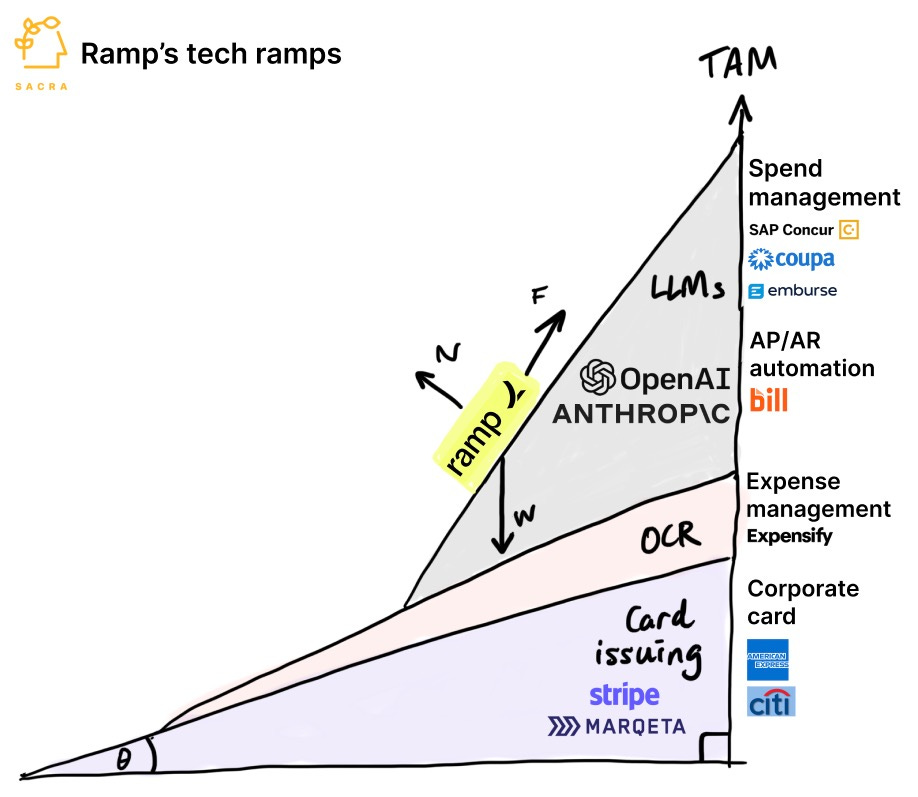

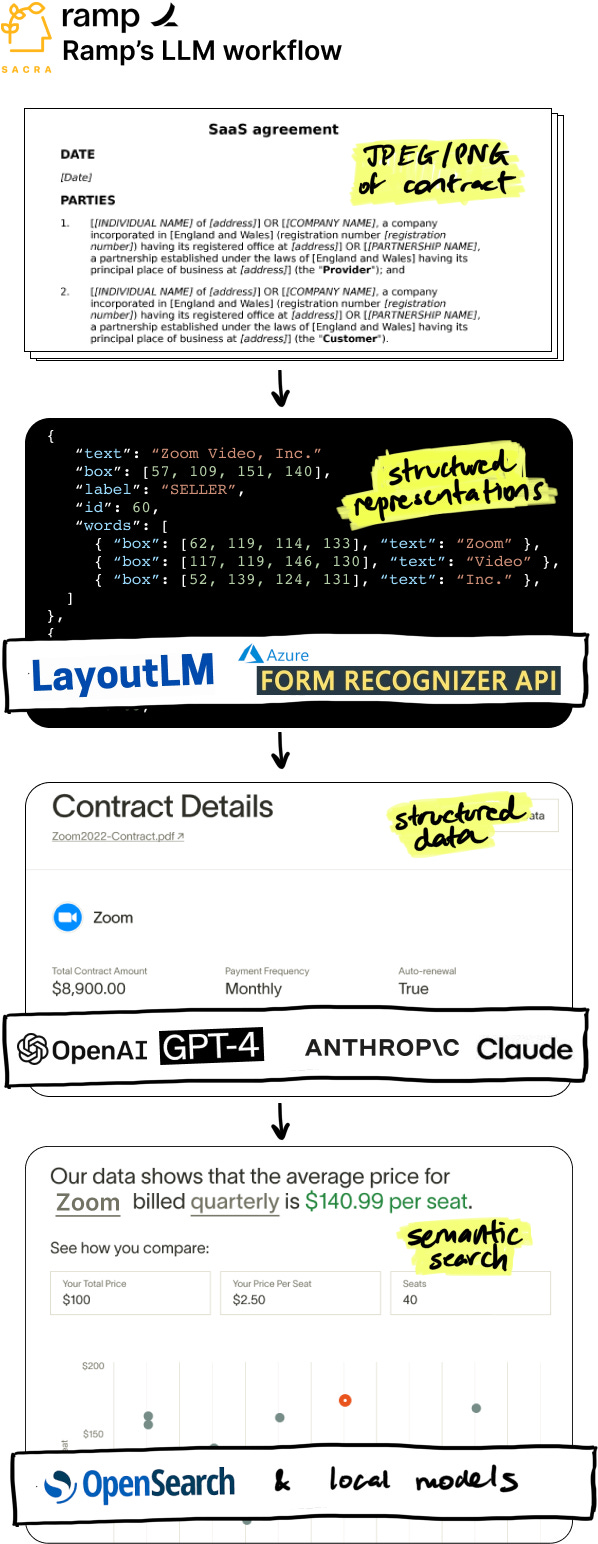

No, not with Terminators crunching numbers, but with large language models (LLMs) automating tasks that used to devour hours. In mid-2023, Ramp (a spend management platform founded in 2019) rolled out a suite of GPT-4 powered features across expense management, vendor management, and even bookkeeping. Why Ramp? Because receipts, invoices, contracts – they’re all essentially language. Ramp’s VP of Product put it simply: “A receipt, a transaction, an invoice: these are all types of language around a financial event, and our job is to help finance teams understand, audit, classify, control, and reconcile these events.” In other words, if you can feed these documents to an AI that understands language, it can do the grunt work that humans used to handle.

Ramp’s first target was the tedious ritual of expense reports. Traditionally, an employee swipes a card, saves a paper receipt, uploads it later, a manager reviews at month-end, and a finance associate reconciles it. Total cost? About 14 minutes of human attention for one $5 latte. Ramp flipped this script by texting employees the moment a corporate card is swiped and letting them reply with a photo of the receipt – then using OCR and AI to automatically categorize and log the expense. Now, with new GPT-4 agents, Ramp takes it further: you feed the AI your expense policy PDF, and it becomes an agent that auto-approves routine expenses, answers employees’ random policy questions via SMS, and flags only the outliers for a human to review. Early beta users saw 85% fewer manual expense reviews needed, while the AI caught 15× more policy violations than frazzled humans did. Turns out robots are pretty good at reading the fine print.

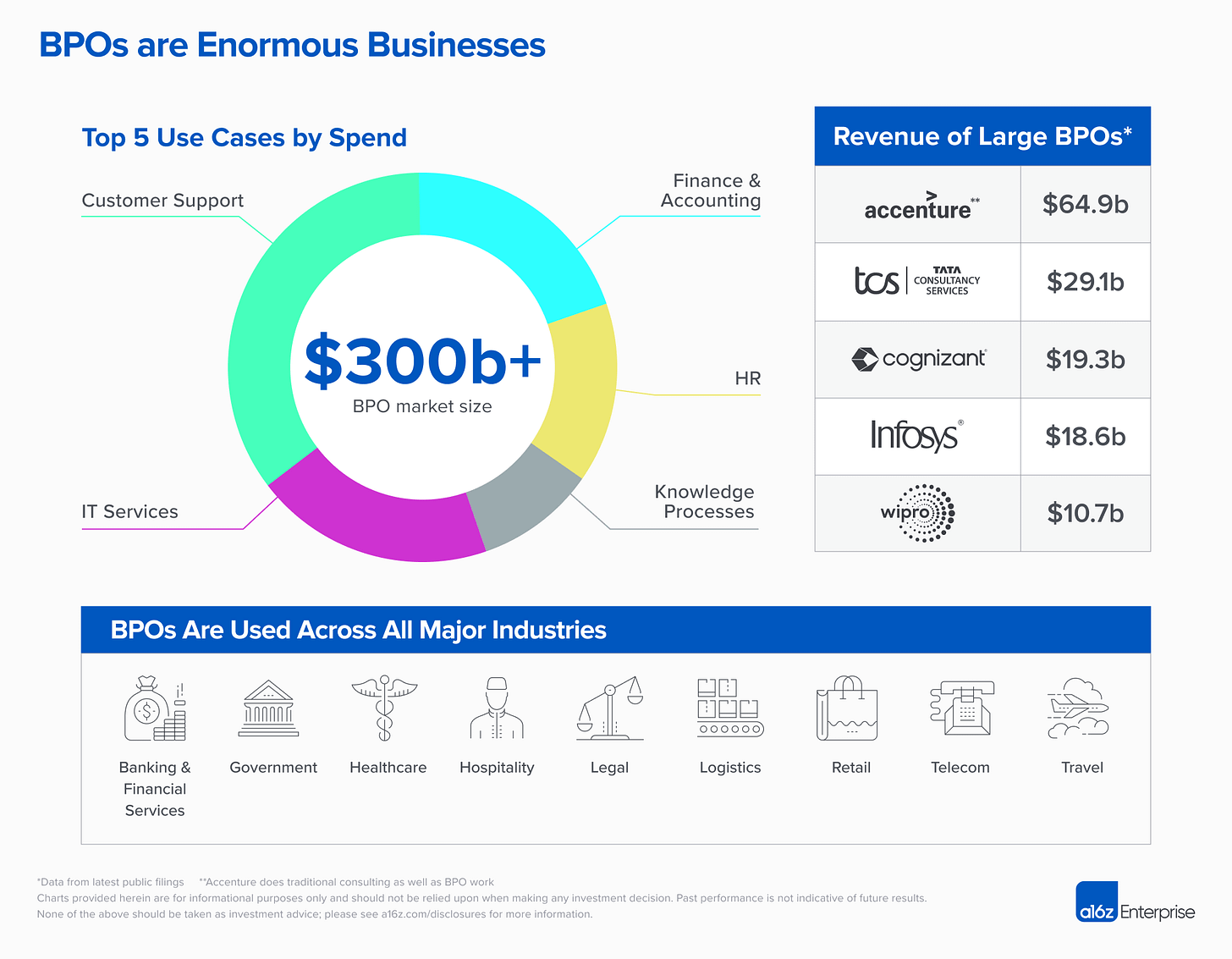

Ramp’s use of AI isn’t just for employee receipts. They’re gunning for accounts payable (AP) automation – think vendor invoices and bill payments – an area owned by incumbents like Bill.com and SAP Concur. By layering OCR on incoming bills, Ramp can ingest messy PDF invoices and turn them into structured data in seconds. LLMs then “understand” the invoice language and output structured metadata (vendor name, due date, line items, etc.). This supercharged data extraction gives Ramp a force multiplier to automate AP/AR workflows that used to require armies of accounts payable clerks or outsourcing to BPOs. In practical terms, the AI can read an invoice, match it to a purchase order, flag any discrepancies, and even schedule a payment – no human keying required. Ramp’s CEO even boasts that today their bots are “filing your expenses, booking your travel, paying your invoices, and closing your books”. If that isn’t end-to-end, what is?

In case you missed the memo, investors are throwing serious money at this trend. Ramp’s recent $500M raise (at a $22.5B valuation) is a big green light to accelerate AI-for-finance innovation. The company openly frames its mission as building “the future of finance” on the back of AI agents. As CEO Eric Glyman quipped, 45 days ago we said “let the robots chase receipts” and raised $200M; now they’re doing much more, so we raised another $500M. It’s not just Ramp, either. The whole industry sees the writing on the wall: CFOs everywhere are asking their teams for an “AI plan”. One day you’re closing the books in Excel; the next, your CFO wants to know how AI can close them faster. Gradually, then suddenly, indeed.

Consider the massive business process outsourcing (BPO) sector – those external firms and offshore teams that handle finance ops for big companies. It’s a $300+ billion market, precisely because enterprises throw mundane, high-volume tasks like invoice reconciliation, claims processing, and payroll at them. Yet BPOs are notoriously clunky: slow turnaround, frequent errors, and workers who lack the client’s context or authority to truly streamline things. Now AI is letting companies productize and “in-house” that work with their own automated agents. Andreessen Horowitz calls it “unbundling the BPO” – startups using AI to bite off pieces of what outsourcers do, but cheaper and better. LLMs have suddenly become exceptionally good at tasks that software couldn’t handle before, like understanding unstructured documents, extracting data, reconciling records across systems, even carrying on conversations (via voice agents) that sound human. In short, if reading invoices or answering vendor emails was too messy for old software, modern AI is on it. A telling example: freight companies traditionally paid BPO firms to audit and

Keep reading with a 7-day free trial

Subscribe to Fintech Wrap Up to keep reading this post and get 7 days of free access to the full post archives.