Exploring How AI is Transforming KYC in Banking by BCG; Understanding Embedded Fintech in U.S. Healthcare; Kraken vs Robinhood vs Coinbase by Sacra;

Personal update

Follow us on Telegram and WhatsApp

Deep Dive of the Week

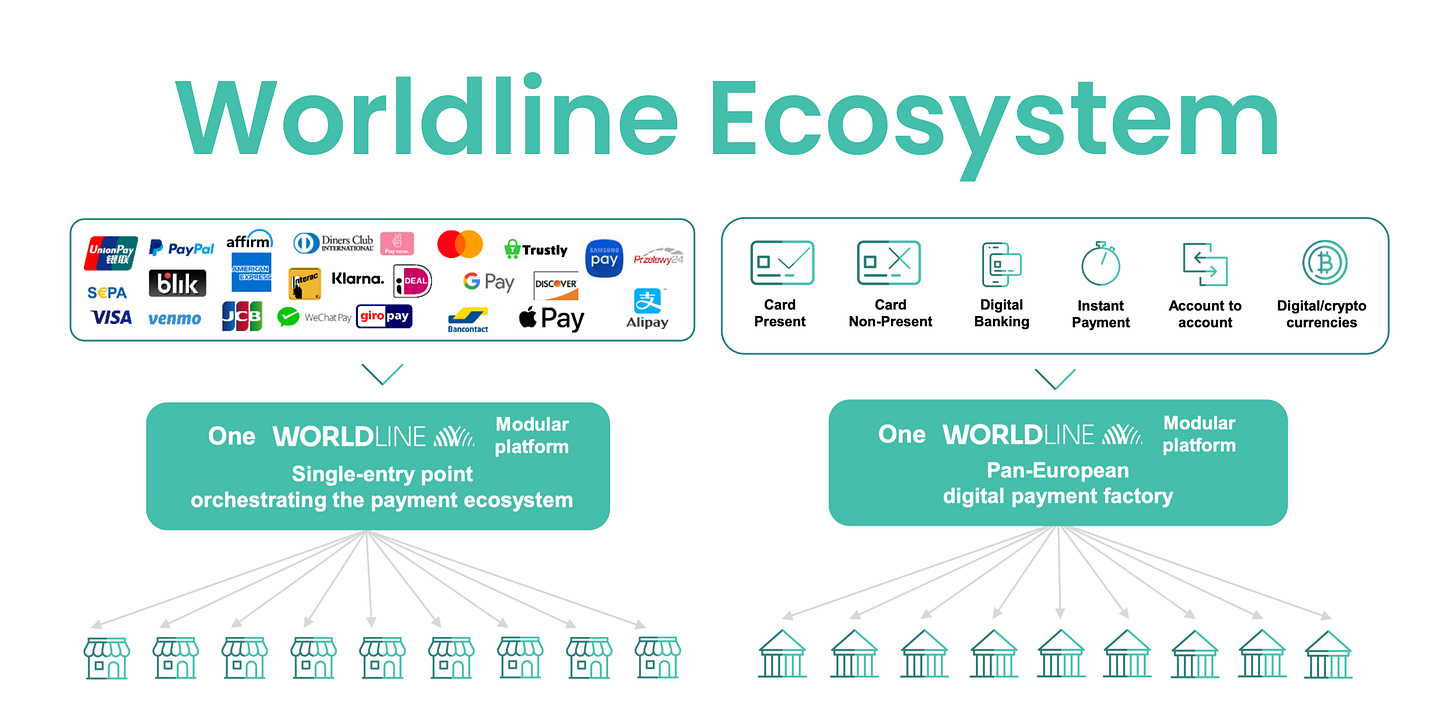

How Worldline Is Trying to Rebuild — Without a Full Recovery (Yet)

I’ll admit, the first half of 2025 wasn’t kind to Worldline’s reputation. Back in June, an investigative series dubbed “Dirty Payments” accused the French payment giant of covering up fraudulent merchants to protect its revenue – including allegedly onboarding questionable clients in porn, gambling, and sketchy dating sites, then shuffling them between divisions to avoid detection. Multiple media outlets piled on, and the fallout was immediate: Worldline’s stock plunged ~20% in a single day. Even Belgian prosecutors opened a money-laundering probe into the company’s local unit. In boardrooms and Slack channels across fintech, the question was whether Europe’s “trusted” payments provider had been playing fast and loose with compliance.

Worldline’s response was equal parts damage control and mea culpa. Management claims that since 2023 they’ve tightened merchant risk controls, terminated high-risk clients (purging merchants representing about €130 million in annual revenue) and maintain a “zero-tolerance” stance on non-compliance. To “restore trust,” the company even commissioned an external audit of its merchant portfolio and risk processes, and it clarified some opaque cash pooling arrangements that had raised eyebrows. In other words, Worldline brought in the auditors to exorcise its demons. (The irony of a firm long touted as a compliance-first European player having to prove it wasn’t the next Wirecard was not lost on anyone).

Investor sentiment remained skittish. Notably, SIX Group – the Swiss stock exchange operator that once was a key Worldline shareholder – essentially noped out. SIX reclassified its 10.5% stake from “strategic” to merely a “financial investment,” pointedly indicating it wouldn’t throw good money after bad. It even took back control of one Worldline unit (an electronic data management business) as part of the divorce. That left Worldline leaning heavily on friendly French banks for support. In a show of solidarity (or perhaps nationalism), Bpifrance, Crédit Agricole, and BNP Paribas agreed to anchor a €500 million capital raise to bolster Worldline’s balance sheet for its turnaround. With fresh cash and a renewed executive team, Worldline set out to win back confidence.

This week’s reports

𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝐆𝐮𝐢𝐝𝐞 - 𝐇𝐨𝐰 𝐭𝐨 𝐅𝐢𝐱 𝐇𝐨𝐭𝐞𝐥 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝐢𝐧 𝟓 𝐒𝐭𝐞𝐩𝐬 𝐛𝐲 𝐄𝐝𝐠𝐚𝐫, 𝐃𝐮𝐧𝐧 & 𝐂𝐨𝐦𝐩𝐚𝐧𝐲

1️⃣𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝐆𝐮𝐢𝐝𝐞 - 𝐇𝐨𝐰 𝐭𝐨 𝐅𝐢𝐱 𝐇𝐨𝐭𝐞𝐥 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝐢𝐧 𝟓 𝐒𝐭𝐞𝐩𝐬 𝐛𝐲 𝐄𝐝𝐠𝐚𝐫, 𝐃𝐮𝐧𝐧 & 𝐂𝐨𝐦𝐩𝐚𝐧𝐲

2️⃣𝐇𝐨𝐰 𝐔𝐏𝐈 𝐓𝐫𝐚𝐧𝐬𝐟𝐨𝐫𝐦𝐞𝐝 𝐈𝐧𝐝𝐢𝐚’𝐬 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝐋𝐚𝐧𝐝𝐬𝐜𝐚𝐩𝐞

3️⃣𝗦𝘁𝗮𝗯𝗹𝗲𝗰𝗼𝗶𝗻𝘀 𝗶𝗻 𝗟𝗲𝗻𝗱𝗶𝗻𝗴 - 𝗘𝘅𝗽𝗹𝗮𝗶𝗻𝗲𝗱 𝗯𝘆 𝗩𝗶𝘀𝗮

4️⃣𝐖𝐡𝐚𝐭 𝐁𝐚𝐧𝐤𝐬 𝐌𝐮𝐬𝐭 𝐃𝐨 𝐭𝐨 𝐖𝐢𝐧 𝐁𝐚𝐜𝐤 𝐌𝐞𝐫𝐜𝐡𝐚𝐧𝐭𝐬 𝐟𝐫𝐨𝐦 𝐏𝐚𝐲𝐭𝐞𝐜𝐡𝐬

5️⃣𝐈𝐧𝐝𝐢𝐚’𝐬 𝐩𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝐬𝐭𝐨𝐫𝐲 𝐡𝐚𝐬 𝐞𝐧𝐭𝐞𝐫𝐞𝐝 𝐢𝐭𝐬 𝐧𝐞𝐱𝐭 𝐜𝐡𝐚𝐩𝐭𝐞𝐫 — 𝐟𝐫𝐨𝐦 𝐬𝐜𝐚𝐥𝐞 𝐭𝐨 𝐬𝐨𝐩𝐡𝐢𝐬𝐭𝐢𝐜𝐚𝐭𝐢𝐨𝐧

6️⃣𝐀 𝐑𝐨𝐚𝐝𝐦𝐚𝐩 𝐟𝐨𝐫 𝐈𝐧𝐯𝐞𝐬𝐭𝐨𝐫𝐬 - 𝐈𝐧𝐬𝐭𝐢𝐭𝐮𝐭𝐢𝐨𝐧𝐚𝐥 𝐀𝐝𝐨𝐩𝐭𝐢𝐨𝐧 𝐚𝐧𝐝 𝐭𝐡𝐞 𝐌𝐚𝐭𝐮𝐫𝐢𝐧𝐠 𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐀𝐬𝐬𝐞𝐭 𝐌𝐚𝐫𝐤𝐞𝐭

7️⃣𝐎𝐩𝐞𝐧 𝐁𝐚𝐧𝐤𝐢𝐧𝐠 𝐈𝐬 𝐑𝐞𝐰𝐫𝐢𝐭𝐢𝐧𝐠 𝐭𝐡𝐞 𝐑𝐮𝐥𝐞𝐬 𝐢𝐧 𝐭𝐡𝐞 𝐌𝐢𝐝𝐝𝐥𝐞 𝐄𝐚𝐬𝐭

This week’s insights

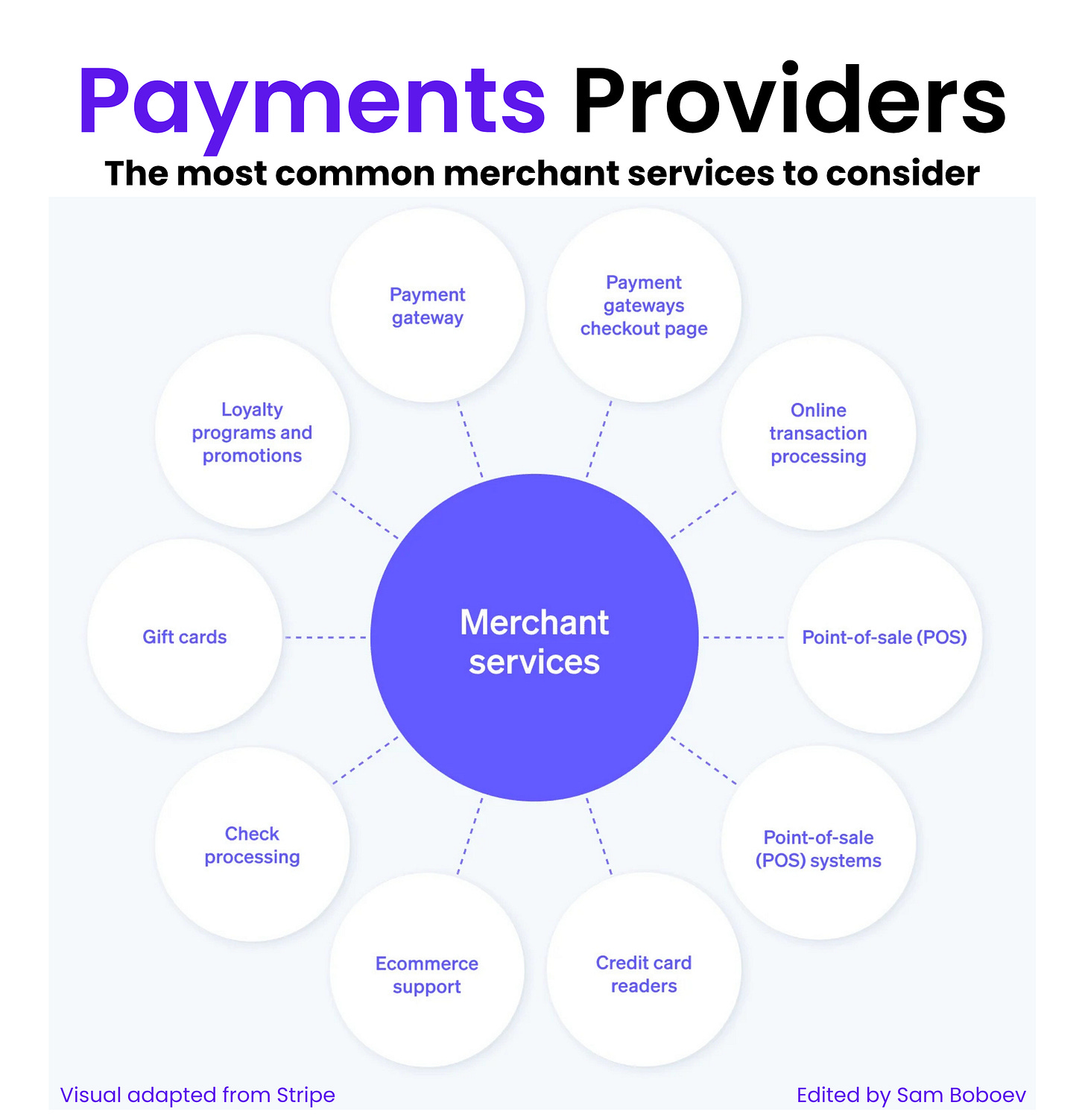

1️⃣𝐓𝐡𝐞 𝐌𝐨𝐬𝐭 𝐂𝐨𝐦𝐦𝐨𝐧 𝐌𝐞𝐫𝐜𝐡𝐚𝐧𝐭 𝐒𝐞𝐫𝐯𝐢𝐜𝐞𝐬 — 𝐄𝐱𝐩𝐥𝐚𝐢𝐧𝐞𝐝 𝐛𝐲 𝐒𝐭𝐫𝐢𝐩𝐞

2️⃣𝐌𝐚𝐬𝐭𝐞𝐫𝐜𝐚𝐫𝐝 𝐯𝐬 𝐕𝐢𝐬𝐚 - 𝐐𝐮𝐚𝐫𝐭𝐞𝐫𝐥𝐲 𝐅𝐢𝐧𝐚𝐧𝐜𝐢𝐚𝐥 𝐑𝐞𝐬𝐮𝐥𝐭𝐬

3️⃣𝐔𝐬𝐞 𝐂𝐚𝐬𝐞: 𝐀𝐈 𝐚𝐬 𝐚 𝐖𝐚𝐥𝐥𝐞𝐭 𝐚𝐧𝐝 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐀𝐠𝐠𝐫𝐞𝐠𝐚𝐭𝐨𝐫 𝐛𝐲 Visa

4️⃣𝐔𝐧𝐝𝐞𝐫𝐬𝐭𝐚𝐧𝐝𝐢𝐧𝐠 𝐄𝐦𝐛𝐞𝐝𝐝𝐞𝐝 𝐅𝐢𝐧𝐭𝐞𝐜𝐡 𝐢𝐧 𝐔.𝐒. 𝐇𝐞𝐚𝐥𝐭𝐡𝐜𝐚𝐫𝐞

5️⃣𝐊𝐫𝐚𝐤𝐞𝐧 𝐯𝐬 𝐑𝐨𝐛𝐢𝐧𝐡𝐨𝐨𝐝 𝐯𝐬 𝐂𝐨𝐢𝐧𝐛𝐚𝐬𝐞 𝐛𝐲 𝐒𝐚𝐜𝐫𝐚

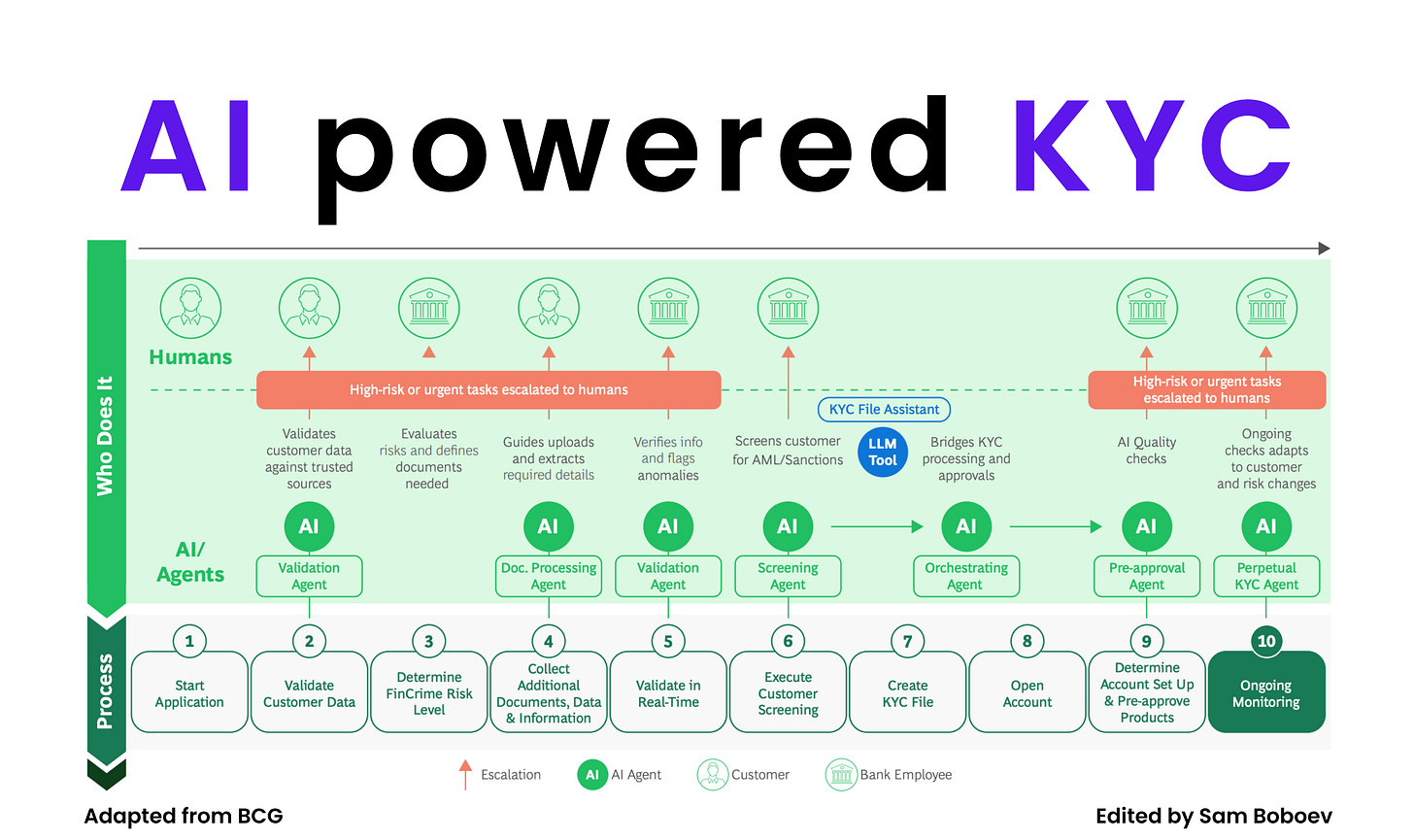

6️⃣𝐄𝐱𝐩𝐥𝐨𝐫𝐢𝐧𝐠 𝐇𝐨𝐰 𝐀𝐈 𝐈𝐬 𝐓𝐫𝐚𝐧𝐬𝐟𝐨𝐫𝐦𝐢𝐧𝐠 𝐊𝐘𝐂 𝐢𝐧 𝐁𝐚𝐧𝐤𝐢𝐧𝐠 𝐛𝐲 𝐁𝐂𝐆

7️⃣𝐁𝐍𝐏𝐋 𝐈𝐬 𝐄𝐱𝐩𝐚𝐧𝐝𝐢𝐧𝐠 𝐈𝐧𝐭𝐨 𝐒𝐮𝐛𝐬𝐜𝐫𝐢𝐩𝐭𝐢𝐨𝐧𝐬 — 𝐇𝐞𝐫𝐞’𝐬 𝐖𝐡𝐚𝐭’𝐬 𝐂𝐡𝐚𝐧𝐠𝐢𝐧𝐠

𝐓𝐡𝐞 𝐌𝐨𝐬𝐭 𝐂𝐨𝐦𝐦𝐨𝐧 𝐌𝐞𝐫𝐜𝐡𝐚𝐧𝐭 𝐒𝐞𝐫𝐯𝐢𝐜𝐞𝐬 — 𝐄𝐱𝐩𝐥𝐚𝐢𝐧𝐞𝐝 𝐛𝐲 𝐒𝐭𝐫𝐢𝐩𝐞

When I first started working with payment providers, the world of merchant services felt like a maze — gateways, acquirers, processors, terminals… all talking to each other behind the scenes.

But once you break it down, it’s actually pretty straightforward. Here’s how Stripe explains the core components every merchant should understand 👇

🔹 Payment gateways

Think of this as the digital cashier.

It securely collects your customer’s payment details (like card numbers) and sends them to the processor for approval. For online payments, it’s built into your website or app. For in-person payments, it’s your POS terminal doing the same job.

🔹 Online transaction processing

This is where the “magic” happens after checkout. The customer’s bank and your bank talk to each other, and the merchant service provider routes the money to the right place.

🔹 Point-of-sale (POS) systems

These combine hardware and software to handle in-person sales. Beyond just taking payments, they track inventory, generate receipts, and sync sales data across channels.

🔹 Credit card readers

Swipe, tap, or insert — the card reader captures payment data and sends it for processing.

They can be standalone, built into POS terminals, or even mobile attachments for phones and tablets.

🔹 Ecommerce support

Today’s merchant service providers go beyond payments — offering website builders, checkout plugins, marketing tools, and analytics to help merchants sell smarter.

🔹 Check processing

Yes, it still exists. Many providers offer tools to digitize or manage check payments alongside cards and digital wallets.

🔹 Gift cards

Keep reading with a 7-day free trial

Subscribe to Fintech Wrap Up to keep reading this post and get 7 days of free access to the full post archives.