Deep Dive: How Worldline Is Trying to Rebuild — Without a Full Recovery (Yet)

I’ll admit, the first half of 2025 wasn’t kind to Worldline’s reputation. Back in June, an investigative series dubbed “Dirty Payments” accused the French payment giant of covering up fraudulent merchants to protect its revenue – including allegedly onboarding questionable clients in porn, gambling, and sketchy dating sites, then shuffling them between divisions to avoid detection. Multiple media outlets piled on, and the fallout was immediate: Worldline’s stock plunged ~20% in a single day. Even Belgian prosecutors opened a money-laundering probe into the company’s local unit. In boardrooms and Slack channels across fintech, the question was whether Europe’s “trusted” payments provider had been playing fast and loose with compliance.

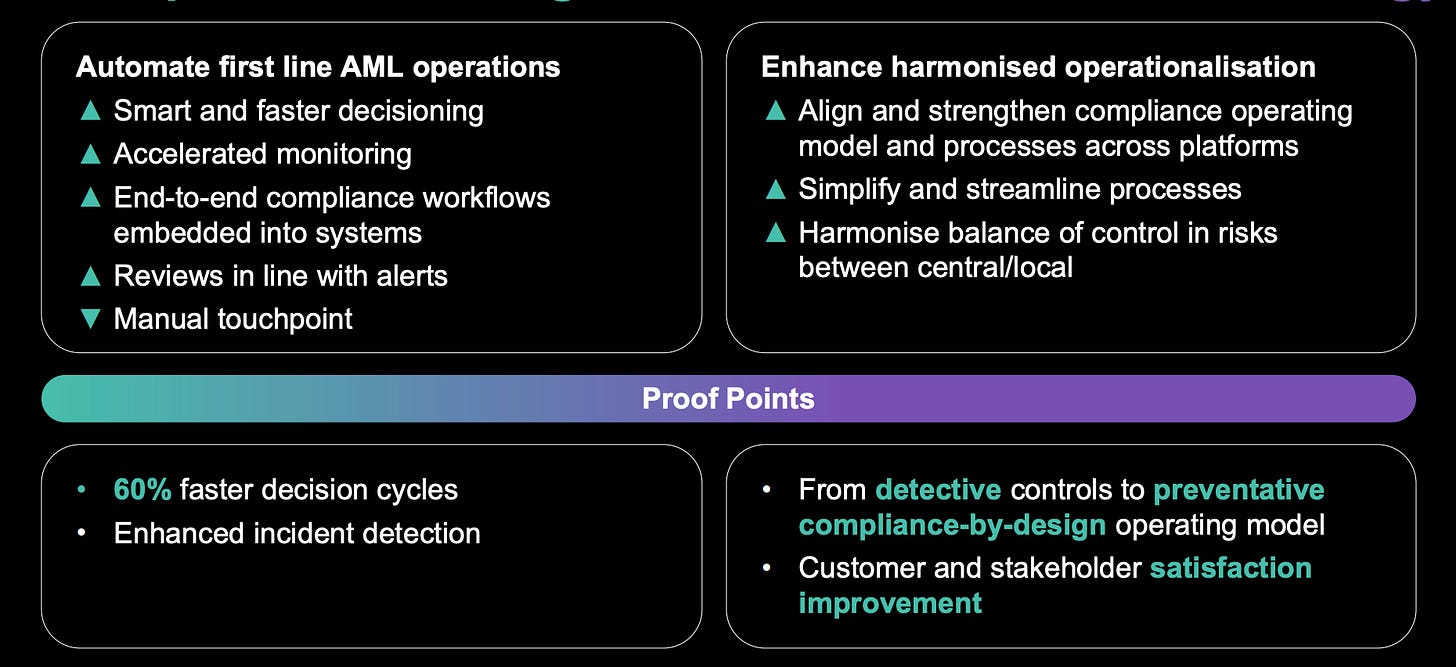

Worldline’s response was equal parts damage control and mea culpa. Management claims that since 2023 they’ve tightened merchant risk controls, terminated high-risk clients (purging merchants representing about €130 million in annual revenue) and maintain a “zero-tolerance” stance on non-compliance. To “restore trust,” the company even commissioned an external audit of its merchant portfolio and risk processes, and it clarified some opaque cash pooling arrangements that had raised eyebrows. In other words, Worldline brought in the auditors to exorcise its demons. (The irony of a firm long touted as a compliance-first European player having to prove it wasn’t the next Wirecard was not lost on anyone.)

Investor sentiment remained skittish. Notably, SIX Group – the Swiss stock exchange operator that once was a key Worldline shareholder – essentially noped out. SIX reclassified its 10.5% stake from “strategic” to merely a “financial investment,” pointedly indicating it wouldn’t throw good money after bad. It even took back control of one Worldline unit (an electronic data management business) as part of the divorce. That left Worldline leaning heavily on friendly French banks for support. In a show of solidarity (or perhaps nationalism), Bpifrance, Crédit Agricole, and BNP Paribas agreed to anchor a €500 million capital raise to bolster Worldline’s balance sheet for its turnaround. With fresh cash and a renewed executive team, Worldline set out to win back confidence.

North Star 2030 or Back to Basics in Payments

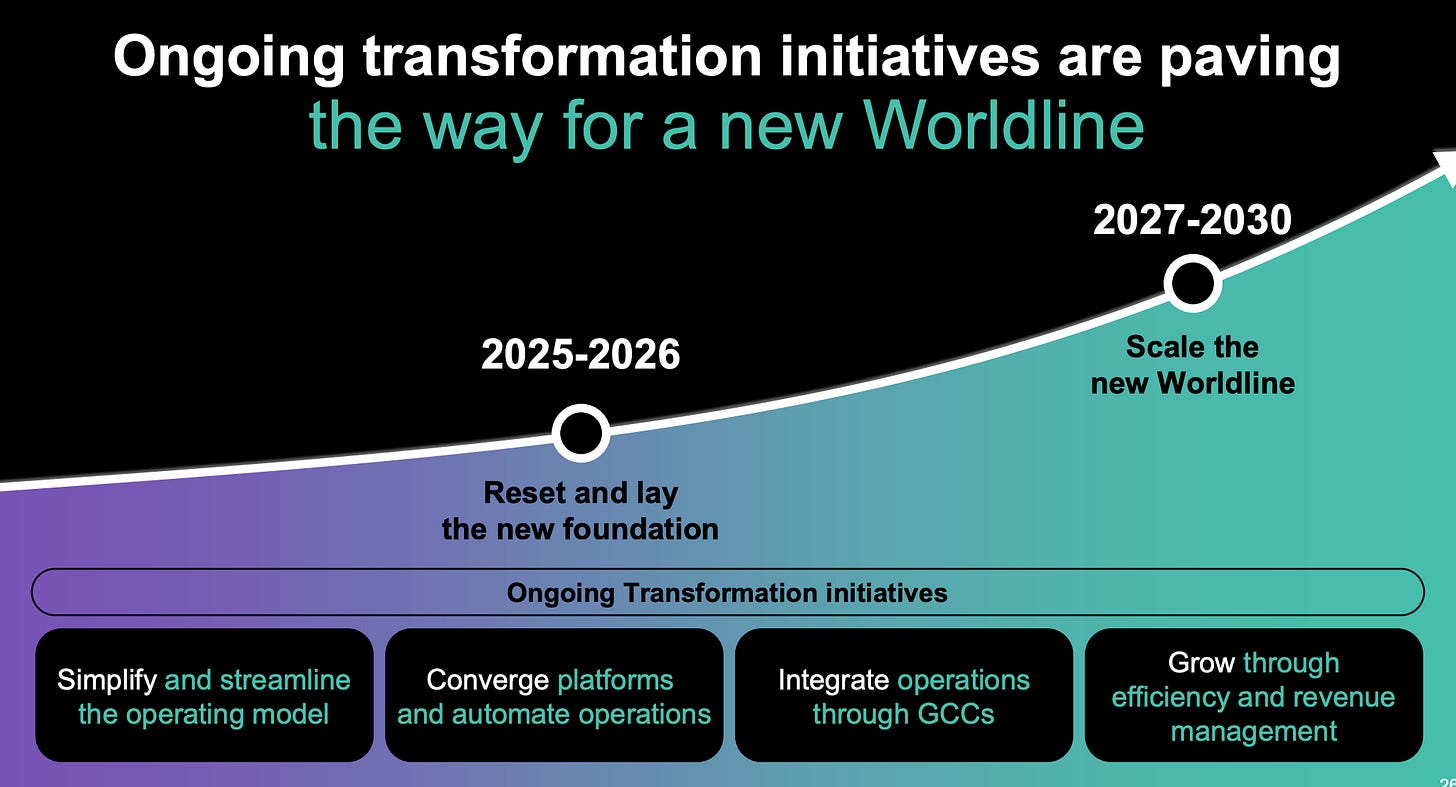

As a fintech nerd who’s watched Worldline for years, I found the company’s Capital Markets Day 2025 to be both sobering and encouraging. CEO Pierre-Antoine Vacheron unveiled a strategic plan called “North Star 2030 – essentially Worldline’s roadmap to redeem itself and refocus on what it does best. The vision is straightforward: “Be the European partner of choice for merchants and financial institutions.” To get there, Worldline is slimming down and doubling down. It’s shedding non-core businesses like a molting snake – selling off the Mobility & e-Transactional Services division, exiting its North American operations, and even divesting some niche data management units to concentrate purely on payments. (When a European payments firm decides to pull out of the U.S. entirely, you know they’re serious about focus.)

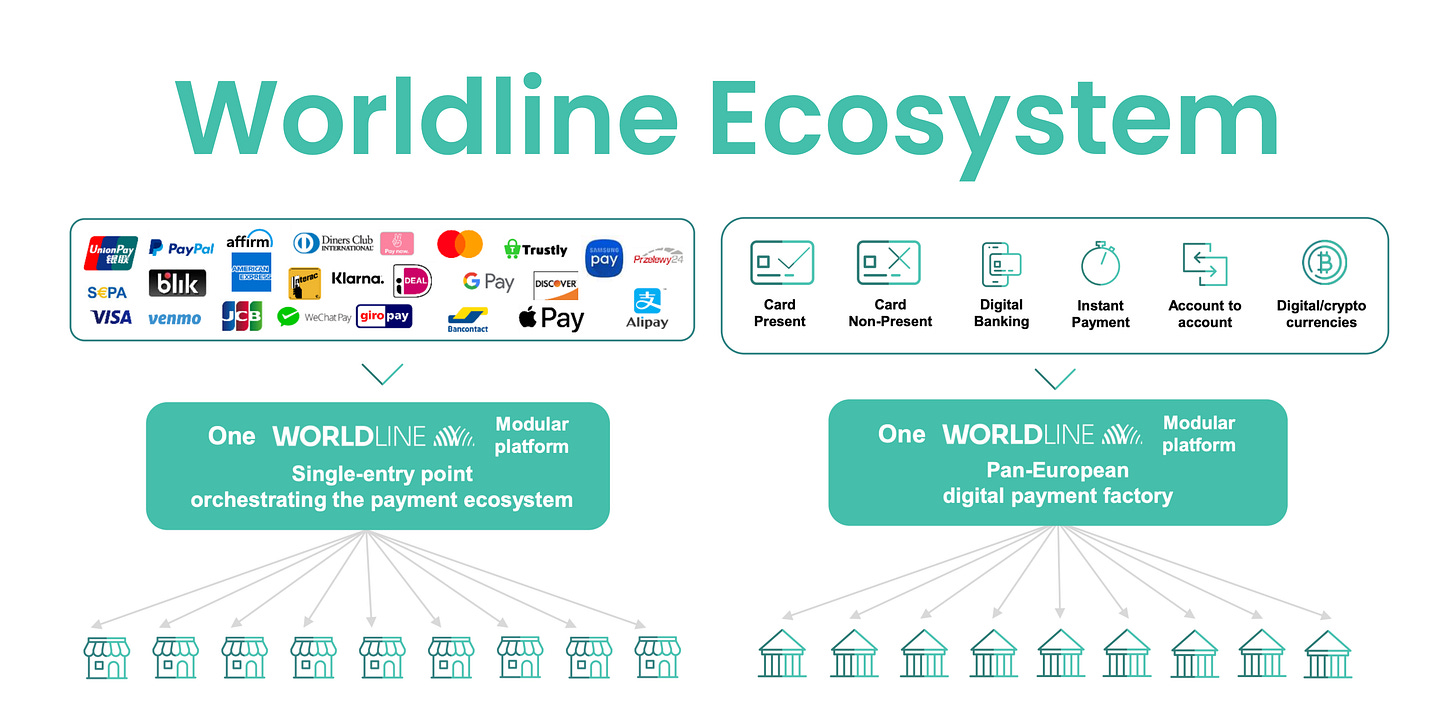

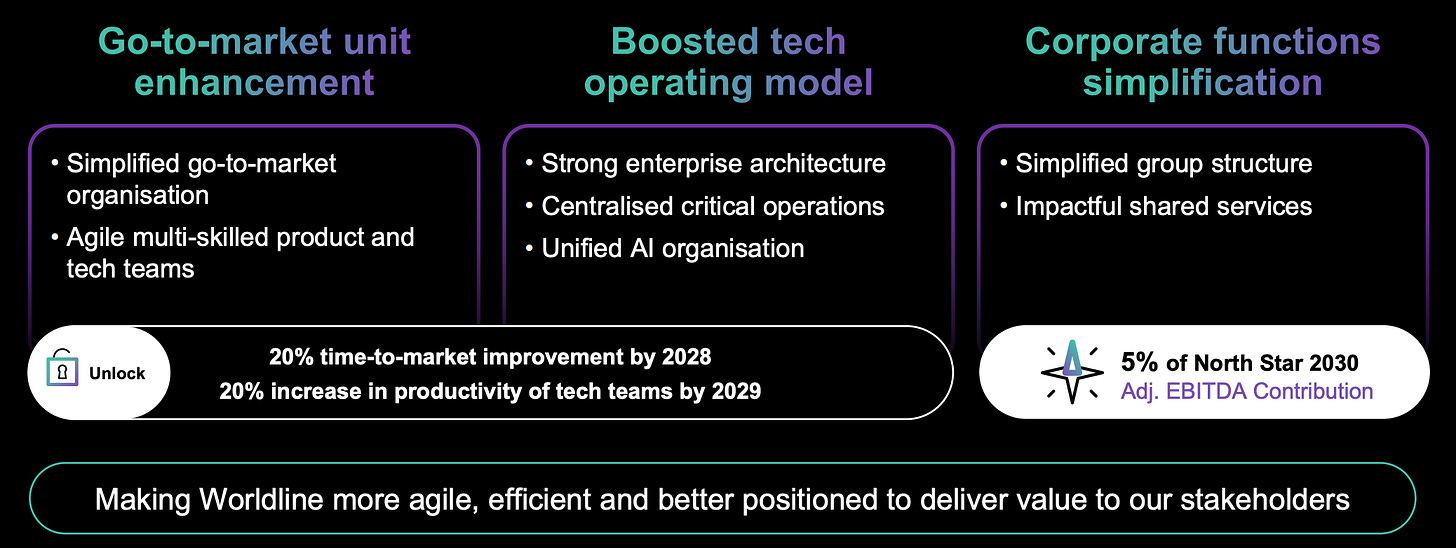

Internally, North Star 2030 is all about simplification and integration. Worldline had grown into a Frankenstein’s monster of acquired systems – remember this is the company that gobbled up Ingenico in 2020 and many bank-owned acquirers before that. Now they’ve committed to converging all those platforms into one modern tech stack. In fact, management says they’ve already decommissioned five legacy platforms this year as a start. The endgame is a unified architecture (leveraging Worldline’s own sovereign private cloud plus public cloud services) that can handle every payment workflow on a common backbone. This means one set of APIs and services powering everything from in-store card swipes to online banking payments, rather than a patchwork of siloed systems. For a company that accumulated platforms like Pokémon, this convergence is long overdue – and absolutely critical if they want to match the seamless tech of younger rivals like Adyen.

Naturally, GenAI has entered the chat. (It’s 2025; every fintech strategy presentation has to drop the AI bomb at least once.) Worldline plans to harness generative AI and automation across operations, risk management, and product development. In practical terms, this could mean AI-driven fraud detection, smarter payment routing, and even using large-language models to speed up coding and customer support. Unlike some buzzword-heavy strategies, here AI actually makes sense: Worldline’s scale (processing 47+ billion transactions a year for banks) gives it a trove of data where machine learning can add value by spotting patterns humans might miss. Early examples are already live – the company has rolled out an AI “smart routing” engine to optimize how transactions are sent through various networks, and it’s piloting “agentic commerce” concepts (think AI-powered shopping bots) in partnership with Google Cloud.

Critically, North Star 2030 also includes a heavy dose of governance and compliance upgrade – a direct response to the trust issues. Worldline says it has “massively renewed” its executive committee and restructured its risk and compliance framework. There’s a new segment-focused go-to-market organization (no more buck-passing between divisions), and a clearer chain of accountability. They want to prove that the fraud fiasco was a one-time lapse and that going forward, Worldline can combine its historical strength in security (some say Worldline was built for Europe’s stringent PSD2, SEPA, and GDPR requirements) with a more innovative, agile culture. In short, regain the image of Europe’s trusted payment infrastructure, but without the stodginess that let bad habits fester.

Keep reading with a 7-day free trial

Subscribe to Fintech Wrap Up to keep reading this post and get 7 days of free access to the full post archives.