Reports: Embedded Payments in the B2B Space; State of Fintech Q1’25 Report; The state of commercial card acceptance 2025;

In this edition of Fintech Wrap Up, I’ve dug into five standout reports that paint a pretty detailed picture of where payments and banking are headed in 2025

Insights & Reports:

1️⃣ The state of commercial card acceptance 2025

2️⃣ Embedded Payments in the B2B Space

3️⃣ State of Fintech Q1’25 Report

4️⃣ 2025 – The Year of Payment Stablecoins: Summary of Opportunities and Risks

5️⃣ The 2025 Digital Banking Performance Metrics Report

TL;DR:

Hey everyone — in this edition of Fintech Wrap Up, I’ve dug into five standout reports that paint a pretty detailed picture of where payments and banking are headed in 2025. First up, Mastercard’s take on commercial card acceptance shows just how crucial cards are becoming in B2B payments — not just for convenience, but for improving cash flow, streamlining operations, and even winning over new buyers. Plus, there’s a clear signal: automation and AI are no longer optional — they’re shaping the future of B2B payments.

Speaking of smarter workflows, a deep dive from Edgar, Dunn & Co. breaks down the rise of embedded B2B payments. The space is growing at 25% annually, fueled by everything from e-commerce to real-time FX demand. The message is clear: platforms that want to stay competitive need to embed payments into existing tools, not bolt them on as afterthoughts.

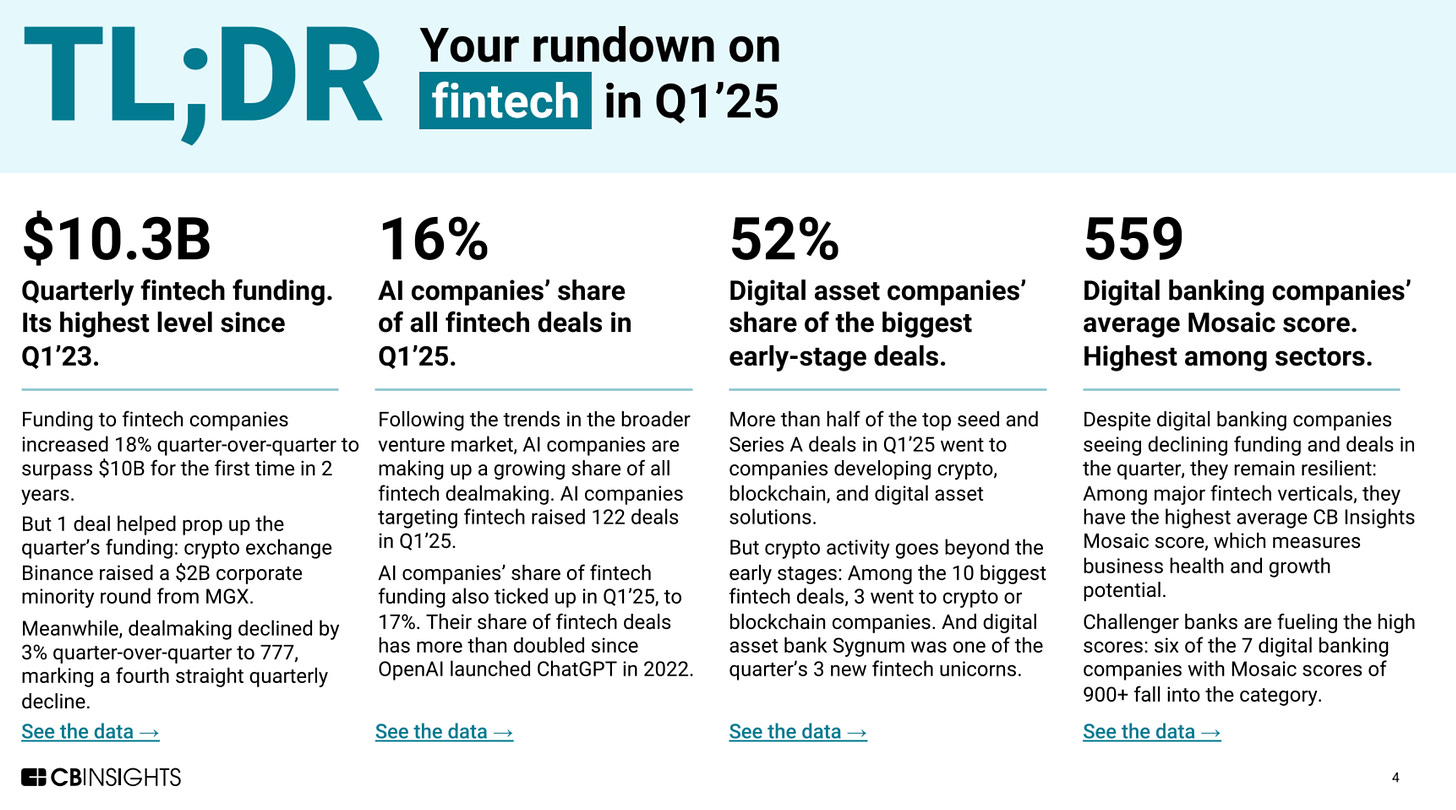

From there, CB Insights’ State of Fintech Q1’25 gave us a mixed bag: funding hit $10B for the first time in 2 years (thanks largely to a $2B Binance deal), but deal volume is still down. That said, AI and crypto are showing strong momentum — AI made up 16% of deals, and crypto is definitely not dead.

Then there’s Deloitte’s sharp summary on payment stablecoins. With over $200B in market cap and growing real-world use cases like remittances and cross-border commerce, stablecoins are becoming more than just a crypto thing. But with great potential comes great risk — from compliance to tech flaws, stablecoin issuers have a lot to get right.

Finally, the Digital Banking Performance Metrics Report from Alkami and Cornerstone shows digital banking is still evolving. Usage is up — 85% of checking accounts are now digital — but digital spending is down, and challenges like fraud, feature adoption, and platform stagnation remain. Interestingly, community banks and credit unions are losing market share not due to onboarding friction, but a lack of compelling product offers.

Catch you in the next one — and as always, feel free to hit reply with your thoughts

Insights

Reports

The state of commercial card acceptance 2025

● B2B payments are growing in volume and complexity

In an increasingly challenging payments landscape, B2B suppliers are managing complex processes alongside multiple priorities and rising payment volumes. Solutions that can successfully streamline complexity in payment ecosystems free B2B suppliers to focus on scaling up their business.

● Cards meet rising buyer demands and needs

Cards can help B2B suppliers more closely align their payment experience with buyers’ needs and expectations. Accepting buyers’ preferred payment methods can help with both strengthening current relationships and attracting new buyers.

● Accepting cards can help optimize payment systems

Addressing tactical pain points, from cash flow to process inefficiencies, cards can help suppliers overcome critical financial challenges. Accepting cards can help B2B suppliers improve working capital by facilitating seamless payment processes and alleviating late payments. This not only saves time and money but also optimizes payment ecosystems to drive growth.

Keep reading with a 7-day free trial

Subscribe to Fintech Wrap Up to keep reading this post and get 7 days of free access to the full post archives.