Embedded Credit Explained; Understanding Value Creation in Financial Services; The Buyer/Supplier Transaction Flow — A Practical Guide

Welcome to the latest edition of Fintech Wrap Up, where we decode the pulse of modern financial innovation.

Daily news on Payments Wrap Up

This week’s reports

Retail Fintech VC in Q2 2025: A Cautious Rebound

1️⃣Europe’s Mobile Payments Race

3️⃣Stablecoins and the B2B Treasury Revolution

4️⃣Blockchains for TradFi: What banks, asset managers, and fintech should know

5️⃣Global fintech funding in H12025 recorded $44.7B with 2216 deals

6️⃣Embedded Credit: The Next Frontier of BaaS

This week’s insights

1️⃣Embedded Credit Explained

2️⃣Stablecoins: It’s about distribution and real-world adoption

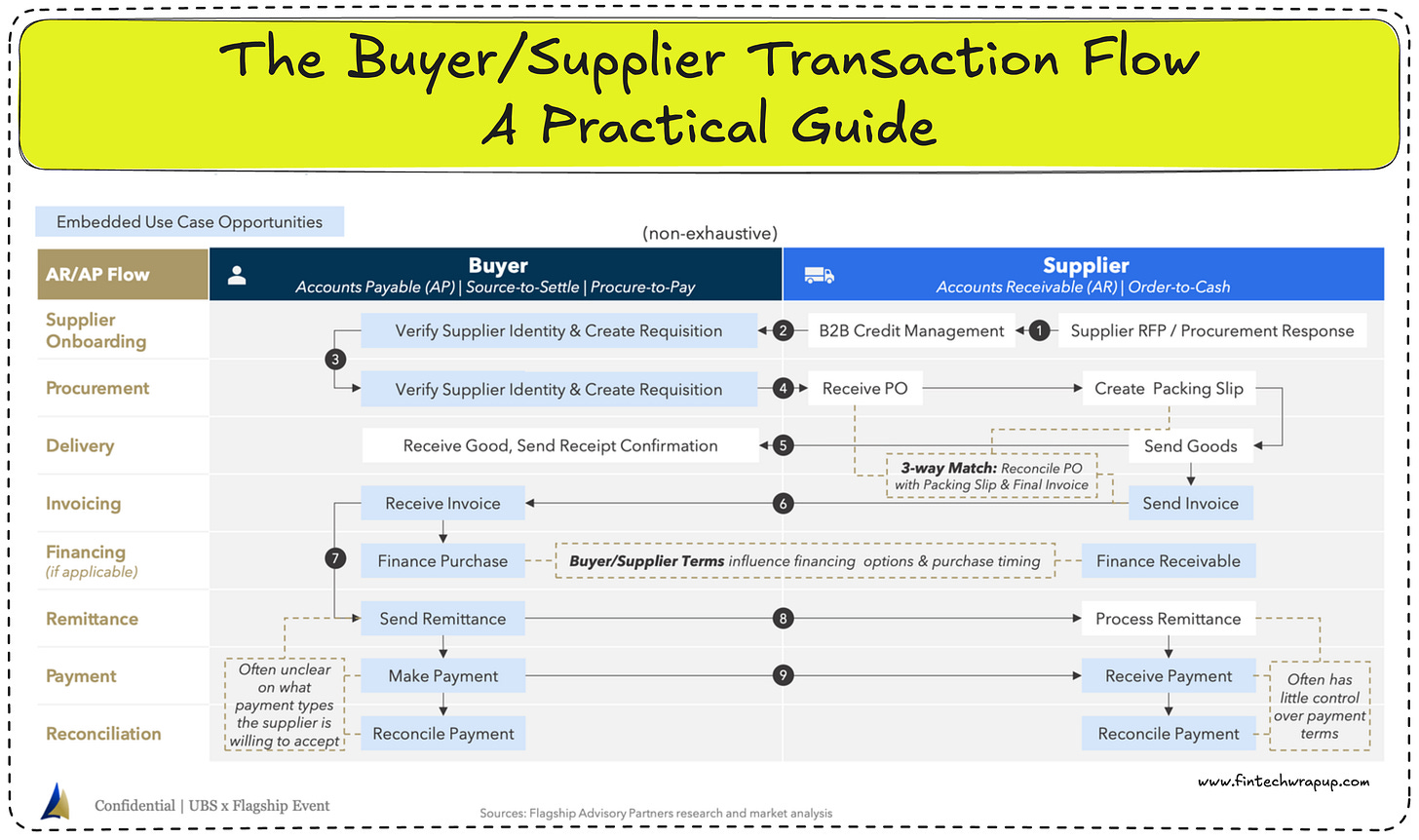

3️⃣The Buyer/Supplier Transaction Flow — A Practical Guide

4️⃣Finance Is Going Autonomous and I am Excited About It

5️⃣Understanding Value Creation in Financial Services

6️⃣What’s the Difference in Token Formats—and Why It Matters for Your Payment Strategy by IXOPAY

7️⃣Inside Arc: Circle’s Purpose-Built L1 Architecture for Stablecoin Finance

Programmable Payments Are Here: Building With Coinbase’s Commerce Protocol

Coinbase and Shopify have teamed up to launch the Commerce Payments Protocol, an open onchain payments standard designed for real-world commerce. Announced in mid-2025, this protocol brings sophisticated multi-step payment flows (think escrow, authorizations, captures, refunds) onto the blockchain, while preserving crypto’s core benefits of speed, low cost, and global reach. In plain terms, it bridges the promise of crypto with the nitty-gritty realities of everyday commerce. The protocol is live on Coinbase’s Base network and open-source for all developers. It’s already powering Shopify’s new USDC payment option, rolling out to millions of Shopify merchants worldwide who can now seamlessly accept stablecoin payments on Base. This marks one of the first large-scale rollouts of crypto payments in mainstream online retail – without users needing to wrestle with volatility or clunky crypto addresses.

So what exactly is this Commerce Payments Protocol? At its core, it’s a set of smart contracts and APIs that replicate the “authorize, then capture” dance of traditional payment networks, but onchain. Coinbase Commerce (Coinbase’s merchant payments arm) has rebuilt its checkout on top of this protocol, making onchain payments more plug-and-play. The protocol is open-source, so any payment provider or platform can integrate it or even run their own instance. (Yes, Coinbase wants this to be a standard, not just their proprietary sauce.) By leveraging Base – Coinbase’s Ethereum L2 – the protocol promises near-instant settlement (we’re talking sub-second, ~200ms in optimal cases) with transaction fees around a penny. And because it’s crypto, it works 24/7, across borders, no bank middlemen required. In short, Coinbase and Shopify just opened the door for stablecoins (like USDC) to move from crypto niche to everyday e-commerce.

Embedded Credit Explained

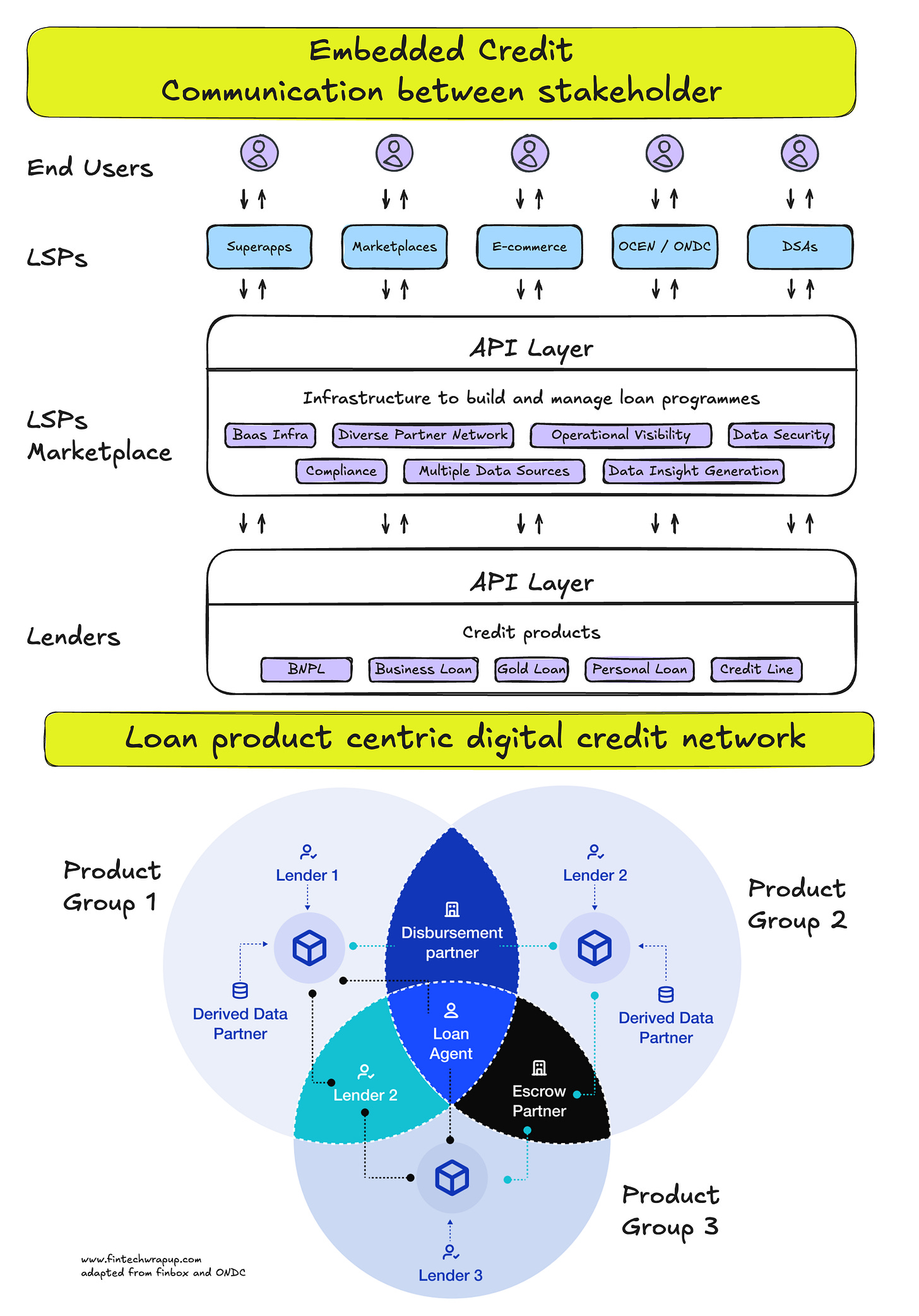

As the ecosystem matures, it is transitioning towards a borrower-first, product-centric network. In this model, borrower needs take centre stage, and credit products are designed to address specific pain points such as flexibility, accessibility, or affordability.

At the heart of this dynamic are Loan Service Providers (LSPs) — customer-facing digital platforms that translate borrower needs into tailored financial solutions, acting as master architects of seamless borrower journeys. LSPs serve as intermediaries between regulated lenders (banks, NBFCs) and borrowers, facilitating loan origination, underwriting, and servicing without extending credit themselves. This includes marketplaces, superapps, DSA aggregators, and fintech platforms that connect borrowers with lenders.

Fig 2: Illustrative view of communication between each stakeholder in embedded credit.

Supporting this dynamic are the lenders (banks and NBFCs) — the foundation upon which the ecosystem is built. They bring the financial infrastructure that sustains and scales embedded credit solutions.

To enable seamless partnerships between LSPs and lenders, however, a technology-driven middle layer is required — one that solves for discovery while facilitating seamless collaboration between banks and digital platforms, hereinafter referred to as the LSP Marketplace.

Keep reading with a 7-day free trial

Subscribe to Fintech Wrap Up to keep reading this post and get 7 days of free access to the full post archives.