Coinbase's Strategy Map; BaaS vs Embedded Payments: A Critical Distinction; How Citi Covers the Entire Payment Lifecyle

NEW YEAR SPECIAL

For today only, I’m offering 25% off the Fintech Wrap Up annual plan, forever.

No trial tricks. No “first year only” fine print. You lock in the lower price for life.

If you read Fintech Wrap Up for clear insights on payments, banking, AI, crypto, and where fintech is actually heading, today’s the day.

This disappears in 24 hours.

Video of the Week

Deep Dive of the Week

How Bank of America Built a $40B Consumer Banking Machine

Bank of America’s consumer banking division is a massive, integrated machine that produces over $41 billion in annual revenue and $10.8 billion in net profit as of 2024, accounting for roughly 37% of the bank’s revenue. This operation spans everything from basic checking accounts and credit cards to digital platforms and wealth management tie-ins. What follows is a first-principles breakdown of how BofA’s consumer banking model works end-to-end, from gathering deposits and making loans to the technology stack, loyalty mechanics, and distribution strategy that bind it all together. We’ll also compare Bank of America’s approach to peers like JPMorgan Chase and Citibank, and tease out hidden fragilities and lessons for fintech operators and banking strategists.

This week’s reports

𝐇𝐨𝐰 𝐀𝐠𝐞𝐧𝐭𝐢𝐜 𝐀𝐈 𝐀𝐜𝐭𝐮𝐚𝐥𝐥𝐲 𝐖𝐨𝐫𝐤𝐬 𝐈𝐧𝐬𝐢𝐝𝐞 𝐁𝐚𝐧𝐤𝐬 𝐚𝐧𝐝 𝐅𝐢𝐧𝐭𝐞𝐜𝐡𝐬

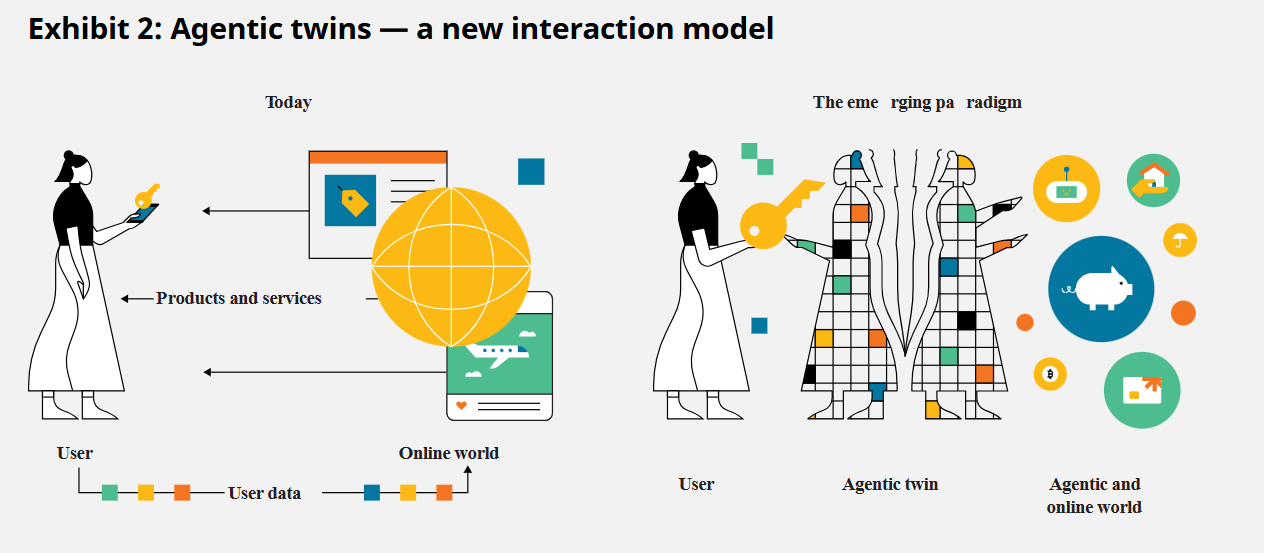

1️⃣𝐇𝐨𝐰 𝐀𝐠𝐞𝐧𝐭𝐢𝐜 𝐀𝐈 𝐀𝐜𝐭𝐮𝐚𝐥𝐥𝐲 𝐖𝐨𝐫𝐤𝐬 𝐈𝐧𝐬𝐢𝐝𝐞 𝐁𝐚𝐧𝐤𝐬 𝐚𝐧𝐝 𝐅𝐢𝐧𝐭𝐞𝐜𝐡𝐬

2️⃣𝐔𝐧𝐝𝐞𝐫𝐬𝐭𝐚𝐧𝐝𝐢𝐧𝐠 𝐇𝐨𝐰 𝐀𝐈 𝐈𝐬 𝐑𝐞𝐝𝐞𝐟𝐢𝐧𝐢𝐧𝐠 𝐑𝐢𝐬𝐤 𝐢𝐧 𝐆𝐥𝐨𝐛𝐚𝐥 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬

3️⃣𝐄𝐦𝐛𝐞𝐝𝐝𝐞𝐝 𝐟𝐢𝐧𝐚𝐧𝐜𝐞 𝐡𝐚𝐬 𝐨𝐟𝐟𝐢𝐜𝐢𝐚𝐥𝐥𝐲 𝐠𝐫𝐨𝐰𝐧 𝐮𝐩

4️⃣𝐆𝐥𝐨𝐛𝐚𝐥 𝐂𝐫𝐲𝐩𝐭𝐨 𝐓𝐚𝐱 𝐑𝐞𝐩𝐨𝐫𝐭 𝟐𝟎𝟐𝟓

5️⃣𝐁𝐫𝐞𝐚𝐤𝐢𝐧𝐠 𝐃𝐨𝐰𝐧 𝐂𝐨𝐫𝐞 𝐁𝐚𝐧𝐤𝐢𝐧𝐠 𝐌𝐨𝐝𝐞𝐫𝐧𝐢𝐳𝐚𝐭𝐢𝐨𝐧

6️⃣𝐔𝐧𝐝𝐞𝐫𝐬𝐭𝐚𝐧𝐝𝐢𝐧𝐠 𝐀𝐠𝐞𝐧𝐭𝐢𝐜 𝐂𝐨𝐦𝐦𝐞𝐫𝐜𝐞 𝐈𝐧𝐟𝐫𝐚𝐬𝐭𝐫𝐮𝐜𝐭𝐮𝐫𝐞 𝐟𝐨𝐫 𝐌𝐞𝐫𝐜𝐡𝐚𝐧𝐭𝐬

7️⃣𝐈𝐦𝐩𝐥𝐢𝐜𝐚𝐭𝐢𝐨𝐧𝐬 𝐨𝐟 𝐁𝐚𝐧𝐤 𝐂𝐡𝐚𝐫𝐭𝐞𝐫 𝐟𝐨𝐫 𝐅𝐢𝐧𝐭𝐞𝐜𝐡𝐬 𝐚𝐧𝐝 𝐁𝐚𝐧𝐤𝐬

This week’s insights

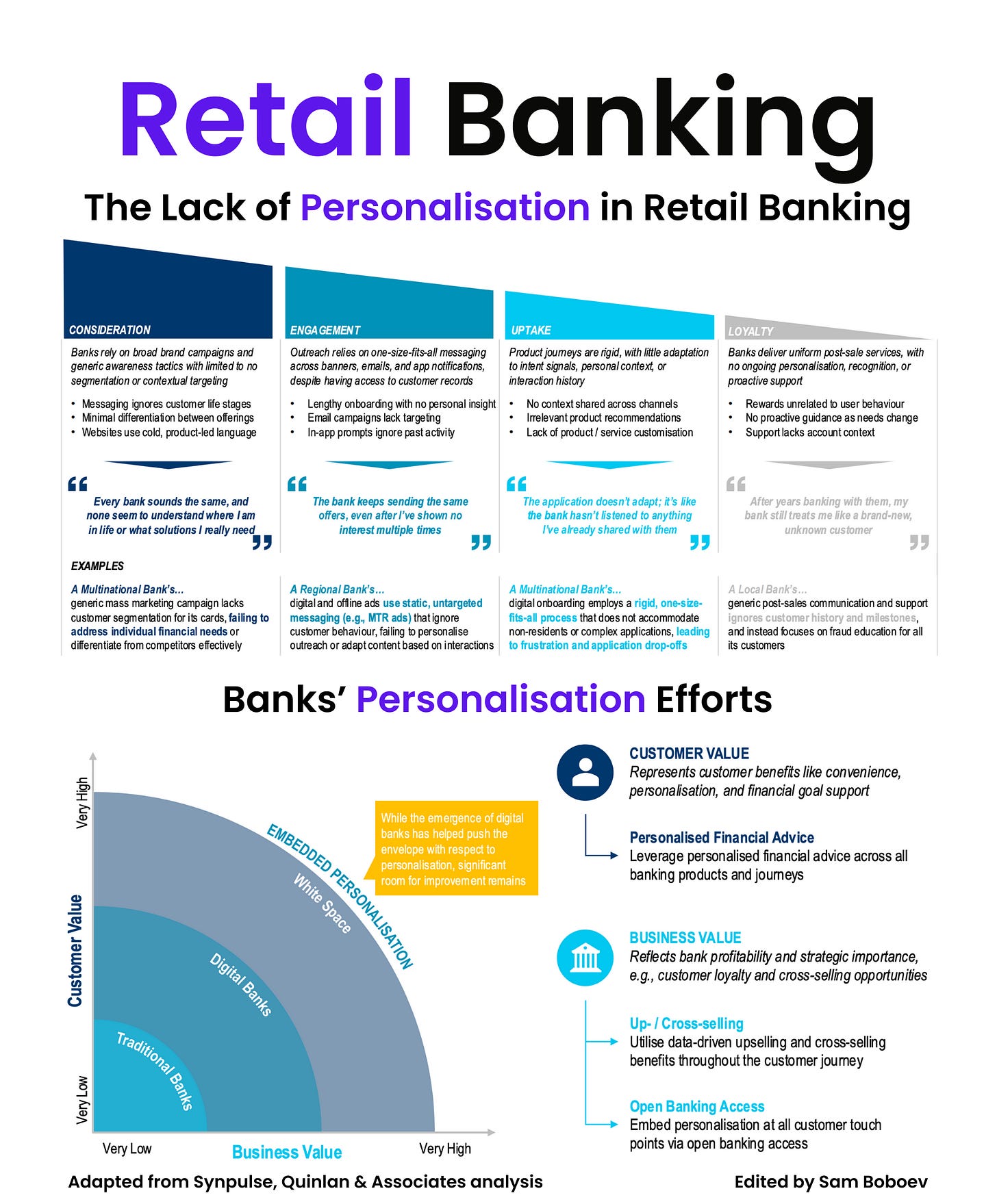

1️⃣𝐔𝐧𝐝𝐞𝐫𝐬𝐭𝐚𝐧𝐝𝐢𝐧𝐠 𝐓𝐡𝐞 𝐋𝐚𝐜𝐤 𝐨𝐟 𝐏𝐞𝐫𝐬𝐨𝐧𝐚𝐥𝐢𝐬𝐚𝐭𝐢𝐨𝐧 𝐢𝐧 𝐑𝐞𝐭𝐚𝐢𝐥 𝐁𝐚𝐧𝐤𝐢𝐧𝐠

2️⃣𝐇𝐨𝐰 𝐂𝐢𝐭𝐢 𝐂𝐨𝐯𝐞𝐫𝐬 𝐭𝐡𝐞 𝐄𝐧𝐭𝐢𝐫𝐞 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐋𝐢𝐟𝐞𝐜𝐲𝐜𝐥𝐞

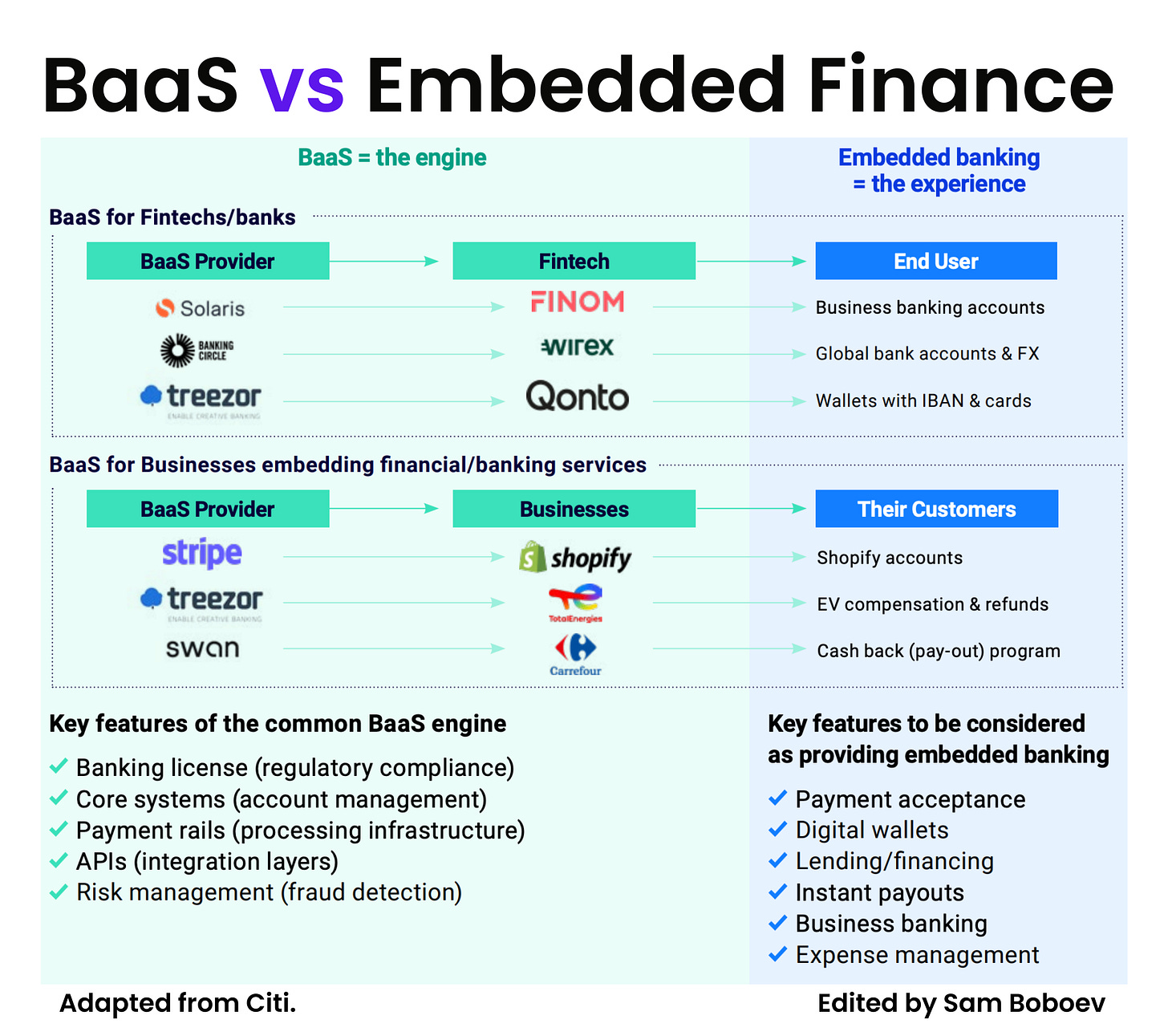

3️⃣𝐁𝐚𝐚𝐒 𝐯𝐬 𝐄𝐦𝐛𝐞𝐝𝐝𝐞𝐝 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬: 𝐀 𝐂𝐫𝐢𝐭𝐢𝐜𝐚𝐥 𝐃𝐢𝐬𝐭𝐢𝐧𝐜𝐭𝐢𝐨𝐧

4️⃣𝐋𝐨𝐧𝐠 𝐓𝐞𝐫𝐦 𝐏𝐞𝐫𝐬𝐨𝐧𝐚𝐥 𝐂𝐫𝐲𝐩𝐭𝐨 𝐓𝐚𝐱 𝐑𝐚𝐭𝐞𝐬 𝟐𝟎𝟐𝟓

5️⃣𝐂𝐨𝐢𝐧𝐛𝐚𝐬𝐞’𝐬 𝐒𝐭𝐫𝐚𝐭𝐞𝐠𝐲 𝐌𝐚𝐩

6️⃣𝐁𝐮𝐢𝐥𝐝𝐢𝐧𝐠 𝐁𝐥𝐨𝐜𝐤𝐬 𝐨𝐟 𝐀𝐠𝐞𝐧𝐭𝐢𝐜 𝐂𝐨𝐦𝐦𝐞𝐫𝐜𝐞 𝐟𝐨𝐫 𝐌𝐞𝐫𝐜𝐡𝐚𝐧𝐭𝐬

7️⃣𝐄𝐱𝐩𝐥𝐚𝐢𝐧𝐢𝐧𝐠 𝐀 𝐍𝐞𝐰 𝐁𝐮𝐬𝐢𝐧𝐞𝐬𝐬 𝐌𝐨𝐝𝐞𝐥 𝐅𝐫𝐚𝐦𝐞𝐰𝐨𝐫𝐤 𝐟𝐨𝐫 𝐌𝐒𝐌𝐄 𝐁𝐚𝐧𝐤𝐢𝐧𝐠 𝐢𝐧 𝐀𝐟𝐫𝐢𝐜𝐚

𝐔𝐧𝐝𝐞𝐫𝐬𝐭𝐚𝐧𝐝𝐢𝐧𝐠 𝐓𝐡𝐞 𝐋𝐚𝐜𝐤 𝐨𝐟 𝐏𝐞𝐫𝐬𝐨𝐧𝐚𝐥𝐢𝐬𝐚𝐭𝐢𝐨𝐧 𝐢𝐧 𝐑𝐞𝐭𝐚𝐢𝐥 𝐁𝐚𝐧𝐤𝐢𝐧𝐠

Most banks think they are doing personalisation. Customers strongly disagree.

I have been digging into recent research from Quinlan & Associates and Synpulse, and the data makes one thing very clear. The personalisation is measurable, widening, and expensive.

✅ Start with expectations.

Around 74 percent of retail banking customers say personalisation is important or critical to their banking experience. Yet only 44 percent say they have actually experienced any form of personalised service. And even among those, 52 percent say they were not satisfied with what they received.

That means more than 70 percent of customers who care about personalisation either never experienced it or were disappointed when they did.

✅ This is not because banks lack data.

Most banks already hold years of transaction history, life-stage signals, product usage data, and behavioural patterns. Despite that, customer journeys are still largely generic. Marketing campaigns remain broad. Emails and push notifications ignore past behaviour. Product onboarding is rigid. Post-sale engagement barely changes whether someone has been a customer for six months or six years.

The result is that every bank sounds the same and treats customers the same, regardless of context.

Digital banks have made progress, but even there, the ceiling is low. Many offer surface-level personalisation like tailored dashboards or basic insights. Truly embedded personalisation, where products, pricing, advice, and support dynamically adapt to the customer’s situation, is still rare.

And the consequences show up in loyalty.

Keep reading with a 7-day free trial

Subscribe to Fintech Wrap Up to keep reading this post and get 7 days of free access to the full post archives.