AI and Vertical Fintech Strategies; The B2B Embedded Payments Value Chain; Open Banking’s Reality Check;

Welcome to this week’s Fintech Wrap Up—a quick dive into the rise of vertical fintech, AI agents in enterprise workflows, and why payments are now a strategic growth lever.

Insights & Reports:

1️⃣ AI and Vertical Fintech Strategies

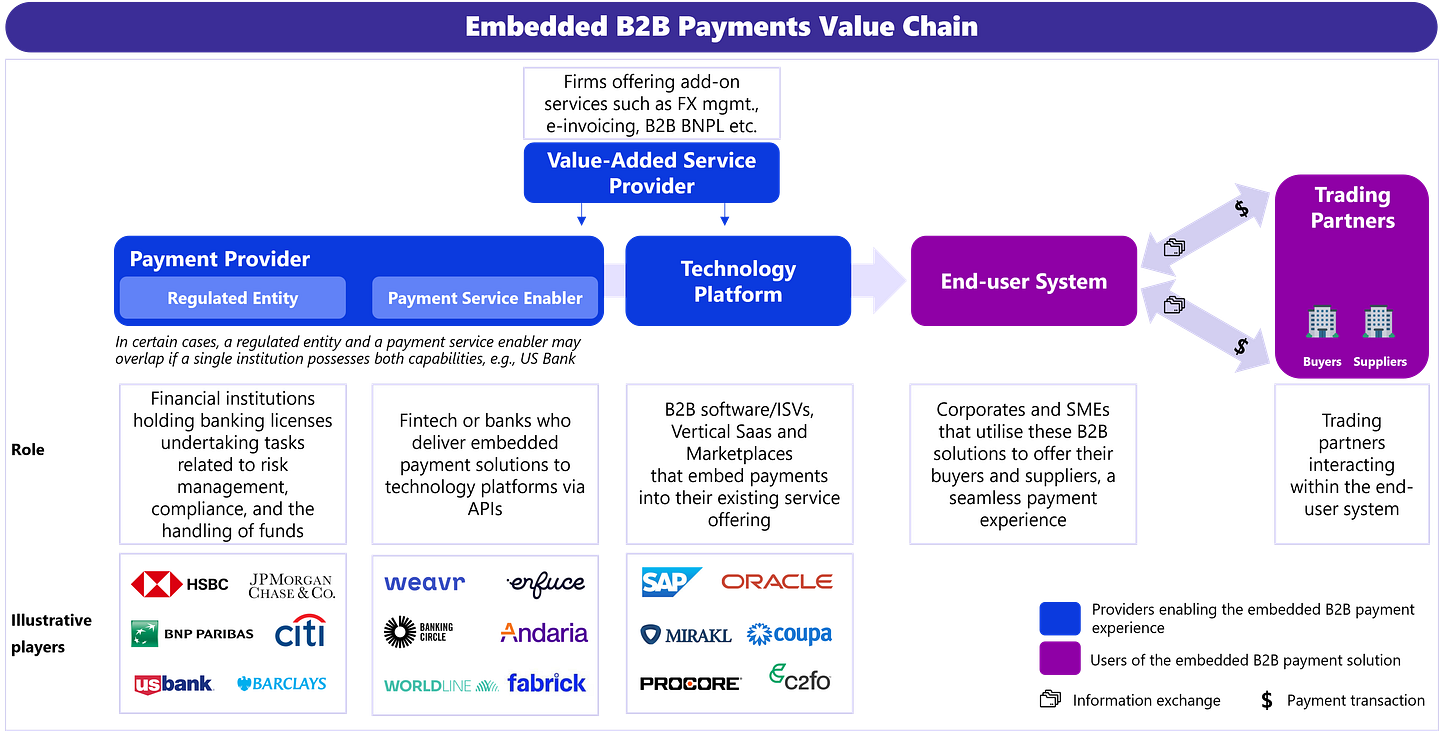

2️⃣ The B2B Embedded Payments Value Chain

3️⃣ Asset Tokenization – Current State of Play

4️⃣ Chime's Vertically-Integrated Tech Platform

5️⃣ Payments as Strategic Advantage

6️⃣ Open Banking’s Reality Check

7️⃣ AI Agents: A to Z

8️⃣ European Commission Looking Into Visa and Mastercard Fees

9️⃣ Revolut reportedly partners with European payment wallet Wero

TL;DR:

Welcome to this week’s edition of Fintech Wrap Up!

Let’s talk vertical fintech. We’re seeing an exciting shift where companies like Toast, Cedar, and Aufinity are doing more than offering financial features—they’re becoming the financial backbone for entire industries. Thanks to AI and a much more accessible fintech infrastructure, startups are now embedding credit, payments, and insurance right into niche workflows—construction, healthcare, travel, you name it. These players start by solving one industry-specific problem, then expand into full-blown platforms. It’s not just smart—it’s sticky.

On the AI front, we’re entering the era of intelligent agents. These aren’t just chatbots—they observe, plan, and act independently across enterprise systems. Whether you’re using prompt chains for predictable workflows or letting agents operate autonomously, this tech is getting seriously powerful. We’re talking real-time data awareness, decision-making, error correction, and multi-step planning. It’s early days, but the potential to automate entire financial and operational functions is real.

Let’s not forget payments. More businesses now treat payments as a core strategic lever, not just a backend function. The average merchant is working with four processors to maximize reach, optimize routing, and serve local payment methods. But complexity has skyrocketed—so orchestration platforms are stepping in to simplify things. Whether you go full orchestration or piece together your own setup, the takeaway is simple: the right payment strategy can unlock real growth.

Asset tokenization is also quietly gaining traction. Sure, it’s only $30B today, but the potential is huge—possibly $16T by 2030. Projects in tokenized money market funds and on-chain lending are already live, and the benefits are hard to ignore: fractional ownership, automated transactions, real-time transparency, and better access for investors. We’re still in the early innings, but the foundation is being laid for a much more open, efficient financial system.

Over at Chime, their decision to build everything in-house is really paying off. Their platform—fully cloud-native, with proprietary processing and real-time data engines—lets them move fast, stay lean, and serve millions without the drag of third-party limitations. Support is increasingly automated, costs are dropping, and user satisfaction is climbing. It’s a great case study in why owning your infrastructure can be a game-changer.

And lastly, a quick reality check on Open Banking. While the vision remains strong—better access, more innovation, broader inclusion—adoption is lagging. There are too many fragmented APIs, limited business incentives, and not enough consumer awareness. Still, with bright spots like the UK’s Variable Recurring Payments and growing regulatory momentum in places like the UAE and Australia, the future looks promising if we can clear some hurdles.

Quick headlines to close: the European Commission is probing Visa and Mastercard over fees. Revolut is quietly integrating with Wero, the new EU payment wallet. And Worldpay is going live with stablecoin payouts through BVNK, unlocking crypto-style settlement across 180+ markets.

That’s it for now. Thanks for reading Fintech Wrap Up—as always, stay curious and keep building

Reports

Insights

How JPMorgan Is Reengineering Banking at Scale

In a global financial landscape defined by volatility and uncertainty, JPMorgan Chase is aggressively evolving to stay on top. Speaking at the bank’s 2025 Investor Day, CEO Jamie Dimon cautioned that “geopolitical risk is very, very, very high” – higher than many market participants may assume – and warned that a worst-case stagflation scenario is “probably two times” more likely than commonly thought. Persistent inflation, rising interest rates, and conflict-driven geopolitical tensions all form a turbulent backdrop. Yet JPMorgan’s leadership exuded confidence that the firm can thrive through turbulence. Management stressed the strength of the bank’s guiding principles – a “fortress” balance sheet, disciplined risk management, and long-term focus – as the foundation for navigating “a range of economic scenarios”. In Dimon’s words, even if conditions deteriorate sharply, “we will be fine”.

The firm is doubling down on customer-centric innovation while fiercely maintaining its traditional strengths in capital and control. Executives detailed how JPMorgan is leveraging its scale and diverse franchises to deliver growth through-the-cycle, harnessing new technologies like AI to drive efficiency and client experience, and engaging constructively – and at times contentiously – with an evolving regulatory regime. The message is clear: in today’s unpredictable environment, JPMorgan intends not just to preserve its leading position, but to extend its competitive edge. What follows is an in-depth look at the bank’s strategic context, business performance, product and platform development, technology investments, regulatory stance, capital strategy, and financial outlook as presented in May 2025.

AI and Vertical Fintech Strategies

The vertical software market has seen a remarkable run in recent years. Leaders like Toast, Shopify, and ServiceTitan have evolved into full-stack operating systems, showcasing the power of a multi-product vertical strategy. This approach drives deeper market penetration, stronger growth efficiency, and higher net retention compared to horizontal peers.

Several tailwinds are accelerating verticalization. User expectations around UX are rising, and horizontal solutions can’t address every edge case. Meanwhile, AI is slashing build costs and enabling automation of complex tasks, allowing vendors to tap into vast service revenue pools—not just software budgets. As a result, industries once deemed too niche for venture-scale returns are becoming attractive opportunities.

This trend is especially promising in fintech. The infrastructure stack has matured, making it easier and cheaper to embed financial services. Yet many sectors remain underserved at the core product level—accounts, payments, loans, and insurance. A small construction business, for example, needs a credit solution tailored to its cyclical cash flow and complex supply chains, not a one-size-fits-all loan.

Vertically tailored financial products—especially in credit and insurance—are increasingly essential. Ferovinum addresses this in the UK wine and spirits industry by enabling inventory-backed financing. In travel, standard corporate cards don't fit high-value, high-risk transactions. Non-profits require payment flows that support unique governance and tax structures.

Keep reading with a 7-day free trial

Subscribe to Fintech Wrap Up to keep reading this post and get 7 days of free access to the full post archives.