Reports: The Corporate Case for Open Banking; Agentic AI in Financial Services - Case Studies; Crypto Wallets 2025;

Welcome to the latest Reports edition of the Fintech Wrap Up — where we’ve collected the latest fintech reports from the past week. You can download all the full reports linked below.

Insights & Reports:

1️⃣ The Corporate Case for Open Banking

2️⃣ How to set up a challenger bank

3️⃣ Embedded Payments (2025)

4️⃣ Agentic AI in Financial Services - Case Studies

5️⃣ Trust in the digital economy 2025

6️⃣ Crypto Wallets 2025

7️⃣ What does OakNorth aim to become in 2025 and beyond?

TL;DR:

Welcome to the latest Reports edition of the Fintech Wrap Up — where we’ve collected the latest fintech reports from the past week. You can download all the full reports linked below.

This week, open banking takes center stage as treasury teams ditch outdated SWIFT messages for real-time APIs. Citi’s report highlights how open banking enables faster, smarter liquidity management with unified account views and instant data. With API aggregators and TMS integration, treasurers are gaining powerful tools to optimize intraday payments, minimize idle funds, and prepare for AI-driven financial decision-making.

Meanwhile, challenger banks face a new playbook. Arthur D. Little outlines four pillars for success: precise customer segmentation, hybrid digital-physical distribution, product innovation, and modular tech stacks. New banks must now go beyond core financial services—offering advisory, trade support, and digital tools to deepen customer loyalty, particularly in SME and global trade sectors.

Embedded payments continue to reshape software monetization. According to JP Morgan, SaaS platforms that integrate full PayFac models see higher revenue potential, improved customer retention, and stronger LTV:CAC ratios—rising from 1.0x to 3.6x. As cash usage shrinks and ACH and card payments dominate, embedded finance is becoming a strategic growth lever for platforms serving restaurants, HR/payroll, and bill pay verticals.

On the innovation front, Agentic AI is redefining financial services. IBM’s case studies reveal how AI agents are boosting personalization, compliance, operational efficiency, and even code deployment. From fraud detection to automated contract review, AI is becoming integral across the financial services value chain—streamlining workflows while improving customer and regulatory outcomes.

Trust in digital commerce is under pressure. Checkout.com’s report reveals how trust now flows through ratings, reviews, and smooth payment experiences. With consumers wary of data misuse and scams, brands must prioritize performance at checkout—ensuring transactions are secure, fast, and frictionless. Trust is no longer earned over time—it’s lost in seconds.

In crypto, wallets are evolving into superapps. Dune’s research shows that smart wallets, powered by innovations like account abstraction and embedded onboarding, are leading a UX revolution. With Base and Safe dominating smart wallet activity, and tools like Privy enabling login in under 200ms, wallets are becoming the central access point to the onchain world—especially in high-growth emerging markets.

Finally, OakNorth outlines its 2025 vision: becoming the leading bank for scaling businesses in the UK and US. With £214.8M in annual profit, a 17% ROE, and strong deposit growth, the bank is doubling down on tech, sustainability, and underserved segments. It’s now targeting the $4.2T US lower mid-market, expanding its product suite beyond lending to include business banking, debit cards, and payments.

Until next time—download the reports, dig in, and stay ahead of the curve.

Insights

Reports

The Corporate Case for Open Banking

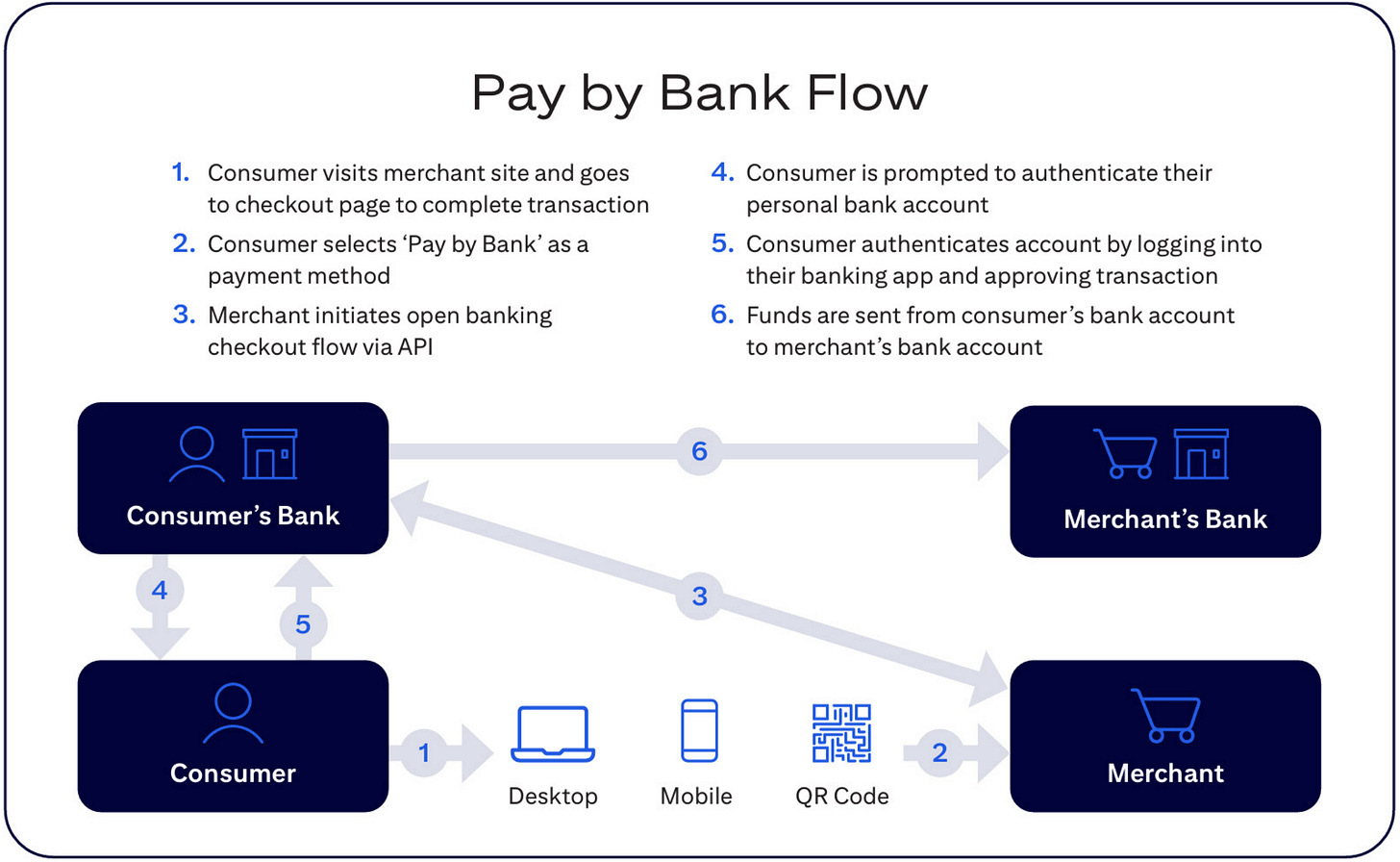

Open banking empowers corporate treasury teams to operate with real-time data, enabling quicker access to information and more efficient processes.

With shorter distribution cycles and rising digital commerce adoption, liquidity management faces growing challenges. Less predictable cash flows hinder accurate forecasting. Real-time reporting and open banking APIs allow treasury teams to respond efficiently in today’s 24/7 global business environment.

👉 Open Banking and Real-Time Treasury

Large multinational corporations must manage counterparty risk, local collections, and payroll across global accounts and banks. Traditionally, treasurers rely on Swift to receive account data, but the speed and quality of information vary across banks. In many cases, by the time Swift messages are received, the data is already outdated—hindering effective forecasting and investment decisions.

To get real-time data, treasury teams often log into each bank’s digital portal. For large enterprises, this is an administrative burden and poses cybersecurity risks. Open banking solves this with balance inquiry APIs, offering a real-time, consolidated view of accounts across countries. API aggregators connect directly with local banks and plug into TMS platforms, delivering consistent information, enabling efficient decisions, and improving liquidity mobilization.

Open banking APIs also reduce dependency on traditional payment rails. They support fund movements, credit/debit alerts, and payment initiation, streamlining operations.

👉 Enhancing Liquidity Management

Optimizing liquidity means ensuring funds are available to meet obligations while maximizing returns. For companies with decentralized accounts, covering intraday payments often involves manual, inefficient transfers. Swift-based processes are too slow to keep up with real-time demands, leading to idle funds that could be better invested.

Keep reading with a 7-day free trial

Subscribe to Fintech Wrap Up to keep reading this post and get 7 days of free access to the full post archives.