Zelle®: What, Why and How; B2B Payments: Trends, Challenges, and Opportunities; Fintech in Africa is still expanding, but the landscape has changed;

Here’s this week’s edition of Fintech Wrap Up, packed with insights on B2B payments, AI-driven digital wallets, banking performance, and the evolving fintech landscape.

Insights & Reports:

1️⃣ B2B Payments: Trends, Challenges, and Opportunities

2️⃣ Digital Wallet Purchasing Agents Could Become Central To The Shopping Journey

3️⃣ Q4 FY24: JPMorgan Chase vs Bank of America (BofA)

4️⃣ Global Card Scheme Performance FY 2024

5️⃣ Zelle®: What, Why and How

6️⃣ Fintech in Africa is still expanding, but the landscape has changed

7️⃣ Deposits: The top profitability lever for retail banks’ CEOs

8️⃣ The Evolution of PayFacs and PFaaS

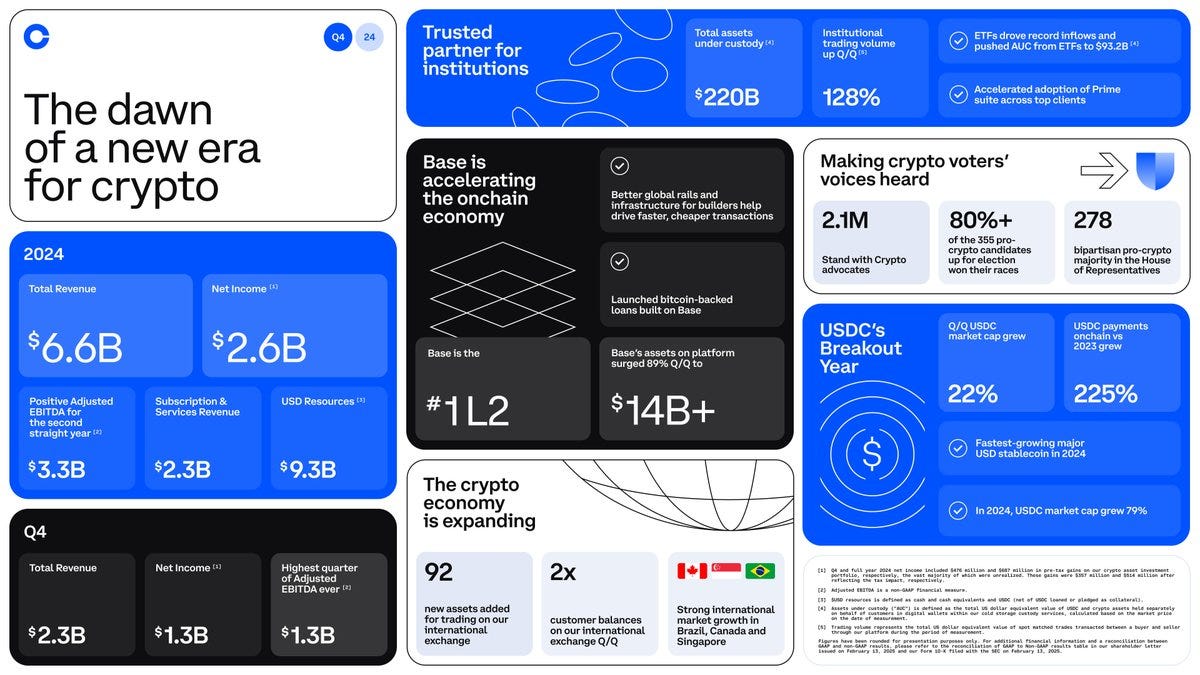

9️⃣ Coinbase Q4 2024 revenue beats forecast by 23% reaching $2.3 billion

TL;DR:

Here’s this week’s edition of Fintech Wrap Up, packed with insights on B2B payments, AI-driven digital wallets, banking performance, and the evolving fintech landscape.

B2B payments are making a comeback, with strategic investors and fintechs eyeing the massive $220 trillion market. While ACH remains dominant, real-time payments (RTP) and stablecoins are gaining traction, promising speed and efficiency. No single method rules them all, so businesses must strategically balance cost, speed, and supplier acceptance. Meanwhile, digital wallets are gearing up for an AI-driven transformation—ARK Invest predicts that AI-powered purchasing agents could drive 72% of all e-commerce transactions by 2030, making digital wallets central to the shopping journey.

On the banking front, JPMorgan Chase and Bank of America both reported strong Q4 results, with record-breaking profits, surging investment banking fees, and renewed confidence in net interest income growth. Meanwhile, Visa and Mastercard continue to lead the card scheme race, but cross-border growth is slowing, and both are doubling down on fraud prevention and strategic partnerships. Speaking of payments, Zelle® is proving its worth in insurance claims, gig economy payouts, and airline compensation, providing instant and seamless transactions with just an email or phone number.

In Africa, fintech is still expanding, but the funding environment is shifting. While the sector has seen explosive growth, challenges like talent shortages and regulatory hurdles remain. Still, with mobile money adoption at an all-time high, the continent’s fintech market is expected to reach $312 billion by 2028. Meanwhile, bank deposits are back in focus as banks navigate shifting consumer expectations and increasing competition, with strategies around term deposit renewals and non-interest-bearing accounts playing a crucial role.

And in curated news, Sequoia Capital is in talks to lead a funding round for Mercury at a $3 billion+ valuation, Coinbase smashed Q4 revenue forecasts with a 23% beat, and stablecoin firm Plasma raised $20 million in Series A funding.

That’s a wrap for this week! What caught your attention? Hit reply and let’s discuss.

Insights

B2B Payments: Trends, Challenges, and Opportunities

Great insights by Erin McCune

B2B payments are heating up again, attracting interest from strategic investors, private equity firms, and fintechs looking to monetize payments. While adoption is slow, momentum is growing as businesses seek efficient, scalable, and strategic payment solutions.

🔹 The Scale of B2B Payments

🌍 Global B2B payment flows exceed $220 trillion, covering supplier payments, payroll, and government transactions. Supplier payments alone make up $130-140 trillion. However, if capital markets, FDI, and treasury flows are included, wholesale payment flows exceed $1,200 trillion.

🔹 Dominant Payment Methods

✅ Most B2B transactions rely on bank transfers (ACH in the U.S. and local equivalents globally). Large strategic payments often use wires, while legacy checks and cash still persist in markets where real-time payments (RTP) are not widely available or have low transaction limits.

Keep reading with a 7-day free trial

Subscribe to Fintech Wrap Up to keep reading this post and get 7 days of free access to the full post archives.