When AI Agents Start Buying for You — The Next Frontier in Commerce; Understanding the BaaS Service Offering; Blockchain-Enabled Identity in Financial Services

Welcome to the latest edition of Fintech Wrap Up, where we decode the pulse of modern financial innovation.

Insights & Reports:

1️⃣What Shopify’s AI Storefront Updates Mean for Commerce and Payments

2️⃣ Renegotiating the Social Contract Between Banks and Society

3️⃣Blockchain-Enabled Identity in Financial Services

4️⃣Understanding the BaaS Service Offering

5️⃣Case Study – Shared Ledger and Tokenised Bank Liabilities

6️⃣Where Financial Services Are Really Putting GenAI to Work

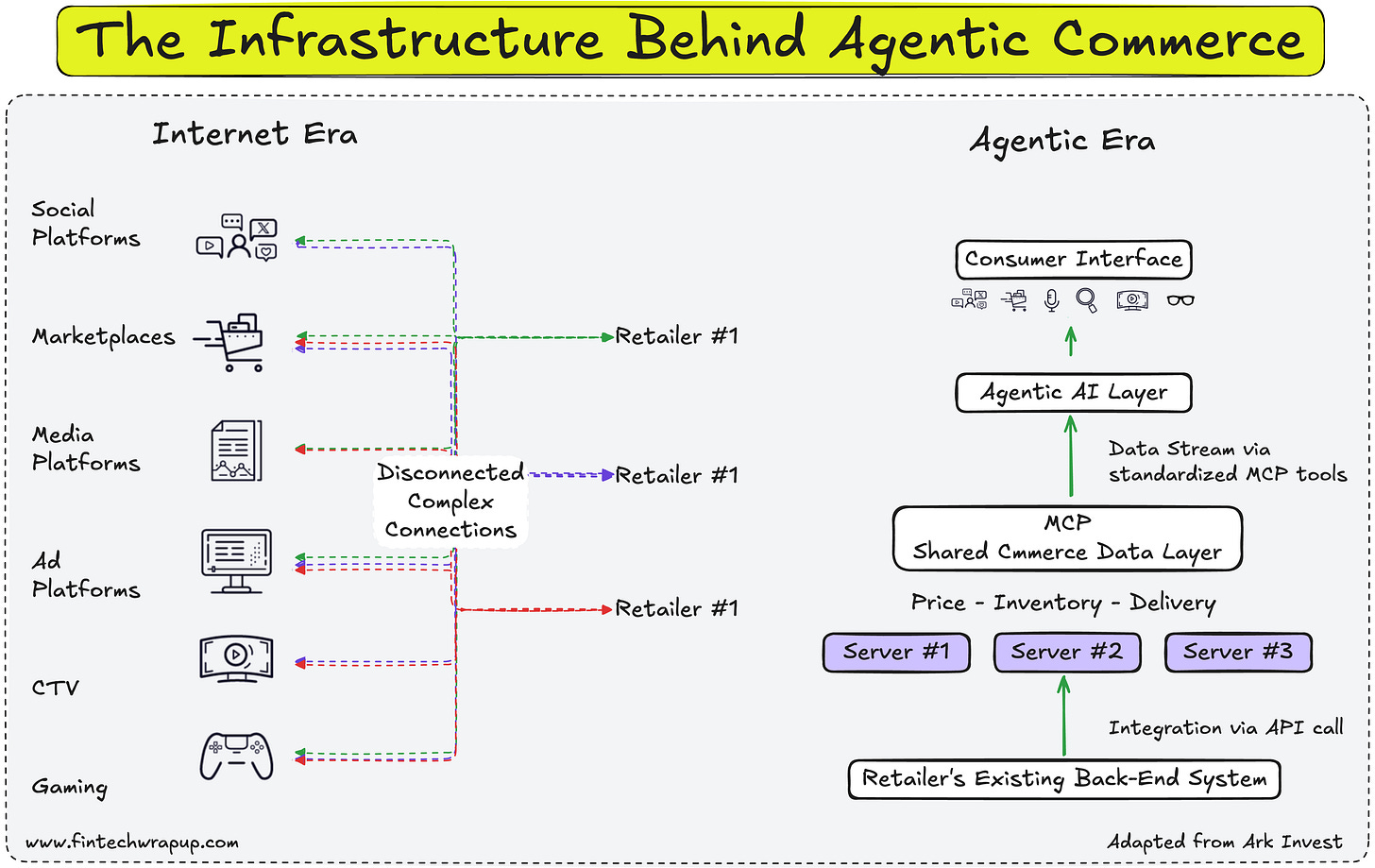

7️⃣The Infrastructure Behind Agentic Commerce

8️⃣When AI Agents Start Buying for You — The Next Frontier in Commerce

9️⃣Booking.com Launches Credit Card: Up to 6% Back in Travel Credit

TL;DR:

Welcome to the latest edition of the Fintech Wrap Up — where we cut through the buzzwords and get to the real shifts shaping money and tech.

What happened? Shopify is going all-in on AI storefronts, rolling out Model Context Protocol (MCP) so conversational agents can query live product data and handle transactions. Banks are grappling with an outdated “social contract” as profitability dips, fintech rivals surge, and regulation trails innovation. Blockchain-enabled identity is moving from theory to practice, and modular Banking-as-a-Service stacks are making it possible to spin up financial products in weeks. Tokenization is quietly transforming cross-border payments, with Ant International cutting settlement from days to seconds. GenAI is also hitting scale: 24% of use cases are enterprise-wide, Klarna’s at 87% staff adoption, and payments giants are eyeing “agentic commerce.”

So what? In commerce, if your data isn’t MCP-ready, AI shoppers may never “see” you. In banking, clinging to the old playbook risks a slow fade in relevance. And in AI, the winners will be those who operationalize fast, not those still debating ROI metrics.

My take: We’re watching infrastructure moments — like HTTPS for e-commerce — happen in real time. Ignore them, and you’re invisible. Lean in, and you’re not just in the game, you’re helping write the rules.

Until next time—thanks for reading Fintech Wrap Up!

Reports

Insights

What Shopify’s AI Storefront Updates Mean for Commerce and Payments

Shopify is betting big that conversational AI agents will become the new storefronts of the internet – and it’s rolling out some ambitious tools to make that happen. If phrases like Model Context Protocol (MCP) and Global Catalog sound like sci-fi jargon, fear not. In this deep dive, we’ll break down Shopify’s Storefront AI Agent strategy, why it matters for merchants, fintech folks, and product managers alike, and how you can ride this agent-led commerce wave to your advantage. Grab a coffee (perhaps recommended by your friendly neighborhood chatbot) and let’s jump in.

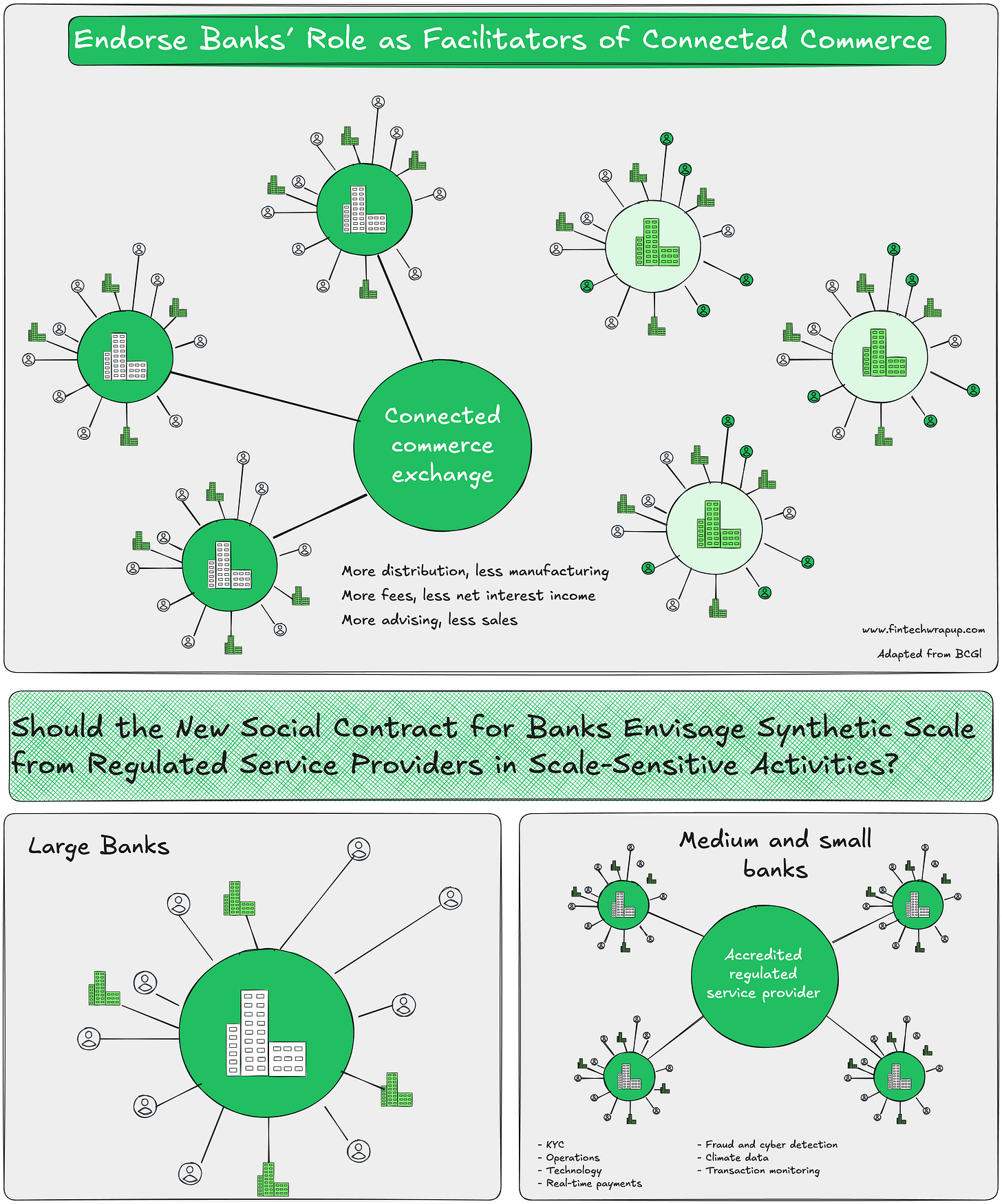

Renegotiating the Social Contract Between Banks and Society

Banks and society have had an unspoken “grand bargain” for centuries: banks get to take deposits and move money, and in return, they’re expected to fuel economic growth, maintain stability, and operate under tight regulatory supervision.

But here’s the catch—this deal is starting to feel outdated.

Today, many banks are trading below book value, signaling weak profitability and reduced capacity to lend. If banks can’t generate returns above their cost of capital, they’ll pull back capital rather than inject it into the economy. That’s a problem not just for banks—but for everyone who relies on credit to keep the economy moving.

Add in AI, digital assets, and fintech competition, and the old rulebook is showing its age. Regulations haven’t kept up, and the traditional playbook often discourages bold innovation instead of enabling it.

So, what could a “renegotiated” social contract between banks and society look like?

Keep reading with a 7-day free trial

Subscribe to Fintech Wrap Up to keep reading this post and get 7 days of free access to the full post archives.