Verification Of Payee rulebook digest: what to pay attention to; Building a Customer-Centric Approach for Instant Payment Success; Pricing Market Landscape - Interesting Opportunities;

This week, we're diving into Generative AI's transformative role in banking, Europe's new Verification of Payee rulebook, and the latest cross-border payment initiatives reshaping global finance.

Insights & Reports:

1️⃣ Generative AI in Banking - Generative AI’s impact goes far beyond cost-effectiveness

2️⃣ Verification Of Payee rulebook digest: what to pay attention to

3️⃣ Types of UK payment systems access

4️⃣ Key Cross-Border Initiatives Around The World

5️⃣ EmFi business models and archetypes

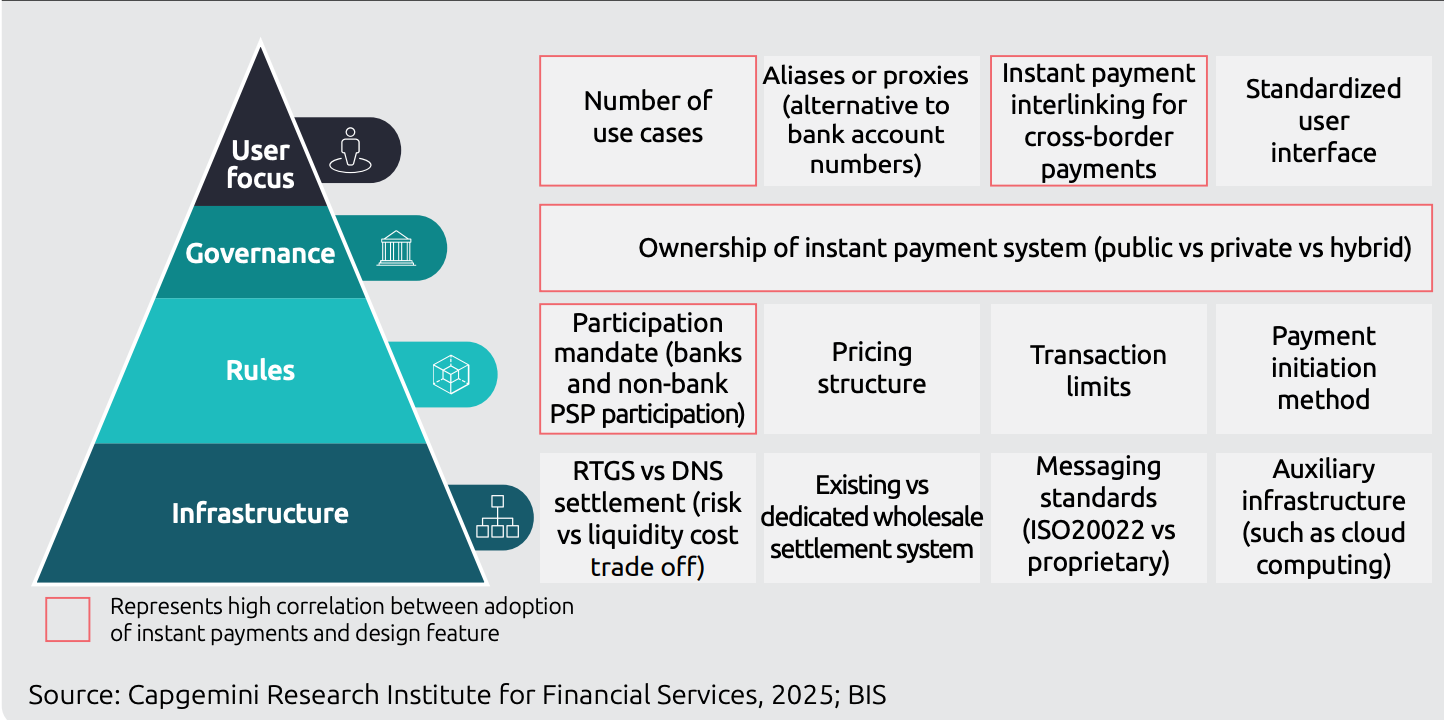

6️⃣ Building a Customer-Centric Approach for Instant Payment Success

7️⃣ Pricing Market Landscape - Interesting Opportunities

8️⃣ Factors contributing to the growth of Superapps in Asia

9️⃣ Klarna Valuation Raised by Chrysalis as Fintech Preps for IPO

TL;DR:

This edition is packed with fascinating developments and insights across the fintech, payments, and banking landscapes.

To kick things off, let’s dive into how Generative AI is shaking up banking. Beyond just cutting costs, GenAI offers banks new ways to engage with customers who prefer voice interactions over traditional interfaces, like seniors and Gen Z. With 24/7 availability, AI-supported bots can enhance customer service and turbocharge back-office tasks like document processing, transforming customer experiences and risk management alike.

In Europe, all eyes are on the Verification of Payee (VOP) rulebook recently released by the EPC. This framework, essential for SEPA payment providers by October 2025, aims to reduce fraud by verifying payees before transactions go through—a significant step towards building trust and safety in digital payments.

On to UK payments—we're seeing new pathways for companies to access Bacs and FPS systems. With options ranging from indirect access through sponsor banks to direct connections with Bank of England settlement accounts, fintechs and e-money institutions can now manage Bacs and FPS payments more seamlessly.

Globally, cross-border payment initiatives are gaining traction. The GCC’s AFAQ and the Arab Monetary Fund's Buna are accelerating payments in the MENA region. In India, NPCI’s expansion of UPI interoperability worldwide is easing payments for NRIs, while in the US and Europe, the IXB pilot is creating new USD and EUR cross-border solutions. Each project brings us closer to the G20’s vision for faster, more affordable global payments.

Then there’s embedded finance (EmFi), emerging as a transformative force with B2B and B2C models that increase loyalty and value on platforms from supply chains to peer-to-peer services. This approach not only improves user experience but fosters trust and security within digital ecosystems.

Finally, there’s a growing interest in usage-based billing and finance solutions, as companies like LogiSense and Maxio redefine billing with an eye on GenAI and SaaS flexibility. With big names like Google investing in Moniepoint and Finix’s $75M fundraise to challenge Stripe, the payment processing space is heating up. And Klarna is making headlines too, as it inches closer to IPO readiness with an impressive valuation boost.

That's it for now! I’ll be keeping an eye on these trends, and as always, I’m here to bring you the best of fintech, banking, and payments. Stay tuned!

Insights

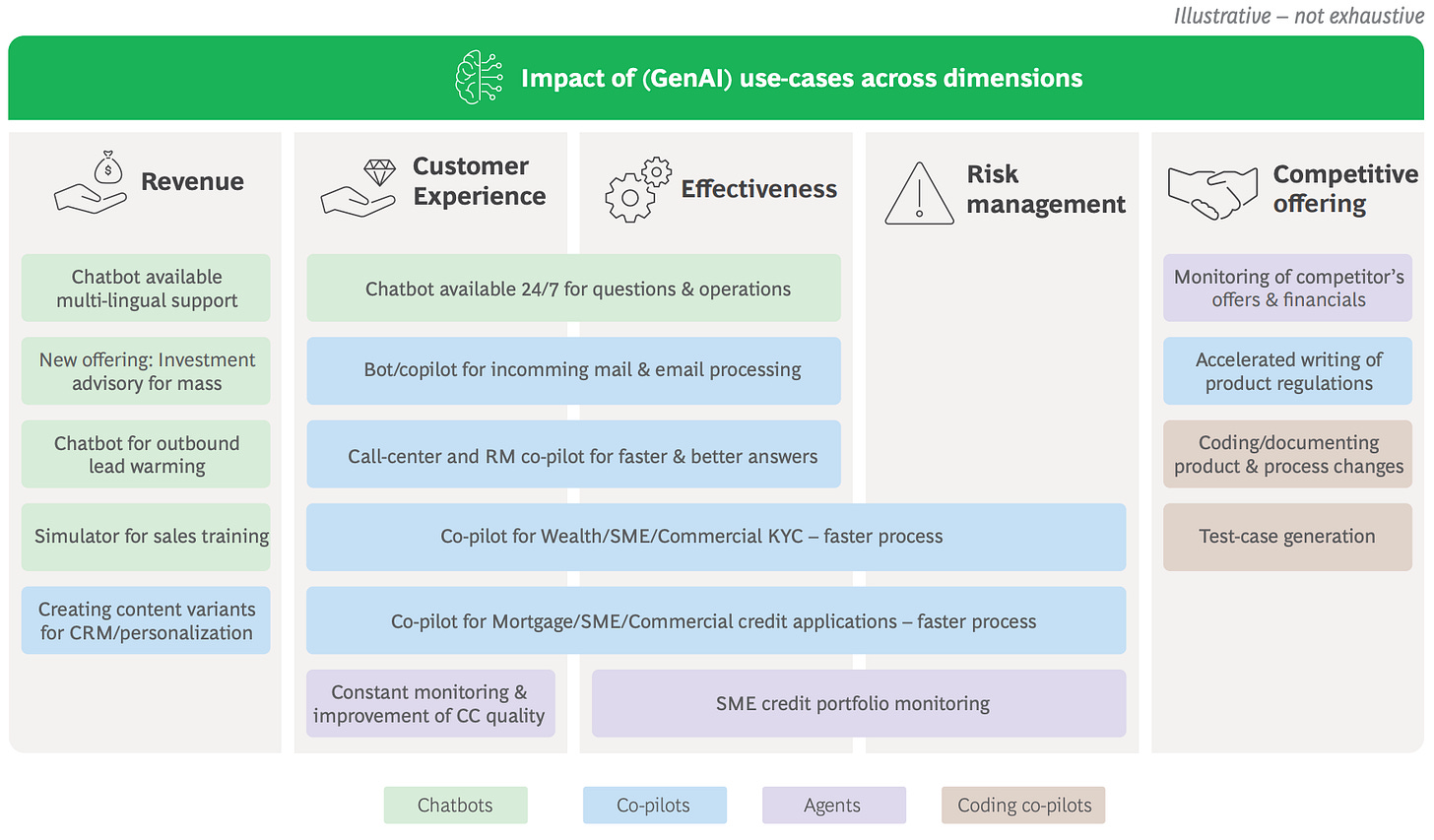

Generative AI in Banking - Generative AI’s impact goes far beyond cost-effectiveness

GenAI’s capabilities mean it can be used to carry out tasks previously restricted to humans, but its potential goes much further than the abilities of the often-quoted parallel with “a large group of diligent and effective people.” This is because of the technology’s ability to access a vast amount of data and at speed, meaning its answers are always synthetized from a wide range of inputs. Moreover, applications can be rolled out at a comparatively low cost, transforming multiple dimensions of operations:

Revenue generation through closer customer engagement: Banks can use chat bots to offer conversational interactions to customers who do not engage well with click-/tap interfaces – a group that includes both seniors and younger cohorts (who prefer talking to clicking). Internal bots, meanwhile, can serve as interactive sales coaches and sparring partners for RMs, as well as produce engaging and convincing content for CRM and marketing.

Transforming the customer experience: Due to a lower cost base and faster response times, Gen-AI supported agents can offer advice 24/7 and without the customer needing to navigate an interactive voice response (IVR) or wait in line. They can help humans respond about three times faster than if they relied on traditional CRMs and knowledge bases. And working alone, the technology can offer human-like interactions, while being more knowledgeable of product features and terms and conditions than any call center agent. Moreover, they can streamline back-office operations so that the bank can process documents, for example relating to loan applications, in minutes instead of days, again raising service levels significantly.

Risk management: GenAI offers a step-change in the timeliness and exhaustiveness of risk management, for example equipping managers to systematically monitor credit portfolios instead of sampling them periodically. Equally, banks can use GenAI to track company reports or relevant news flow in real time.

Keep reading with a 7-day free trial

Subscribe to Fintech Wrap Up to keep reading this post and get 7 days of free access to the full post archives.