Using Data and AI to Combat Instant Payments Fraud; Breaking Down the Crypto Growth Funnel; Agentic payments are quickly moving from concept to infrastructure

I’d love to hear how you’re currently managing FX risk

In my career building fintech and payments products — from digital wallets to embedded finance tools — one lesson has stayed consistent: currency risk is invisible until it hits your margins.

If your business buys, sells, or pays across borders, you’re already exposed to foreign exchange risk — the kind of volatility that quietly eats into your profits.

Think of it this way:

You sign a contract to import goods worth €100,000. By the time payment is due, a small 3–4% movement in exchange rates can wipe out your expected margin.

Most businesses I’ve met don’t have dedicated treasury teams or complex hedging instruments. They simply need practical tools to:

✅ Hold multiple currencies

✅ Pay suppliers globally without unnecessary conversions

✅ Protect their margins from daily rate swings

That’s exactly why Wraap Up was built — giving businesses multi-currency accounts, international transfers, and an FX Risk Manager that helps monitor, hedge, and automate FX decisions in real time.

It’s a problem I’ve seen across industries — from e-commerce and logistics to B2B payments — and one we’re solving through automation, data, and smarter treasury infrastructure.

If your business deals with multi-currency operations or cross-border payments, I’d love to hear how you’re currently managing FX risk — or if it’s something you’re starting to think about.

Daily news on Payments Wrap Up

Deep Dive of the Week

What OpenAI and Stripe’s Agent Commerce Protocol (ACP) Means for Your Roadmap

Is chatting with an AI about your next purchase the new “add to cart”? Tech’s latest power couple, Stripe and OpenAI, certainly hope so. They’ve teamed up to launch what is essentially a new Agentic Commerce Protocol (ACP) – an open standard that lets AI agents like ChatGPT seamlessly help you shop and pay inside a conversation. In other words, ChatGPT can now act as your snarky but efficient personal shopper, recommending products and checking you out without ever tossing you to a website. It’s a bold attempt to turn AI chat into the next storefront, and it has the fintech world buzzing.

But behind the buzzwords (and there are plenty – “agentic commerce,” anyone?), what’s actually happening? More importantly, why should product managers and payments nerds care?

This week’s reports

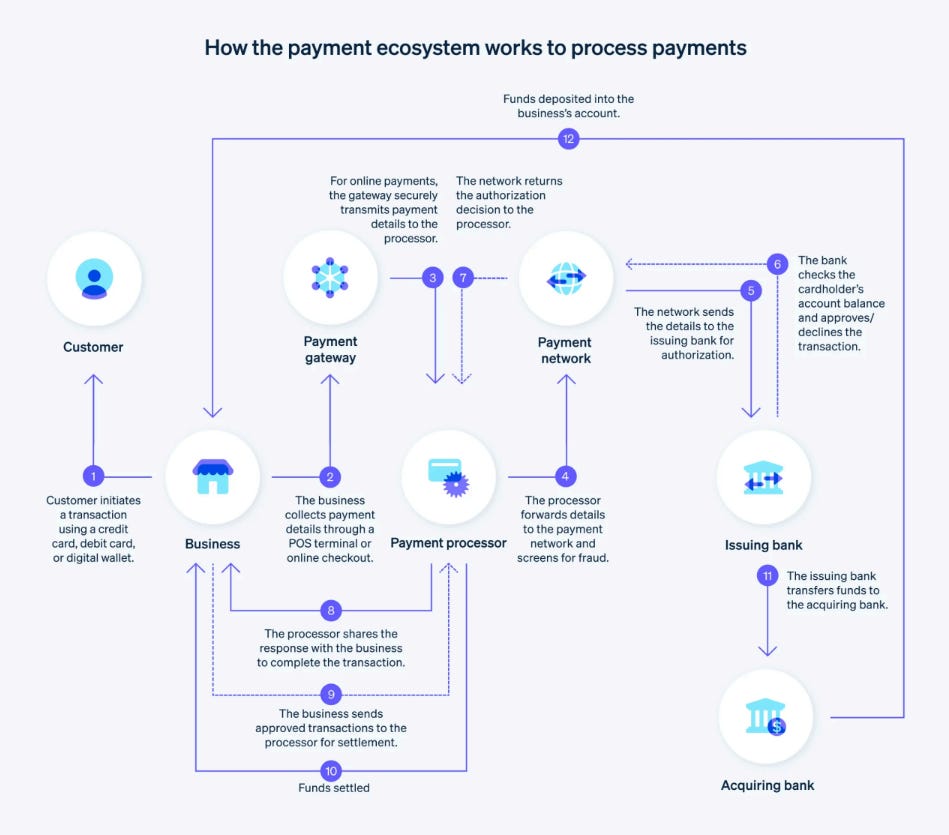

Inside the Payment Industry Ecosystem: How Money Moves Behind the Scenes

1️⃣Inside the Payment Industry Ecosystem: How Money Moves Behind the Scenes

Keep reading with a 7-day free trial

Subscribe to Fintech Wrap Up to keep reading this post and get 7 days of free access to the full post archives.