Tokens and their characteristics; Factoring vs. B2B BNPL; From Merchant Acquiring to Merchant Services;

This week in Fintech Wrap Up, we are exploring the evolution of merchant acquiring into embedded finance, the rise of AI in financial automation, and the growing impact of B2B BNPL on payments

Insights & Reports:

1️⃣ Tokens and their characteristics

2️⃣ From Merchant Acquiring to Merchant Services

3️⃣ Factoring vs. B2B BNPL

4️⃣ Cyberattacks Targeting FPS Operators and Service Providers

5️⃣ AI Market Map: Fintech

6️⃣ Klarna, Afterpay, or PayPal: Which Is the Most Widely Used Payment Installment?

7️⃣ CBDC Use Cases: Cross-Border Payment

8️⃣ The 2025 Crypto Crime Report

9️⃣ MoonPay Acquires Iron to Add Enterprise-Grade Stablecoin Solutions

TL;DR:

Here’s my latest Fintech Wrap Up, bringing you the biggest fintech and payments updates you need to know.

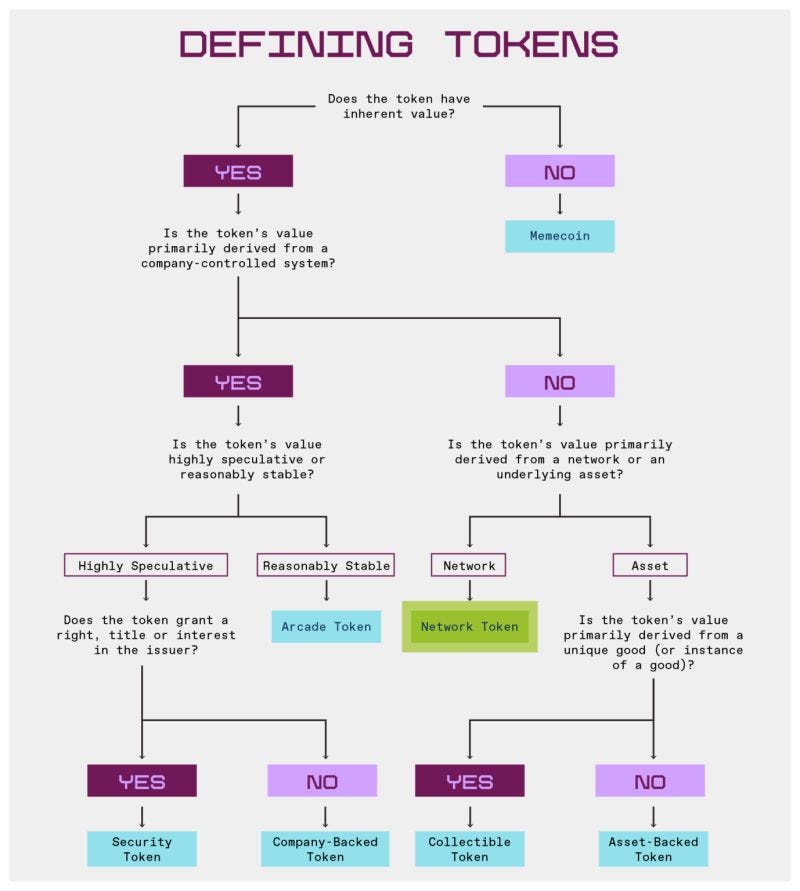

Let's start with tokens—these digital assets are more than just cryptocurrencies. They come in various forms, from network tokens like ETH and SOL to security tokens, company-backed tokens, and even arcade tokens (think Robux). The differences in design dictate their use cases, regulatory treatment, and value. Understanding these nuances is key, especially as tokens continue shaping the digital economy.

On the payments side, merchant acquiring is evolving. With traditional acquiring becoming commoditized, companies are shifting toward value-added services (VAS) and embedded finance. Acquiring growth is slowing, but VAS and embedded finance are booming, projected to make up over 50% of acquirers’ revenue soon. Software platforms are taking over merchant services, bundling payments with business tools and controlling the payment relationships of 60-70% of merchants.

In B2B payments, BNPL is becoming a game-changer. Unlike traditional factoring, which is slow and costly, B2B BNPL provides instant liquidity, automates credit risk, and eliminates the administrative hassle. Providers like RollingFunds are integrating BNPL into marketplaces, e-commerce, and distribution networks, making B2B transactions smoother and more predictable.

Cybersecurity remains a top concern for payments players, with FPS operators and service providers facing increasing threats. DDoS attacks, phishing, ransomware, and business email compromise are rampant. Fast Payment Systems (FPS) are particularly attractive targets for cybercriminals due to the speed and anonymity they offer, making robust security a non-negotiable priority.

The AI fintech market is heating up, with automation reshaping accounts payable/receivable, tax compliance, KYC, auditing, and wealth management. AI-driven startups like Tabs and Outmin are revolutionizing financial processes, making them more efficient and scalable. AI is also tackling compliance bottlenecks, reducing manual work, and helping financial institutions stay ahead of regulatory challenges.

BNPL remains a hot topic, with Klarna leading installment payments across multiple product categories, particularly in furniture and fashion. Meanwhile, PayPal dominates in electronics and DIY, and Afterpay thrives in fashion and personal care. The BNPL boom has given consumers more purchasing flexibility, but concerns over debt traps linger.

CBDCs (Central Bank Digital Currencies) are gaining traction in cross-border payments. They promise lower transaction costs, faster settlements, and improved transparency. By reducing reliance on intermediaries and enabling real-time transfers, CBDCs could transform how money moves across borders, provided regulatory and interoperability challenges are addressed.

In crypto, crime is evolving. Illicit activities now range from cybercrime to national security threats, with some bad actors operating off-chain but laundering funds on-chain. The latest Crypto Crime Report sheds light on these trends, showing how the landscape is shifting as crypto goes mainstream.

Rounding out this edition, we saw major fintech deals making waves. Plata Card raised a massive $160M in Series A at a $1.5B valuation, MoonPay acquired Iron to boost stablecoin solutions, and Bilt Rewards snapped up Banyan to enhance item-level data in commerce.

That’s all for now—stay tuned for the next edition of Fintech Wrap Up.

Before we kick off this edition let’s take a moment and talk about about reconciliations in fintech vertical!

Fintechs are processing millions of transactions daily… but behind the scenes, finance teams are drowning in manual work. Why? What do you think?

Insights

Tokens and their characteristics

A blockchain is a decentralized network of computers maintaining shared ledgers, functioning like a “computer in the sky.” Tokens are immutable data records on these ledgers, tracking quantities, permissions, and ownership rights. Since tokens are embedded in software, they can represent anything—stores of value (e.g., Bitcoin), utility assets (e.g., Ether), collectibles (e.g., NFTs), payment stablecoins (e.g., USDC), or even digital securities.

Tokens vary in functionality; some grant voting or economic rights, while others simply enable network usage. They can be fungible (identical units, like currency) or non-fungible (unique, like collectibles). These design differences determine a token’s use case, value, and regulatory treatment. Understanding token classifications is crucial to avoid misinterpretations, such as equating memecoins with network tokens.

🔹 Network Tokens

Network tokens power blockchain protocols, enabling operations, governance, and incentives. Their value is tied to the network's economic mechanisms, such as staking, burning, and consensus participation. Examples: BTC, ETH, SOL, UNI.

🔹 Security Tokens

Security tokens represent ownership in financial assets like stocks, bonds, or revenue-sharing agreements. They are subject to securities regulations and enhance liquidity in capital markets. Examples: Etherfuse Stablebonds, Aspen Coin.

🔹 Company-Backed Tokens

These tokens derive value from a centralized company’s product or service. They are often speculative and may resemble securities if linked to company profits. Examples: FTT (FTX), BNB (originally).

🔹 Arcade Tokens

Used in digital ecosystems for payments, rewards, or in-game transactions, arcade tokens are non-speculative and designed to retain a fixed function. Examples: FLY (Blackbird), Pocketful of Quarters, Robux.

🔹 Collectible Tokens

Non-fungible tokens (NFTs) representing ownership of digital or physical assets like art, music, or memberships. Often used for branding, gaming, and event access. Examples: CryptoPunks, Bored Apes, ENS Domains.

Keep reading with a 7-day free trial

Subscribe to Fintech Wrap Up to keep reading this post and get 7 days of free access to the full post archives.