Tokenization Use Case Patterns; Scaling Your Infrastructure for Payment Success; Wallets in The Post Web;

This week’s big takeaway? Wallets are no longer just for holding crypto — they’re becoming intelligent control centers for your digital identity and assets

Insights & Reports:

1️⃣ Wallets in The Post Web

2️⃣ Payments: Automated dispute representment

3️⃣ Tokenization Use Case Patterns

4️⃣ Traditional vs. Agentic Checkout Flow

5️⃣ Scam Classifier

6️⃣ Scaling Your Infrastructure for Payment Success

7️⃣ Scaled Fintechs Are Concentrated in Five Verticals

8️⃣ Stablecoin giant Circle's shares surge in blowout NYSE debut

9️⃣ Mastercard and PayPal Partner to Redefine Checkout with One Credential

TL;DR:

Welcome to the latest edition of the Fintech Wrap Up — your go-to for what’s next in fintech, payments, and digital infrastructure.

This week’s big takeaway? Wallets are no longer just for holding crypto — they’re becoming intelligent control centers for your digital identity and assets. In the Post Web world, wallets will power AI agents that act on your behalf while keeping you in control. But we’re not there yet — most smart wallets still rely on centralized systems for UX and recovery. The path forward? A phased approach that blends onboarding ease today with decentralization tomorrow, using tech like MPC and DePIN to make it happen.

If you handle payments, here’s something practical: chargebacks are getting a much-needed upgrade. A new automated dispute process replaces manual workflows with end-to-end intelligence — analyzing claims, generating tailored evidence, submitting across networks, and learning from outcomes. It’s a game-changer for reducing fraud and saving revenue.

On the infrastructure side, tokenization is quietly reshaping asset management. The World Economic Forum highlights what makes an asset ready to be tokenized — from physical commodities like gold to complex OTC products. If you’re building in this space, focus on traits like divisibility, operational load, and regulatory clarity.

We also look at how commerce is changing: AI agents can now complete purchases at the exact moment of intent — on social posts, in browser extensions, or via virtual assistants. Rich metadata flows with every transaction, enabling real-time fraud checks and agent scoring.

Plus: the new ScamClassifier helps banks and fintechs spot scam patterns with more precision, and smart merchants are upgrading from single PSP setups to orchestrated, multi-processor stacks that drive long-term payments performance.

That’s your fintech edge for the week. See you in the next edition.

Reports

Insights

Agentic AI in Payments and Commerce

The fintech world is entering a new era where AI can do more than chat or make recommendations – it can act. In this “agentic” age of commerce, autonomous AI agents are increasingly capable of making purchases, managing finances, and executing transactions on behalf of users without direct human intervention. What began as experimental chatbots has rapidly evolved into full-fledged agentic AI systems with “advanced human-like reasoning and interaction capabilities” that are “transforming the finance and retail sectors” among others. In just the past few months, major payment networks, fintech giants, and startups alike have unveiled tools to empower these AI agents to shop, pay, and transact in the real world. This deep dive explores how the concept of agentic AI emerged in payments and commerce, what key solutions are being built – from PayPal’s Agent Toolkit to Visa’s Intelligent Commerce – and what it all means for consumers, merchants, and the broader fintech ecosystem.

The significance of this shift is hard to overstate. Some compare it to the leap from physical stores to e-commerce, or from web shopping to mobile. As Visa’s Chief Product and Strategy Officer Jack Forestell put it, “Just like the shift from physical shopping to online, and from online to mobile, Visa is setting a new standard for a new era of commerce” with AI agents. The idea is that soon millions of consumers will trust AI assistants to not only find the perfect product or best deal, but also buy it for them – all while handling payments seamlessly in the background. According to Forestell, “Soon people will have AI agents browse, select, purchase and manage on their behalf. These agents will need to be trusted with payments, not only by users, but by banks and sellers as well”. In other words, the race is on to build the trust, infrastructure, and standards that will let AI-driven commerce flourish safely.

This isn’t just hype from incumbents. A wave of startups and developers is also charging into the agentic payments gold rush. In late 2024 and early 2025, “a surge of launches by startups [aimed] to capitalize on the new AI agent economy” has been evident. Fintech innovators see an opportunity to remove friction from transactions by letting AI do the heavy lifting. But they also recognize huge challenges around security, identity, and fraud when algorithmic agents start handling money. Are we really ready to let AI agents loose on our wallets? This article will delve into how the industry is addressing those questions and reimagining commerce itself – from autonomous shopping assistants to AI-powered back-office bots – all through the lens of factual developments and solutions that have emerged in the past year.

Wallets in The Post Web

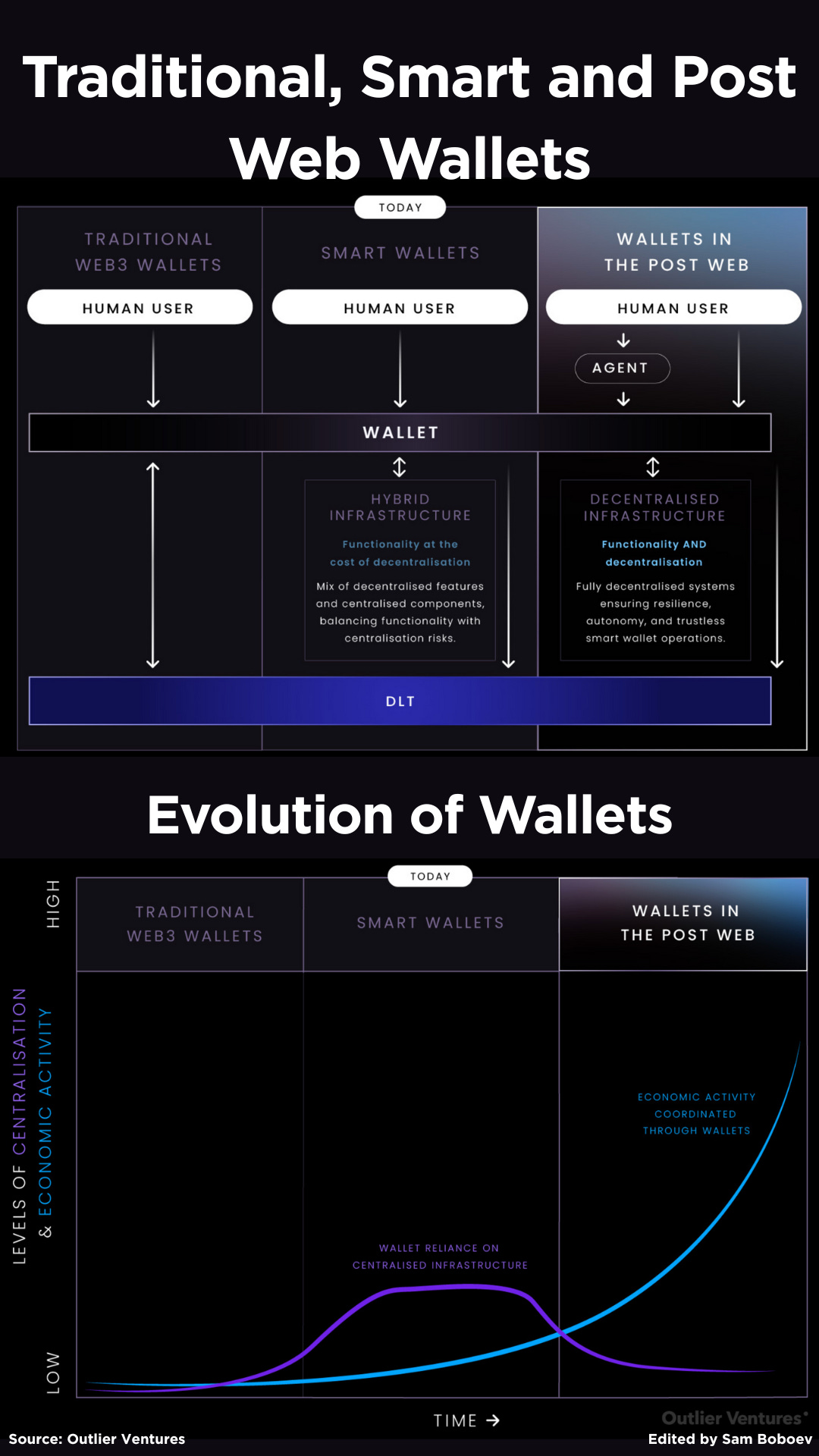

In The Post Web, wallets become secure, programmable gateways for managing identity and assets — including data, memory, prompts, and permissions — enabling AI agents to interact with decentralised apps and infrastructure on a user’s behalf.

Today in Web3, wallets mainly store cryptographic keys, facilitate transactions, and allow users to self-custody assets while interacting with dApps. In The Post Web, they must evolve into comprehensive hubs for managing personhood and asset itineraries.

Wallets will also carry context, memory, and prompts — enabling personalisation and secure, agent-driven experiences while preserving user control over identity and assets

Before diving deeper, let’s look at the state of smart wallets, which are already simplifying asset management and laying the groundwork for Post Web wallets.

🔹 Smart Wallets

Smart wallets are a major Web3 innovation — moving beyond key storage to programmable tools for managing assets, identity, and dApp interactions. Features like gas abstraction, automation, and conditional execution improve UX and make wallet use more intuitive.

This is key for The Post Web. While agents will handle many tasks, users will still need interfaces to manage identity, consent, and ownership directly.

🔹 Centralisation Concerns

Today’s smart wallets often depend on centralised infrastructure — including relayer networks, cloud-based recovery, and off-chain notification systems — creating points of failure and deviating from Web3’s decentralised ethos.

Many features, like gas abstraction, rely on these systems. But as wallets coordinate more value and critical activity, decentralising this infrastructure is essential to reduce risk and uphold trust.

🔹 Traditional, Smart, and Post Web Wallets

Current smart wallets are hybrids — blending decentralised features like account abstraction with centralised backends. This tradeoff delivers functionality but introduces centralisation risks. As wallets handle more economic coordination, decentralised infrastructure must replace centralised scaffolding.

Keep reading with a 7-day free trial

Subscribe to Fintech Wrap Up to keep reading this post and get 7 days of free access to the full post archives.