Reports: The State of Crypto Lending; The State of Fintech in the Middle East; The 2025 Crypto Crime Report;

Welcome to a fresh Reports Edition of Fintech Wrap Up! I’ve been diving into some of the latest and most revealing reports in our industry, and here’s what caught my eye.

Insights & Reports:

1️⃣ Q1 2025 FinTech Insights

2️⃣ Fintech Embraces GenAI: A Transformative Year Ahead in 2025

3️⃣ The State of Onchain UX

4️⃣ The State of Crypto Lending

5️⃣ The State of Fintech in the Middle East

6️⃣ Payments without borders: A new era for Latin America

7️⃣ The 2025 Crypto Crime Report

TL;DR:

Hey folks — welcome to a fresh Reports Edition of Fintech Wrap Up! I’ve been diving into some of the latest and most revealing reports in our industry, and here’s what caught my eye (and yes, you can download all the full reports below for a deeper dive).

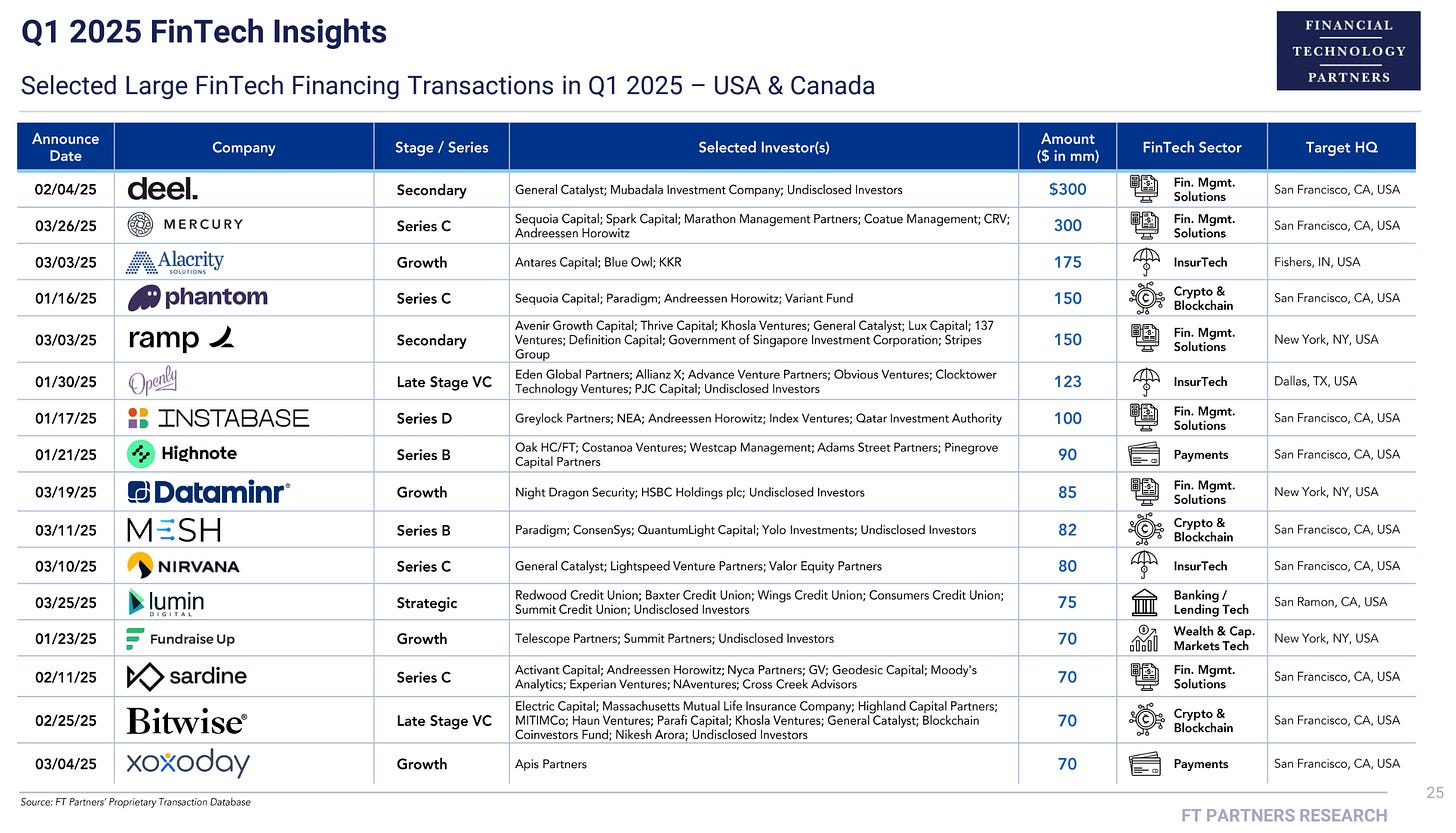

Let’s start with Q1 2025 — it was a wild ride. Fintech funding bounced back with nearly $14B raised, up 50% YoY, and while IPO hopes fizzled (looking at you Klarna, eToro, and Chime), M&A deals surged with a record 47% YoY increase. The biggest headlines? Rocket Companies’ $9.4B acquisition of Mr. Cooper, and private equity getting bolder than ever. Meanwhile, strategic investors are still in the game, participating in 39% of funding rounds, though IPO markets remain on shaky ground.

One theme you can’t ignore? GenAI. It’s become a cornerstone of fintech innovation — 2/3 of companies say it’s mission-critical for 2025. We’re seeing real traction in productivity, marketing, fraud prevention, and wealth management. The buzzword now is Agentic AI—models that can autonomously execute complex tasks. But there’s still plenty of caution in areas like Regtech and compliance, especially in the UK where regulatory hurdles loom large.

Web3? It’s evolving fast. According to The State of Onchain UX, wallets are gaining traction (Europe’s leading in new wallet creation), but real mainstream UX still has a way to go. Most users still see trading as the main use case, even if they talk big about payments and social apps. Ethereum, Solana, and Base are carving out their niches, but interoperability, cost, and security remain key friction points.

On the crypto lending side, DeFi is roaring back. Lending volumes there shot up 959% from the bear market lows, now even above previous bull cycle peaks. CeFi, meanwhile, is still limping along post-crash. The market has consolidated significantly—Tether, Galaxy, and Ledn now dominate, replacing the fallen giants like Celsius and BlockFi.

Zooming out to regional trends, the Middle East is thriving with over 1,500 fintech startups and $4.2B in funding raised in 2023 alone. The UAE leads in scaleups, and players like Tabby and Tamara are turning into unicorns. Adoption is high, especially in KSA and Turkey, and early-stage deals are growing larger despite global headwinds.

And in Latin America, we’re seeing a payments revolution. Brazil’s Pix is setting the standard with real-time, 24/7 payments. Cross-border initiatives like the Nexus Project are also picking up steam, and fintechs across Mexico, Chile, and Colombia are boosting financial inclusion at an impressive pace.

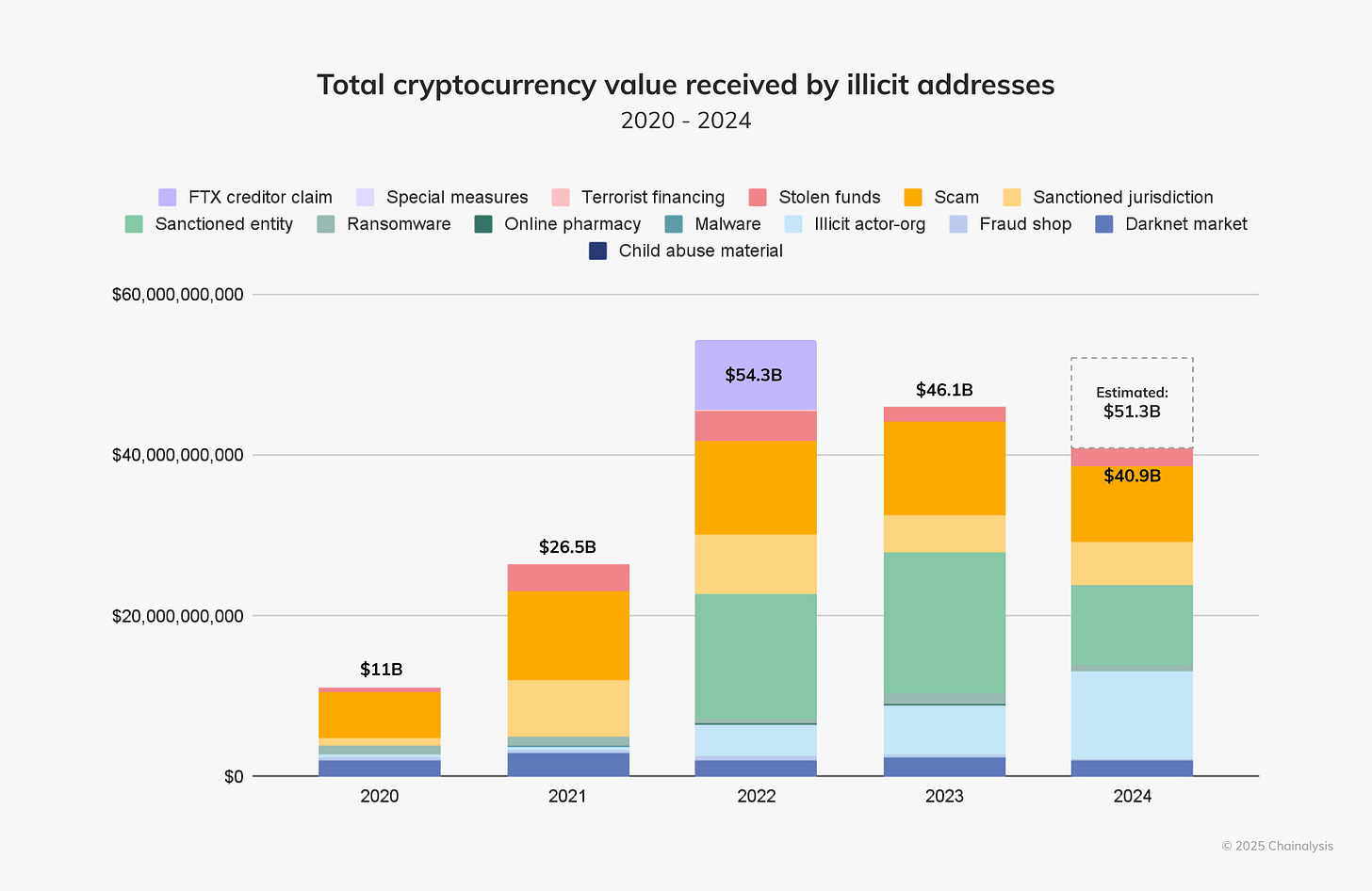

Lastly, Chainalysis’ Crypto Crime Report shows a YoY drop in illicit crypto volumes—$40.9B in 2024 versus $46.1B in 2023 (though that number is likely to rise as more addresses are identified). Still, crypto crime made up only 0.14% of on-chain activity, a small sliver, but a reminder that the battle for trust and compliance continues.

That’s a wrap for this special edition—you can download all the reports featured here to explore the full data, trends, and insights. Got a favorite stat or takeaway? Hit reply and let me know!

Insights

Reports

Q1 2025 FinTech Insights

👉 Strategic Investors Hold Steady

Strategic and corporate VCs participated in 39% of FinTech funding rounds this quarter—down from the 2022 peak of 45%, but in line with 2024's full-year trend. While not surging, strategic involvement remains a solid pillar of FinTech deal activity.

👉 IPO Hopes on Hold

In March, Klarna and eToro grabbed headlines by filing for US IPOs, fueling hopes of a long-awaited public market comeback. But by early April, both had shelved their plans following market volatility triggered by President Trump’s new global tariffs. Circle also filed in early April, joining Gemini and Chime, who had previously filed confidentially. Chime is reportedly pausing its IPO efforts for now. The IPO window remains murky.

👉 M&A Surges Amid Uncertainty

M&A was the dominant story of the quarter. Deal count jumped 47% YoY, reaching a new all-time high. Even excluding mega-deals like Capital One’s pending $35B acquisition of Discover (announced in Q1 2024), volume was still up 30% YoY. While Q1 lacked headline-grabbing mega-deals, it delivered 13 transactions over $1B, led by Rocket Companies’ $9.4B acquisition of Mr. Cooper Group.

Private equity made bold moves too—Clearlake is taking Dun & Bradstreet private in a $7.7B deal, while EQT is acquiring Fortnox for $5.5B. Over 90% of acquisitions were strategic, with players like Clearwater Analytics, Fiserv, Paychex, Alkami, Flywire, Shift4, and Payoneer making notable moves. Major corporates including American Express and Munich Re also made strategic buys.

Given the lag between public market shifts and private market reactions, we’re likely not yet seeing the full impact of recent macroeconomic upheaval. However, early Q2 data hints that deal activity—and opportunity—remain strong.

👉 Capital Raising Rebounds

Private FinTech financing totaled nearly $14B in Q1, up 50% YoY from Q1 2024’s low of just over $9B. The quarter was boosted by Binance’s record-setting $2B crypto-based investment from MGX—the largest in crypto history. Even excluding Binance, capital raising still rose 28% YoY.

Keep reading with a 7-day free trial

Subscribe to Fintech Wrap Up to keep reading this post and get 7 days of free access to the full post archives.