The NextGen Xtensible Core Banking; Multi-rail strategy in payments; Embedded Finance Pricing Guide for Vertical SaaS Platforms;

This week in Fintech Wrap Up, we dive into Mastercard's strong Q3 earnings, the transformative potential of Apple's NFC opening for third-party wallets, and the rise of NextGen core banking systems

Insights & Reports:

1️⃣ Mastercard Q3 Earnings

2️⃣ The NextGen Xtensible Core Banking

3️⃣ Embedded Finance Pricing Guide for Vertical SaaS Platforms

4️⃣ Apple in Payments: Opportunity for Third-Party Wallets

5️⃣ AI in Banking Use Case: Loan Default Prediction Prototype

6️⃣ What Does a Modern Payments Technology Stack Look Like?

7️⃣ Multi-rail strategy in payments

8️⃣ Cleo’s evolution trajectory

9️⃣ How BaaS is Redefining Traditional Banking Models

TL;DR:

Here’s what’s new in fintech, payments, and banking this week, brought to you by Fintech Wrap Up!

Mastercard’s Q3 earnings delivered strong results, with a 15% year-over-year jump in adjusted earnings per share, driven by growing cross-border volumes and switched transactions. However, operating expenses and incentives remain a challenge. On the tech side, the rise of NextGen core banking is revolutionizing how banks operate, with cloud-native and API-driven systems empowering business users to innovate without heavy reliance on developers. Speaking of innovation, embedded finance continues to shine, offering vertical SaaS platforms a golden opportunity to boost SMB retention and revenue. The key? A robust product-first approach paired with seamless payment experiences.

On the payments front, Apple’s decision to open NFC to third-party wallets could be a game-changer. Players like PayPal, Cash App, and Shopify’s Shop Pay are well-positioned to capitalize on this shift, bridging offline and online payments in exciting new ways. Meanwhile, AI is transforming banking operations, as seen in a cutting-edge loan default prediction model that’s helping lenders mitigate risk with tree-based algorithms and real-time insights.

In corporate banking, a multi-rail payment strategy is becoming essential. Banks like Bank of America are setting new benchmarks by integrating multiple payment methods into a unified customer experience. This approach not only improves efficiency but also creates valuable cross-channel insights to drive personalization and loyalty.

Let’s not overlook Cleo, the millennial-friendly personal finance app that has soared to $150M ARR by integrating AI for smarter chatbots and credit-building tools. Its success underscores the growing demand for engaging, personalized financial solutions.

Lastly, Klarna is making waves with its confidential IPO filing in the U.S. and partnerships with Google Pay, signaling an exciting new chapter for BNPL. Meanwhile, Zing is teaming up with Checkout.com to expand digital payment options for its members.

That’s a wrap! Stay tuned for more insights next week, and as always, let’s keep pushing the boundaries of fintech innovation.

Insights

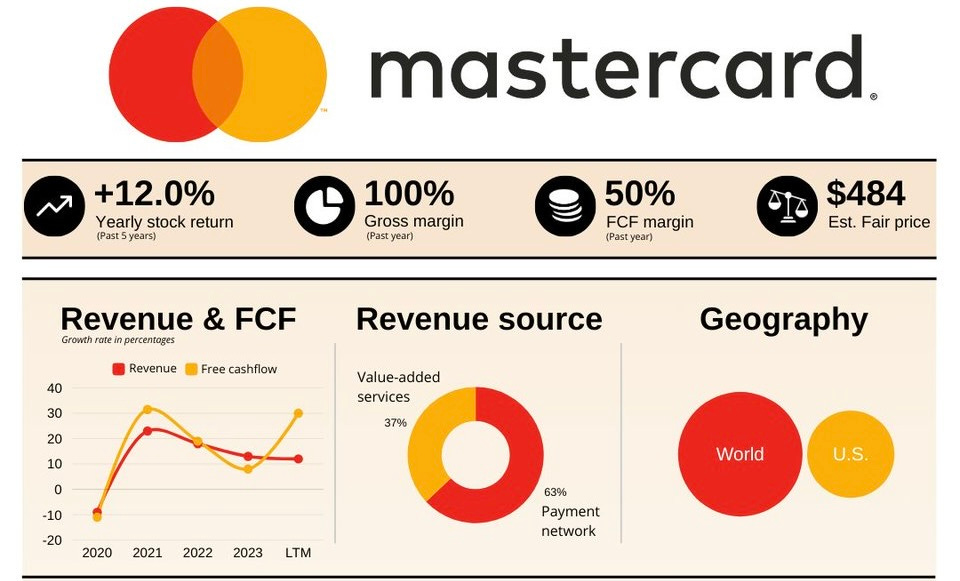

Mastercard Q3 Earnings

MA reported third-quarter 2024 adjusted earnings of $3.89 per share, which surpassed the Zacks Consensus Estimate by 4.3%. The bottom line improved 15% year over year. Its shares gained 1.7% in the pre-trading session.

Net revenues of the leading technology company in the global payments industry advanced 13% year over year to $7.4 billion. The top line beat the consensus mark by 1.6%.

The quarterly results reflect benefits from increased gross dollar volume, cross-border volumes, strong demand for value-added services and growth in switched transactions. However, the upside was partly offset by escalating operating expenses and higher rebates and incentives.

MA’s Q3 Operational Performance

Gross dollar volume (representing the aggregated dollar amount of purchases made and cash disbursements obtained from Mastercard-branded cards) increased 10% on a local-currency basis to $2.5 trillion. Yet, the metric fell short of the Zacks Consensus Estimate of $2.52 trillion and our estimate of $2.51 trillion.

Cross-border volumes rose 17% on a local currency basis. Switched transactions, which indicate the number of times a company’s products have been used to facilitate transactions, improved 11% year over year to 41.1 billion. The metric outpaced the consensus mark of 40.7 billion.

Value-added services and solutions net revenues of $2.7 billion advanced 18% year over year and met our estimate. The year-over-year growth was driven by higher demand for consulting and marketing services, expansion of fraud, security, identity and authentication solutions, as well as effective pricing strategies.

Payment network rebates and incentives increased 17% year over year as a result of new and renewed deals.

MA’s clients issued 3.4 billion Mastercard and Maestro-branded cards as of Sept. 30, 2024.

Adjusted operating expenses escalated 12% year over year to $3 billion due to increased general and administrative expenses.

Operating income was $4 billion, which grew 4% year over year but slightly missed our estimate of $4.03 billion. Operating margin deteriorated 450 basis points year over year to 54.3%.

Mastercard’s Financial Position (As of Sept. 30, 2024)

Mastercard exited the third quarter with cash and cash equivalents of $11.1 billion, which climbed nearly 29% from the 2023-end level. The figure is way higher than the short-term debt of $750 million.

Keep reading with a 7-day free trial

Subscribe to Fintech Wrap Up to keep reading this post and get 7 days of free access to the full post archives.