The case for becoming a bank; Klarna’s business model; Accelerating cross-border payments: The dawn of a new era;

In this edition, I explore the expansion of real-time payment networks globally, the strategic importance of launching card programs, and the transformative impact of banking licenses on fintechs

Insights & Reports:

1️⃣ Accelerating Cross-Border Payments: The Dawn of a New Era

2️⃣ APIs Ecosystem and Economy Value Chain

3️⃣ Launching a card programme

4️⃣ How cross-border payments are processed through Nexus

5️⃣ The Case for Becoming a Bank

6️⃣ Banking (Ops) - The Four Pillars for a Programmable Back Office with Zero Ops

7️⃣ Klarna’s Business Model

8️⃣ 8 ways to optimize interchange and scheme fees

9️⃣ Zilch Surges to Profitability, Surpasses $130M in Revenue

TL;DR:

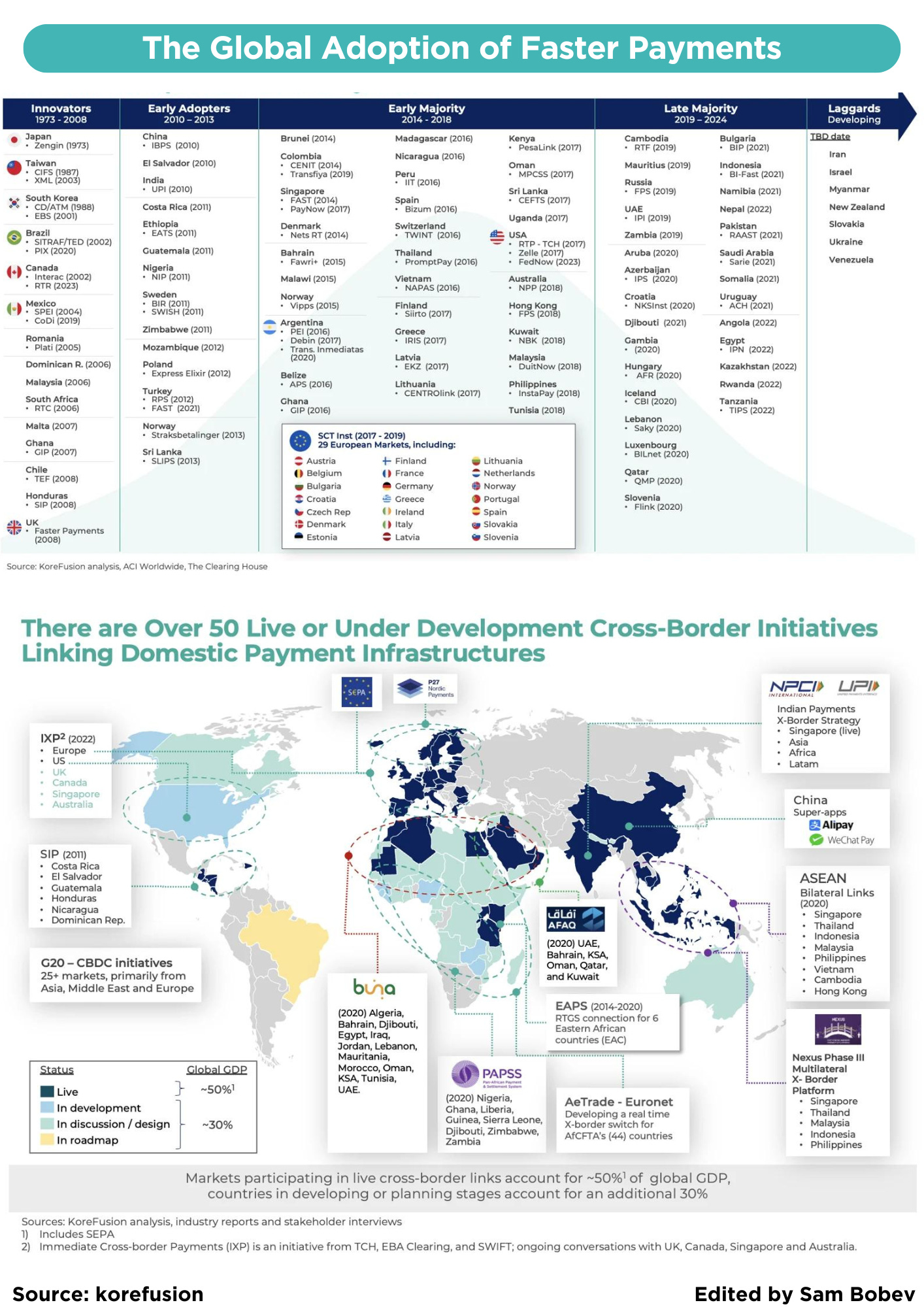

In this edition of Fintech Wrap Up, I explore several key trends and developments that are shaping the future of the fintech, payments, and banking industries. We begin with the rapid acceleration of cross-border payments, driven by the success of real-time payment (RTP) systems in over 80 countries. Initiatives like Project Nexus and cross-border links in ASEAN markets are revolutionizing international transactions by leveraging existing RTP infrastructures. These efforts are not just about speed—they’re fostering financial inclusion by bringing unbanked populations into the digital economy and reducing reliance on cash.

Next, I delve into the growing significance of APIs in the fintech ecosystem. APIs have become critical for businesses looking to innovate and expand their services. They are the digital connectors that allow enterprises to integrate their operations seamlessly into new applications, driving both local and global growth. Understanding the API economy’s value chain is crucial for enterprises to maximize the potential of these technologies, from developer engagement to the end-user experience.

The edition also covers the essentials of launching a card program, emphasizing the need for real-time controls and a robust technical onboarding process. Dynamic spend controls, like those implemented by Monzo and Santander, are becoming standard, allowing customers to manage their spending preferences directly, which enhances security and user experience.

I also discuss the strategic advantages of fintechs like Revolut obtaining banking licenses. For companies focused on financial services, becoming a bank is a game-changer. It improves lending economics, offers greater control over regulatory processes, and allows for more strategic market positioning. This trend is a clear signal of the maturation of the fintech sector, where the ability to offer banking services directly can set companies apart in a crowded market.

Klarna’s business model is another focus, particularly its ability to generate revenue through its Buy Now, Pay Later (BNPL) services. Klarna’s short-duration loans allow it to recycle capital quickly, driving profitability despite the high capital intensity of the model. This efficiency is a key reason why Klarna has managed to thrive in the competitive BNPL market.

Lastly, I highlight some significant news, including Zilch’s impressive milestone of reaching profitability with over $130 million in revenue, Revolut’s launch of crypto payment cards integrated with Apple Pay and Google Pay, and the explosive growth of UAE-based fintech Ziina. These stories reflect the dynamic nature of the fintech industry and the continuous innovation that keeps pushing the boundaries of what’s possible in digital finance.

Insights

Accelerating Cross-Border Payments: The Dawn of a New Era

The adoption of immediate, faster, or real-time payments (RTP) has witnessed remarkable progress over the past two decades. As of 2023, more than 80 countries have either implemented or are in the process of deploying domestic RTP infrastructures. While the degree of adoption, platform architecture, and user experience may vary across different markets, countries such as India, Thailand, and Brazil have embraced RTP systems as the new standard for peer-to-peer (P2P) transactions and are gaining popularity in peer-to-merchant (P2M) payments as well.

With RTP platforms maturing and introducing new functionalities, these payment solutions have become more user-friendly and have expanded to support a wide range of use-cases. They are now seamlessly integrated into a wide array of applications, ranging from banking apps and digital wallets to super-apps, online marketplaces, and payment automation platforms.

Crucially, RTP infrastructures have played a pivotal role in addressing the needs of previously unbanked or underbanked populations, facilitating transactions between bank accounts and digital wallets, and contributing to the gradual reduction in cash usage. Moreover, they have been catalysts for innovation, bringing transformative changes across the payments industry ecosystem and its value chain.

A New Frontier in Cross-Border Payments

The global success of RTP systems has sparked a new trend: the emergence of over 50 initiatives aimed at establishing cross-border links between domestic RTP infrastructures. These initiatives leverage the existing user base and industry participants of domestic payment schemes to facilitate cross-border transactions while maintaining a familiar interface and user experience.

Examples of such initiatives include bilateral cross-border links in ASEAN markets, ongoing efforts to develop international acceptance for UPI by the National Payments Corporation of India (NPCI), multilateral platforms like Project Nexus by the BIS Innovation Hub in Singapore, and hub-and-spoke platforms such as Buna or AFAQ in the Middle East.

Since 2020, these initiatives have gained significant momentum, driven by the endorsement of the G20 and collaboration with international organizations such as the Bank for International Settlements (BIS), the Financial Stability Board (FSB), the World Bank Group (WBG), and the International Monetary Fund (IMF). With more than 100 countries actively involved in efforts to link their payment infrastructures, collectively representing around 80% of global GDP, cross-border payments have become a focal point for heads of state and regulators worldwide.

Source korefusion

Keep reading with a 7-day free trial

Subscribe to Fintech Wrap Up to keep reading this post and get 7 days of free access to the full post archives.