Deep Dive: The B2B Fintech Pricing Journey and Why Pricing and Packaging Matters More When You’re Launching Your Second Product

Pricing is both an art and a science, and in this edition of Fintech Wrap Up, we’re unpacking the strategies to get it right at every stage of your fintech journey

TL;DR:

Hey everyone! In this edition of Fintech Wrap Up, I’m diving into one of the trickiest but most crucial aspects of building a fintech product—pricing. Drawing from Andreessen Horowitz’s (aka a16z) wealth of experience, we explore how to approach pricing at different stages of a fintech company’s journey, from pre-PMF simplicity to the nuanced strategies of scaling businesses. The key takeaway? Simplicity wins in the early days, but as you grow, pricing becomes a powerful lever to capture value and fuel scalability.

We delve into customer-driven discovery, value-based pricing, and even the art of “kicking the can down the road” with freemium models, offering practical steps for determining willingness to pay. Real-life examples, like Square’s transparent flat-fee pricing and Atlassian’s clever segmentation with JIRA Service Desk, highlight how the right pricing model can drive adoption and set the foundation for long-term success.

And if you’re gearing up to launch a second product, we’ve got you covered! From revisiting pricing metrics to avoiding cannibalization with smart segmentation, this guide is packed with actionable insights to help you navigate pricing with confidence. Whether you’re just starting out or scaling up, this edition will help you turn pricing into a competitive advantage. Let’s dive in together and unlock the full potential of your fintech journey!

All the credits go to Andreessen Horowitz's (aka a16z) team.

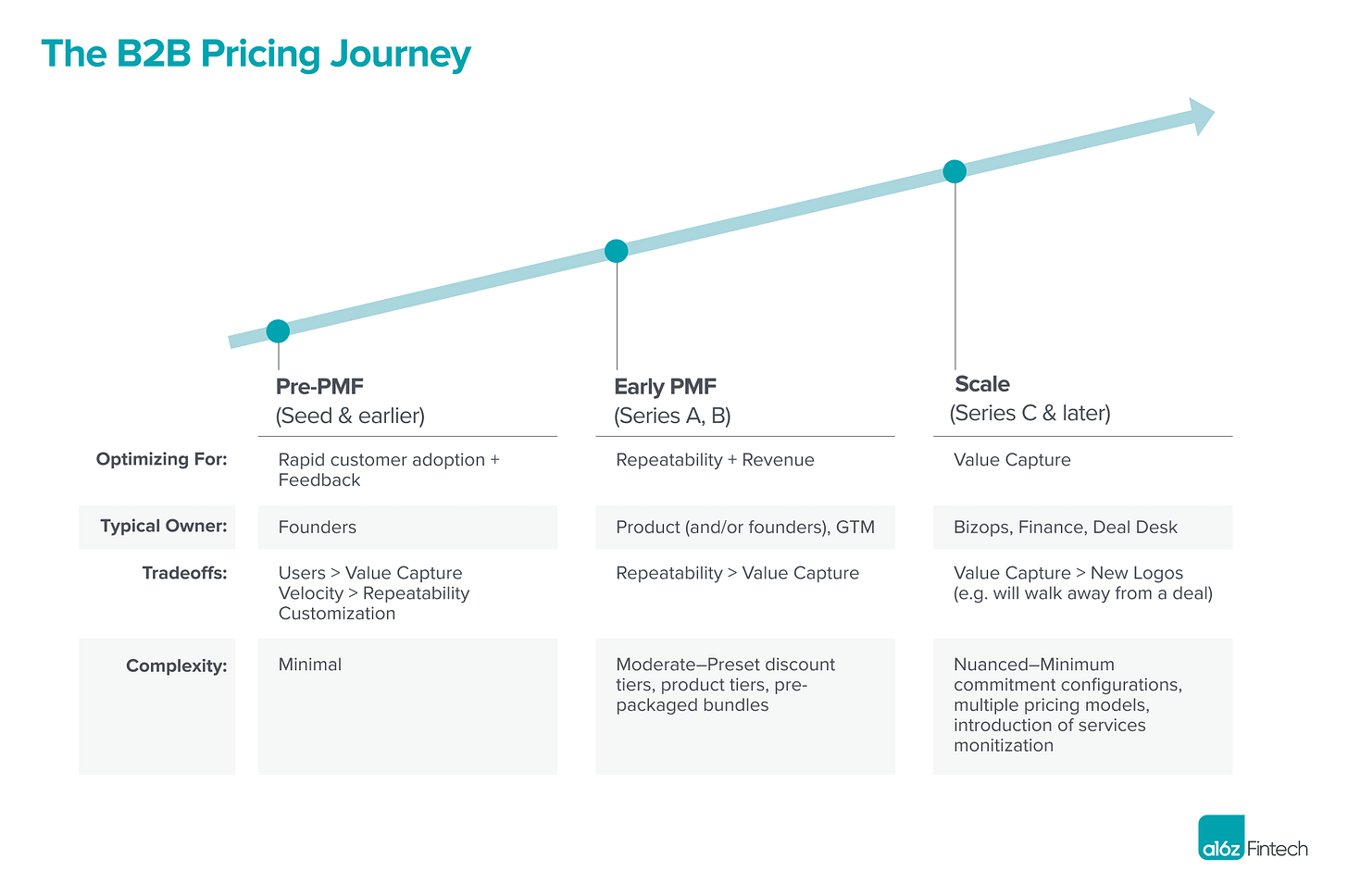

The B2B Fintech Pricing Journey

Pricing a new product or service can be confusing, and founders—be they first-timers who’ve just shipped their MVP or veterans whose products have been in market for years—are often unsure how much time they should be spending on pricing strategy. Pricing can be particularly tricky for B2B fintech companies, which have multiple paths to monetization (e.g., some combination of SaaS vs. transactional revenue, or freemium vs. subscription). B2B fintech companies also need to earn more trust from their customers than the average B2B business, because they’re handling someone else’s money.

Having talked to dozens of fintech companies inside and outside the a16z team's portfolio, the a16z team has come to realize that simplicity is the key when it comes to pricing, especially at the earliest stages. This may seem counterintuitive given how “black box-y” this subject can often feel—look no further than any B2B fintech company’s website to see that Enterprise pricing requires you to “Call Sales.” To better understand pricing in practice, we’ve put together several frameworks (and the a16z team's opinions on each) for the following:

How to think about pricing at each stage of a company

The tradeoffs to consider as pricing evolves

Understanding different fintech pricing models at your disposal

How to assess whether your pricing model is working

Though these frameworks primarily apply to B2B fintech companies, given that more and more companies are monetizing via fintech, the a16z team feels as if understanding fintech pricing could be beneficial for any number of companies. (And for web3-specific pricing, you should check out this guide from a16z team's colleagues at a16z crypto.)

Let’s dive in.

Where to start

After building an MVP that’s ready for showtime, one of the most daunting tasks for founders is determining what pricing to offer their customers in the earliest days of the business. There’s no perfect formula for how to do this, but there are several basic frameworks from which one can start.

Keep reading with a 7-day free trial

Subscribe to Fintech Wrap Up to keep reading this post and get 7 days of free access to the full post archives.