Open Finance and Financial Data Access (FiDA) Regulation; Visa Acceptance Risk Standards; Neobanks 2025: Revenue Titans vs. Valuation Darlings

Daily news on Payments Wrap Up

This week’s reports

Advanced Payments Report 2025: What Every Fintech Leader Needs To Know

Support my work by becoming a free subscriber or upgrading to paid one. Your support matters!1️⃣Advanced Payments Report 2025: What Every Fintech Leader Needs To Know

2️⃣How Many Stablecoins Do We Really Need?

3️⃣The Need for AI Explanability in Finance

4️⃣Stabelcoins are the backbone of LATAM’s onchain economy

5️⃣Moving Embedded Finance From Promise to Practice

6️⃣A Framework for Pricing AI Products

7️⃣ML Observability: Bringing Transparency to Payments and Beyond

This week’s insights

1️⃣Visa Acceptance Risk Standards

2️⃣Payment hub functional architecture

3️⃣Neobanks 2025: Revenue Titans vs. Valuation Darlings

4️⃣What Are Contextual Commerce Payments?

5️⃣What is Model Context Protocol (MCP)?

6️⃣How Payment Orchestration Delivers ROI by Ixopay

7️⃣Open Finance and Financial Data Access (FiDA) Regulation

What You Need to Know about Tempo - Stripe’s L1 Blockchain

Stripe – yes, that Stripe, the $90B fintech known for online payments – just decided to build its own Layer-1 blockchain network called Tempo. The announcement dropped in early September 2025, when Stripe’s CEO Patrick Collison took to X to say that “existing blockchains are not optimized” for the booming use of stablecoins on Stripe’s platform. In other words, the current crypto rails weren’t cutting it for Stripe’s scale, so they’re making a new one. Bold move, Stripe.

Visa Acceptance Risk Standards

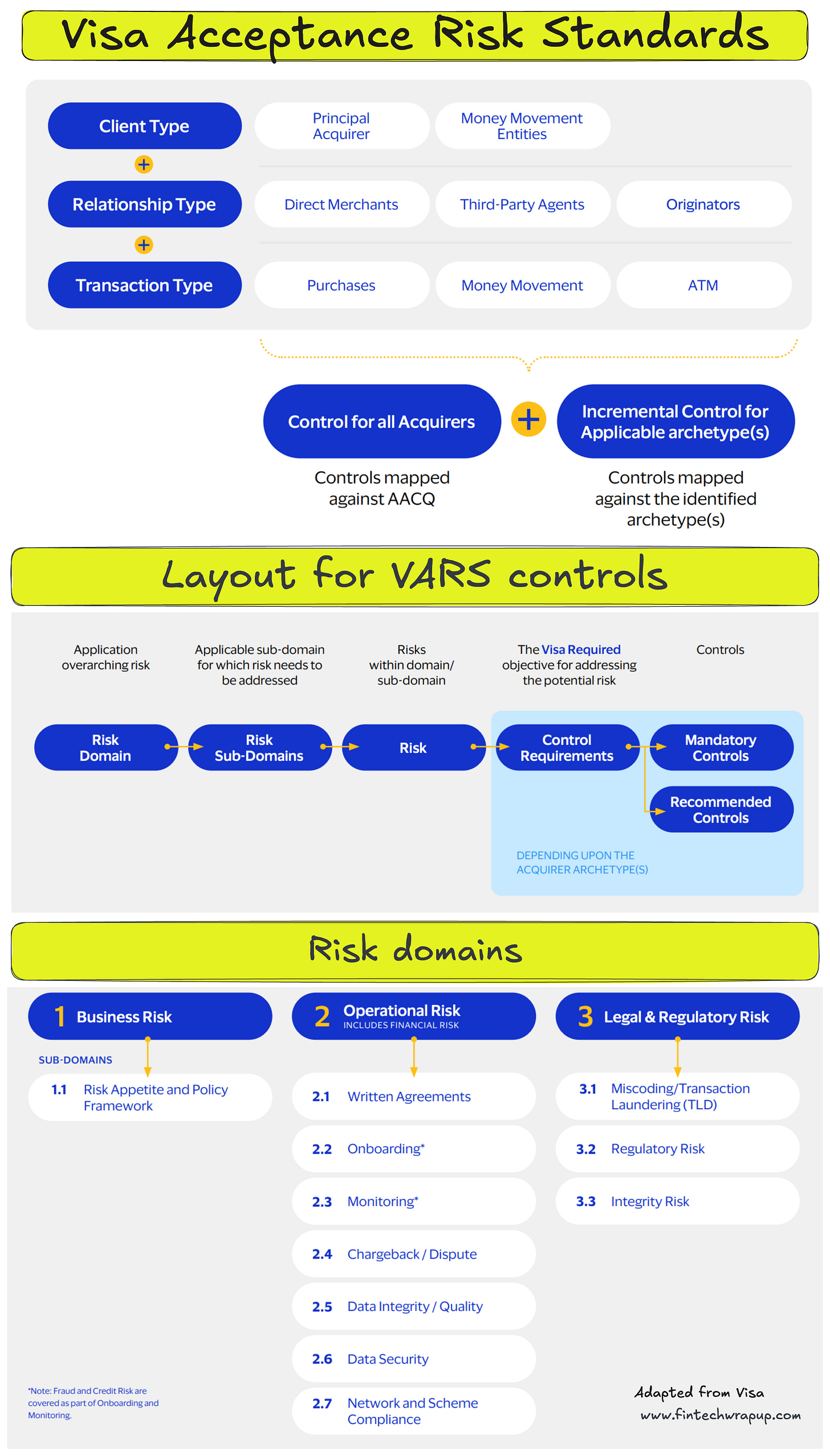

The Visa Acceptance Risk Standards (VARS) is a risk control framework designed to help safeguard the Visa payment system.

All participants involved in the Visa Payments System, either directly or indirectly, share the responsibility of minimizing risks to ensure customer trust and safety. Direct participants include Acquiring entities and Money Movement Entities, and indirect participants include Third-Party Agents (e.g., Payment Facilitators, ISOs), Merchants, and Third-Party Reviewers.

Complying with VARS helps Acquirers, their Third-Party Agents, and their Merchants develop strategies and tools to monitor risk events, while promoting innovation, and encouraging business growth.

👉 The VARS is designed to help Acquirers:

• Understand their accountabilities and responsibilities to the Visa payment system.

• Implement required controls and consider adopting recommended controls

where applicable.

• Manage and control their relationships with Merchants and TPAs.

• Effectively and efficiently mitigate risks related to payment security (fraud) and integrity

👉 Defining Acquirer Archetypes

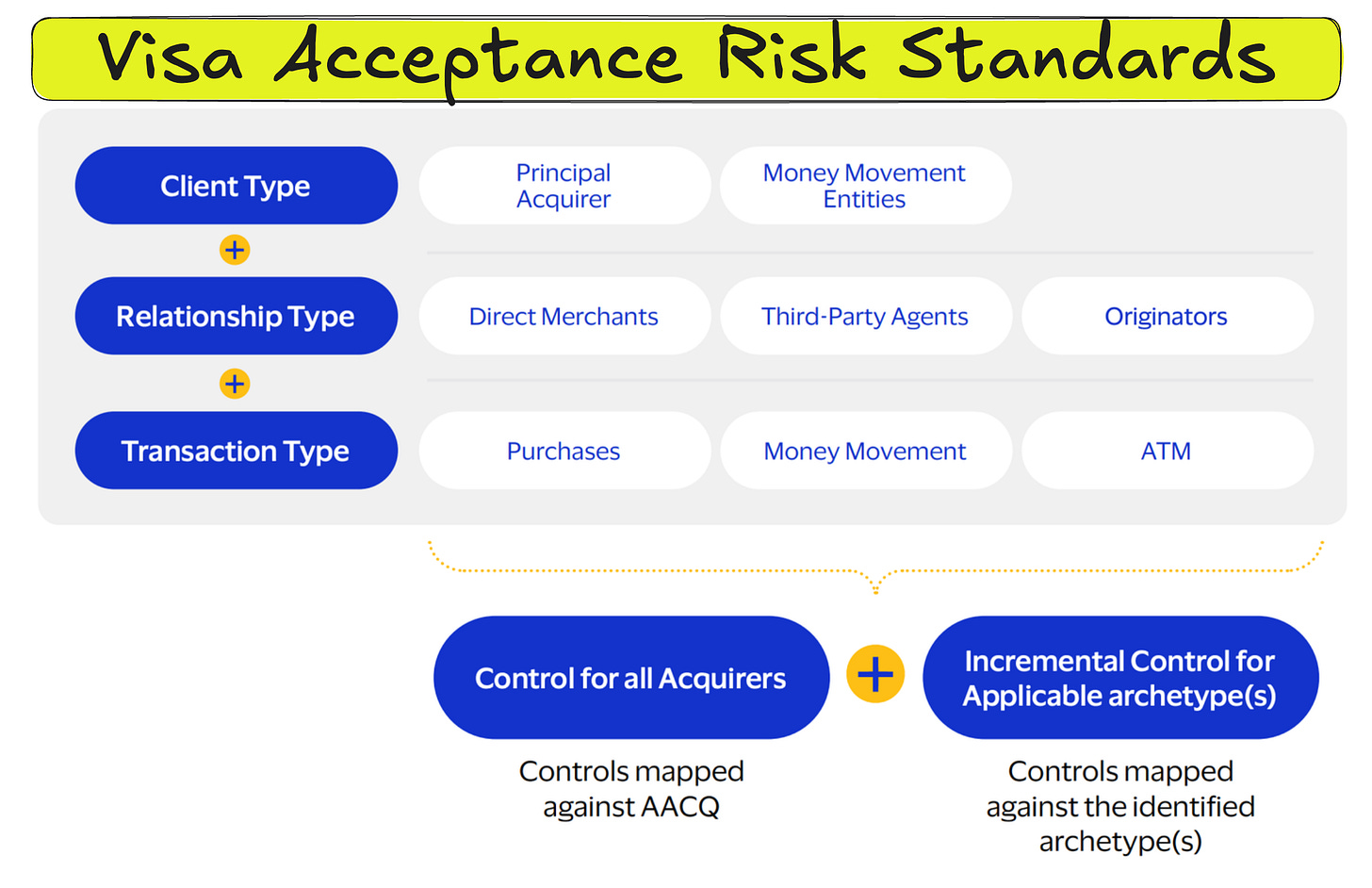

To reflect different business models, Visa has defined Acquirer archetypes. These are based onthe type of Visa Client, Acquirer Relationship, and Transactions, as seen in the graphic below.

👉 Identifying Acquirer Archetypes

Keep reading with a 7-day free trial

Subscribe to Fintech Wrap Up to keep reading this post and get 7 days of free access to the full post archives.